Uber's Third Engine: Driver-Led AI Work | PA Dispatch No. 4

A quick view of this week’s shifts in platforms, valuations, and AI adoption. Numbers, context, and curated reads you can use.

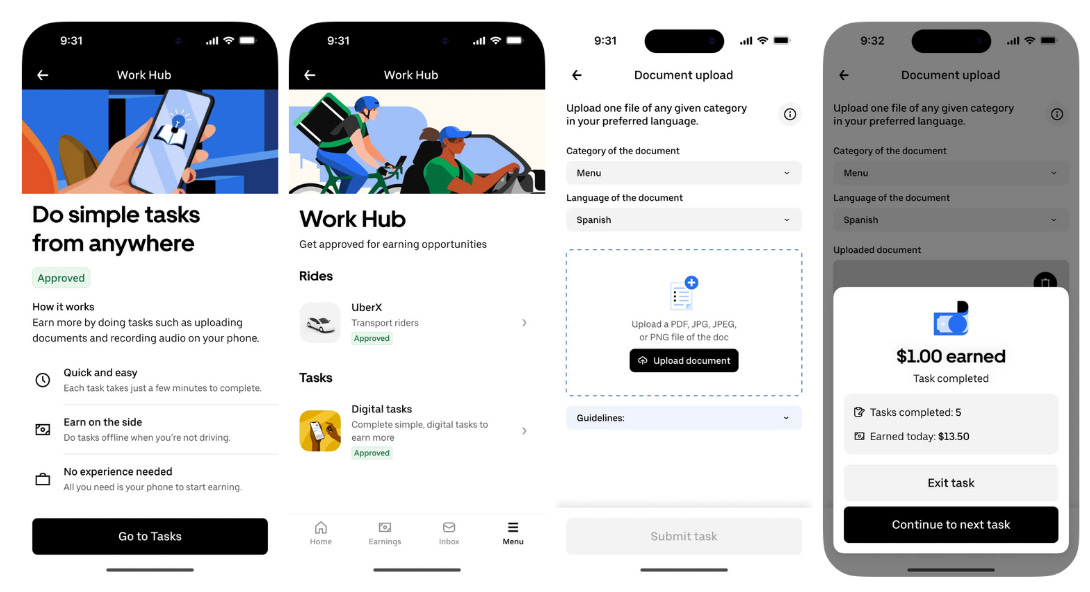

Uber’s Push to Turn the Driver App into AI Work

Uber is quietly turning the Driver app into an on-ramp for AI work. Select U.S. drivers and couriers can now complete bite-sized “digital tasks” (voice clips, menu/photo uploads, document snippets, multilingual prompts, etc) to train models and earn between trips. It’s classic Uber and the push into monetizing the flywheel: find latent supply → instrument it with product → route demand through a marketplace. Instead of rides and deliveries, the “ride” is RL/labeling instead of a passenger. The pilot is live and positioned explicitly as new, flexible work layered on top of mobility and delivery, with Uber itself advertising data-labeling and testing services on the corporate site.

The scale math is where this gets interesting for Uber:

~33M trips per day * ~8.8M drivers and couriers = An ocean of micro-idle windows the company already optimizes with heatmaps and batched dispatch.

Even single-digit participation and minutes-per-day can translate into millions of labeled units at U.S.-grade quality, a supply pool that rivals specialist shops and Mechanical Turk while avoiding their cold-start and QA headaches. If ads became the high-margin “second engine” for delivery networks, RL/labeling can rhyme for mobility: a capital-light, counter-cyclical revenue line that monetizes the long tail of driver downtime without cannibalizing trips. Turning operational exhaust into P&L is the same discipline I’ve highlighted in marketplace S-curve stacking and incremental margin engines before.

Uber hasn’t published task rates or contribution targets, so think in illustrative ranges: if ~5% of active U.S. drivers opted in and averaged ~10 minutes/day at micro-task rates typical of on-shore annotation, you’re plausibly talking tens of millions of annualized, high-gross-margin dollars at pilot scale. This is small next to $12B quarterly revenue, but with attractive unit economics (no pick-up deadhead, native fraud controls, built-in identity) and strategic spillovers (better maps, safer AV/ADAS, faster product QA). A functioning, QA-verified workforce inside the Driver app is also a defensible data-ops moat as AV mixing ramps and idle windows shift. Execution caveats apply like task quality, fair pay, and not distracting from rides, but as a flex-work adjacency it’s on brand and potentially durable.

Remembering A Friend, Dr. Nolan Williams

I wanted to share a personal note: my friend Dr. Nolan Williams passed away earlier this month. Nolan’s research and humanity left a lasting mark on the field of psychiatry and on everyone who knew him. A fund has been created to support his wife, Dr. Kristin Raj, and their two young children. You can learn more or contribute here:

Performance & Valuation Snapshot

As a reminder these snapshots below are interactive (filter/order/search). Unfortunately substack emails present them as a stale image that you need to click through to view them so I highly recommend clicking or viewing on Platform Aeronaut if you’re coming from email.

What I Read This Week

Visa unveils “Trusted Agent Protocol”: A standard to identify/verify shopping agents for safer agentic commerce this holiday season.

Sabre debuts AI-native “classless” pricing engine (CRO): ontinuous pricing with claimed ~3.5% revenue lift; Riyadh Air named as partner

Waymo targets London launch in 2026: First international robotaxi market announced; supervised testing to start soon.

DoorDash + Waymo pilot driverless deliveries in Phoenix: Starts with DashMart; customers unlock the trunk to retrieve orders.

Amazon opens new same-day grocery depot in Minnesota: 185k-sq-ft site extends same-day perishables radius ~800 sq mi.

U.S. online grocery hits a record $12.5B in Sept: Up 31% YoY; momentum continues into fall.

American Airlines Unveils New AI Trip Planner: Shows early promise but needs significant improvement

Agentic Commerce Deep Dive III from Freda Duan: Implications of agentic commerce on merchants/platforms, payment stack, and ads players

Poll of the Week

From My Recent Work

Transcript Highlights (Exec Signals)

“Our loyalty program is set to double the EBITDA by the end of the decade, signifying expansive growth.” - Andrew Nocella

“Our major cost focus at United is to drive real cost efficiency through our use of technology,” - CEO Scott Kirby.

“Starlink could be the biggest game-changer for United since it’s the fastest and most reliable for our MileagePlus members,” - Brett Hart.

“The U.S. economy remains on solid footing, and our customer base is financially strong.” - Ed Bastian

“The bifurcation you’re seeing in the industry is going to continue.” - Ed Bastian

“Revenue grew 4%, led by premium, corporate, and loyalty, reflecting the power of Delta’s brand.” - Ed Bastian

“Delta’s loyalty ecosystem continues to be a powerful driver of enterprise value.” - Glenn Hauenstein

The information presented in this newsletter is the opinion of the author and does not reflect the view of any other person or entity, including Altimeter Capital Management, LP (”Altimeter”). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for informational purposes and should not be construed as investment advice or an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Altimeter and its clients trade in public securities and have made and/or may make investments in or investment decisions relating to the companies referenced herein. The views expressed herein are those of the author and not of Altimeter or its clients, which reserve the right to make investment decisions or engage in trading activity that would be (or could be construed as) consistent and/or inconsistent with the views expressed herein.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.