Monetizing Meals: Advertising Ecosystems at Instacart, Uber Eats, and DoorDash

A deep dive into the technology, partnerships, and competitive maneuvers redefining how advertisers reach shoppers between the curb, kitchen, and couch.

Today Instacart and Pinterest announced a new partnership aimed at enabling high-intent advertising and creating a closed-loop measurement where Pinterest ads can be tied to actual product sales across the Instacart Marketplace. Pinterest users browsing dinner recipes will be able to see sponsored ingredient lists and tap to fill the cart and get it delivered.

I figured I would do a deep dive on the advertising businesses across delivery including Instacart, Uber, and DoorDash. Advertising is a huge contributor to the financials of each player and will only increase into the future.

The Delivery Media Network Ecosystem

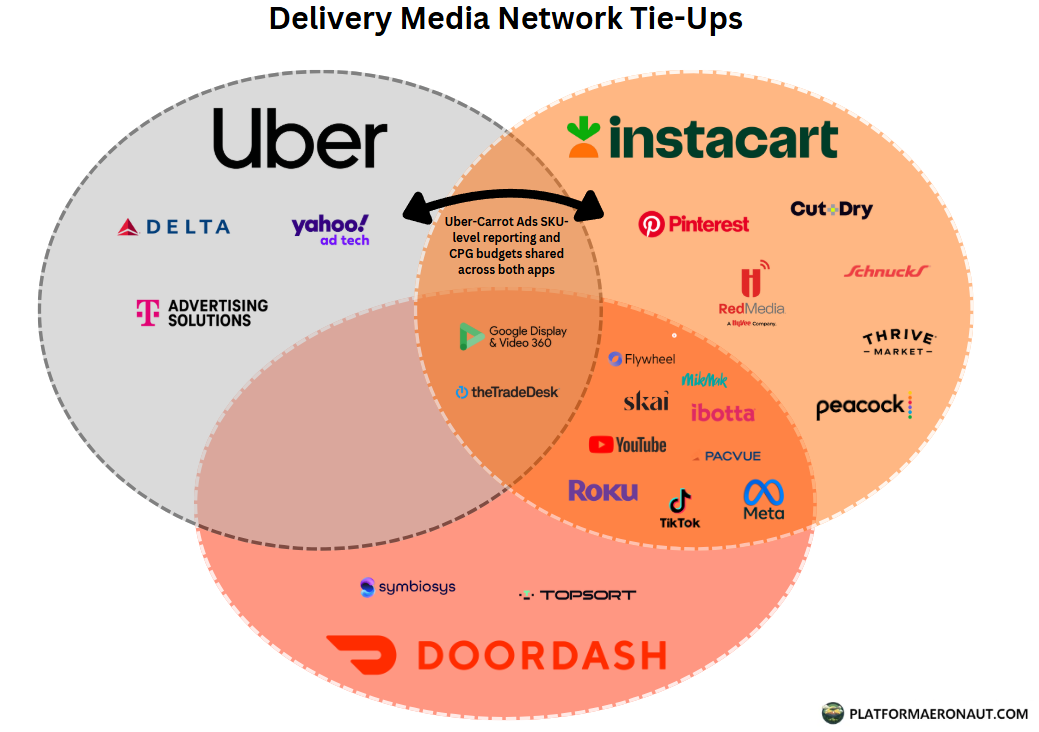

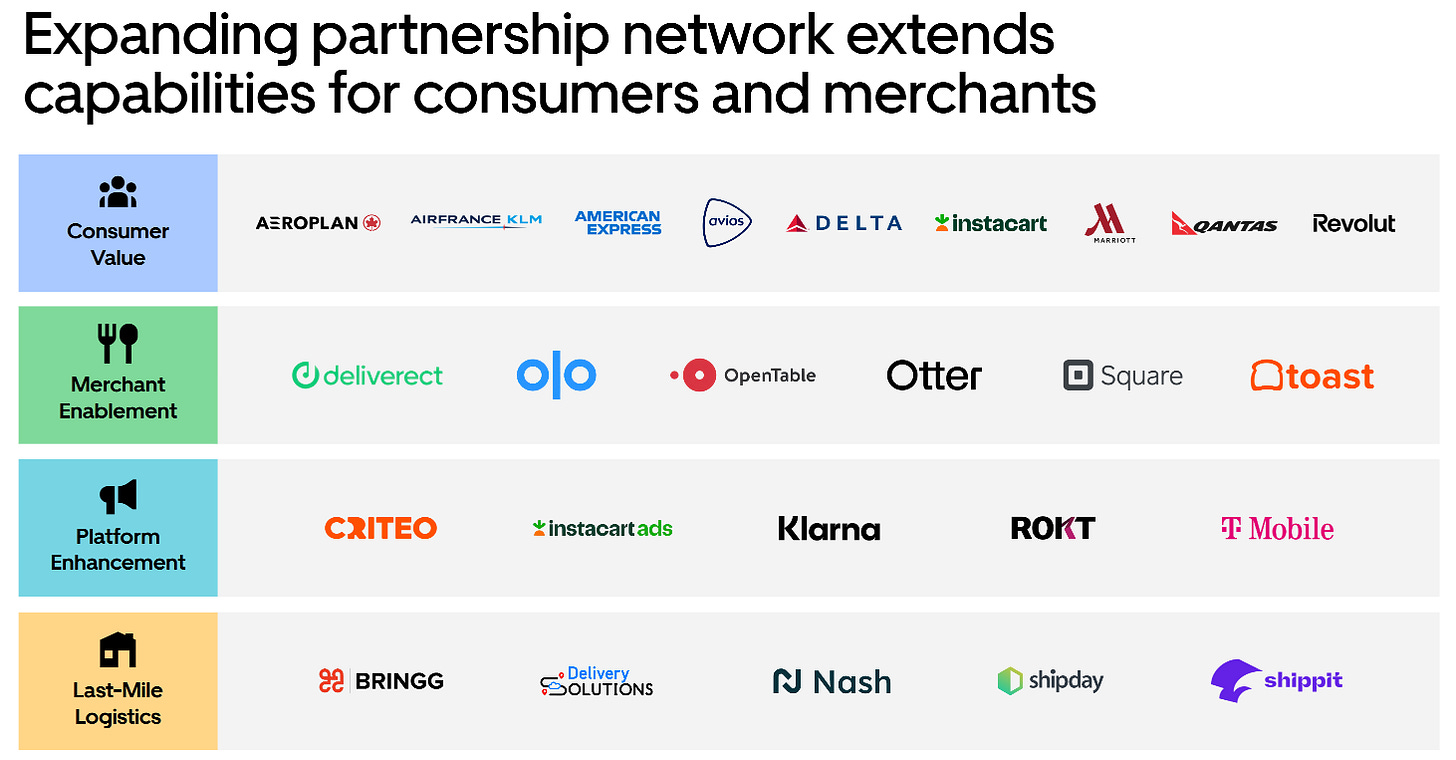

Beyond grocery bags and takeout boxes, delivery apps are morphing into full-blown retail media networks. Beyond Instacart, DoorDash and Uber Eats are also racing to monetize their apps and data through advertising. Instacart’s own retail media network now spans on-platform ads (sponsored products and search in the Instacart app), in-store channels (smart Caper carts with ads in supermarkets), and off-platform integrations like Pinterest and over 220 grocery retailers’ websites. Instacart even powers many grocers’ white-label ad programs through its Carrot Ads software. Here’s my venn diagram overview of the state of delivery media network tie-ups:

This delivery media landscape has blurred traditional boundaries. Retailers that once only sold goods now sell ad inventory, and delivery apps that once spent heavily on marketing are now making marketing money themselves. Every major delivery player is courting CPG brands and retailers in overlapping ways: Instacart brings 1,800+ grocery partners and 7,000 brands into its network; DoorDash’s Wolt subsidiary extends its ad network across 30+ countries; Uber leverages its massive mobility user base and is rolling out new formats like in-app “journey ads” for riders. We even see frenemies Uber & Instacart partnering, and Instacart working with streaming platforms like Roku, Tiktok, and YouTube to make TV and video ads shoppable.

For brands, these delivery platforms are attractive “one-stop shops” to reach consumers when they’re deciding what to eat or buy next. For the platforms, advertising is a high-margin revenue stream that can subsidize the costly logistics of delivery. It’s no wonder DoorDash’s CFO declared the company’s app to be “the fastest-growing retail media network in history.”

Instacart is Promiscuous

With the addition of the Pinterest partnership, you’ll notice Instacart has a huge variety and span of partnerships to help enable it’s advertising business. A few of the more interesting deals:

Combine this with direct relationships enabling click-to-buy with full attribution across TikTok, Roku, YouTube, and Meta as well as couponing at Ibotta and the full gambit at The Trade Desk and Google and you have a deepening ad network that can provide value well beyond the Instacart app.

The Uber and DoorDash Cold War

From the chart you’ll also notice a big empty space overlapping Uber and DoorDash. Given the intense rivalry we’ve seen both parties try to corner specific partnerships with not much overlap beyond the ad giants like The Trade Desk and Google.

Uber has a relationship with T-Mobile to power in-vehicle advertising for ridesharing as well as a newly announced partnership with Delta Airlines. DoorDash acquired Symbiosys to drive AI-powered tools and advertisements. Both are trying to go-it-alone for the most part and we’re seeing a bit of a cold war among advertising.

Show Me the Money: Advertising as a $1B+ Business

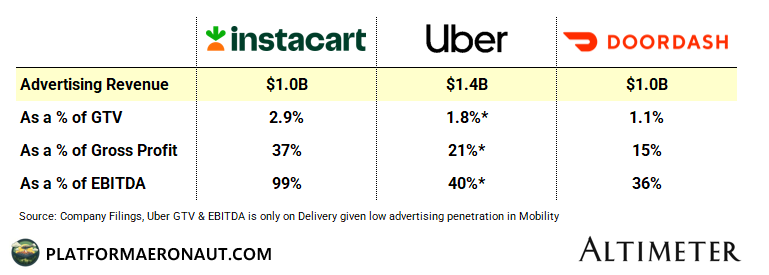

If there were any doubts that ads could move the needle for food delivery, the financials now speak for themselves. Advertising has quickly become a billion-dollar business for each of the Big 3 U.S. delivery platforms:

Instacart

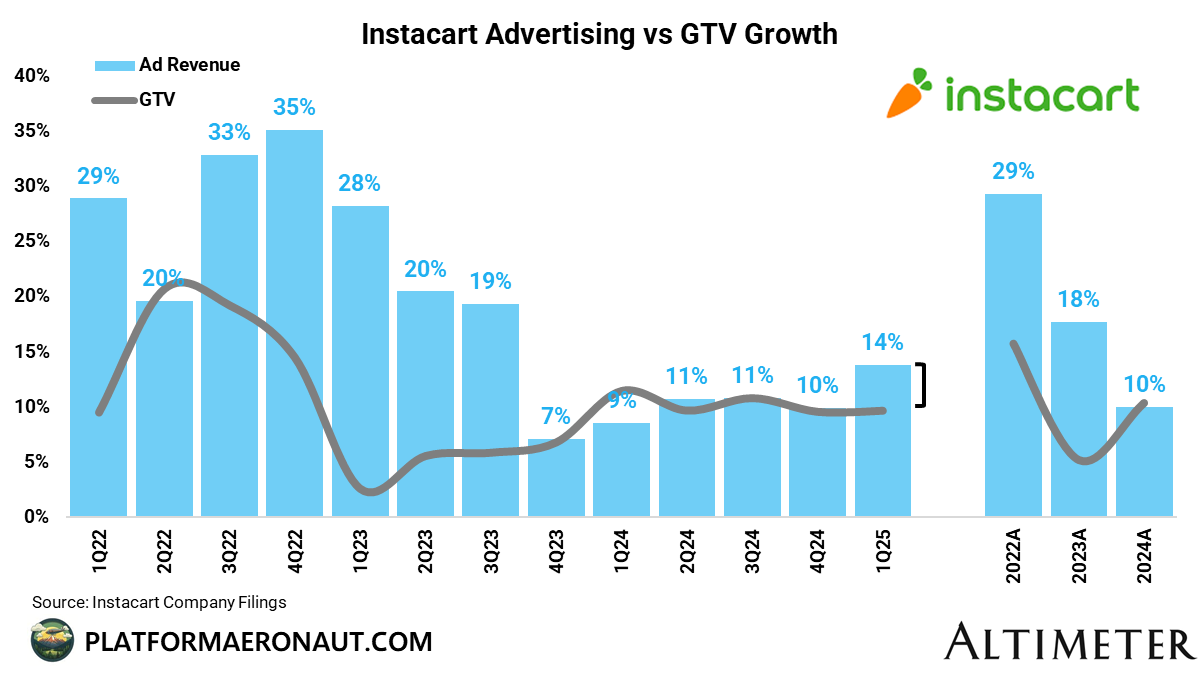

In 2024, Instacart’s advertising (and other) revenue hit $958 million, comprising roughly 30% of its total revenue. By Q4 2024, Instacart boasted about 7,000 active brand partners spending at a >$1B annual run-rate on its platform. That represents ~3% of Instacart’s GTV, up from 2.6% in 2022. In short, nearly one-third of Instacart’s revenue now comes from those sponsored product placements and banner ads nudging you to add Doritos or Coke to your cart. Importantly, this revenue is high margin essentially pure profit after some tech and sales costs, making Instacart profitable.

The key unlock for Instacart is whether they can continue to grow advertising revenue at a higher rate than GTV. The most important metric for whether CPG advertisers allocate incremental dollars is whether the platform overall is growing. In 1Q25 we saw a re-acceleration of Instacart’s advertising revenue above GTV:

Instacart Strengths

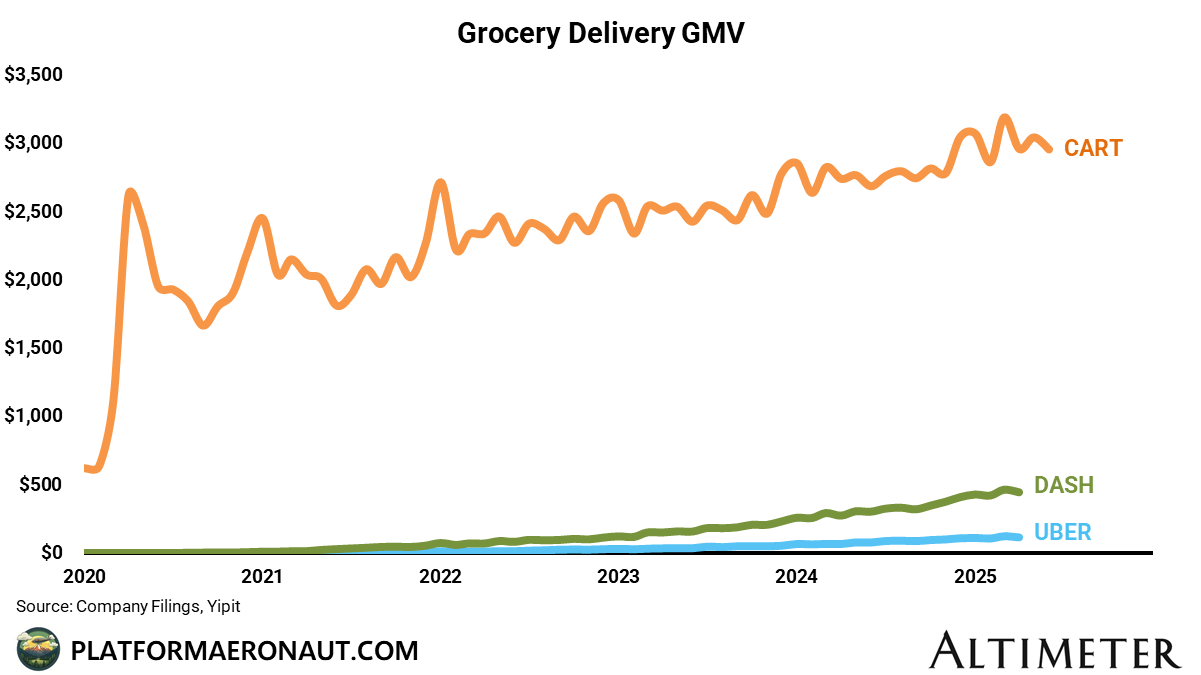

They’re the undisputed leader in grocery delivery and with Carrot Ads they have a head-start in a retail media network. They benefit from entrenched CPG relationships, large basket sizes (>$100), and a lot of first-party purchase data. Despite high growth in the grocery category from DoorDash and Uber Eats, Instacart remains wildly dominant among 3P marketplaces:

Instacart Weaknesses

When you look at overall grocery spend beyond the share that the big 3 delivery players have, the behemoths remain Amazon ($47B of ad revenue) and Walmart ($4B of ad revenue). While Instacart is growing GTV higher than overall US consumer grocery spend, it’s hypergrowth days are behind it with lots of competition. Additionally they must remain solidly in a symbiotic relationship with grocers as opposed to parasitic which may be a challenge.

DoorDash (Including Wolt)

DoorDash was later to the ads game but is catching up at warp speed. The company revealed that in 2024, DoorDash (plus Wolt) Ads crossed a $1 billion annualized run-rate, an astonishing ramp considering DoorDash only started building its ads platform a few years ago. DoorDash hasn’t broken out ads as a separate line item in earnings yet, but third-party estimates and its own press releases show ads are now material and potentially accounting for 15% of gross profit and 36% of EBITDA.

By acquiring Symbiosys in mid-2025, DoorDash aims to accelerate beyond its own app by letting brands bid on search terms and run collaborative campaigns with retailers off-platform.

DoorDash Strengths

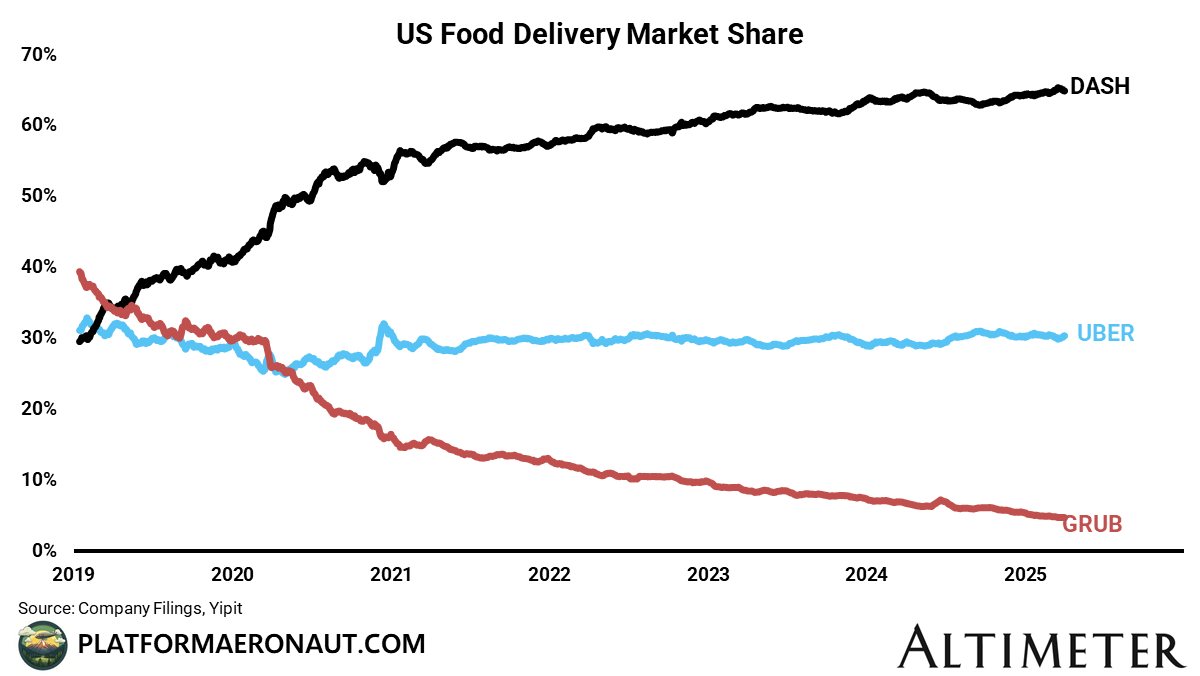

Simply put, DoorDash is the dominant restaurant delivery platform in the United States. They have ~66% market share across the US (although that share in top-10 MSAs is closer to 50%). The market went from a 3-player knife fight to a clear #1 category position player with DoorDash:

You have an A+ management team that has become dominant, a hyper fixation on expanding the TAM both globally and horizontally, and an insane amount of data and breadth from the merchant and consumer base.

DoorDash Weaknesses

The challenge for DoorDash is two fold: 1) low AOV / high competition from Uber where most restaurants are already on both platforms, and 2) potential distraction from various acquisitions. Recent acquisitions include:

Uber (Eats)

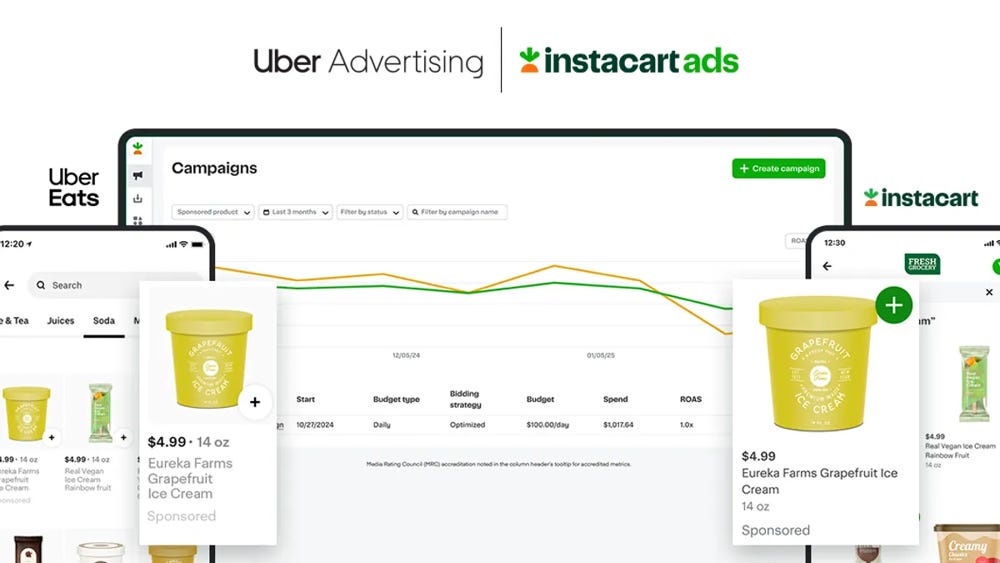

Uber was arguably the slowest to turn on the ad monetization engine, but it’s making up for lost time. Uber’s CEO Dara Khosrowshahi famously joked that in early days they had “zero” ad business, because they had no ads at all. By 1Q25, Uber announced its overall advertising run-rate (Mobility + Delivery) had surged to $1.5 billion, growing over 60% year-on-year.

The vast majority of these advertising revenues are from the food delivery side of the house. One understated component for Uber though is that this excludes “Merchant funded deals” which are when a merchant, grocer, or restaurant chooses to provide a BOGO or discount to end consumers. No monetary advertising dollars change hands, but the Uber platform benefits from incremental order and GTV volume associated with discounting. This may actually understate the true economic value of the advertising flywheel for Uber.

Uber Strengths

With a global prescence across both delivery and mobility, there is a unique ability for Uber to push into brand advertising rather than just being limited to performance marketing for restaurant and grocery delivery. In a period of time where the big get bigger and winners keep winning from scale and size, we’ll likely continue to see Uber attract an outsized portion of advertising revenue.

Uber Weaknesses

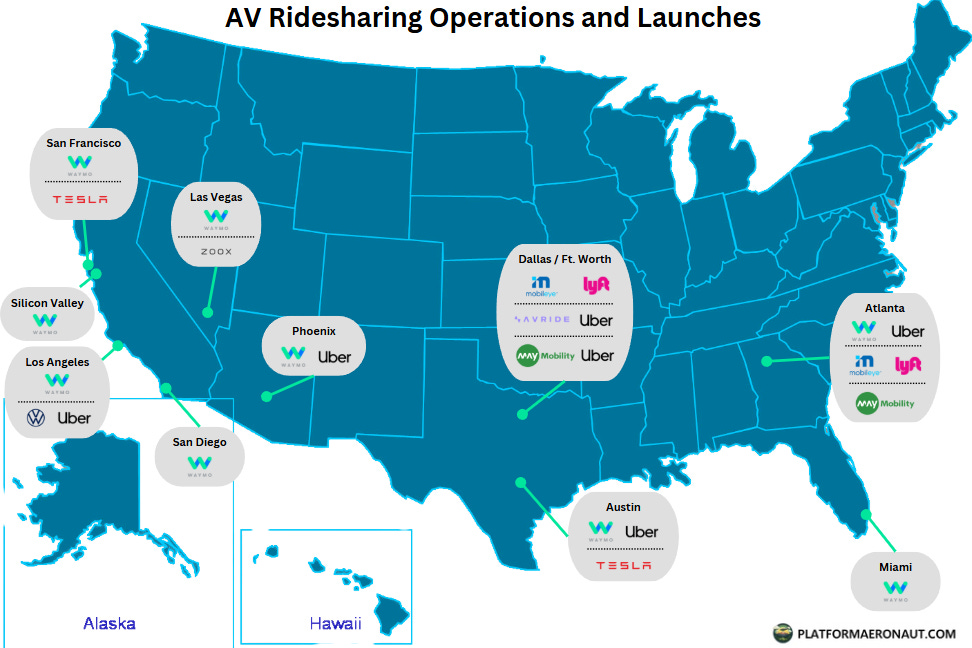

Despite the global scale, Uber is #2 category position in food delivery in the United States which has the largest prize pool for CPG advertising. And the complexities of running a global multi-vertical business and competing with Robotaxi and AVs at the same time may present execution and focus challenges:

Bottom Line: Advertising is Huge and Growing

With all three delivery players in the US achieving advertising revenue scale >$1B run-rate, it’s become the most important component from a financial perspective. I often like to compare businesses to Booking, but the one thing that Booking or the OTAs never had as they scaled (until more recently) was a huge advertising tailwind.

H/T to modestproposal1 for his long tweet thread on every business becoming an advertising business.

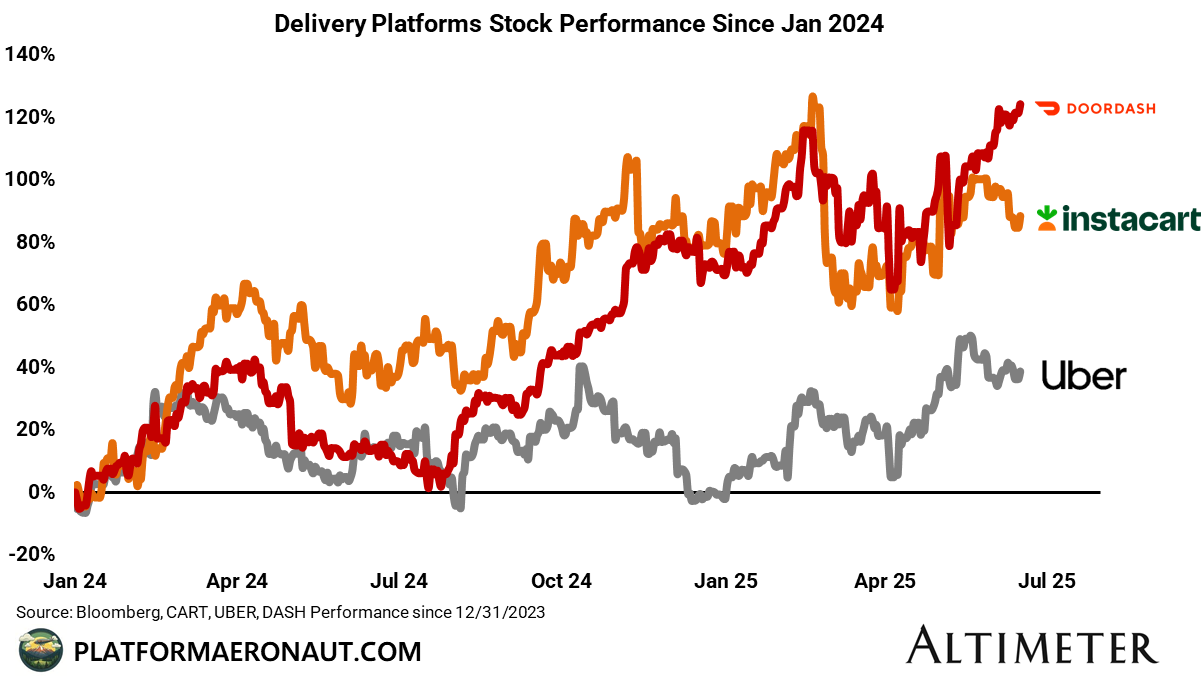

To end here’s a quick look at stock performance for the three since Jan 1 2024:

Tickers Mentioned: UBER 0.00%↑ DASH 0.00%↑ CART 0.00%↑ PINS 0.00%↑ GOOGL 0.00%↑ META 0.00%↑ ROKU 0.00%↑ DAL 0.00%↑ IBTA 0.00%↑ TTD 0.00%↑BKNG 0.00%↑

The information presented in this newsletter is the opinion of the author and does not reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for informational purposes and should not be construed as investment advice or an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Altimeter and its clients trade in public securities and have made and/or may make investments in or investment decisions relating to the companies referenced herein. The views expressed herein are those of the author and not of Altimeter or its clients, which reserve the right to make investment decisions or engage in trading activity that would be (or could be construed as) consistent and/or inconsistent with the views expressed herein.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Fantastic post. Thank you.