Mind the Gap: Incremental vs Actual Margins for Experience & Mobility Platforms

Tracking the second-derivative profits that point to tomorrow’s steady-state returns at UBER, DASH, LYFT, CART, EXPE, BKNG, and ABNB

With earnings season behind us, I can take a breather and do a bit of a deeper dive into the second derivative on margins. For the big experience and mobility players, investors often focus on GBV margins. You’ll find large e-comm players can generate 5-7% EBITDA margins on GBV. For more immature players still in the growth stage the question is what do steady-state margins look like for the business at maturity?

What I like to look at is incremental EBITDA margins on GBV on a trailing 12-month basis. It helps to smooth out one-time impacts and it really gives you a sense for what leverage the business is getting over its fixed-base and investments.

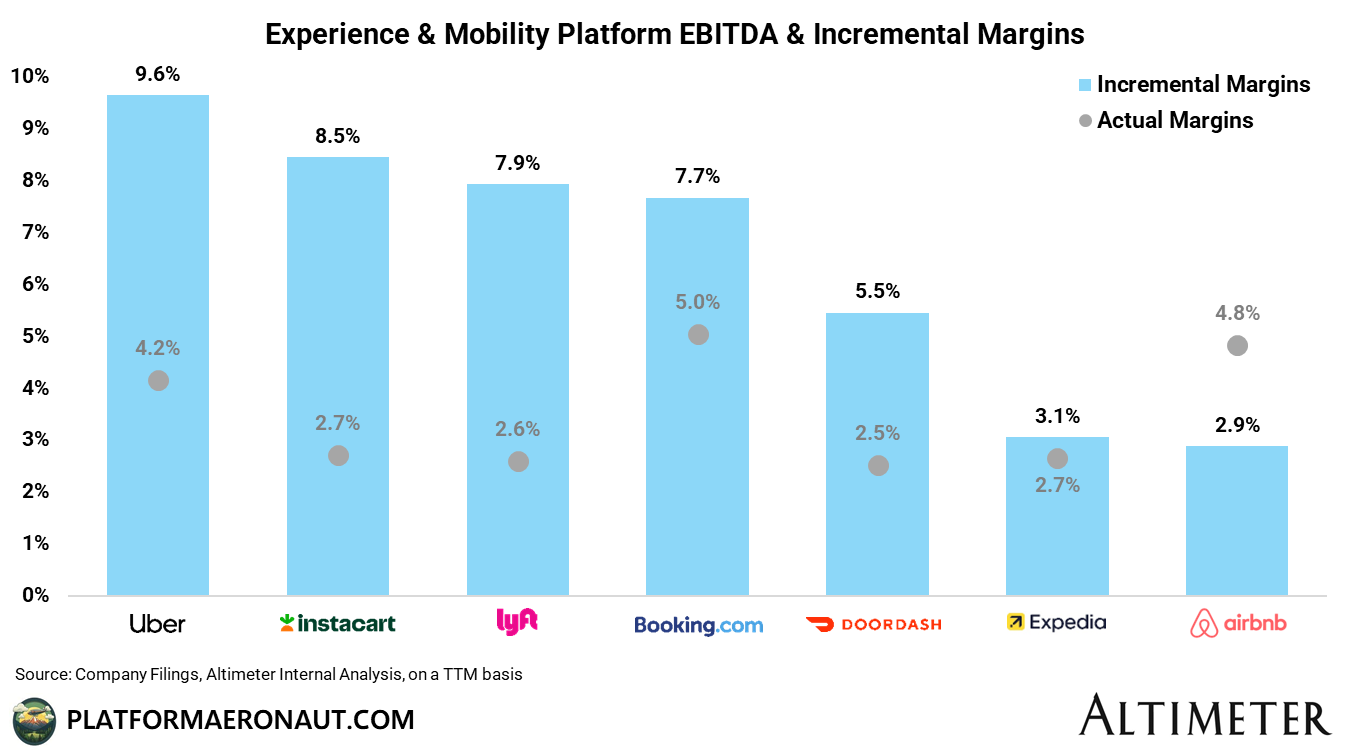

For my subset of experience and mobility platforms, here’s the latest as of 1Q25 actual EBITDA to GBV margins and incremental (essentially Y/Y $ growth in EBITDA versus Y/Y $ growth in GBV):

The way to interpret this is to take Uber, for example. On a TTM basis in 1Q25, they delivered 9.6% incremental EBITDA margins. Essentially for every $1.00 of incremental GBV booked on the platform the company generated $0.096 of EBITDA. More importantly, the actual EBITDA margin for the period was 4.2% and given the 9.6% is significantly higher, the second derivative shows expanding margins. Incremental margins are an excellent leading indicator for margins and assuming steady state operation of the business (no covid comps), it can demonstrate the upside run-rate margins the business can eventually get to.

The Gap: Incremental vs Actual Margins

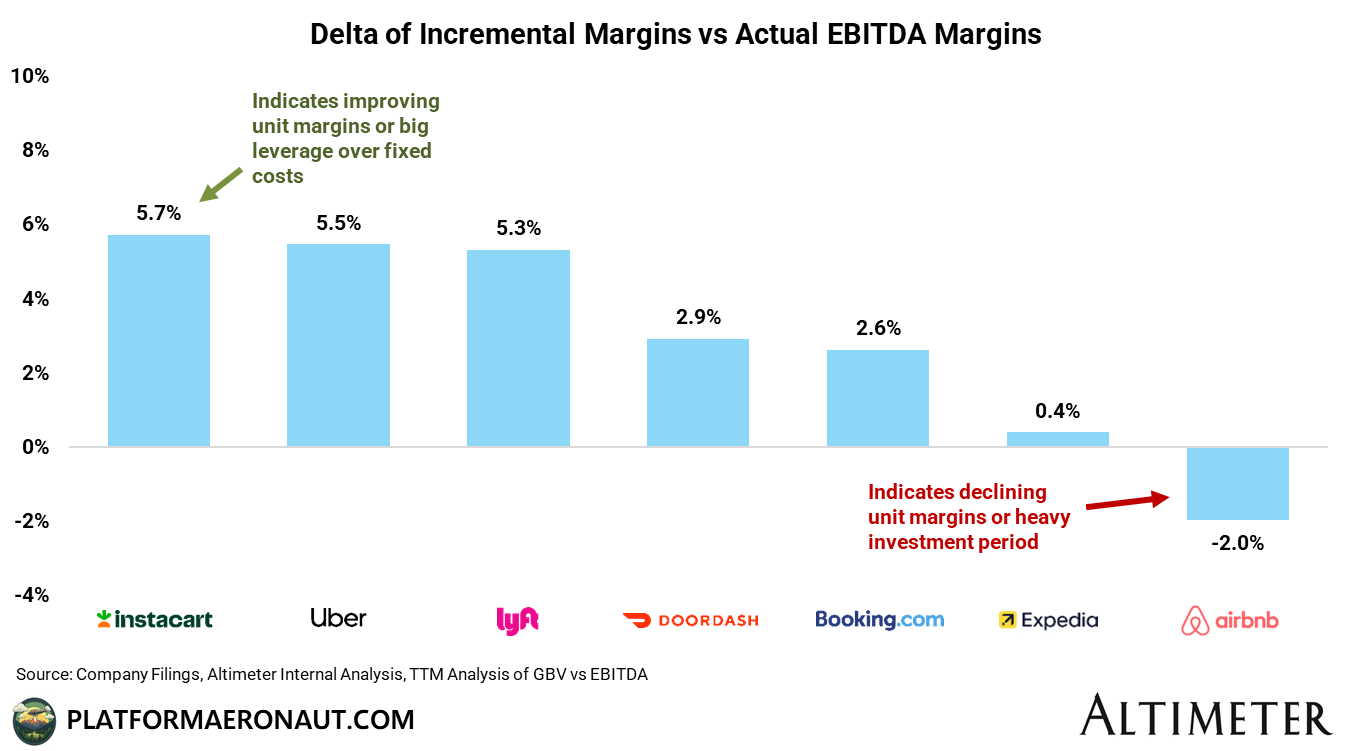

Looking specifically at the delta between the two can be helpful to diagnose the robustness of the margin expansion:

For a company like Instacart it can demonstrate a) significantly improving unit economics and/or b) big leverage over the fixed costs of the business. For Instacart specifically they’ve been hyper-focused on both unit economic improvement on the cost side (batching, order accuracy, etc), growth above GBV on the advertising revenue side, as well as keeping incremental fixed cost investments low and it’s delivering the highest incremental margins vs actual out of the peer group.

On the other hand, Airbnb’s incremental margins coming in below actuals recently shows a) the headwinds from AOV compression but more accurately b) big marketing and fixed cost investment into the new experiences and services businesses as they try to scale that. None of this is to say that Airbnb’s weak incremental margins are good or Instacart’s strong ones are bad in a vacuum, but it’s a valuable attribute to analyze with full context of the strategy.

Gut Check: EBITDA vs FCF Margins

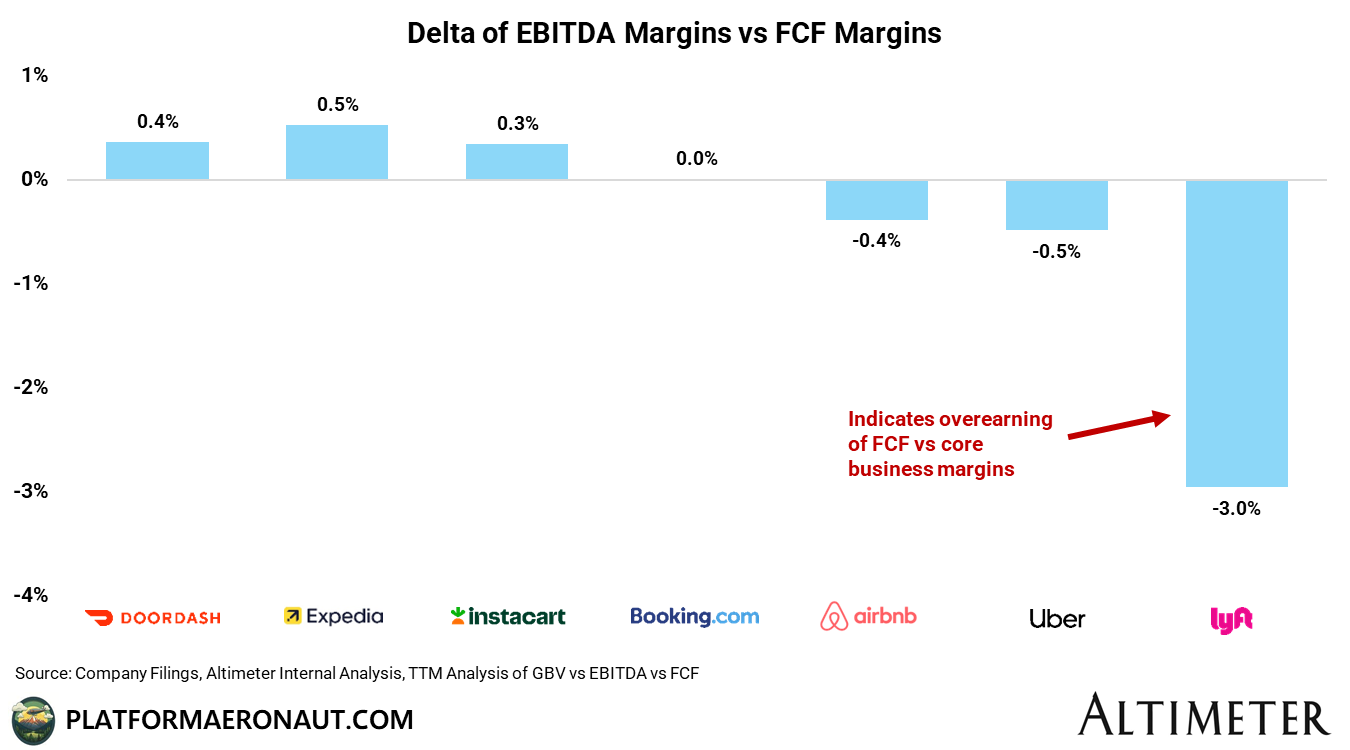

A good gut check to do is to compare EBITDA margins to FCF margins. Capex-heavy businesses like airlines or cruise lines will deliver 40-50% EBITDA conversion to FCF in good times (and -100% in bad times). Software businesses like Snowflake that collect pre-commitments and are growing quickly can see EBITDA conversion of 150-200% or even higher earlier on in the growth cycle. For these experience and mobility businesses there’s neither heavy capex (except when Expedia stupidly built a new HQ), nor big pre-commitments from customers. As a result the gap between EBITDA and FCF tends to be pretty minimal:

But as you can see the big delta for Lyft is something to dig deeper into. It’s either a result of overearning of FCF from timing of working capital (especially around insurance liabilities), or short term depression of EBITDA. Given their growth and improvements to incremental margins my guess is an overearning of FCF, and so you’d anticipate EBITDA conversion for Lyft specifically to come down as things normalize with working capital. The remainder of the peer group is pretty normal, although DoorDash, Expedia, and Instacart are likely overearning a little bit on FCF right now from working capital benefits that’ll normalize over time.

Let’s do a little bit of a deeper dive on each of the companies, note these are all on a trailing 12 month basis to smooth out the charts and give a better indication into longer term trends.

Uber: Capturing high incremental margins

Uber keeps capturing high incremental margins of around 10% showing high potential ceiling to the business. Broken out by segment doesn’t show much of a difference either. Both Delivery and Mobility (including allocating a pro-rata share of overhead expenses) are approximately at 10%.

The biggest lever here? From 2022 to 2024 Uber only added an incremental $400M of overhead expenses while adding $12B of GBV. Combine that with the advertising revenue at a run-rate over $1.3B and you get impressively high incremental margins.

“You should model us for steady margin expansion year-on-year; that’s the bar we hold ourselves to even while investing for growth.”

- Prashanth Mahendra-Rajah, CFO Uber on 1Q25 Earnings Call

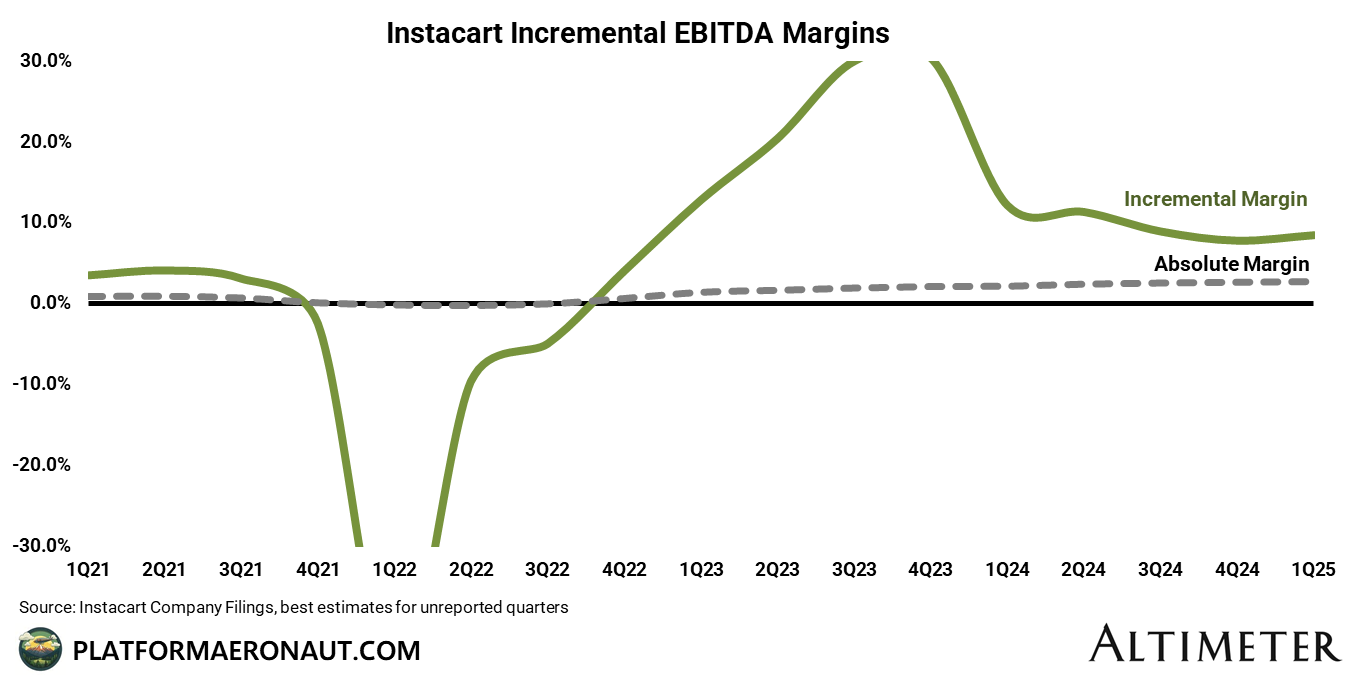

Instacart: Driven by advertising revenues

Even going back to the 2023 S-1 filing it’s apparent how important the CPG advertising business is to Instacart. There’s a bit of noise with COVID comps and harvesting some margin in 2023, but the run-rate incremental margins for Instacart have stabilized around 8%. Just like Uber has heavily pushed into advertising, Instacart’s revenues there are growing 400bps faster than GTV at the same time they’ve maintained cost discipline.

“Our goal remains annual EBITDA expansion both in absolute dollars and as a share of GTV in 2025.”

- Emily Reuter, CFO Instacart on 1Q25 Earnings Call

Lyft: Finally Finding Stability?

Pricing battles, number 2 category position, driver undersupply, management changes; these are all sources of volatility that have contributed to Lyft underearning on margins but in the past year or so they’ve finally found a groove. We’ll see how the transition to AVs is for Lyft, but they appear to finally have found some stability on incremental margins driving bottom line for the business.

Lyft’s exceptional Q1 — 16 % rides growth and strong profit expansion — shows our model of growth with discipline is working.

- Erin Brewer, CFO Lyft on 1Q25 Earnings Call

DoorDash: Heavy Grocery and International Expansion

DoorDash has maintained significantly higher GOV growth than Uber as they’ve pushed into grocery and international with Wolt and now Deliveroo (pending M&A). This does come at the expense of incremental margins, but so long as they can maintain high growth it’s the better long-term option. Despite that investment they have super healthy incremental margins well above the absolute showing continued expansion.

“Looking at 2025, we expect Adjusted EBITDA as a percentage of Marketplace GOV to rise sequentially in each of the first three quarters.”

- Ravi Inukonda, CFO DoorDash on 4Q25 Earnings Call

Airbnb: Heavy Investment Ahead of Experiences & Services Launch

Airbnb benefited significantly from COVID as they rapidly scaled the S-curve and went from losing money to incredibe long-term margins. More recently though they’ve seen incremental margins dip well below absolute as they’ve re-invested into the business. I posted a primer recently on the experiences and tour business which is worth a read.

For the full year, we continue to expect an adjusted EBITDA margin of at least 34.5%, in line with what we shared in February. Now that includes $200 million to $250 million of investment to launch and scale new businesses in 2025. These investments will have the biggest impact on our margins in the second half of the year since our new offerings go live on May 13. Now as these new businesses scale over the coming years, we expect them to be significant drivers of future revenue growth.

- Ellie Mertz, CFO Airbnb on 1Q25 Earnings Call

Expedia: Floundering

Sometimes they’re expanding margins, sometimes they’re reinvesting into the business. We’re in a period now where management is reinvesting into the business, especially after posting a quarter where they grew 300bps slower than peer Booking. The revitalized push into B2B is a great idiosyncratic investment, but there’s likely some underinvestment from the previous CEO that requires redirection of dollars.

At the same time:

“Looking ahead, we are committed to continuing to deliver margin expansion while growing our top-line.”

- Ariane Gorin - CEO, Expedia on 1Q25 Earnings Call

Booking: Stone cold execution

Booking continues to just execute like a machine. Continual high growth for the segment and margin expansion despite the maturity of the business. For a deeper dive on the dilution side my earlier post about BKNG as the gold standard is worth a read.

“We expect to continue to expand our Adjusted EBITDA margins in 2025 and deliver margin growth of just under 100 basis points.”

- Ewout Steenbergen - CFO Booking Holdings 4Q24 Earnings Call

Tickers Mentioned: BKNG 0.00%↑ ABNB 0.00%↑ EXPE 0.00%↑ UBER 0.00%↑ LYFT 0.00%↑ CART 0.00%↑ DASH 0.00%↑

The information presented in this newsletter is the opinion of the author and does not reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for informational purposes and should not be construed as investment advice or an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Altimeter and its clients trade in public securities and have made and/or may make investments in or investment decisions relating to the companies referenced herein. The views expressed herein are those of the author and not of Altimeter or its clients, which reserve the right to make investment decisions or engage in trading activity that would be (or could be construed as) consistent and/or inconsistent with the views expressed herein.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Hey Thomas, I'm new to your publication. I am wondering if you could share how you calculate incremental margins? Also how come you have single digit actual margins for booking holdings while their financial statements show roughly double digit >20% ebitda margins?

Great post!