Tours & Experiences Primer: Will Airbnb Disrupt the Global Experiences Industry or Flop?

The newly relaunched Airbnb Experiences business is super exciting, but is it a new S-curve for the business or doomed to flop like the original incarnation?

Airbnb Founder and CEO Brian Chesky has been talking about adding new S-curves to the core STR offering for a long time:

“A great business could get to $1 billion of revenue, and you should be able to expect one or a couple of businesses to launch every single year for the next five years.” - ABNB Q4 2024 Call

Yesterday at their summer product release they announced and launched new experiences (tours, attractions, etc) as well as services (think massages, in-home chefs, etc):

This has been a long time coming as the original experiences offering wasn’t up to snuff and never really hit escape velocity. They culled a bunch of lower quality and stopped accepting new applications as the company re-vitalized the offering, culminating in what we saw launched earlier this week.

But the big question is whether this will a) see widespread consumer adoption, and b) what it’ll do from a competitive perspective to peers like Viator (Tripadvisor), Klook, and GetYourGuide.

The Global Experiences TAM: $300B Growing Slower than Expected

For the past 5-10 years we’ve seen continued promise for tours, activities, and experiences being the next big S-curve for OTAs. I believe that Tripadvisor’s entire future is on the back of Viator since the core business is getting eviscerated due to overreliance on Google SEO. And startups GetYourGuide and Klook have continued to raise VC money to tackle the market as they expand beyond their origin geographies.

The problem is that the industry just isn’t growing that quickly:

Despite the industry being large (over $265B in 2024 estimated from industry sources), the big online players just aren’t that penetrated into the market. It’s an industry forecasted to grow at 7% between 2024A and 2030E, so in order for this to be attractive to Airbnb it has to either be a) a penetration story or b) a market share story.

Why penetration is low and it’s a hard problem to tackle

I’ll caveat that penetration has increased over time as traditional and independent tour operators have increasingly moved online and put their offerings on online platforms, but it’s been a slow process. To put it in some context, the above forecasted 13% by 2030 is approximately the same as online grocery delivery is today (~15%), and what online food delivery is as a % of total food spend in the United States (~13%). So think of tours and experiences as being 5-10 years behind grocery and food delivery as a penetration story, and that’s without the benefit of a global pandemic forcing everybody to adopt those habits. But why is it difficult:

Disaggregated supply of long-tail chaos

While there’s plenty of big tour operators running ferries in Norway, bus tours in Boston, and Louvre tours in Paris, there’s an absolutely enormous long-tail of tour and experience operators. The guy down the road in Half Moon Bay running a surf lesson business is a cash-only business run out of his van. Getting that fragmented tech-light tail online is slow, painful, and often not worth a 20% commission. It’s a big opportunity just like Booking aggregated the long-tail in European hotels, but it took 15 years to do so.

The Economics Aren’t Great

If you are in the long tail of experiences offering a cooking class for $50 per person what amount are you willing to give up for discovery? The big online operators have a 15-25% take rate and so giving up $12-13 of your $50 per person feels like an awful lot. Plus the servicing costs and the marketing costs for that experience aren’t going to be terribly different than they are on a $500 hotel room so the economics aren’t nearly as attractive. Also think of the fungibility of the product. If nobody signs up for your cooking class as an operator you’re not out much, maybe your gnocchi filling goes bad. If your $500/night Airbnb goes empty the operator has a high degree of fixed and carrying costs they’re missing out on.

Booking Behavior Doesn’t Align

The normal booking and planning flow for a vacation is as follows: 1) find a flight two to three months out, 2) book a hotel or an Airbnb shortly after the flight but usually not at the same time, 3) book your rental car or transportation once you know where you’re going and how to get there, 4) book your tours and experiences a couple weeks beforehand. The dislocation of time means in order for Airbnb or Booking to bring you back for an experience booking they have to re-capture your attention which is difficult or expensive or both.

Big Attractions Happily Sell Direct

A big portion of the TAM is for things like museums, theme parks, and observation decks which already have foot traffic or are highly in-demand. Usually they’re bigger operators and are already online and tech enabled. Why would they be willing to pay Viator or GetYourGuide 25% commission just for discovery?

Many Transactions are still Walk-up or Concierge Desk

Even after covid and rapid digitalization, 70%+ of tours and activities are booked offline. People walk up to a ticket window, or they ask the concierge desk to book them a duck-tour in Boston, or they get a referral from a friend. Even though I am very digital first there’s something to be said about the concierge at the hotel or resort assisting me with booking a cooking class or boat rental while on vacation.

What Does the Competitive Layout Look Like?

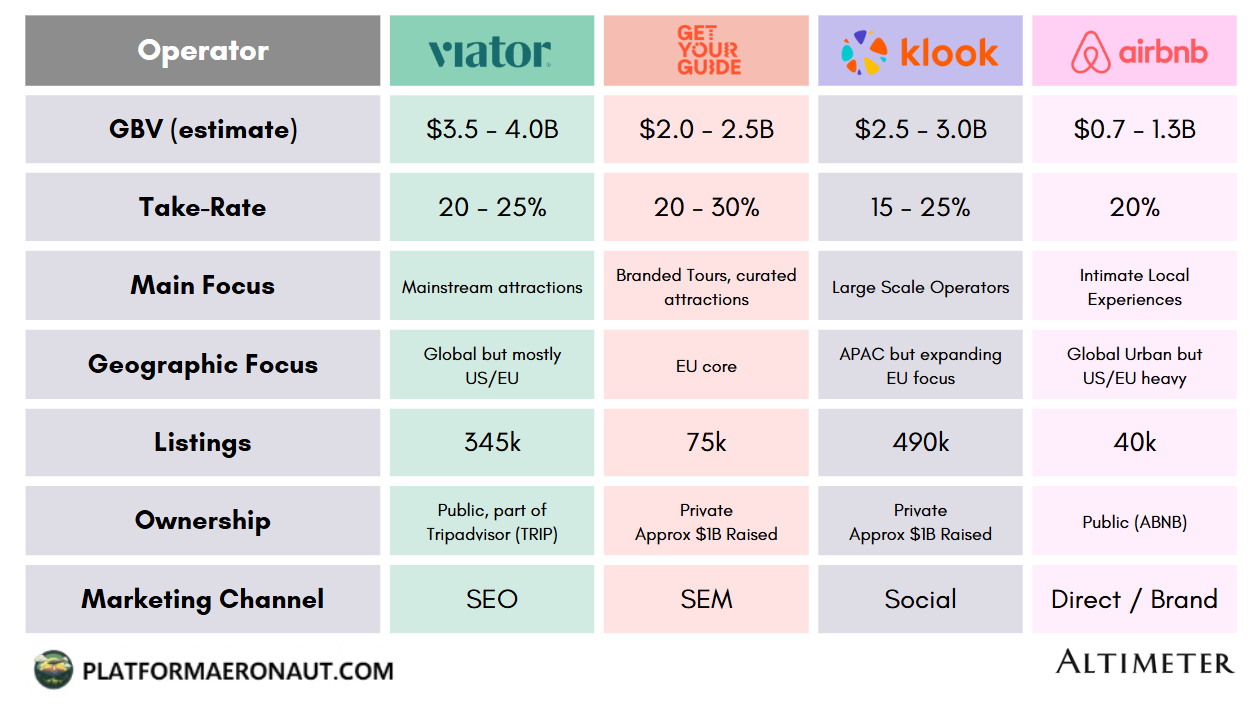

With Airbnb re-entering the market we have four big global players in tours and experiences (ignoring the TUI or other specific operators):

Viator

Part of Tripadvisor (although long rumored to either be spun out or sold), Viator has been the best known of the online players and is the largest globally. Growth has been pretty anemic though, with 1Q25 Viator revenue growth of only 11%. TRIP never broke out Viator financials pre-pandemic but growing only low double digits and barely above industry CAGR is a rough place to be for the market leader.

Their big challenge is an overreliance on Tripadvisor.com which is in the middle of getting killed by Google SEO challenges. With the majority of Tripadvisor.com traffic coming through SEO, and SEO traffic getting killed through Google cannibalization for AI summaries, that flows through to a tough environment for Viator which never really stood alone from the Tripadvisor brand.

Strengths: Definitely the scale leader, have some tailwind from Tripadvisor funnel, a decent balance of marquee attractions and long-tail.

Weaknesses: Quality control issues across 345k listings and likely downward fee pressure from Klook and Airbnb, (plus the mentioned Google SEO challenges)

GetYourGuide

A private and VC funded startup, GetYourGuide has been the mobile-first leader in the EU for tours and experiences. There’s not a lot of publicly available data on their financials beyond challenges achieving meaningful profitability. They tend to be more reliant on SEM versus Viator’s reliance on SEO from an external observation.

Strengths: Main strengths are brand resonance in Europe and a mobile first focus. They also have exclusive GYG Original tours and so a focus on consumer trust has been big.

Weaknesses: Profitability and likely hit on elevated take-rates are a challenge, remains to be seen how a push into the US market will go. Reliance on SEM marketing could be a challenge as SEO dies and unknown of how it’ll work in an AI-first world.

Klook

The fast growing APAC focused startup with VC funding takes the mobile first aspect of GetYourGuide and puts it on steroids. If Viator is the boomer of Experiences, GetYourGuide and Airbnb are the Millenials, then Klook is the Gen Z company from an operational perspective. They’re hyper mobile (including on the software side for operators and payments), and get the fast majority of their traffic direct or unpaid or high margin through social media (Tiktok and Instagram campaigns and influencer marketing).

Strengths: Structurally higher margins due to APAC cost structure and social marketing, lower take-rate, a huge SKU count, and super high cross sell.

Weaknesses: Brand is not well known for US and EU expansion, unknown whether social marketing success in APAC will transfer or not.

Airbnb

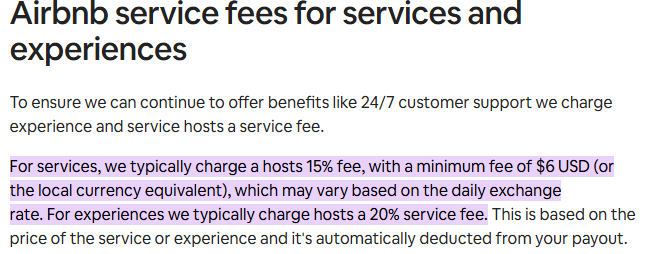

As noted above, the relaunch of Airbnb Experiences will be interesting to track. The original concept never got off the ground as a meaningful contributor. Chesky is attempting to tie the unique and differentiated supply and the brand voice that Airbnb has to the experience supply. If it works it’ll be killer and well loved and definitely deserving of the 20% take-rate. But one has to acknowledge that this is attempting to conquer the most disaggregated and complicated part of the market TAM.

Strengths: Brand strength, unique differentiated experience supply, huge existing customer base for core product.

Weaknesses: Scalability of differentiated supply, lack of proven ability to successfully cross-sell, big aggressive competitors outside of core US and some western European markets.

In Summary

Overall I’m super excited to see what Airbnb can do with the relaunched experiences, it’ll definitely be great from a consumer perspective. The bigger challenge is whether this can grow to the $1B type opportunity new S-curve that Chesky is hunting. He has acknowledged they’re going to try a couple things a year with the aspiration of that type of contribution and not everything will get there or succeed. Whether the unit economics are good enough, whether there’s enough supply, whether it’s big enough to be more than a rounding error on total GBV: these are all outstanding questions.

The next 6-12mo will unlikely see much direct competitive overlap between Airbnb and the other big players as they’re approaching the problem of online penetration from a different tack, but given enough scale the big platforms will start colliding once we see online tour penetration hit >10% in the same way we saw it happen with UBER vs LYFT in mobility and UBER vs DASH in food delivery. The industry just isn’t mature enough yet for these types of direct battles to play out yet.

Tickers Mentioned: BKNG 0.00%↑ ABNB 0.00%↑ EXPE 0.00%↑ TRVG 0.00%↑ TRIP 0.00%↑

The information presented in this newsletter is the opinion of the author and does not reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for informational purposes and should not be construed as investment advice or an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Altimeter and its clients trade in public securities and have made and/or may make investments in or investment decisions relating to the companies referenced herein. The views expressed herein are those of the author and not of Altimeter or its clients, which reserve the right to make investment decisions or engage in trading activity that would be (or could be construed as) consistent and/or inconsistent with the views expressed herein.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.