DoorDash TAM Expansion and a Push into POS Systems?

At Dash Forward 2025 DoorDash announced restaurant bookings, Dot autonomous delivery robots, expanded grocery access, and DashMart fulfillment, and more, let's dive into what their TAM looks like now

With the Dash Forward 2025 event revealing a ton of new product announcements I wanted to do an overview of DoorDash’s TAM expansion efforts over the past several years as well as dig into what I think is coming down the pipeline: a restaurant/retail POS system push (long rumored but clues piling up).

At the event the company revealed a bunch of new additions to the platform including restaurant bookings, DoorDash Dot autonomous delivery robot, DashMart Fulfillment Services, expanded grocery access, and a slew of app updates both for consumers and dashers.

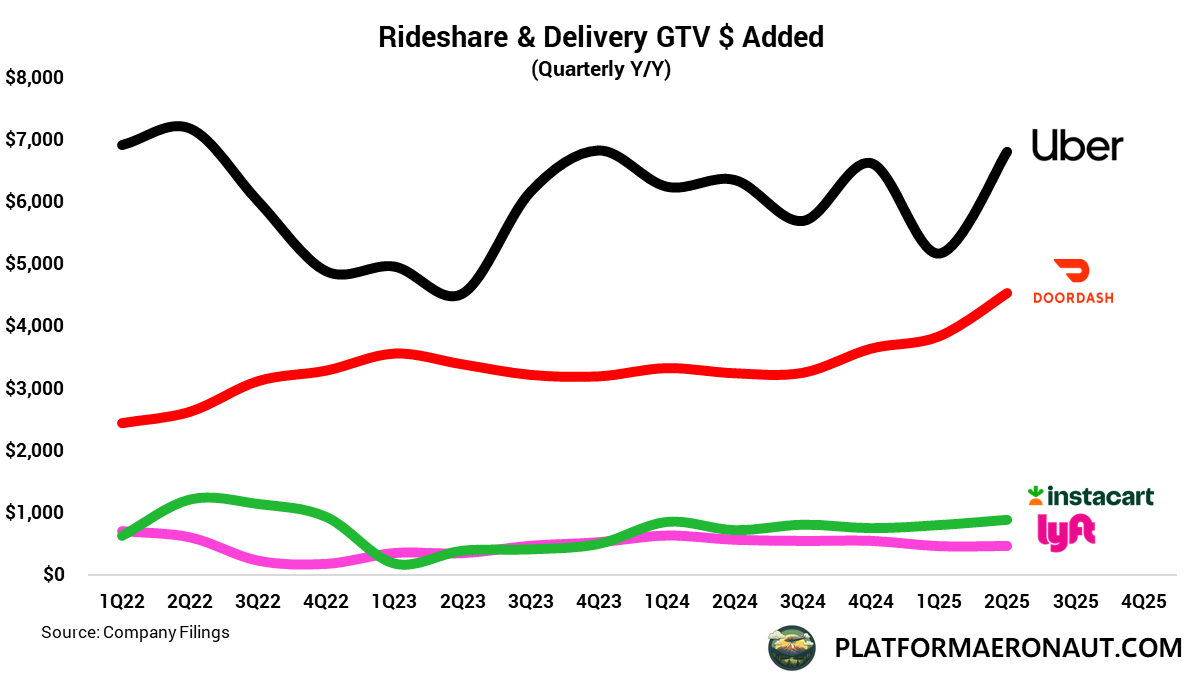

Among competitors DoorDash has continued to accelerate the second derivative of absolute $ growth in GTV Y/Y. How they’ve done it is a deliberate focus on TAM expansion outside of core restaurant delivery.

I did a deep dive on the philosophical clarity that DoorDash has around TAM expansion and reinvestment back in 2023 and it’s hard to argue they haven’t been perfectly aligned with that vision throughout their entire time in the public markets.

DoorDash TAM

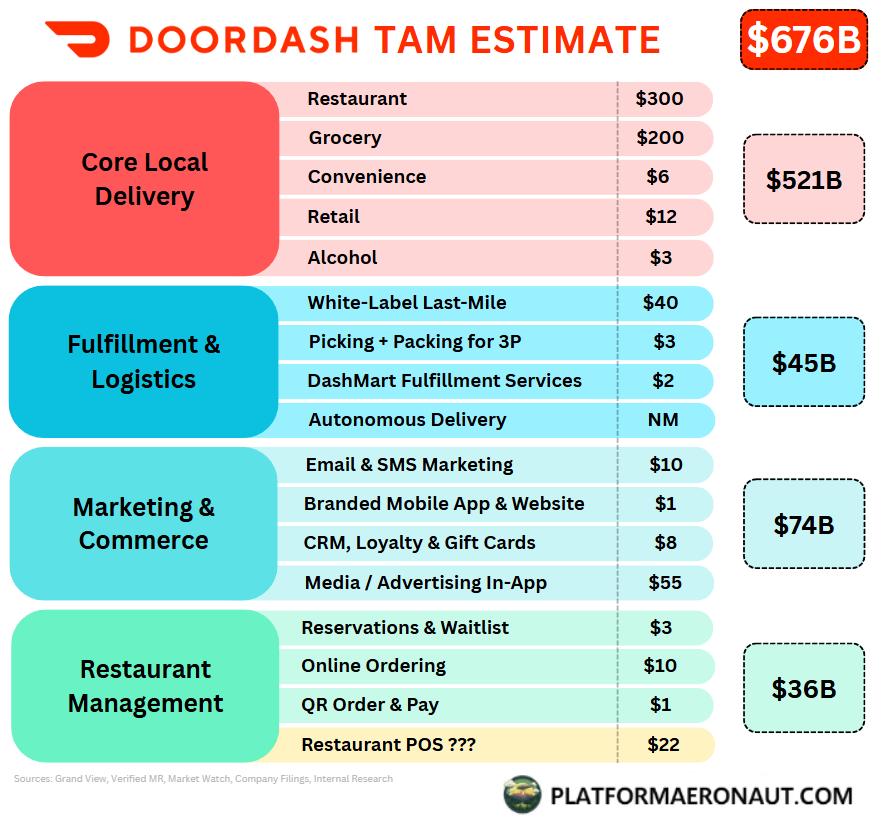

For a business that started with a hyper focus on the core restaurant delivery market in the United States, we’ve come a long way. Back when DoorDash filed for an IPO they identified a rough TAM of $302B based on total off-premise food consumption in the United States. Fast forward 5 years and by my estimate that TAM has more than doubled to $676B once you add in all the other segments, focuses, and opportunities that they’re focused on addressing:

Core Local Delivery

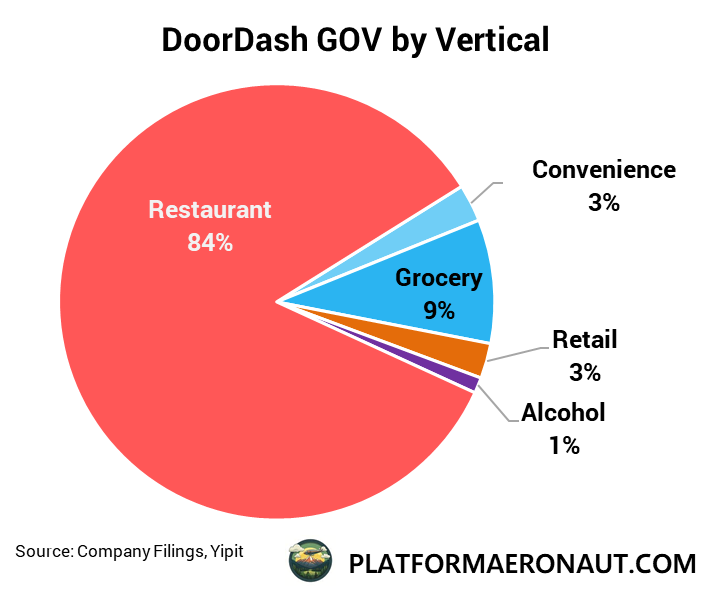

The biggest component of local delivery started and remains within restaurant delivery. It’s why consumers originally download the app and why they continue to use it more than 1x per week to order food to their home or office.

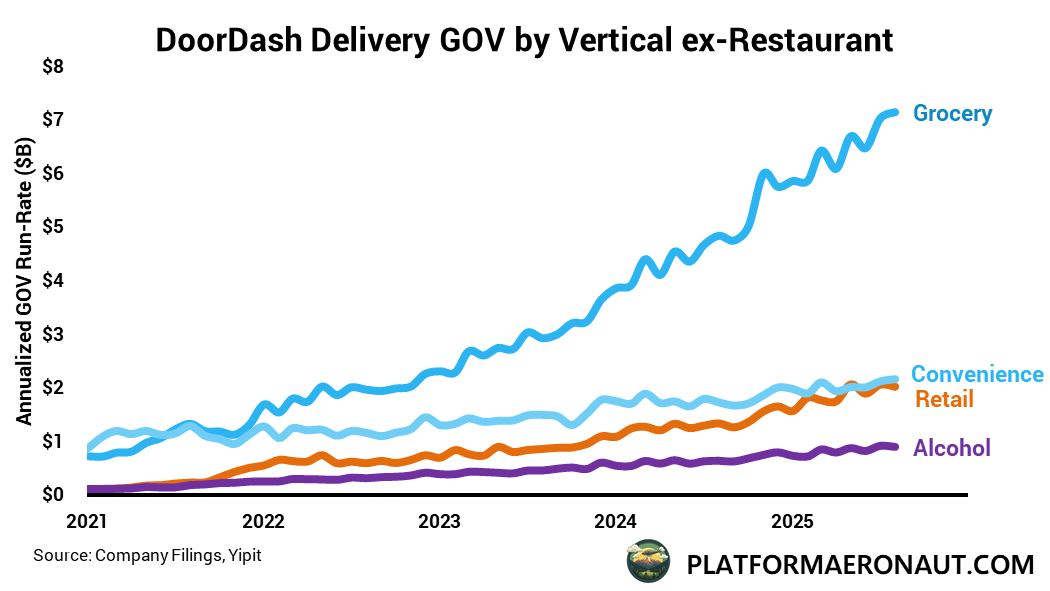

And this global delivery TAM and all of these numbers can get supercharged by continued internationally expansion with Wolt and the Deliveroo acquisiton. Beyond restaurant delivery though, when you look under the hood at those various components separating out restaurant delivery you can see over time the growth in grocery and retail (albeit off small bases):

While grocery has reached an over $7B GTV run-rate, the big question is about ability to continue scaling and the use case here. While the death of exclusive inventory and the rise of grocery cross listing across every platform has been here and continues to grow, does DoorDash have the technology, picker/driver quality, and consumer intent to drive big basket sizes? I explored unit economics and market models in grocery delivery last month:

The challenge for DoorDash here is that the consumer intent is split into 1) weekly big basket orders, and 2) smaller basket top-up orders. Most of the profitability and the big CPG advertising dollars are in the big basket sizes (>$100/order) where Instacart tends to dominate, while DoorDash and Uber Eats have seen extensive growth in total GTV but average basket sizes much more in-line with the top-up orders (<$75). That’s not to say that DoorDash can’t continue to build a really big business in top-up smaller orders, that’s clearly the strategy behind Amazon’s expansion into fresh same-day grocery and it’s a big market.

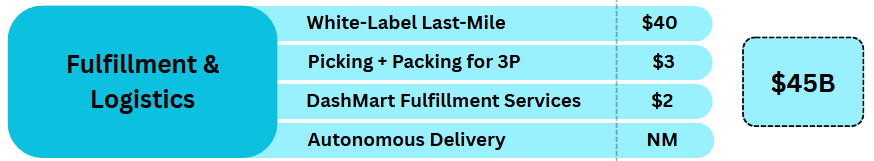

Fulfillment & Logistics

Underappreciated by the market is the white-label delivery portion of the business. DoorDash’s Drive/Dispatch is the “use our drivers, keep your customer” use-case and typical customers are multi-unit restaurants, regional grocers, DTC brands, and specialty retailers.

Retailers use it for coverage, control, and time-windows and plugs into the existing e-comm stacks so the merchant owns the session, loyalty, promos, and support policies while DoorDash handles courier selection, routing, ETAs, live tracking, proof-of-delivery, and exception handling. Beyond the pure last-mile delivery some partners use DoorDash for in-store picking (staff augmentation during peak times) and recently announced was micro-fulfillment via DashMart.

DashMart Fulfillment Services

Think of this as DoorDash’s venture into the Amazon model. Given the significant investment in DashMart’s, DoorDash has a large selection, geographical coverage, and optimized driver picking and delivery. They’ve already started working together with CVS Pharmacy and Party City and it enables retailer brands to extent same day delivery in an efficient and flexible manner. DoorDash benefits from incremental demand liquidity to optimize their network.

The entire goal behind fulfillment and logistics is making DoorDash the #1 in mindshare for delivery of anything from both a consumer and retailer perspective.

Forward-placing SKUs raises on-time rate and lowers cost per drop and enables merchants to fulfill same-day delivery even after stores close.

Dot Delivery Robot

There are plenty of competitors and Uber Eats has been testing and utilizing delivery robots for awhile, but Dot is DoorDash’s foray into 1P autonomous delivery robots.

It’s hard to put a TAM on this as it’s all pretty experimental, but the key competitive advantage from Dot appears to be speed; it can go up to 20mph for rapid neighborhood trips and delivery. It’s still an pilot-scale but could potentially be a game-changer, the value is cost/ETA improvement on shorter delivery routes.

Marketing & Commerce

The biggest component of this with the most traction so far is media and in-app advertising. Whether that’s sponsored listings, meal deals, or brand/CPG advertising, it’s already at a more than $1B annual revenue run-rate:

The more interesting components here that have an increased focus in the Dash Forward 2025 event is the continuing compilation of marketing, loyalty, credit cards, and branded apps and websites.

A large piece of this is as a result of the Symbiosys ad-tech/retail-media platform that DoorDash acquired in Jun 2025 for $175m. It’s essentially an off-platform amplification and attribution layer that allows DoorDash to go to a restaurant and capture not only the in-app advertising monetization, but the greater marketing budget a restaurant may have.

The CRM and guest experience component has been bolstered by the acquisition of SevenRooms for $1.2B in Jun 2025. It brought guest profiles/CRM, marketing automation, and some other components I’ll mention later that are more restaurant management.

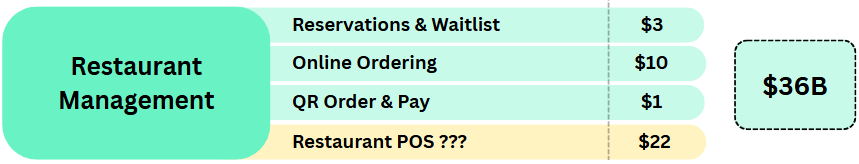

Restaurant Management

Beyond online ordering which is sort of consistent with the white-label enablement layer and mobile app/website construction, the big existing components here both came from acquisitions.

Reservations and Waitlist were part of the SevenRooms acquisition and is a real opportunity to compete vs OpenTable, Resy, Tock, and Toast Tables. It’ll be integrated into the app as a new “Going Out” tab.

QR Order & Pay came from the Bbot acquisition back in Mar 2022 for $88m and has been a bit orphaned ever since as most of the years after have been hyper focused on delivery as opposed to in-restaurant.

But there are several clues which lead me to putting a lot of pieces together on DoorDash building a restaurant and retail POS system.

DoorDash Restaurant POS?

Remember that Uber was working on a POS system awhile back that eventually got cancelled, and it wouldn’t surprise me if DoorDash is still doing so. A full POS system would enable DoorDash to push deeper into the stack and capture some of the $12-20k per restaurant economics that other POS systems capture.

One big complaint from restauranteurs about DoorDash is that in essence they are being double charged by their POS for facilitating a delivery and then again by DoorDash. Selling a POS system would help collapse and minimize some of this double charging.

Evidence of DoorDash Building a Restaurant POS called “Carte”

Dec 2021: Bbot pre-acquisition filed trademark for a Restaurant POS called “Carte”

Mar 2022: Acquisition of Bbot to Bolster In-Store Digital Ordering

Jun 2023: Report about DoorDash building a POS called “Carte POS”

Mar 2025: Continued rumors about “Carte POS” in a 2025 Industry Blog

May 2025: Acquisiton of SevenRooms building out Reservations, Marketing, Loyalty, and Table Management

Jun 2025: DoorDash hiring Global Sourcing Manager for “custom-built private label tablets and smart devices”

July 2025: Rumors on Reddit of a DoorDash POS live in San Francisco from a Restauranteur

Today: Job opening in Merchant Platform Innovation for an “exciting new confidential initiative”

Challenges for DoorDash

The biggest challenge I see is a lot of hesitation from restaurant owners to have their POS and system-of-record being run by their biggest demand generation platform. For the same reason hoteliers wouldn’t use an OTA for their PMS, a restauranteur wants to keep separation from DoorDash on the back end of the house.

Assume you run a restaurant that is 50% in-house, 35% DoorDash delivery, and 15% Uber Eats delivery today. If you utilize Toast or SkyTab today they are independent of the economics and competition within delivery. If you adopt a DoorDash POS then suddenly you may not own the data or feel independence of customer ownership or be able to negotiate take rates between Uber Eats and DoorDash as freely. Certainly you’ll save some $ as DoorDash bundles and packages to get customers in the door, but it’s not a strategy without significant hurdles and adoption challenges.

There’s also switching costs and complexity, data ownership, and rate-parity complications. Can merchants negotiate marketplace take-rates if the POS is bundled? How can I trust my main demand funnel to not screw me over once I’m locked into a POS for the next 6-8 years?

The size of the TAM is big in restaurant and retail POS but it’s not without challenges to overcome if DoorDash is actually working towards the product.

Tickers Mentioned: DASH 0.00%↑ UBER 0.00%↑ CART 0.00%↑

The information presented in this newsletter is the opinion of the author and does not reflect the view of any other person or entity, including Altimeter Capital Management, LP (”Altimeter”). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for informational purposes and should not be construed as investment advice or an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Altimeter and its clients trade in public securities and have made and/or may make investments in or investment decisions relating to the companies referenced herein. The views expressed herein are those of the author and not of Altimeter or its clients, which reserve the right to make investment decisions or engage in trading activity that would be (or could be construed as) consistent and/or inconsistent with the views expressed herein.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Unit economics look great, but that doesn't translate into a great investment.

Since 2022 the company has allocated ~$2 billion to share buy backs, yet the share count has increased by 20%, diluting shareholders significantly.

How can that be?

Stock based comp has a run rate of ~12% of top line revenue! And that's just at the level it is booked at - by the time it vests it will cost the company and it's shareholders far more than that. But management don't want us to focus on that.

Free Cash Flow margins look good in the high teens after having added back SBC (we all know compensation isn't a real cost of the business, right?!?), but Operating Margins which include an understated SBC cost of low single digits, don't meet the hurdle rate of any intelligent investor.

Returns on capital at <2%, I wonder why. Maybe because most capital is being used to enrich insiders at the expense of the business and its shareholders.

Did you know that Twitter was a wonderful business - in the right place at the right time. It went public in 2013 at about $45 and was taken private a decade later at the same price. A lost decade for shareholders. It never paid a dividend, so in real terms shareholders were significantly down. But guess what... Jack Dorsey, its CEO, took his personal wealth from zero to $4.5bn over the same period.

History doesn't repeat but it rhymes. Caveat Emptor!

The POS speculation is fascinating - the evidence you've compiled is pretty convicing. I think the biggest challenge will be convincing restaurants to consolidate their tech stack with their primary demand channel. The analogy to OTAs and PMS systems is spot-on. However, if DoorDash can bundle it attractively with lower take rates and better data integration, smaller independent restaurants might bite, especially those frustrated with legacy POS providers. The SevenRooms acquisition makes a lot more sense in this context - building a full-stack restaurant management platform. Great investigative work connecting these dots!