Navan S-1 & TMC Industry Deep Dive | A Modern AI-Powered Travel Management Company

Navan’s S‑1 shows a TMC built like software: a single platform where AI, direct content, and payments converge to pull unmanaged spend on‑platform (and gross margins along with it).

Corporate travel is a big but oddly antiquated market. Navan is attacking it like a software company: consolidating travel, payments, and expense into one AI-first platform. Before jumping into the specifics of Navan (formerly TripActions), it’s worthwhile to do a primer on Travel Management Company’s (TMC) in terms of market size, what they do, and who are the big players.

The Travel Management Company (TMC) Industry

$2.1T Global Corporate Travel Spend

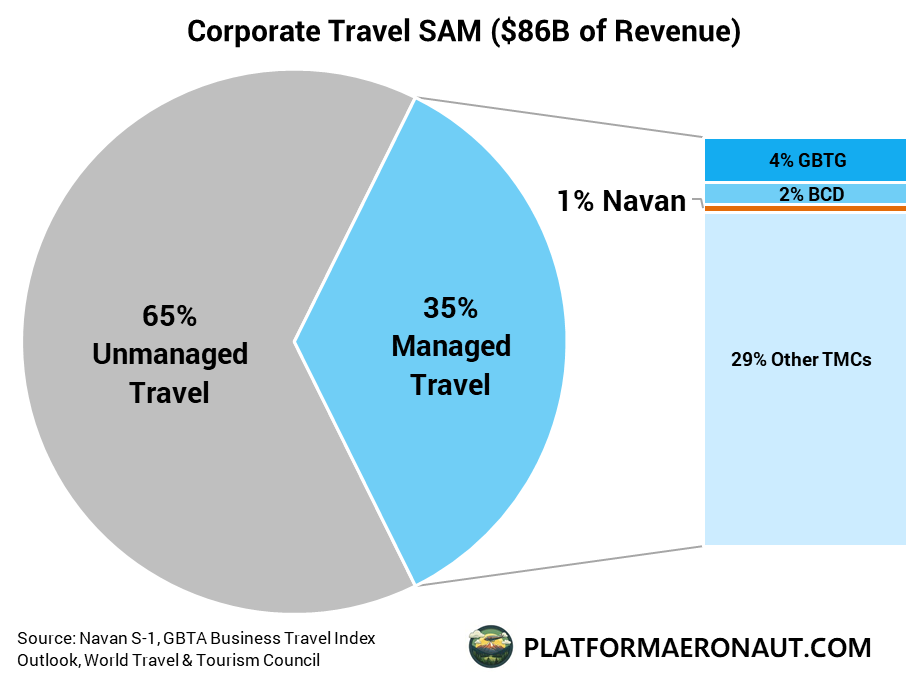

Global spend on corporate travel is around $2.1T depending on the sources, and if you map that into what’s the addressable for Navan they say the current servicable TAM for the business is $185B across business travel management (managed & unmanaged), “bleisure”, expense management, and payments. The business travel slice alone implies an $86B revenue opportunity at Navan’s 7% usage yield. Importantly 65% of that travel is still unmanaged which is SMB-focused, green space to expand, and the fastest growing cohort.

To provide a quick definition here on managed vs unmanaged:

Managed Travel: A centrally governed program where employees book through approved tools/TMCs under enforced policies, with negotiated rates, consolidated payment, duty of care, and reporting.

Unmanaged Travel: Employees book independently on consumer/direct channels with minimal policy enforcement, no centralized contracts, and fragmented payment/data.

Traditional TMCs play in the managed travel space but the flywheel is on focusing on convertion unmanaged → managed or “lightly-managed” which is where corporates let travelers book anywhere but auto-ingest receipts/itineraries to restore data, policy nudges, and duty-of-care coverage.

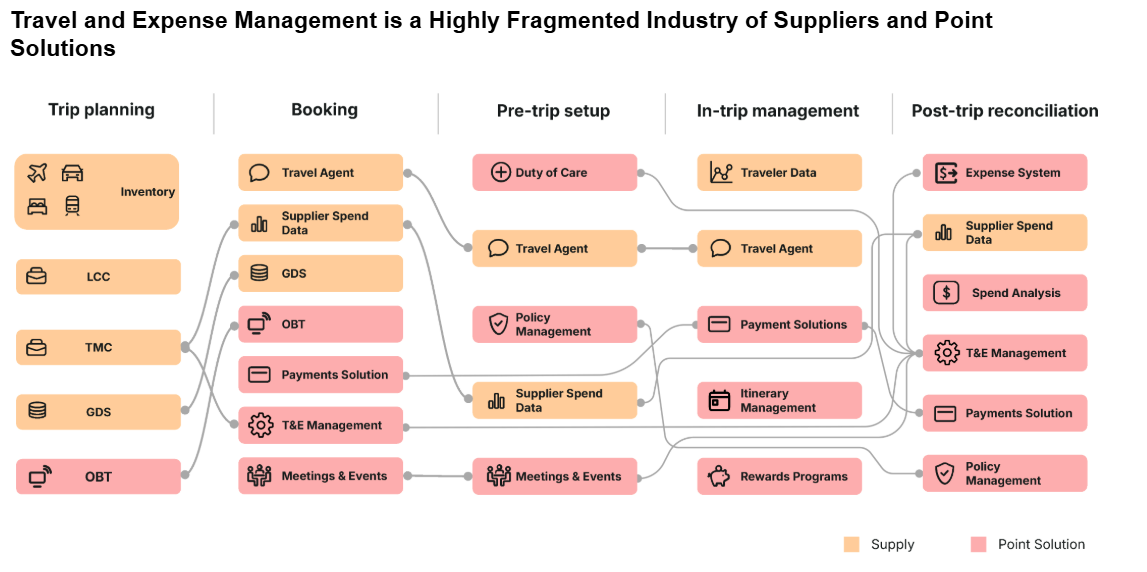

Fragmented Stack with Offline Glue

Legacy travel and expense is a bit of a daisy chain: GDS pipes, multiple booking tools, an offline TMC desk, separate expense software, separate analytics, duty-of-care, VIP, meetings & events, and often a separate payments layer. In the S-1 Navan included this fragmentation diagram to emphasize this:

Incumbents Margin Structure

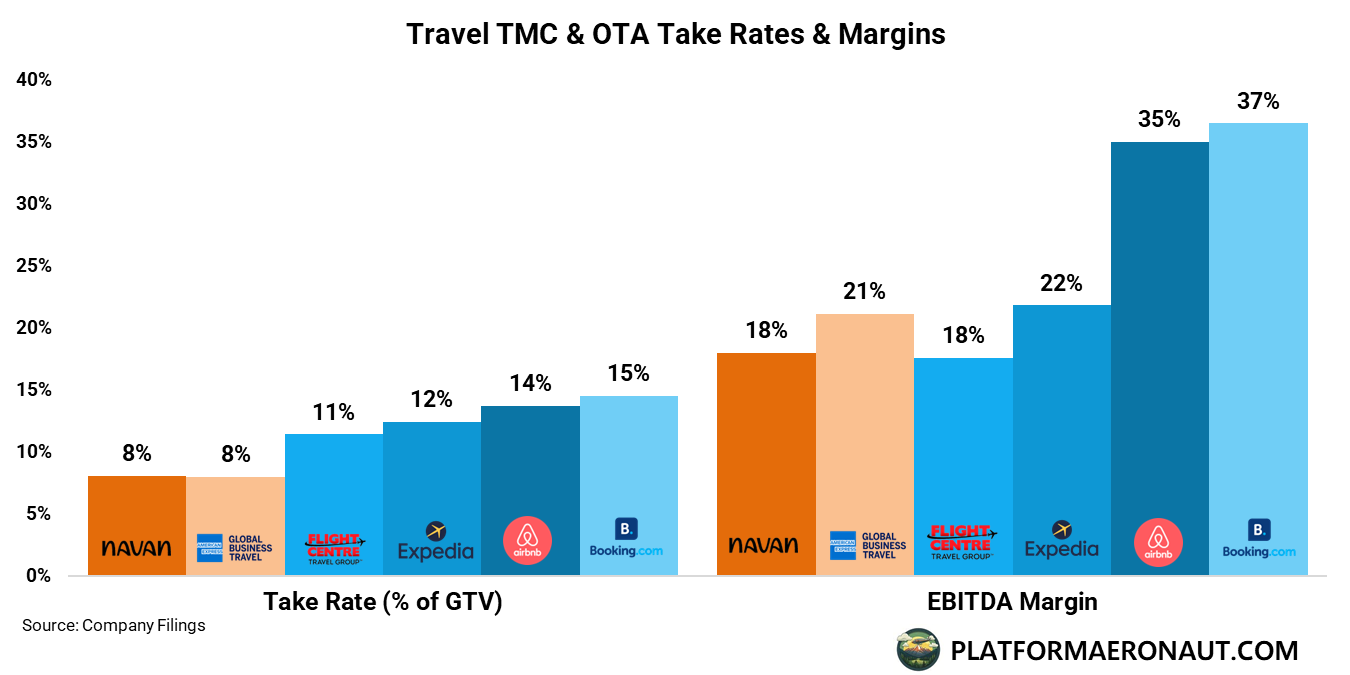

Modernizing TMCs (Amex GBT, CTM) are inching towards high 20s to low 30s EBITDA margins over time, assisted by scale and some automation. Fundamentally though, they’re still service-heavy and often roll-ups of dozens of previously independent players leaving behind a complex disaster of technology on the back-end. That margin ceiling for the legacy TMCs is the bar for a modern AI-assisted platform like Navan.

Since 2016, Amex GBT has consolidated multiple assets, including SMT, KDS, Banks Sadler, Hogg Robinson, DER Business Travel, 30SecondsToFly, Ovation Travel, Egencia (from Expedia), and Carlson Wagonlit (CWT) now). That’s a lot to digest and standardize and modernize.

At a high level Navan looks a lot today like GBTG or Flight Centre (an OTA but also has a slew of TMCs under the hood like FCM Travel Solutions). But the underappreciated margin expansion happening at Navan ought to place the bar higher for them from a margin perspective.

Navan High-Level Financials

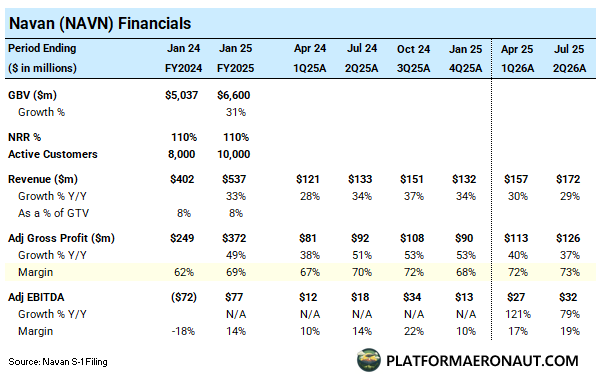

Navan is on an off-cycle fiscal year so for the below their FY2025 ended in January 2025 and for all intents and purposes is actually 2024.

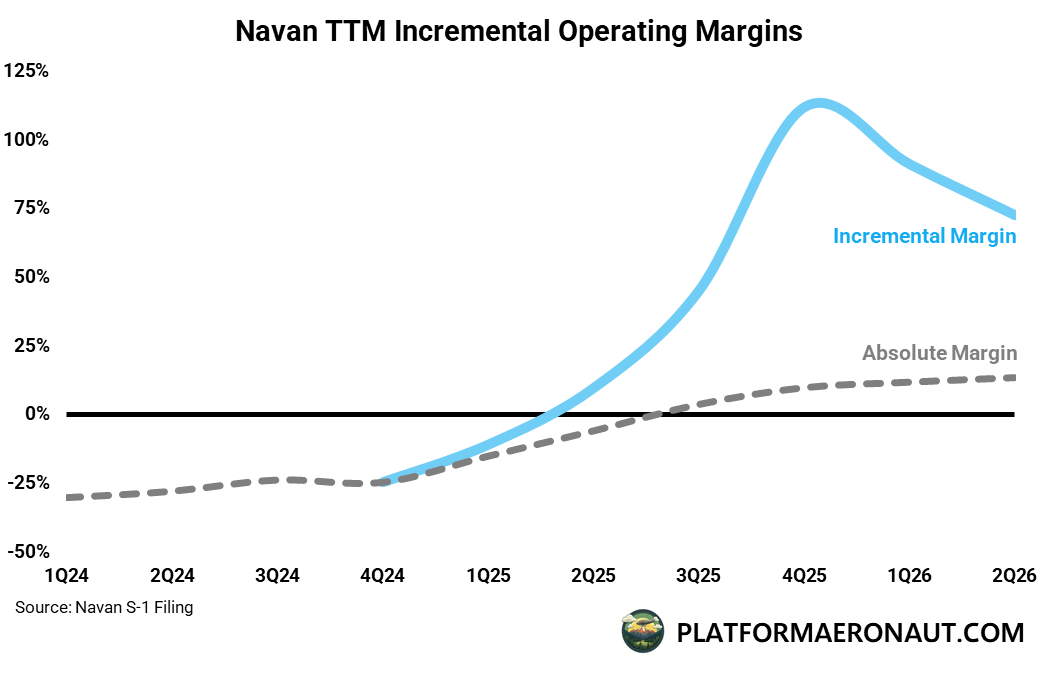

At a high level we have a business growing 29% last quarter with an NRR of 110%. With the corporate travel space growing 6-8% annually that NRR demonstrates the land and expand flywheel that is delivering above core industry growth for existing customers. That makes sense given the more tech forward customer base Navan focuses on. The company hit adjusted EBITDA profitability last year as the AI tailwinds and scale it’s hitting allow fairly high incremental margins:

The breakdown on revenue is that 90% is usage-based (from generating bookings), while only 10% is subscription based (mostly expense management). The majority of the revenue model for Navan comes from enabling travel bookings.

Gross Margin Expansion

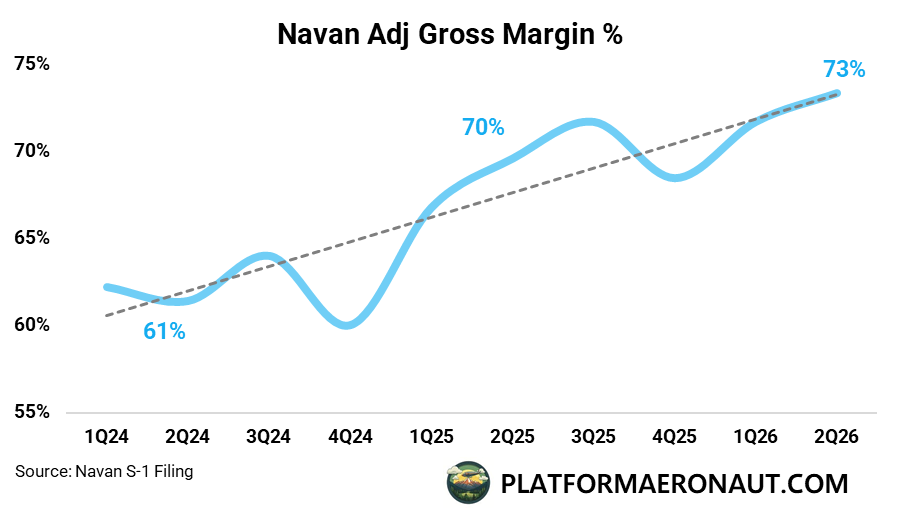

The most notable thing on the financials beyond growth is the non-GAAP gross margin expansion from 62% in FY24/CY23 to 73% in 2Q26 ending July 2025. From the S-1:

“Our proprietary AI framework, Navan Cognition, significantly enhances support capabilities and has improved our gross margins, while leveraging powerful technology capabilities across our platform, making Navan an increasingly formidable competitor. For example, our AI-powered virtual agent chatbot, Ava, handled approximately 50% of user interactions during the six months ended July 31, 2025. Our gross margin improved from 60% in fiscal 2024 to 68% in fiscal 2025, and improved from 67% for the six months ended July 31, 2024 to 72% for the six months ended July 31, 2025.”

The Growth Flywheel

The flywheel today from a financial perspective is:

Keep adding new customers and penetrate both the managed and unmanaged corporate travel market. From 2023 to 2024 they added 25% more active customers.

Continue to drive NRR of 110% or above.

By doing both of those things you can sustain a business growing north of 20% for a long period of time as they penetrate the market. 10% NRR contribution + 10-25% customer growth = >20% top-line growth with huge incremental margins from automation and scale.

The Special Sauce: What’s Different Here?

Think of Navan as three layers working together:

An agentic AI layer to automate support and decisions

A cloud supply and payments graph to maximize compliant choice and monetization

A unified UX/pricing model designed to pull unmanaged spend on-platform

Agentic AI (Ava + Navan Cognition)

Navan’s AI agent Ava absorbs 50% of interactions and has been delivering huge gross margin improvement (10% over the past 1.5 years!). This automation displaces high-tough agent work and is a big unlock versus legacy competitors to move away from a huge bank of customer service agents.

Their cognition framework is a supervisory, graph-based agent framework that marries ML personalization with LLM reasoning. It routes tasks (search, rebook, cancel, policy adjudication, expense coding) across specialized virtual agents with compliance and fact-checking gates. Through this you get fewer hallucinations and the ability to handle real actions (not just chat support).

All of this shows up in the metrics for customer support:

Overall CSAT score of 96%

Virtual Agent CSAT score of 78% (on par with human agent performance)

NPS of 43

50% of user interactions handled by Ava

What it Matters: Every percentage point shift from human support to AI compounds across millions of transactions. It hits COGS first (which we’re already seeing), then enables faster customer ramp time, higher adoption, and more GBV through the platform.

Navan Cloud: Supply, banks, and direct rails in one pane

Navan’s bread and butter versus competitors is a huge variety of direct connects versus heavy reliance on the GDS.

Supply Aggregation: access to 600+ airlines across (GDS, NDC, direct-connect), 2m+ hotels (across OTAs/GDS/direct-connect), 40+ rail partnerships, 40+ car rental, and 45+ black car providers. Direct + API inventory is increasingly strategic for TMCs as NDC proliferates. And as there’s is the potential for MCP or even further direct access methods for inventory and booking, it places Navan in a superior competitive position to legacy competitors.

Payments Fabric: Connections to major networks and 200+ banks with multiple issuers and it’s own corporate cards through both American Express and BrexPay for individual bookings.

Why it Matters: Navan has built the anti-GDS architecture by in aggregate broadly plugging in direct content where it exists and providing one system of record to both traveler and finance department. By enabling everything in one place it raises on-platform share, improves policy compliance, and boosts usage yield. Navan is doing to legacy TMCs what Brex and Ramp have been doing to Amex and Concur. It’s cloud native and AI-enabled disruption of a sleepy legacy business.

Unified Travel + Expense + Payments (with Flexible Pricing)

From a customer perspective, Navan makes the majority of their money through usage-based pricing. 90% of revenue is usage-based (supplier commissions, per-trip fees, payment economics) vs 10% traditional SaaS fees.

Expense automation reduces tons of pain points. While Ramp or Brex do a great job, they’re a software layer on top. With Navan the policy is enforced at booking and the point of purchase with virtual cards so that expense report dissolves into automated reconciliation. For companies not ready to switch payment providers, Navan Connect pulls 3P card rails into the same controls.

Personal Travel Benefits: An underappreciated fly-wheel is that Navan also has personal travel enablement that helps lock in customers. A SDR at a company utilizing Navan can also book their vacation or personal travel and benefit from all of the same support, pricing, and rewards that the platform enables. If you get a great experience for your corporate travel, and you use it for your personal travel as well it creates significant lock-in for customer behavior.

Why it Matters: This is the core flywheel, Navan lands with travel, expands to payments and expense, drives up NRR and card spend, and lifts margins as software and AI replace manual workflows. Most importantly this helps Navan continue to penetrate the 65% of business travel that is unmanaged. That’s a much more significant TAM than merely competing for displacement of legacy TMC providers.

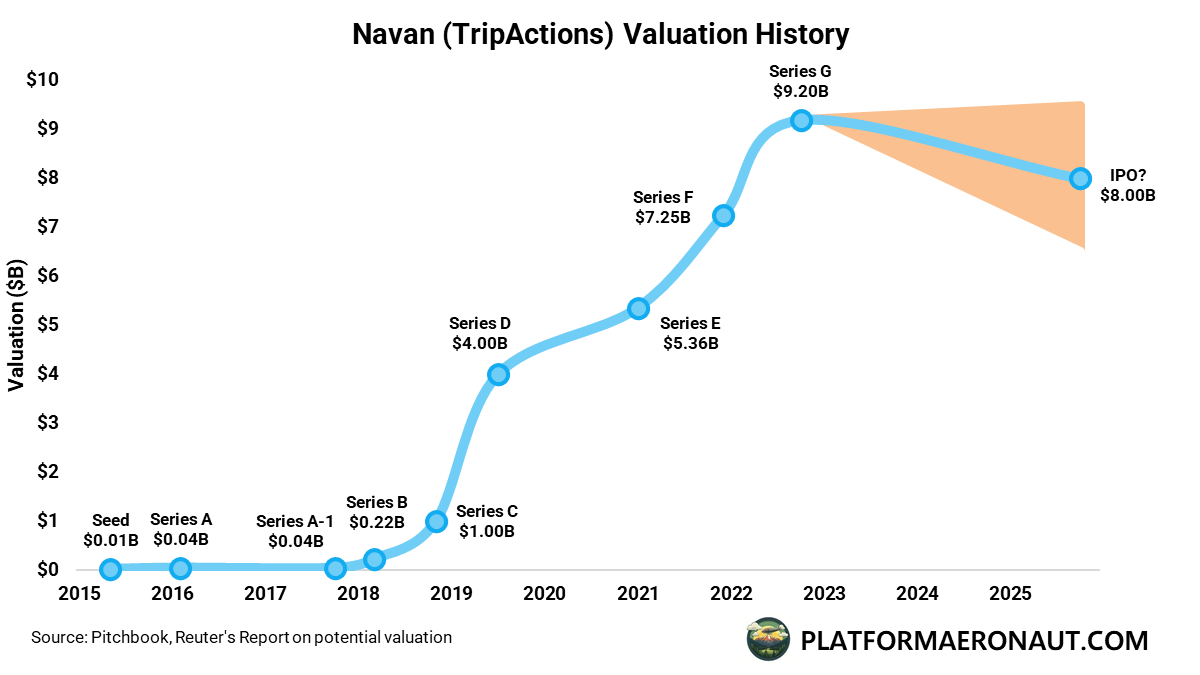

The IPO and History

Navan (formerly TripActions) has been around since 2015 but really started scaling into 2019 and then into the pandemic. They raised their last big round in 2022 at $9.2B. Reuters and word on the street is a valuation somewhere around $8B which although is a down-round IPO represents a more grounded reality.

An $8B IPO for Navan would be somewhere around 1x EV / GBV which in the context of OTAs or internet marketplaces like Uber, Lyft, or Doordash is somewhere in the zone.

That’s a significant premium to where Amex GBT is trading today (somewhere around 0.2x EV / GBV), but Amex GBT is legacy, maxxing out on margins, and isn’t growing (consensus top-line growth for this year is 2.5% and is 4.6% for next year).

The big question for Navan is whether it gets treated like a Ramp, Brex, or software company that can trade at a 8-10x EV / Revenue multiple and 35-40x EV / EBITDA or whether it trades more in-line with traditional TMCs that trade at 2x EV / Revenue and 8-10x EV / EBITDA. The answer is that we’ll see as the IPO roadshow progresses and it prices sometime in mid-October.

The information presented in this newsletter is the opinion of the author and does not reflect the view of any other person or entity, including Altimeter Capital Management, LP (”Altimeter”). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for informational purposes and should not be construed as investment advice or an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Altimeter and its clients trade in public securities and have made and/or may make investments in or investment decisions relating to the companies referenced herein. The views expressed herein are those of the author and not of Altimeter or its clients, which reserve the right to make investment decisions or engage in trading activity that would be (or could be construed as) consistent and/or inconsistent with the views expressed herein.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.