Why Does Dilution Matter? + Charts on ABNB, PINS, SNAP & Infra Software | PA Dispatch No. 7

A quick view of this week’s shifts in platforms, valuations, and AI adoption. Numbers, context, and curated reads you can use.

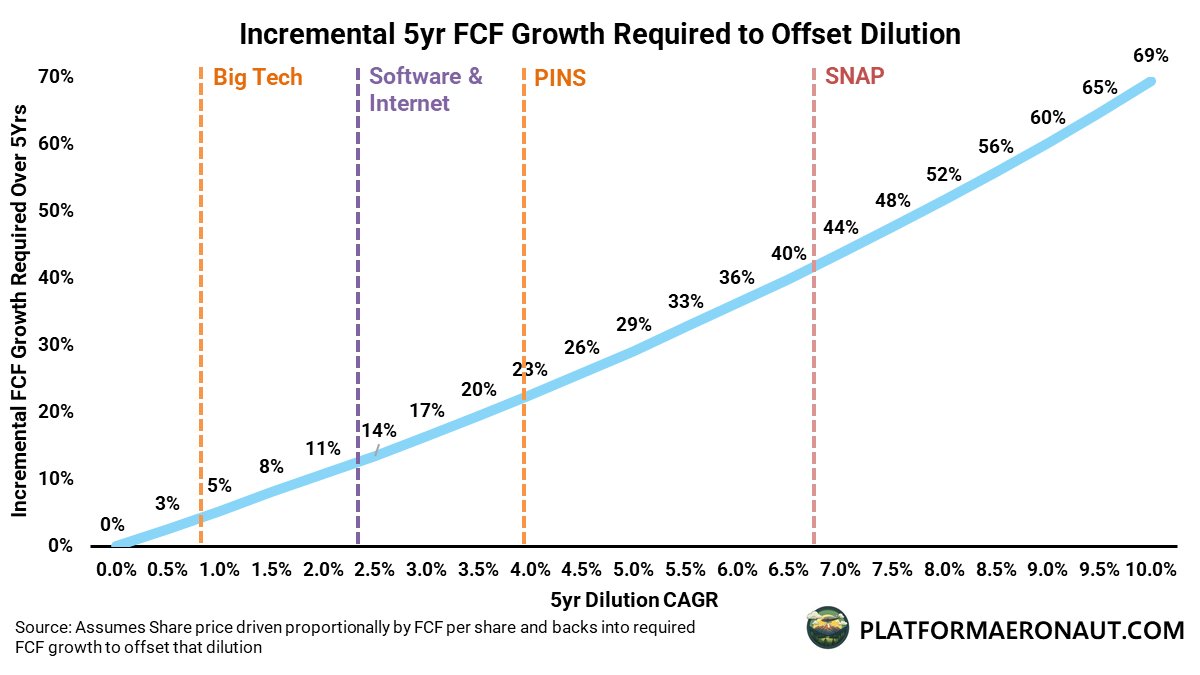

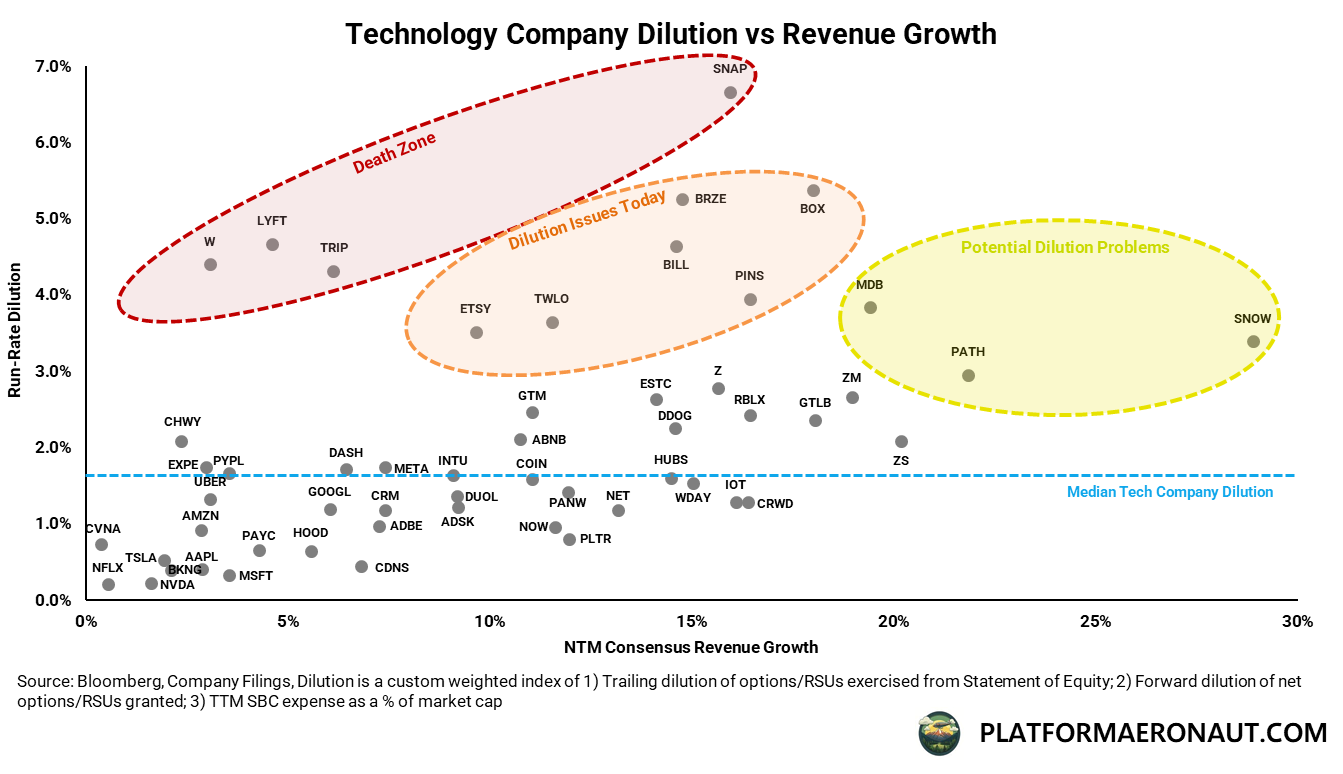

In a market increasingly focused on next quarter and momentum it’s easy to ignore dilution. Calculating it also can be a big hand-wavy and there’s several ways to do so. But why does it matter? To simplify it to the extreme assume you have a company valued off FCF per Share, what does incremental FCF growth have to be over a 5yr period to offset differing levels of dilution?

When non-tech firms are diluting at <0.5% levels and big tech is doing so at ~1% the incremental FCF growth over 5yrs to offset that additional dilution is <5% which is a pretty reasonable deal.

But look at Pinterest and Snap, with Snapchat diluting >6.5% the incremental required FCF growth just to offset that dilution is >40%. Do longer term investors think that the high dilution levels at that company are justified by expected FCF or EPS growth?

After publishing my Q3 deep dive on dilution metrics for technology last week, I wanted to post a few more charts on specific companies that were interesting:

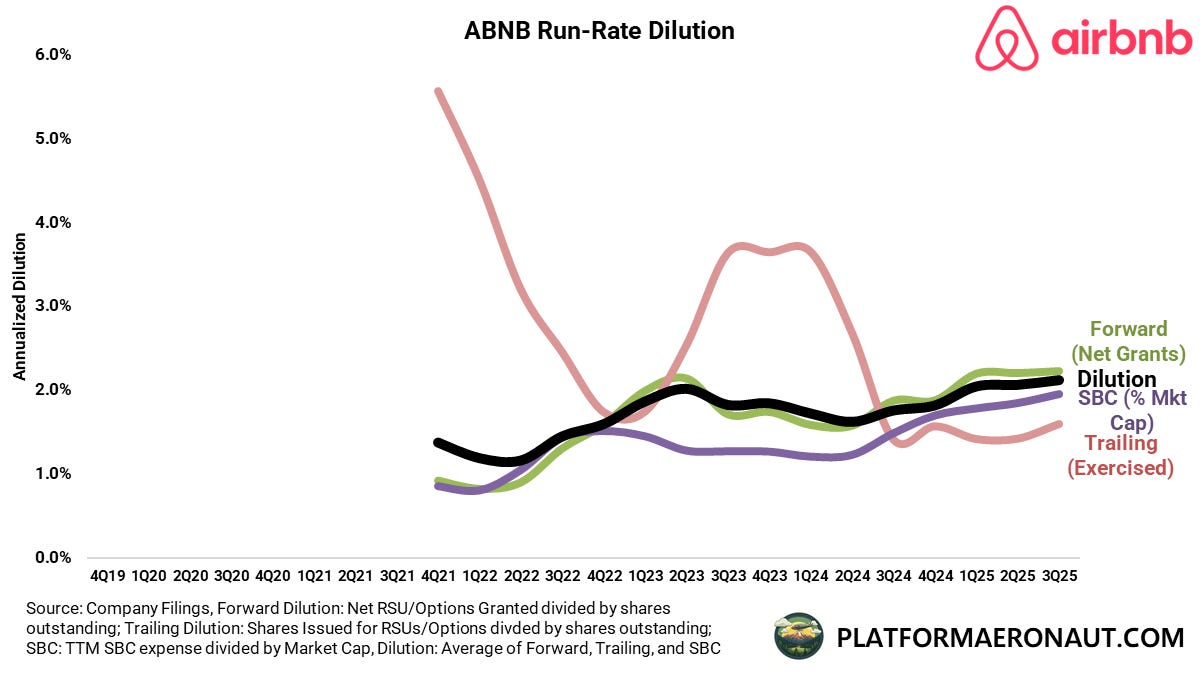

Airbnb: Worsening Dilution from New Grants

For a company that burst onto the public markets and post-covid hit long term margin targets well ahead of schedule, the dilution metrics at Airbnb have continued to worsen. I weigh trailing dilution lower than the other metrics as it’s fairly backward looking, but we’ve seen forward dilution continue to increase from <2% in 2024 to >2% so far in 2025. They’re undergoing a heavy investment cycle into experiences and services, but there’s definitely not a lot of discipline.

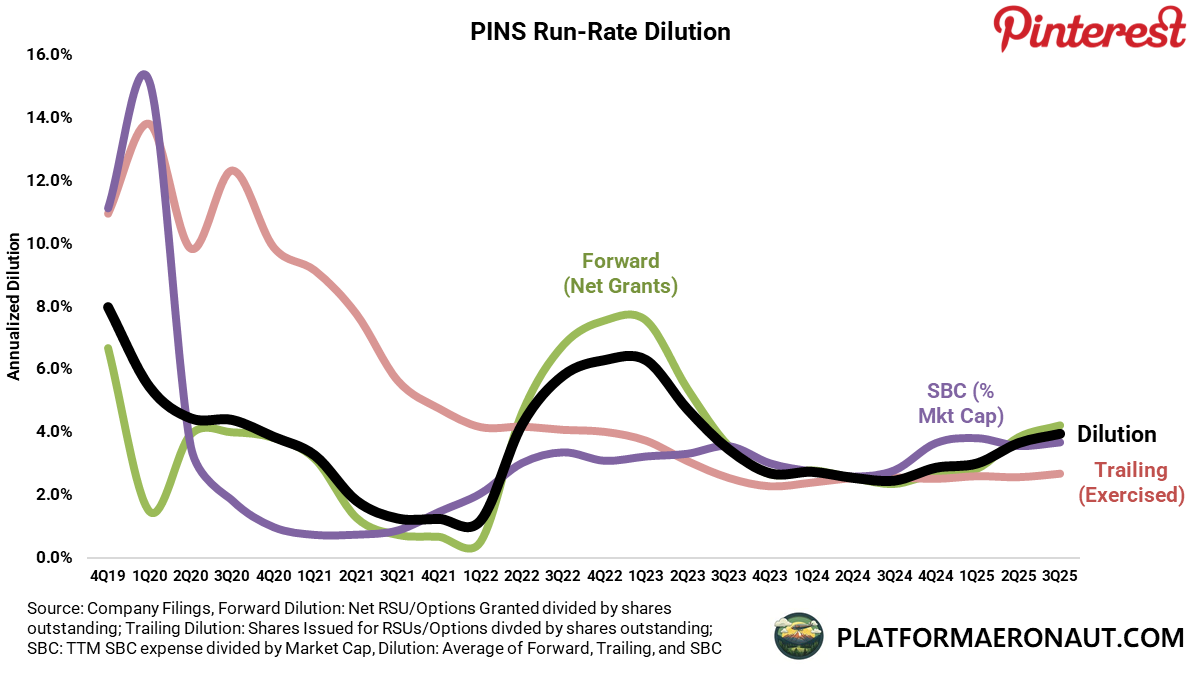

Pinterest: Recovered from 2022 but Worsening

Pinterest dilution in 2022 was particularly egregious among internet businesses but it’s been slowly creeping up again. YTD 2025 they’ve issued 26m RSUs/options versus 18m total for FY24 and FY23. And that’s with a stock that’s been dead money since 2023.

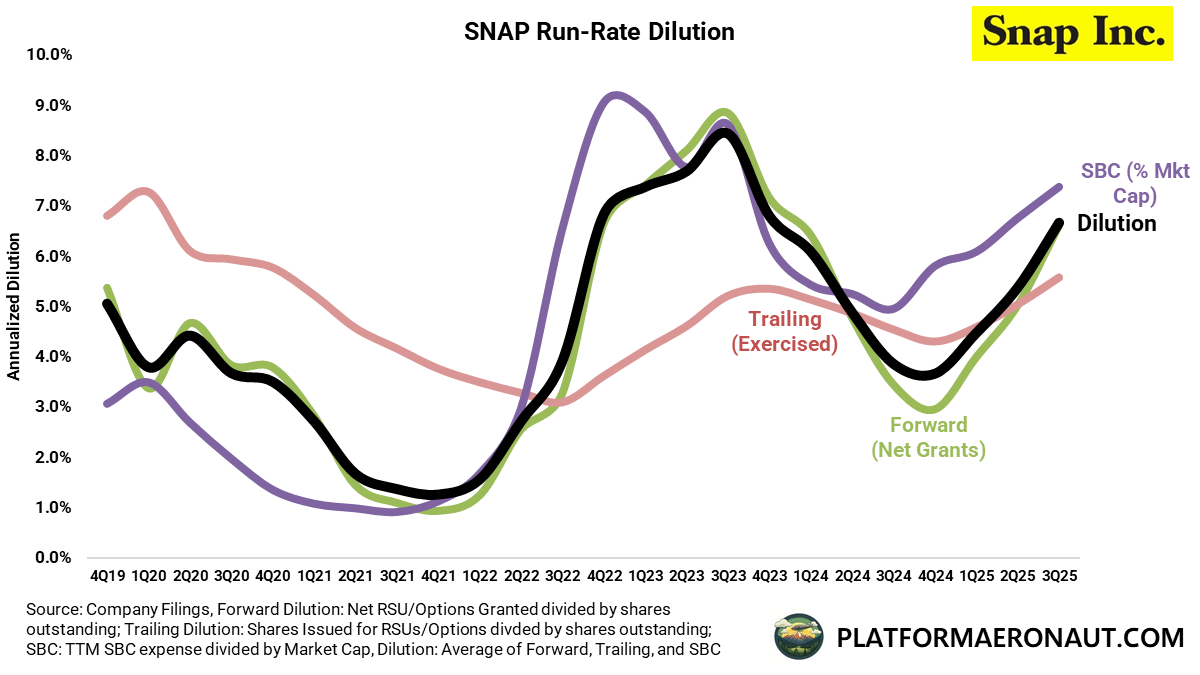

Snap: Dilution Machine Masquerading as a Public Company

Long held as one of the most egregious diluters in the public markets, Snap continues to worsen approaching 2023 levels of dilution. They’ve issued 93m net options/RSUs YTD 2025 through Q3 versus 50m for all of 2024.

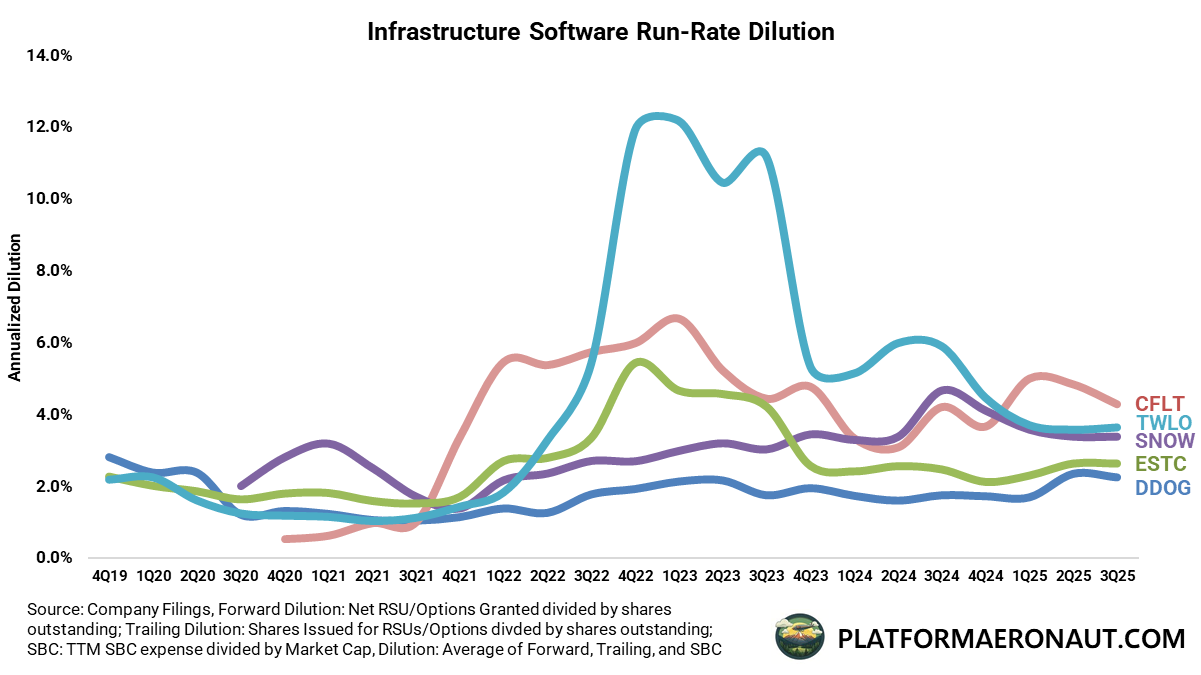

Infra Software: High Growth but High Dilution

Ignoring the 2023 chaos of Twilio slamming into a post-pandemic wall and then revamping the cost structure and dilution of the business, generally infrastructure software is diluting between 2-5%. Utilizing my first chart at the top you could justify Snowflake dilution given 27% top-line growth and similarly for Datadog, but Confluent is particularly bad for a mid-teens grower (on consensus), and Twilio remains ugly for a 10% grower.

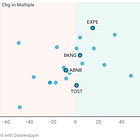

All of this can be rolled up into a dilution vs revenue growth chart with some nice bubbles breaking companies down into potential dilution problems, dilution issues today, and what I’ll call the death zone of high dilution and low top-line growth. Companies in the death zone will find it hard to escape the weight of dilution around their neck and deliver shareholder value.

Performance & Valuation Snapshot

As a reminder these snapshots below are interactive (filter/order/search). Unfortunately substack emails present them as a stale image that you need to click through to view them so I highly recommend clicking or viewing on Platform Aeronaut if you’re coming from email.

What I Read This Week

Barry Diller on Google, AI & the future of travel search: The IAC/Expedia chair weighs in on AI-era distribution dynamics at Phocuswright.

Sabre unveils Concierge IQ (gen-AI chat for airlines): A direct-channel assistant to plan, book, service and redeem loyalty in one conversation.

Waymo approved to expand across Bay Area & SoCal: Big California footprint green-lit; CPUC approval still needed for paid rides in new zones.

Tesla gets ride-hailing (TNC) permit in Arizona: A necessary step toward robotaxi ops; not an approval for driverless service.

Kroger to shut 3 Ocado CFCs; pivots to Instacart/DoorDash/Uber: $2.6B impairment now; e-comm profit target +$400M by FY26;

Peek raises $70M; buys ACME Ticketing & Connect&GO: Capital goes to AI and category consolidation in attractions/experiences infra.

Why a Grab–GoTo merger may be too late: Strategic/market realities complicate long-rumored Southeast Asia superapp tie-up.

Recent Posts

Transcript Highlights (Exec Signals)

“More number of monthly active users in the first 9 months… twice the number compared to 12 months of last year.”

“When we generate a dollar of efficiency… the best use of that dollar is to put it back because that drives more profit dollars in the future.”

“We are replatforming our underlying tech infrastructure… the larger portion of our investment… The new platform natively comes with AI capabilities… speeding up development and personalization.”

“Travelers are increasingly willing to invest in high-quality travel experiences, highlighting strong consumption power.”

“Our international bookings grew by around 60% year over year... demonstrating robust growth despite macroeconomic uncertainties.”

“In the long run, we do not see any structural limitations to our profit margins.”

The information presented in this newsletter is the opinion of the author and does not reflect the view of any other person or entity, including Altimeter Capital Management, LP (”Altimeter”). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for informational purposes and should not be construed as investment advice or an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Altimeter and its clients trade in public securities and have made and/or may make investments in or investment decisions relating to the companies referenced herein. The views expressed herein are those of the author and not of Altimeter or its clients, which reserve the right to make investment decisions or engage in trading activity that would be (or could be construed as) consistent and/or inconsistent with the views expressed herein.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.