Experience & Mobility Platform Incremental Margins & Earnings | PA Dispatch No. 6

A quick view of this week’s shifts in platforms, valuations, and AI adoption. Numbers, context, and curated reads you can use.

Incremental Margins

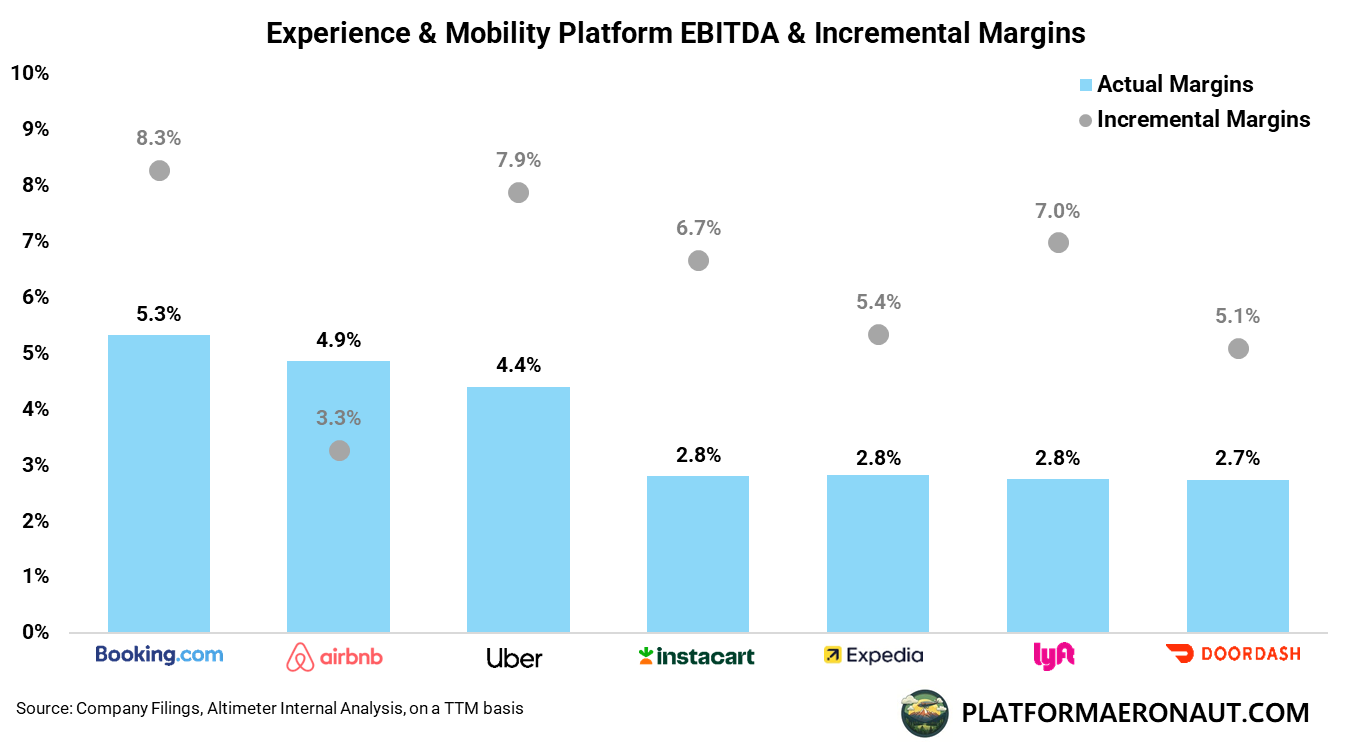

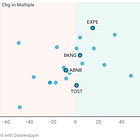

With Q3 earnings nearly wrapped for the major rideshare, delivery, and travel platforms, we’re starting to see a clearer picture of who’s compounding operational leverage and who is hitting a ceiling. Below is one of my favorite charts that captures the state of play: EBITDA margins (as a % of GBV) versus incremental margins across the Experience & Mobility ecosystem

Incremental margins show how much profit falls through from each new dollar of growth. Plotting that against absolute EBITDA margins gives you a quick read on who’s expanding efficiently versus who’s buying growth. Caveat that Instacart hasn’t reported yet so that’s still TTM through Q2 2025, but there’s a couple interesting takeaways:

Incremental margins for the majority of the space are super healthy

Booking continues to defy gravity with 5.3% TTM EBITDA margins on $185B of GBV, and still expanding. For a company that should be in harvest mode, it continues to compound like a growth stock.

Uber, Expedia, Instacart, Expedia, and DoorDash I would characterize as very solid. There’s a bit of reinvesting into the product at each, but incremental margins > actual margins = margin expansion which is what matters.

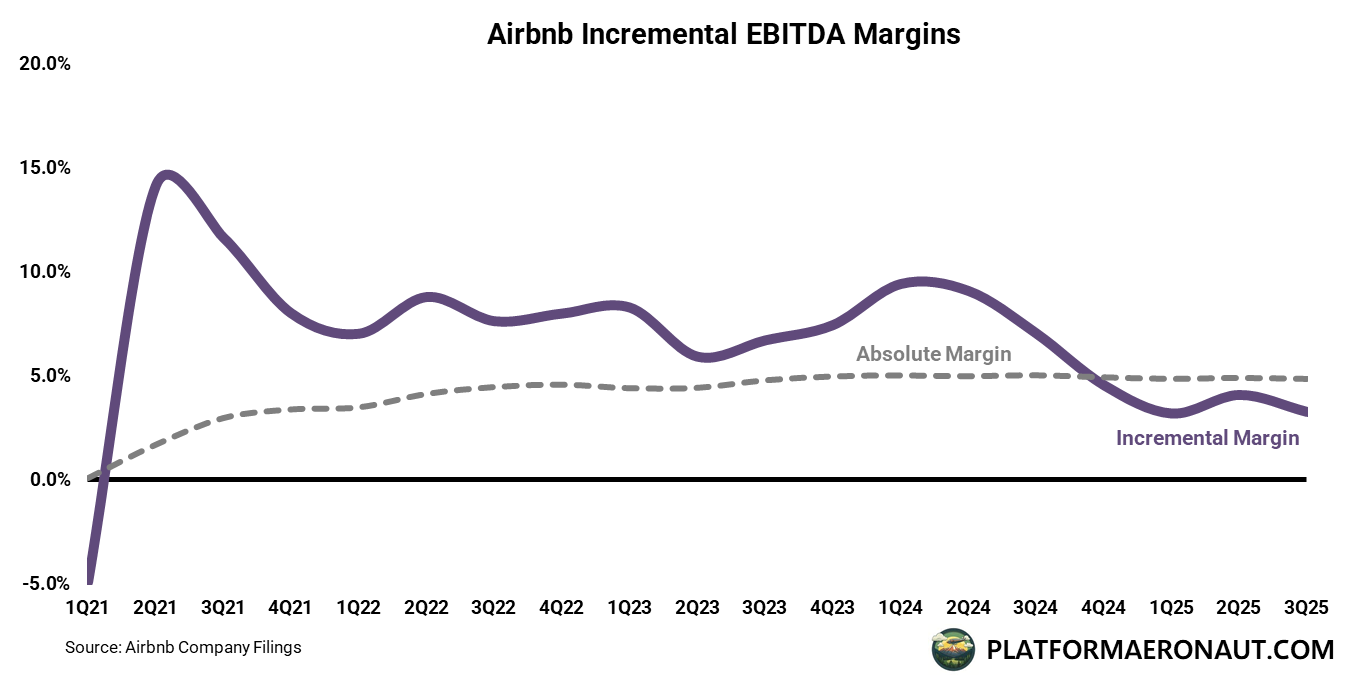

What is going on at Airbnb?

While they’re certainly re-investing into the product and trying to re-launch experiences and services and create a host marketplace, the incremental margins at Airbnb are horrendous and have consistently been getting worse:

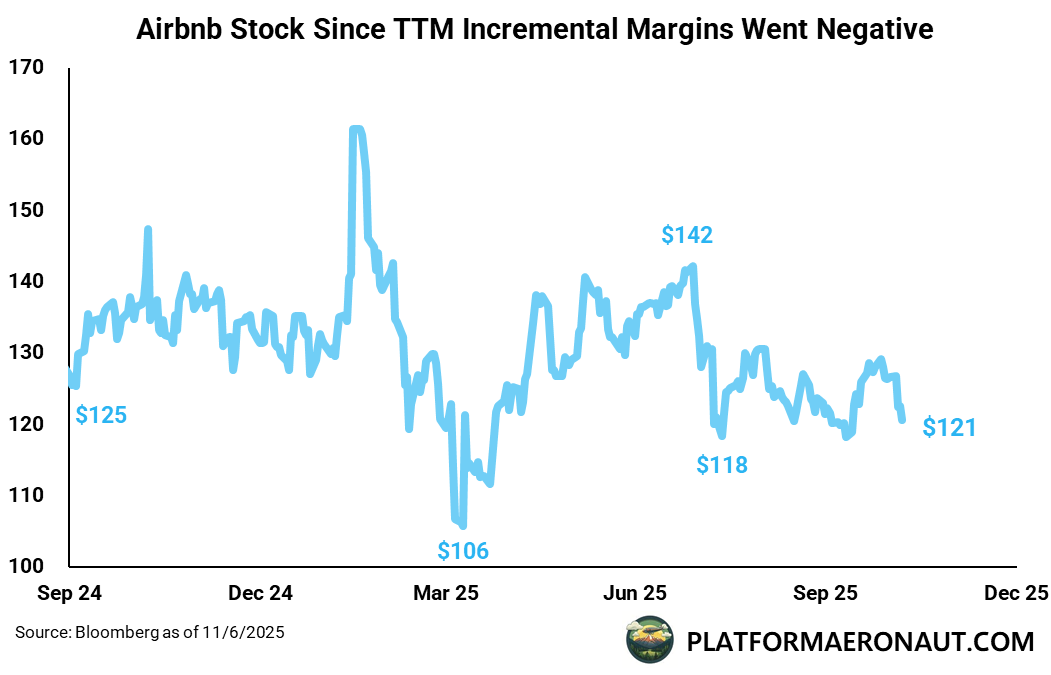

And this is while the business is essentially growing in-line with peers at Expedia and Booking. It’s no wonder that the stock has been dead money with slower growth at industry average and no margin expansion:

Is the S-curve for alternative accomodations over? Are Booking and Expedia just getting better at competing for supply and customers? Is is a struggle of affordability and value for STRs versus traditional hotels? Is it lack of hyperfocus on the cost structure? It could be a bit of all of it but it’ll be interesting to see what/if Brian Chesky and the team can do over the next 12mo with experiences and services and accelerating the core alternative accomodations market.

On the Q3 2025 call, they did hint at margin expansion next year and 2025 being a heavier investment year vs 2026:

”And as we look to ‘26, we anticipate that, one, obviously, we’re scaling the revenue associated with those businesses. And while there is ongoing investment, we don’t have the same heaviness of the kind of first year launch. So you should anticipate that across experience services across hotels, across AI, we will be investing in those next year to drive growth.”

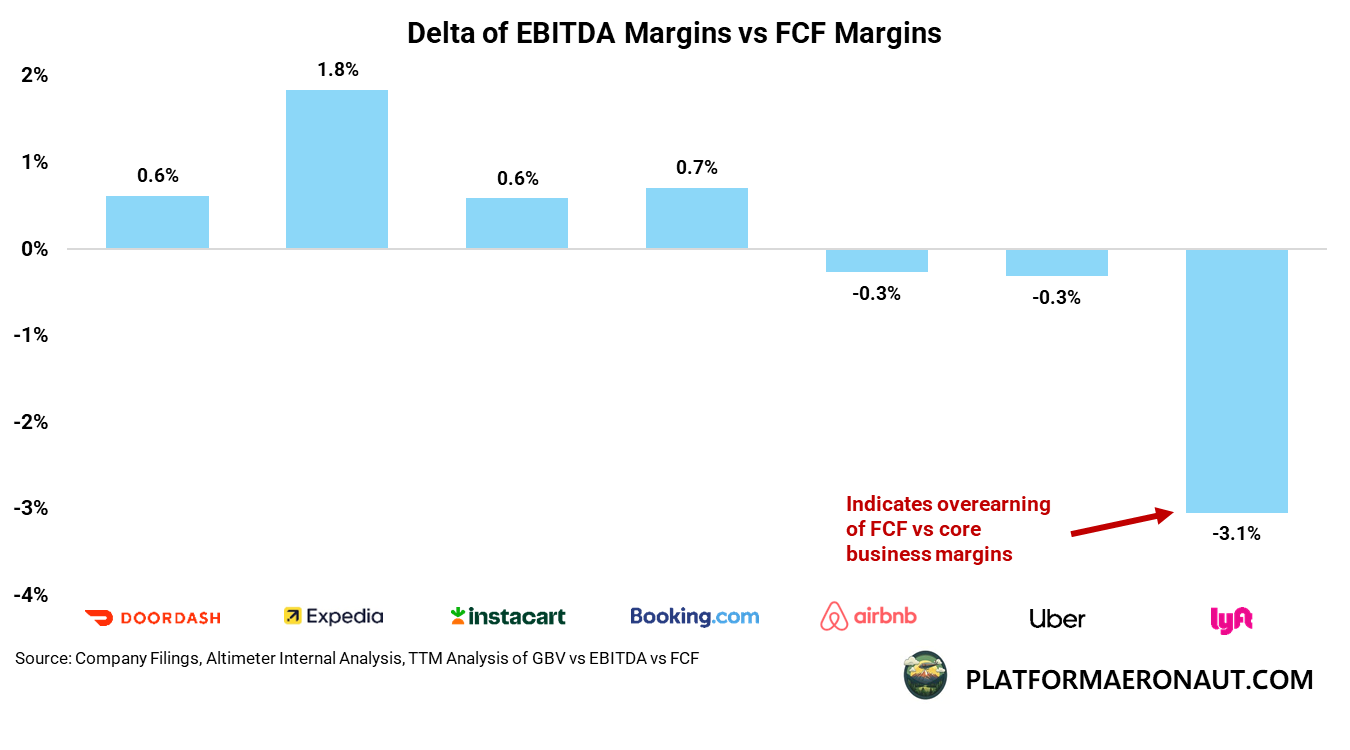

Looking at FCF Margins: Lyft Still Way Overearning

I like to look at EBITDA margins (to GBV) vs FCF margins to see if there’s any outliers, and Lyft remains the big one, generating way more FCF as a % of GBV than they are EBITDA. There’s just a significant amount of working capital benefit that Lyft is accuring that none of the other similar companies are seeing. I’d expect this to reverse and normalize over time but something to keep an eye on.

Performance & Valuation Snapshot

As a reminder these snapshots below are interactive (filter/order/search). Unfortunately substack emails present them as a stale image that you need to click through to view them so I highly recommend clicking or viewing on Platform Aeronaut if you’re coming from email.

What I Read This Week

Google’s AI Mode can now book tickets & appointments: Google expands “agentic” capabilities inside Search from info to transactions.

Amazon sues Perplexity over agentic shopping: Case spotlights governance risks as AI agents automate e-commerce workflows (relevant to travel commerce too)

Oversee & FCM add NDC “reshopping”: New corporate-travel capability auto-optimizes fares post-booking.

Waymo to expand robotaxis to Las Vegas, San Diego & Detroit: Biggest footprint yet; new Zeekr-designed vehicles coming

Tripadvisor to lay off ~20% amid TRIP–Viator merger: Boston Globe reports several hundred roles affected as brands combine.

Uber Eats × Toast global partnership: POS-to-marketplace tie-up lets restaurants run Uber ads/promos from Toast.

Kroger extends Instacart as primary delivery partner: Expanded AI-powered collaboration aims at faster fulfillment.

DoorDash will ramp 2026 tech & autonomy spend: Wall Street balks at heavier investment in robots and unified platforms.

How NYC became a nightmare for Airbnb: Enforcement of Local Law 18 slashes listings from ~60k (2018) to ~3k in 2025

From My Recent Work

Transcript Highlights (Exec Signals)

“Our philosophy has always been to reinvest back in the business”

“We have the largest audience with the most number of frequency.”

“Overall unit economics are improving across the business”

“The average cross-platform consumer is spending three times more than single-product users”

“Our partnership with Waymo continues to be excellent from an operational standpoint.”

“AV is not profitable today… but we expect that AV won’t be profitable for a few years.”

“Our win rates...are up year over year against all major competitors”

“It took us more than 10 years to reach our first billion in ARR, and just two years to double it.”

“Q3 in the summer was GPV per location exceeded expectations.”

From My Recent Work

Uber × Nuro / Lucid / Stellantis / Nvidia: The Next Phase of Rideshare Autonomy | PA Dispatch No. 5

The information presented in this newsletter is the opinion of the author and does not reflect the view of any other person or entity, including Altimeter Capital Management, LP (”Altimeter”). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for informational purposes and should not be construed as investment advice or an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Altimeter and its clients trade in public securities and have made and/or may make investments in or investment decisions relating to the companies referenced herein. The views expressed herein are those of the author and not of Altimeter or its clients, which reserve the right to make investment decisions or engage in trading activity that would be (or could be construed as) consistent and/or inconsistent with the views expressed herein.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

are you sure you have the right numbers for ABNB? how can absolute margin be so low?

The incremental margins data for Expedia is intresting. At 5.4% they're actualy doing better than some of the delivery platfroms but lagging behind Booking. Looks like their reinvestment stratgey into product is paying off without hurting profitability too much.