Uber × Nuro / Lucid / Stellantis / Nvidia: The Next Phase of Rideshare Autonomy | PA Dispatch No. 5

A quick view of this week’s shifts in platforms, valuations, and AI adoption. Numbers, context, and curated reads you can use.

Uber’s Latest Wave of AV Announcements

Uber’s latest wave of AV partnerships continues the deluge of announcements and drive towards being the dominant autonomy platform. The company recently announced an exclusive AV partnership with Nuro and Lucid with ongoing Lucid Air pilots in premium ride-hail tiers. But the more strategic move is Uber’s deepening integration with Stellantis and Nvidia, both of whom it’s collaborating with to standardize the data and simulation layer for future robotaxi deployments. Uber’s AV team is already leveraging Nvidia Drive Sim and Omniverse Cloud XR to model traffic behavior, and Stellantis has begun feeding those simulation data sets into its own in-vehicle stack built on Nvidia Drive Thor. It’s a closed feedback loop: Uber provides the real-world telemetry and consumer demand, Nvidia provides the compute, and Stellantis builds the production hardware.

For Stellantis, the partnership is existential. The group plans to roll out Drive Thor-powered ADAS and Level 3+ autonomy across 14 brands starting 2026 (Jeep, Chrysler, Ram, and Maserati among them) turning its fleet into a software-defined network of potential Uber endpoints. Nvidia’s role here goes beyond chips; it’s becoming the operating substrate for automotive AI, similar to how AWS underpins cloud computing. With Uber as a downstream mobility partner, Nvidia gains access to petabytes of anonymized ride-hail data that can train perception models at scale, while Stellantis secures an immediate commercial channel for its autonomous-ready vehicles. It’s a three-way flywheel: data → inference → deployment → monetization.

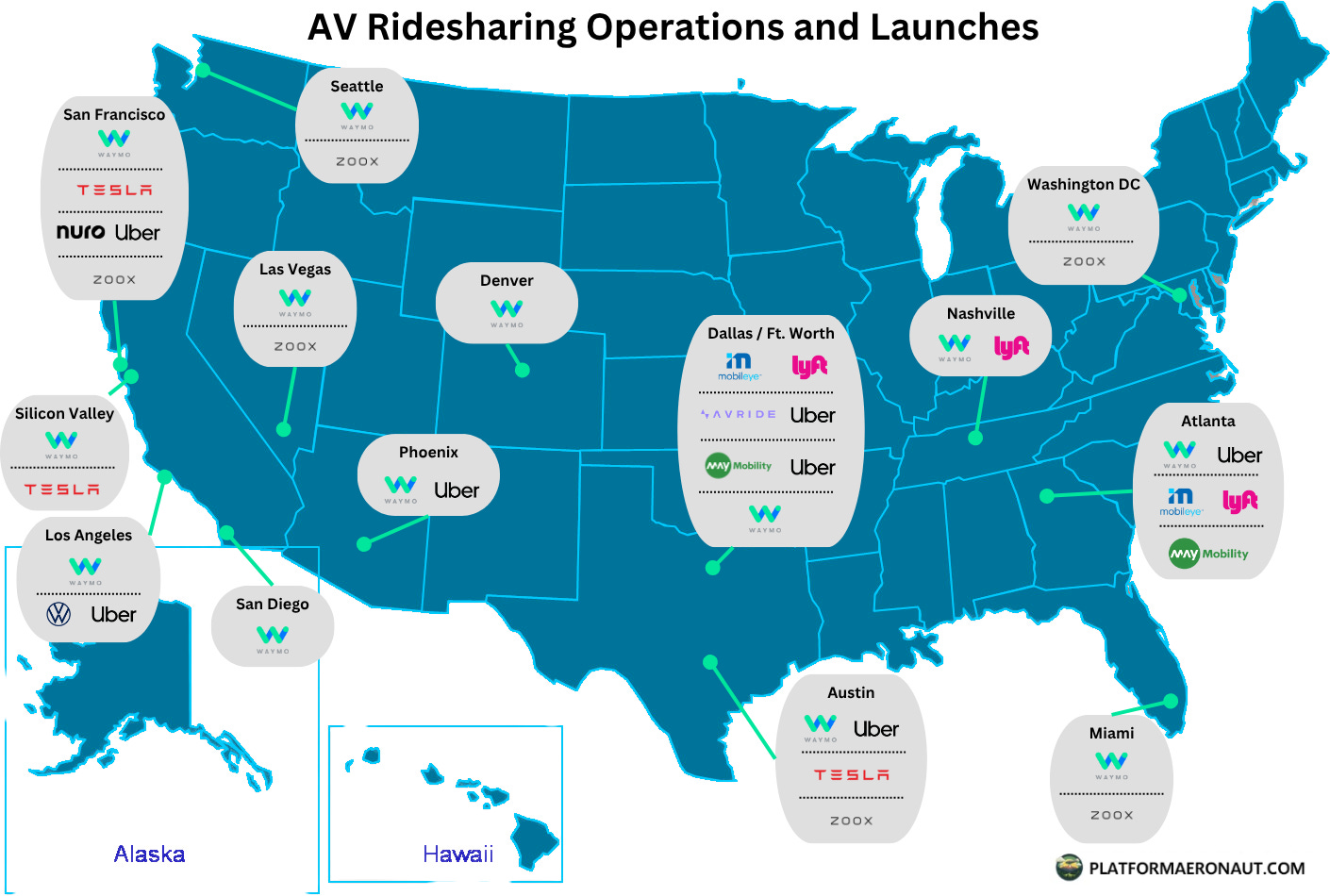

At the same time, the U.S. testing footprint is widening. Waymo is rolling out in Denver, expanding its 1P operations from California into a high-altitude, four-season environment. Zoox and Waymo are both scaling in Seattle, a key testbed for lidar performance in rain and low-light conditions. The Waymo × Lyft partnership in Nashville aims for 2026, and Zoox has announced launches and testing in Austin, Miami, and DC as it transitions from validation to early commercial service. Taken together, these deployments underscore a broader shift: the autonomous race is no longer about who perfects the robotaxi first, but who builds the connective tissue between AI models, carmakers, and consumer demand. Uber’s alignment with Nvidia and Stellantis may quietly be the most durable architecture in that ecosystem.

Performance & Valuation Snapshot

As a reminder these snapshots below are interactive (filter/order/search). Unfortunately substack emails present them as a stale image that you need to click through to view them so I highly recommend clicking or viewing on Platform Aeronaut if you’re coming from email.

What I Read This Week

Stellantis teams with Nvidia, Uber & Foxconn on Level-4 robotaxis: Production targets 2028; Uber to seed initial fleets.

Uber to take on Waymo in SF with Lucid/Nuro robotaxis: Plans point to late-2026 rollout and a broader AV scale-up.

The Next Shift in AI Distribution: From MCP to A2A: Why it matters for hotels

Grubhub pilots sidewalk robots with Avride in Jersey City: Urban navigation & reliability under test; broader city rollout eyed.

Expedia Group: new study on content & AI: Video drives decisions; travelers open to AI but still want human input.

Google hints at a deeper push into travel with agentic AI: Focus is on more “helpful” planning experiences that do more than search.

Tesla expands Austin robotaxi area to ~245 sq mi: Fourth expansion since launch; still limited fleet and waitlist.

Poll of the Week

From My Recent Work

Transcript Highlights (Exec Signals)

“The reality situation is that bookings have grown faster than our ability to deploy the appropriate growth investments.”

“We estimate now that 3.2% of global gaming bookings or revenue is going through Roblox, and that’s up from 2.3% last year.”

“We believe there’s a wonderful opportunity to share and develop what we believe is going to be the industry standard in communication for social and mobile apps,”

“As we enter the fourth quarter, we continue to observe stable levels of global leisure travel demand.”

“What we are seeing in terms of traditional search that we still see volume growth.”

“Connected trip transactions...grew mid-20% year-over-year in the third quarter.”

“Genius members book more often, convert at higher rates, and cancel less.”

“We are not just a rental car company. We are a service company delivering a dependable product.”

“Our focus has to be if we want to offer a differentiated product, our stand is going to be on customer experience.”

“Demand is held up better than many expected, but it’s uneven across segments and geographies.”

The information presented in this newsletter is the opinion of the author and does not reflect the view of any other person or entity, including Altimeter Capital Management, LP (”Altimeter”). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for informational purposes and should not be construed as investment advice or an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Altimeter and its clients trade in public securities and have made and/or may make investments in or investment decisions relating to the companies referenced herein. The views expressed herein are those of the author and not of Altimeter or its clients, which reserve the right to make investment decisions or engage in trading activity that would be (or could be construed as) consistent and/or inconsistent with the views expressed herein.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

This breakdown of Ubers latest AV moves comes at such an intresting time for AI, and it makes me wonder how quickly this 'operating substrate' approach by Nvidia will expand beyond automotive into other industries. What do you think are the long-term implications of this tight feedback loop between data, inference, and deployment, especially for smaller tech players trying to break into the market? Your analysis here is truly insightful.