Waymo+Uber Market Dynamics as Tesla Tests the Robotaxi Waters

San Francisco lessons, Austin early reads, and what consumer surveys reveal about adoption as Tesla finally enters.

With Tesla launching Robotaxi services in Austin it’s a good time to take a step back and review the market dynamics of Waymo competing so far. Rumors have Tesla’s launch being on June 22nd, likely with 5-10 vehicles in a limited scope invitation only service and teleops for control. Compare that to Waymo who has been delivering autonomous ridesharing services across four geographies for quite some time and we have a real sense of the dynamics and market impact.

Impact in San Francisco

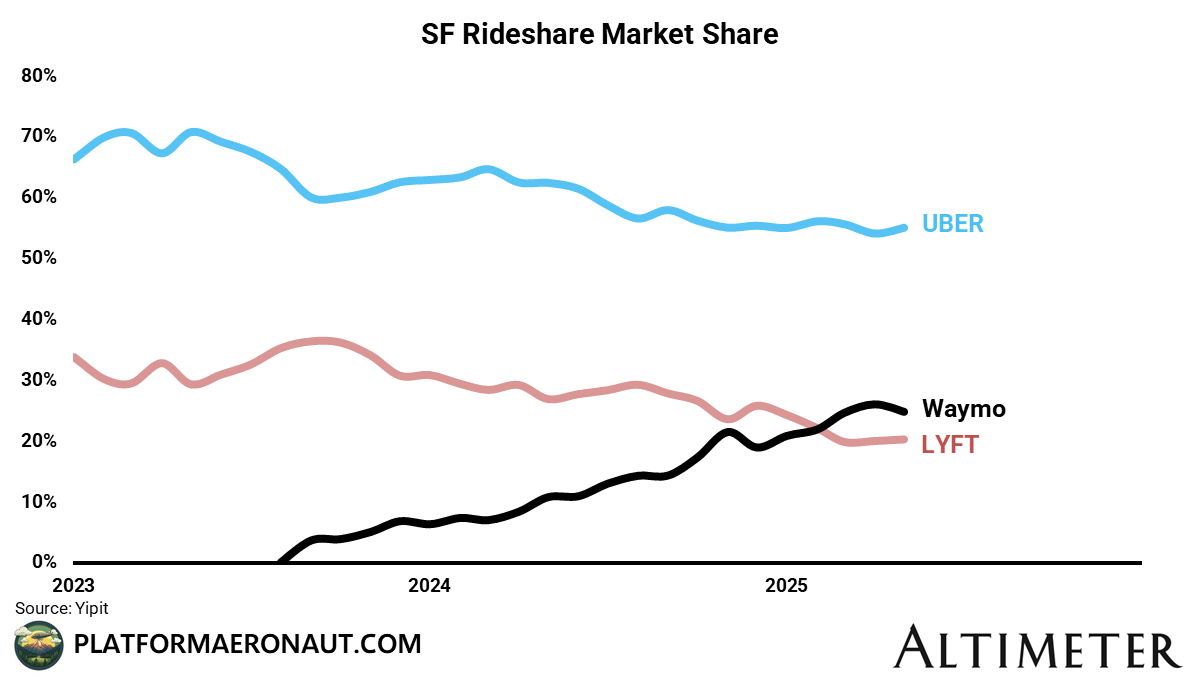

There’s been much discussion on twitter and among industry observers about the success that Waymo has achieved in San Francisco since launch. Anecdotally it’s a great service and they’ve certainly taken market share from Uber and Lyft especially. The most recent Yipit data through May appears to be demonstrating some stability in market share between the three with Waymo at 25%, Uber at 55% and Lyft at 20%.

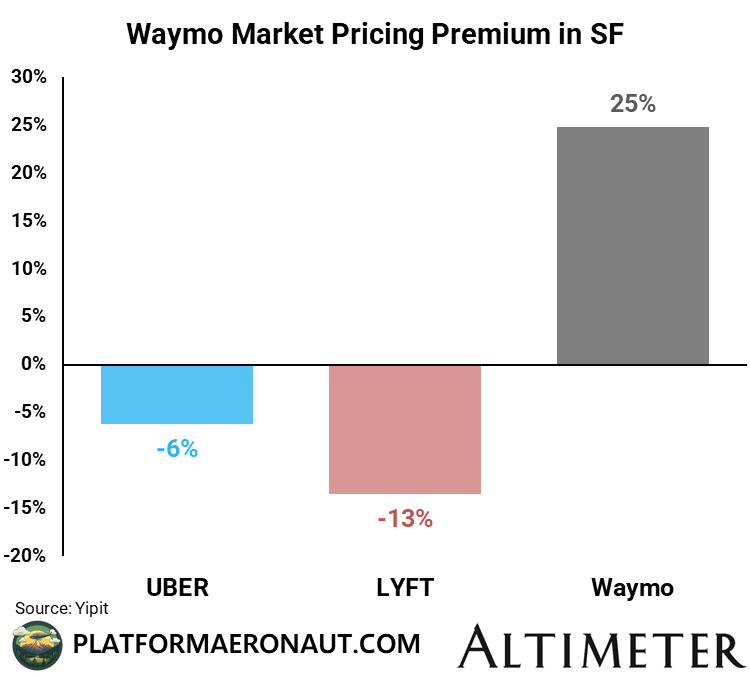

While the big competitive concern for Uber and Lyft is that Waymo is able to take such a significant market share and even more so given that Waymo appears to be pricing at a significant premium to Uber and Lyft:

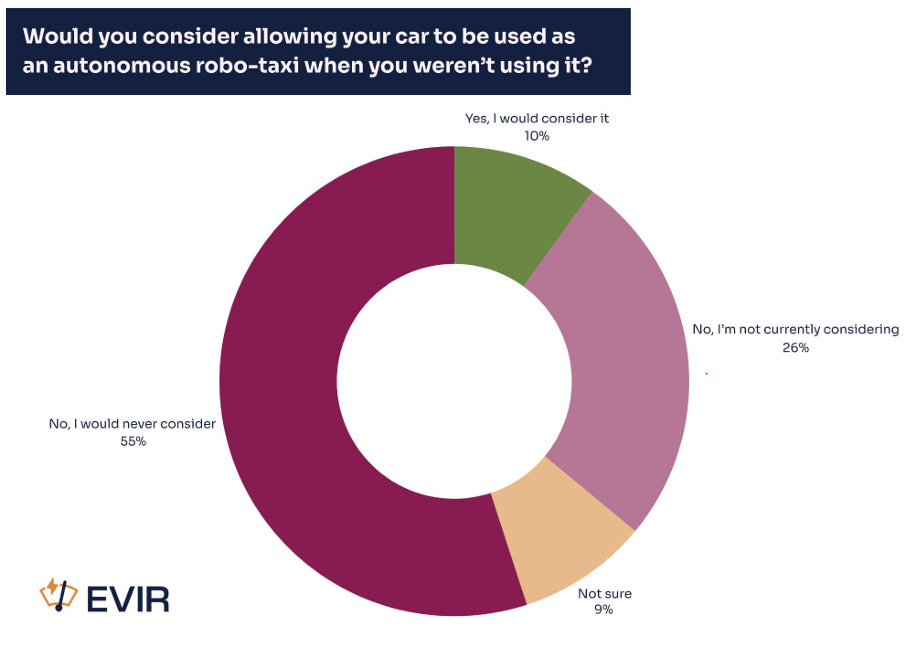

The above chart is the price difference versus the overlapping operational area average for UberX, Standard Lyft, and Waymo. The one caveat I’ll put out there for SF is that it’s a tech heavy, disruption-friendly market. There’s a reason that Uber and Lyft and Airbnb and other companies focused on the Bay Area first. Uber execs have said that denial rates for Waymo AVs in Phoenix were roughly 50% for an extended period after launch. And survey data from May by EVIR demonstrates >70% of consumers say they are not considering or would never consider riding in an Autonomous and/or self-driving taxi:

So the success of Waymo as a stand-alone competitor in San Francisco may be attributable to the unique aspects of that market. We haven’t seen quite the same level of success in LA so far. We will start to see Waymo encroach more as they expand their service zones. Just today Waymo announced expanded operations in both the Bay Area and Los Angeles.

How is Austin Developing So Far?

With Austin being the first true greenfield expansion of the Waymo-Uber tie up where Waymo’s are exclusively available through the Uber app it’s a great case study for how this could extend to other geographies.

Comparing ATX to the other Waymo operations in SF, LA, and PHX shows how quickly it’s scaling. I believe this to be a big positive proof-point for the Uber-Waymo partnership model as it’s scaling far more rapidly than any of the other markets. And when we look to pricing versus operating zone average we can see the benefit in that Uber+Waymo can maintain a price premium and Lyft has to undercut to just survive.

And if you chart the relative market share for Waymo+Uber vs Lyft in Austin you get a chart showing the combo taking share directly from Lyft. Compared to the average market share for the three months prior to launch, Waymo+Uber has taken almost 700bps of market share from Lyft:

The crux of the argument that Uber has been putting out there around it’s value from demand generation, utilization, and the benefit of the hybrid network appears to be playing out in the very early days of Waymo+Uber in Austin. But the big question will be around what happens with Tesla’s launch in a few days.

The biggest potential disruption that Tesla can provide is if they’re able to enter the market at scale with a meaningfully lower average fare. Tesla’s vertical integration and ability to drive costs down could meaningfully undercut both traditional ridesharing as well as Waymo given the high cost of Waymo vehicles today.

Here is a previous blog I had on the potential impact from Tesla and the economics of AV ridesharing.

Some Interesting Survey Results Around Tesla Robotaxi

Even after Tesla launches their beta ridesharing operationg in Austin we still won’t likely have clear visibility into scalability or the financials because all the rumors point to an extremely small and limited launch at first. 5-10 vehicles accessible to insiders only won’t really demonstrate demand liquidity or help them find the efficient frontier on pricing. So once we have additional data I’ll do a deeper dive on the success or lack-there-of. In the interim The EV Intelligence survey results from May 2025 that I referenced above had some interesting consumer tidbits about Tesla that are worth highlighting:

The Majority of Consumers Believe Tesla FSD is Unsafe

Not sure how this breaks down on party lines but there are extremists on both sides on twitter and in the media around the safety of Tesla FSD.

77% of Consumers Aren’t Open to Using Tesla FSD

The wording on this one is a bit odd because it conflates using it yourself or merely riding in a vehicle using full self-driving, but it’s still an extremely high %.

48% of Consumers Believe Tesla FSD should be illegal

This one is kind of a shocker. The fact that almost half of consumers believe FSD should be illegal is wild. Getting outside of the tech echo-chamber in the Bay Area can be illuminating when it comes to views of technology advancement.

Only 10% of Consumers Would Consider Letting their Personal Vehicle be Used as a Robotaxi

This one isn’t as surprising to me. Part of the huge bull case for Tesla is the argument everybody will lend their vehicle out to the robotaxi AV network. It’s a nice thing in theory until the first time your vehicle comes back and somebody took a dump in it or vomited on the seat.

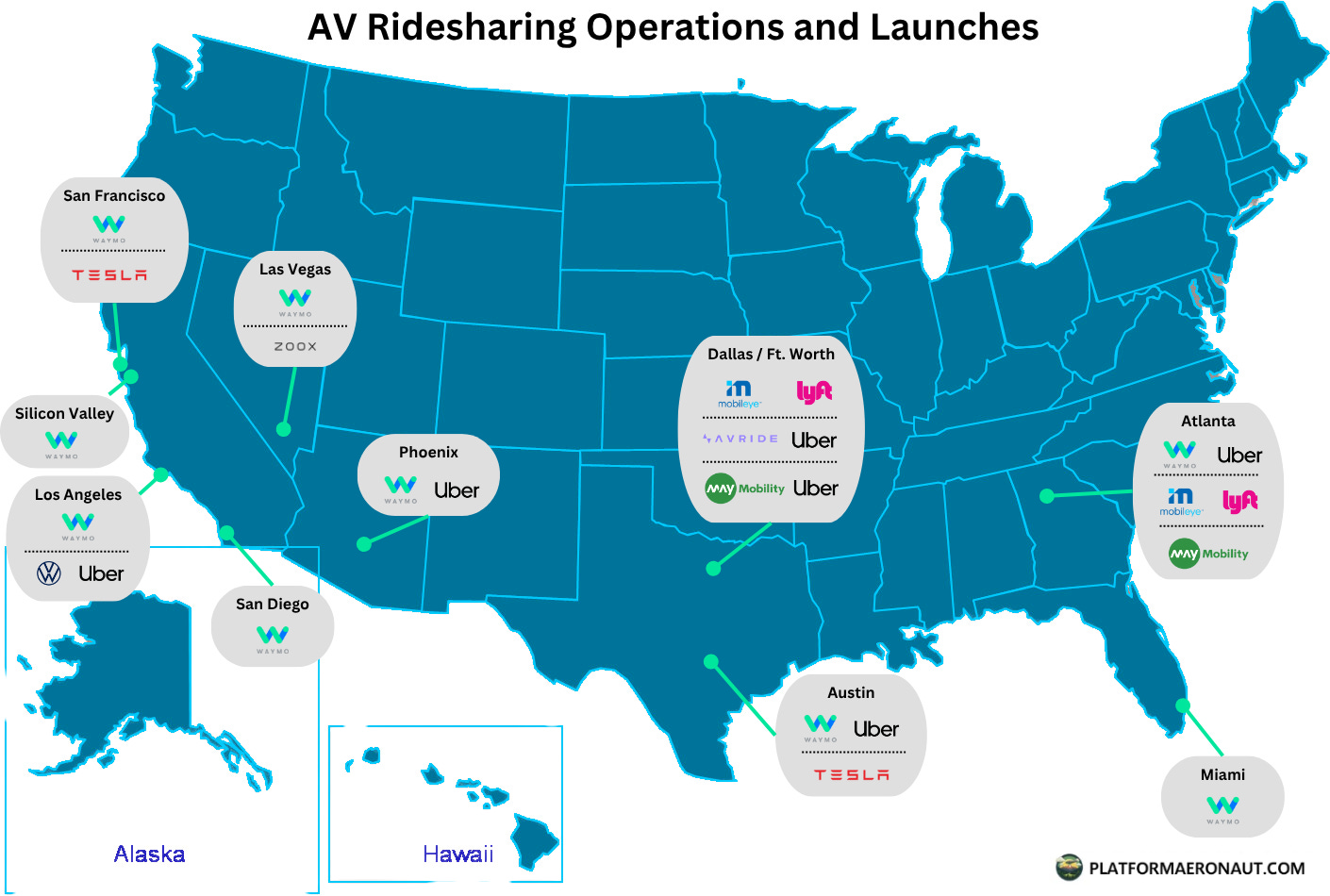

Bonus: Updated US AV Rideshare Partnership Launch Map

Here is my updated map of US Autonomous Vehicle rideshare launches and operations both announced and currently operating. The biggest changes since my February blog are:

AVRide and Uber and May Mobility and Lyft in Dallas / Ft. Worth

Tickers Mentioned: UBER 0.26%↑ TSLA 0.00%↑ LYFT 0.00%↑ GOOGL 0.00%↑

The information presented in this newsletter is the opinion of the author and does not reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for informational purposes and should not be construed as investment advice or an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Altimeter and its clients trade in public securities and have made and/or may make investments in or investment decisions relating to the companies referenced herein. The views expressed herein are those of the author and not of Altimeter or its clients, which reserve the right to make investment decisions or engage in trading activity that would be (or could be construed as) consistent and/or inconsistent with the views expressed herein.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Great analysis, thanks for sharing!

Absolutely agree on the section on consumer willingness to share private vehicles as robotaxis.

the gap between theory and consumer reality is massive here.

Most people like the idea of monetizing their idle vehicle… until they imagine the wear, hygiene issues etc.

Cars are still emotional and personal assets for many — not just financial ones.

Excellent. I appreciate your perspective.