Tesla Robotaxi: Impact on Rideshare Model

Tesla has made huge strides in Autonomous Vehicle technology and the CyberCab is coming, is it a threat or opportunity for Uber and Lyft?

When Tesla’s FSD team threw out the old rule-based models and focused on camera based end-to-end model it was a step-function change in their ability to deliver on full self driving. From an economic perspective when you go from making 1-2% monthly sequential improvements in the old model to 10%+ improvements it dramatically moves up the date at which Tesla can target autonomous vehicle ridesharing and everybody is looking forward to August 8th to see the reveal of the CyberCab.

For the purposes of this analysis I’m going to assume that Tesla a) achieves FSD b) actually produces AV/CyberCabs. Tesla has a long history of over-promising and under-delivering but clearly the market has changed it’s mind on feasability given the multiple compression to Uber over the past several months:

The AV Rideshare Opportunity for Tesla

As a reasonable base case I’m assuming that by year two we have 100k robotaxi’s operating scaling up to a fleet of 3m after a decade. ARK and others have some absolutely wild assumptions based on total miles driven but I want to frame the impact on ridesharing in what is economically feasible over the next decade. It’s not hard to imagine that autonomous ridesharing can be $165B of GBV in a decade which is approximately what global rideshare market size is today.

I’ll caveat this analysis and say it is excluding the opportunity for existing Tesla owners to make money off their vehicles because I think there’s a few challenges:

Peak Utilization of personal vehicles and peak time for rideshare trips perfectly overlap. I want my Tesla available during commute times which means I can only make it available during off-peak. If off-peak average fares are only $4-5/trip how much could I feasibly earn to make it worthwhile after Tesla takes a rake?

Headache of participation from cleaning, maintenance, and insurance. What if somebody trashes my Tesla or pukes in it?

Privacy concerns over somebody else being in my vehicle and going through my glove box

Vehicle Costs, Capex, Lifespan and Trips per Day

Vehicle Cost: $25,000 Let’s take Elon at his word that the CyberCab will come out at a $25,000 MSRP

Lifespan: 4 years / 200k Miles These vehicles will be run roughly and constantly with a lot of charging so a reasonable base case here is they last 4 years / 200k miles before requiring replacement. If the CyberCab has no pedals and no steering wheel it’s hard to imagine there is any residual value and so depreciation is just 25% a year over 4 years.

Capex: $100B With a 4 year lifespan and a goal of 3m robotaxis operating by year 10 you need to purchase ~4.5m vehicles to achieve 3m net of retirements. At $25,000 a pop that’s $100B of capex required for the fleet. If Tesla owns and operates 100% and they’re charging a 12% margin on each vehicle then that $100B goes to $88B.

Trips per Day: 19.0 Waymo today is doing 13 trips per day but they’re subscale. Estimates for physical drivers range from 10-20 a day but average closer to 12. If you take minutes per trip today of 15-16min, add in 15min of buffer to get to next rider you get a theoretical maximum of 40 trips per day. But we need to account for downtime for cleaning, charging, maintenance, and demand (you don’t want the full fleet operating at 2am), so you end up with ~19 trips per day.

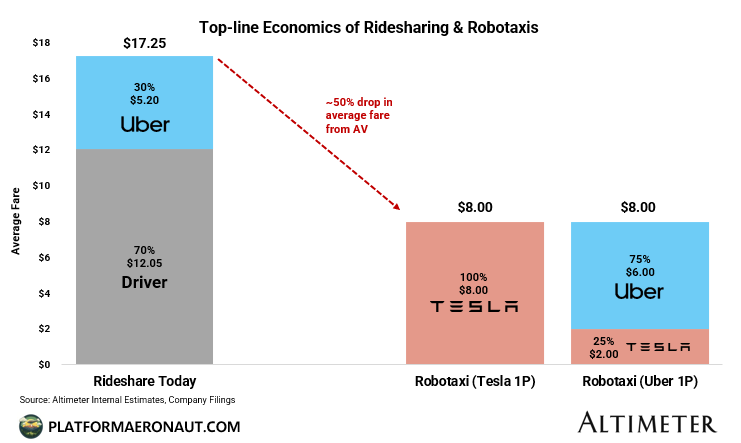

Price per Trip

The average rideshare trip today is approximately $17 which is $1.25/min and $2.75/mi. There’s publicly available data on how that demand is distributed throughout the day so you would assume that peak times (9am/5pm) are significantly higher and off peak (3am) is lower. With lower unit costs for autonomous vehicles (which I’ll go into below), I’m assuming average price per trip can go from $17 to $8 with a distribution throughout the day as follows:

If you’re operating an AV rideshare network you want close to 100% of your fleet running during peak times and you’d utilize the off peak early morning hours for maintenance/charging/cleaning as much as possible.

Unit Costs

In ridesharing today the costs borne by the rideshare network provider (Uber/Lyft) are limited to technology, payment processing, incentives, customer service, corporate overhead, and insurance. Cleaning, storage, charging/gas, and maintenance are off-loaded onto the driver or fleet owner and covered by the 70% share of fare that goes to the driver. But if we assume that Tesla is going to own/operate or Uber is going to own/operate and lease FSD from Tesla, then those costs get brought into the unit cost calculation.

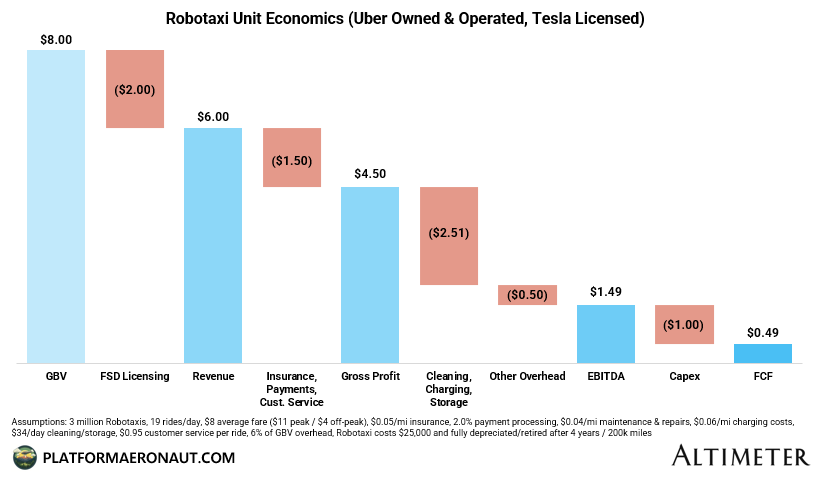

Insurance/Mile: $0.05 One can make the argument that insurance for AV should be cheaper due to it being safer but I’d expect initially liability costs will be higher as the model is proven. To be conservative here let’s assume it’s about the same as non-AV is today in year 10 with the opportunity to go materially lower longer-term.

Payment Processing: 2.0% A cost already borne by Uber/Lyft that they’re trying to bring down through partnerships (like Uber<>Paypal).

Customer Service/Ride: $0.95 You’ll save on support for drivers, but there’ll still be core customer service expenses for issues with payment/rides/safety.

Cleaning and Storage / Vehicle / Day: $34 The biggest underestimated cost it likely around cleaning and storage. For this I’m just taking what Avis and Hertz “Direct Vehicle and Operating Costs” per rental day is. On one hand an AV provider will save on fewer staffing costs from rental car reservation desks, but you’ll need round-the-clock staffing and more frequent cleaning and charging infrastructure to service the vehicles.

Charge Cost / Mile: $0.06 There’s an opportunity for Tesla to charge at lower/breakeven/subsidized costs given the supercharger network, but I’m just plugging in today’s market rate.

Maintenance & Repairs / Mile: $0.04 Fender benders, new tires, etc

Other Overhead: 6-9% of GBV Roughly in-line with what Uber and Lyft can do longer term, there’s overhead R&D and G&A requirements to operate the network

Net-net you end up with the following cost structure:

Cost of Revenue: $1.50/ride from insurance/payments/customer service

Operating Costs: $2.50/ride from cleaning/storage/charging/maintenance

Overhead: $0.50/ride from corporate overhead

Autonomous Rideshare Unit Economics

If you sum up all of the above assumptions with the idea that Tesla is going to build, own, and operate the CyberCab fleet themselves you end up with a business that generates $3.30/ride in EBITDA and $2.42/ride of FCF.

What does Tesla’s FCF look like in year 10?

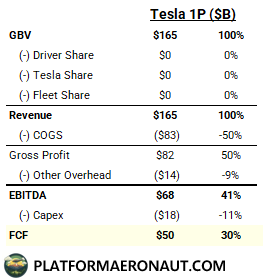

Assuming a fleet of 3 million Robotaxi’s and a 30% FCF margin, Tesla can generate $68B of EBITDA and $50B of FCF.

This is significantly better than what Uber and Lyft are earning today but that’s the opportunity for removing the human driver. You can materially lower average fare while increasing margins.

The reality is that although Tesla will likely own and operate the fleet to start as a proof of concept, eventually owners or fleet managers will need to step in to provide supply and this 30% FCF margin likely goes down. Much like Uber and Lyft “off-loading” costs of servicing/cleaning/maintenance to drivers today, Tesla will burden most of those costs with fleet owners but will also likely need to share 70%+ of economics to offset that and provide a profit margin for CyberCab owners.

How do Uber and Lyft fit in?

The above outlines a scenario where Tesla goes Genghis Khan on the traditional rideshare model and goes it alone 100% Tesla. But there’s several challenges to that:

Cost / Capital Outlay: Can Tesla afford to take on $88-100B of capex? Building that Robotaxi fleet also has a big opportunity cost for vehicles that could be produced and sold to consumers. Do they take on corporate debt to finance it or do they finance the vehicles through a subsidiary at 10-12% or higher rates? Is there demand from PE or fleet managers to buy all these vehicles if Tesla keeps the majority of economics?

Demand Generation: Can Tesla generate enough demand to have a robust and healthy supply/demand balance? Waymo partnering with Uber even given the small scale of the business demonstrates the importance of the demand/consumer side.

Regulatory: Can Tesla achieve a positive regulatory outcome or is it worthwhile to partner with the rideshare providers who have *plenty* of experience working with regulators.

Competition: If Waymo, Wayve, or others catch up to Tesla on AV technology can Tesla still dominate market share? When Amazon bought Whole Foods the consensus was that Instacart was screwed, but it actually catalyzed other grocers to partner with Instacart. If Tesla goes-it-alone might we see AV Technology providers and the OEMS all catalyzed to partner with Uber and/or Lyft?

Alternative 1: Tesla Licenses FSD and Sells CyberCabs to Uber & Lyft

Instead of keeping 100% of the economics but carrying the burden of capex, regulation, and demand gen, Tesla could sell CyberCabs to Uber and Lyft and take a 25% share of gross bookings as a FSD fee.

Impact on Tesla

This has several advantages:

Capital Light: Put the capital expenditure obligation on Uber or fleet managers operating on Uber. Saves $88B+ of Capex

Corporate Focus: Tesla can stay focused on dominating autonomous vehicle technology instead of the distraction of spinning up a consumer platform. It’s existential to Tesla to stay several steps ahead of peers on the tech side.

Margin Accretive: While 100% Tesla owned can generate 30% FCF margins in the above outlined scenario, if you’re just producing vehicles and developing AV tech through R&D that 25% share of rideshare FSD is almost 100% margin.

The downside is that from a financial perspective it does generate a lower absolute FCF than running it themselves, but it does so materially de-risked and allows focus on 1) tech and 2) vehicle production

It’s also important to note that partnering with a rideshare provider doesn’t preclude Tesla operating their own 1P network with either wholly owned or owner-provided vehicles. Most likely is some combination of 1P and 3P.

Impact on Rideshare Providers

If we flow through the same unit economics as for Tesla above but with some marginal savings on overhead expenses through scale you get a business that can generate 6-7% FCF margins as a % of Gross Bookings:

You may say that’s a shitty deal for Uber as now they have a ton of capex and FCF margins are only 6-7%, but from a fundamental perspective that’s higher than FY26 consensus FCF margins are (5.0%).

There is also the opportunity to partner with fleet managers as Uber has started to do with Moove, Hertz, and Localiza around the globe. If you allow the experts in managing fleets to deal with that side of the business you take 100-200bps hit on FCF and a bigger hit on EBITDA margins but you have a big opportunity cost savings on capex for purchasing CyberCabs.

Here is the summary financial profile of ridesharing providers in year 10 with a fleet of 3m robotaxis in operation:

It’s kind of a poor business model for the fleet owner, but if you look at the long term through-the-cycle average FCF margins for the car rental businesses it’s negative/break-even and autonomous vehicles are an existential threat to them as well. I’m sure they’d be willing to transition to fleet managers and hyper-focus on costs and efficiency to drive returns.

Alternative 1a: Capacity Purchase Agreements

With similar economics as described above, Uber might also have the option of capacity/mile purchase agreements. Instead of paying Tesla a 25% share of GBV, Uber could pay Tesla, Waymo, or fleet owners a set dollar amount for X number of miles and then operate/re-sell that capacity that themselves.

This is akin to the merchant model for OTAs or the capacity purchase agreements that major airlines enter into with regional carriers like SkyWest or Mesa Airlines. The upside for Tesla or Waymo is that they earn a guaranteed dollar return with predictability that is easier to finance against, and Uber takes the risk but also more of the upside. The economics are similar from a FCF margin perspective as the GBV share % model, but have a fixed cost of revenue per mile paid to partners.

Alternative 2: Rideshare Providers become like OTAs

Let’s envision a world in a decade that looks like this: Tesla holds 60% share in autonomous ridesharing technology and the remaining 40% is split among 4-5 different companies (Waymo, Wayve, Nvidia maybe?, etc).

Let’s also assume that Tesla owns and operates some of their fleet, but a large percentage is owned either by individuals or fleet managers and competitors are licensing their AV tech to OEMs and the vehicle ownership is 100% individuals and fleet managers.

Tesla operates a 1P rideshare business through the Tesla app but doesn’t have enough market share given competition to 100% dominate the demand side of the business and so in reality there are a dozen AV Rideshare network apps from Tesla, Ford, Waymo, Wayve, etc that essentially connect their vehicle owners to demand for ridesharing services.

In this scenario Uber and/or Lyft can operate in the same fashion that Booking or Expedia operate today where they are demand generation for each of the separate OEM/AV platform companies. Given the brand loyalty and strength and the demand generation abilities of Uber combined with theoretical market segmentation of AV providers there is the argument to be made that Uber could command 15-20% of GBV for acting as the consumer facing side of the business. 1P and 3P solutions would exist alongside one another, but it’s reasonable that Uber and Lyft could generate 25-40% EBITDA margins similar to the OTAs do today.

What Outcome is Likely?

The most likely outcome here is that Tesla goes ahead full force with their 1P solution. They do a combination of wholly-owned vehicles and vehicles that they sell to individuals and fleet managers and operate the rideshare network on their app.

Tesla has a 1-2year head start on AV technology given the improvements we’ve seen with FSD 12+ and assuming these tech improvements continue they’ll be the only real option for AV taxis beyond Waymo in the next 1-2 years. With Tesla capturing this opportunity we’ll see significant investments into competitors. Capital won’t be the issue though, it’ll be availability of data for training purposes. The non-Tesla data is disaggregated and disorganized but I think a Tesla rideshare network will spur competitors to figure out ways to accumulate data in a way that can train competitive models.

As competition ramps up and the autonomous rideshare industry becomes more fragmented and Tesla struggles with the demand side that’s the opportunity for Uber and Lyft to take the dominant role on the consumer facing side either as operators of the fleet, using fleet managers, or worst case acting in a similar way that OTAs do to hotels today.

The reality is that the best ridesharing network for consumers over the next decade will be a hybrid one with human and AV drivers that has the shortest pickup wait times and the lowest cost.

Tickers Mentioned: TSLA 0.00%↑ UBER 0.00%↑ LYFT 0.00%↑ BKNG 0.00%↑ EXPE 0.00%↑ GOOGL 0.00%↑

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Terrific analysis. Enjoyed reading it.