Platform Aeronaut Dispatch | No. 2 | AI Travel Distribution Models & EA Take-Private

A quick view of this week’s shifts in platforms, valuations, and AI adoption. Numbers, context, and curated reads you can use.

Thoughts & What’s New

What Will AI Travel Distribution Look Like?

I continue to think on this and try to explore the plausible routes that travel distribution looks like in an AI and agentic world. Here’s my rough thinking of the possibilities of where things go but I’m open to feedback and comments:

Branded Apps & Agents

Consumers keep starting inside big brands surfaces whether it’s Booking, Expedia, Marriott, Delta, or emerging white-glove agents like Otto. The apps embed agents that search, hold inventory, resolve changes, and upsell across the brand’s owned graph. With >50% of OTA traffic direct today there’s a tangible possibility things break this direction and that’s where most of the internal efforts at incumbents have been focused.

App-Store Model

MCP-style “plugins” compete inside of general AI frontends (think Chrome-extension like economics). User’s “install” an OTA, metasearch, or a niche concierge into ChatGPT or Claude and the horizontal AI is able to monetize through revenue sharing, reviews, and sponsored listings much like Apple does today. The supply and enablement companies participate in a robust advertising ecosystem like SEM does today to get user installations.

Open-Internet Model

Horizontal agents (ChatGPT, Claude, Gemini) keep the full funnel of discovery while vertical search and aggregators only win if they’re demonstratably faster, cheaper, and more accurate. They compete much like the early days of the internet on Google with SEO. If your travel company has the best, quickest, and most accurate data out there you will naturally rise to the top when a user queries “Find me a family-friendly resort in Cancun.”

OS/Wallet/Identity Agent

The travel discovery and agent lives at the OS layer (Apple, Google, Microsoft) and can read calendar, email, and wallet details. It auto-rebooks when flights slip and brokers supply via existing rails. Distribution here is default-placement plus ecosystem trust. Think of the billions of dollars that Google pays Apple for default search engine placement.

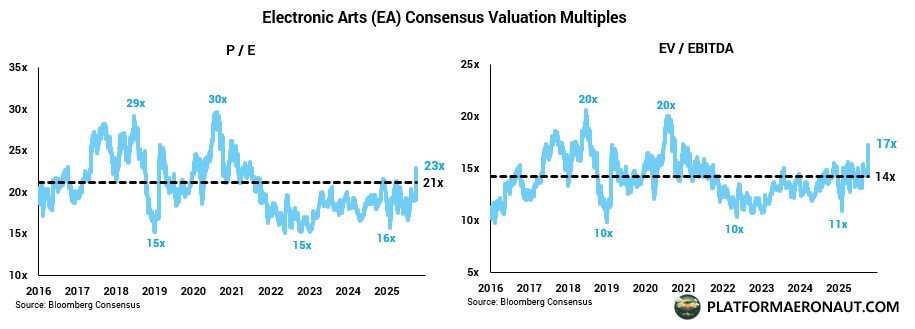

Electronic Arts to be Acquired by Saudi PIF and Silver Lake for $55B

It was a rumor last week and confirmed on Monday, but EA is being taken private in a deal valuing the business at $55B.

Performance & Valuation Snapshot

What I Read This Week

ChatGPT Launches Agentic Commerce Protocol (ACP): An open standard that enables a conversation between buyers → AI Agents → Businesses to complete purchases

Booking.com Smart Flex Is Expanding: Booking is auto opting-in hotels to Smart Flex which allows Booking to widely offer “flexible cancellation for a fee.” Booking takes the inventory risk for Smart Flex cancellations, captures the cancellation fee, and has the obligation of back-filling or paying the hotel for the room.

Uber Grocery+Retail at $12.5B Run-Rate by YE25: Up from $10B run-rate in May, Uber expects to exit 2025 at a $12.5B GBV run-rate

Only 10% of Business Travel Buyers trust AI Recommendations: In the business travel segment, just 1 in 10 buyers express confidence in AI-based bookings or itinerary tools, trust remains a huge barrier.

Kroger and DoorDash Expanding Relationship: Bringing grocery delivery to 2,700 Kroger stores on DoorDash

GetYourGuide AI Product Push: The fall product release from GetYourGuide includes AI-powered review management, expansion into multi-day tours and theme parks, and AI-powered filters for consumers enhancing traveler discovery

Expedia Research on how fragmented hotel distribution leads to rate leakage: 98% of hoteliers lose an average of 6% of revenue annually due to rate leakage (essentially wholesalers, bed banks, or redistributors sniping rates).

TikTok reveals Smart+ Travel Ads: Enabling catalogue, event, and direct bookings within Tiktok

Poll of the Week

From My Recent Work

Transcript Highlights (Exec Signals)

Added some additional transcripts but generally just ready for earnings season to begin to test this out more thoroughly:

“Take Airbnb from a pre-AI app to the first or one of the first truly native AI applications.”

“Shift Airbnb from a marketplace for vacation rentals to a global community where you can travel and live anywhere.”

“Evolve from vacation rentals to becoming this entire ecosystem like Amazon, where we can sell homes, services, experiences, and many things we haven’t yet announced.”

“FREENOW carries revenue margins in the low teens compared to North America’s mid-30%.”

“Our DoorDash partnership is only ~10% penetrated, but growth continues to outpace the overall business.”

Product innovation (Price Lock, Women+ Connect, Lyft Silver) expanding customer base. Lyft Silver targeting seniors (>65 demographic, now 18% of U.S. population, growing to 20%+).

“Underpenetrated markets still represent two-thirds of the TAM across North America.”

The information presented in this newsletter is the opinion of the author and does not reflect the view of any other person or entity, including Altimeter Capital Management, LP (”Altimeter”). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for informational purposes and should not be construed as investment advice or an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Altimeter and its clients trade in public securities and have made and/or may make investments in or investment decisions relating to the companies referenced herein. The views expressed herein are those of the author and not of Altimeter or its clients, which reserve the right to make investment decisions or engage in trading activity that would be (or could be construed as) consistent and/or inconsistent with the views expressed herein.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.