The Great Debate: OTAs, AI, and the End of the 10 Blue Links Era | PA Dispatch No. 10

A quick view of this week’s shifts in platforms, valuations, and AI adoption. Numbers, context, and curated reads you can use.

Last week at Skift Megatrends, I did a live, two-minute-clock, buzzer-happy debate with Skift’s Seth Borko and Sarah Kopit on what AI means for travel distribution. I’m sharing my answers below in a cleaner format than stage banter allows. You can view the entire debate on Vimeo if you have 30 minutes to spend.

The meta-point across all seven questions is simple: AI doesn’t need to “kill” a business model to permanently impair it. If you lose control of discovery, you lose pricing power, and in travel pricing power is the whole game.

Does AI mean the OTAs are done for? Are the glory days over?

No, OTAs are not “done.” But the glory days are absolutely over. OTAs were built for a world where discovery lived in a browser, routed through search, and ended in a click. That structure created a compounding advantage: more demand → more supply → better conversion → more marketing efficiency → more demand. The problem is we’re now exiting the era where “ten blue links” is the primary UX for discovery. As discovery moves inside AI interfaces, OTAs get pushed down the funnel and down the value stack, and that’s where take rates compress.

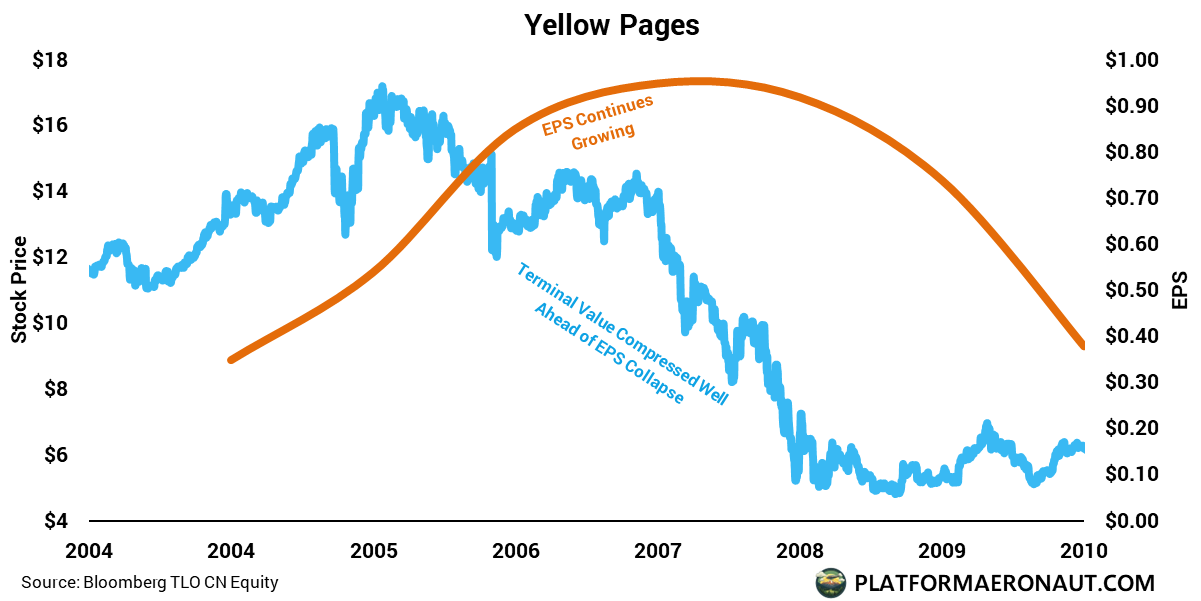

I used the Yellow Pages analogy on stage for a reason. Yellow Pages didn’t vanish overnight; it threw off cash for years. But the market correctly understood that once distribution control was broken, the multiple was terminally impaired. That’s the OTA setup: still profitable, still relevant, but increasingly abstracted behind whoever owns the interface where intent is created and routed.

Will Generative AI become the primary front door for travel booking?

Yes, and it’s basically the continuation of Question 1. The key point isn’t “AI is cool.” The key point is that AI collapses the funnel. Discovery, planning, comparison, and eventually booking can happen in one conversational workflow, instead of the current tab-sprawl of: search → metasearch → OTA → supplier → back to OTA → price paranoia → “did I just click an ad by mistake?”

On stage I framed this as a consolidation of eyeballs problem. Over time, super-cycles reduce the number of “front doors.” There were ~170,000 travel agents in the U.S. pre-internet. That collapsed. Search consolidated to Google. OTAs consolidated to a handful of scaled winners. In AI, it’s increasingly a two-front-door world: ChatGPT/OpenAI and Google/Gemini. If the router of intent sits upstream at that scale, booking becomes a routing decision, not a browsing decision.

Is “zero-click” travel marketing an existential threat to the industry?

To the industry broadly? No. Travel demand doesn’t evaporate. But to the click-dependent distribution model that sits underneath OTAs and metasearch economics? Yes, it’s existential. OTAs were built as marketing machines. Search sends clicks. Clicks convert. Take rates sit on top of that flow. If the user gets an answer inside an AI interface and never needs to visit an OTA page, the substrate changes.

The uncomfortable part: OTAs aren’t structurally designed for an “answer world.” Their muscle memory is paid acquisition + conversion optimization on their own properties. If AI interfaces compress clicks dramatically (and early data suggests they do), you don’t just lose volume, you lose leverage. And when leverage shifts to the interface owner, margin structure becomes negotiable. Zero-click doesn’t mean zero value. It means value moves up the stack to whoever owns the interface.

Are we overestimating how fast consumers will let AI book travel for them?

No, I think we’re underestimating it. The trust hurdle is real, but trust isn’t linear. It’s lumpy. It feels impossible right up until it suddenly feels normal. People don’t wake up and delegate a $10,000 family vacation on day one. Delegation starts small: a repeat hotel, a simple domestic flight, a rebooking during a disruption. Once it works twice, the behavior shift is fast.

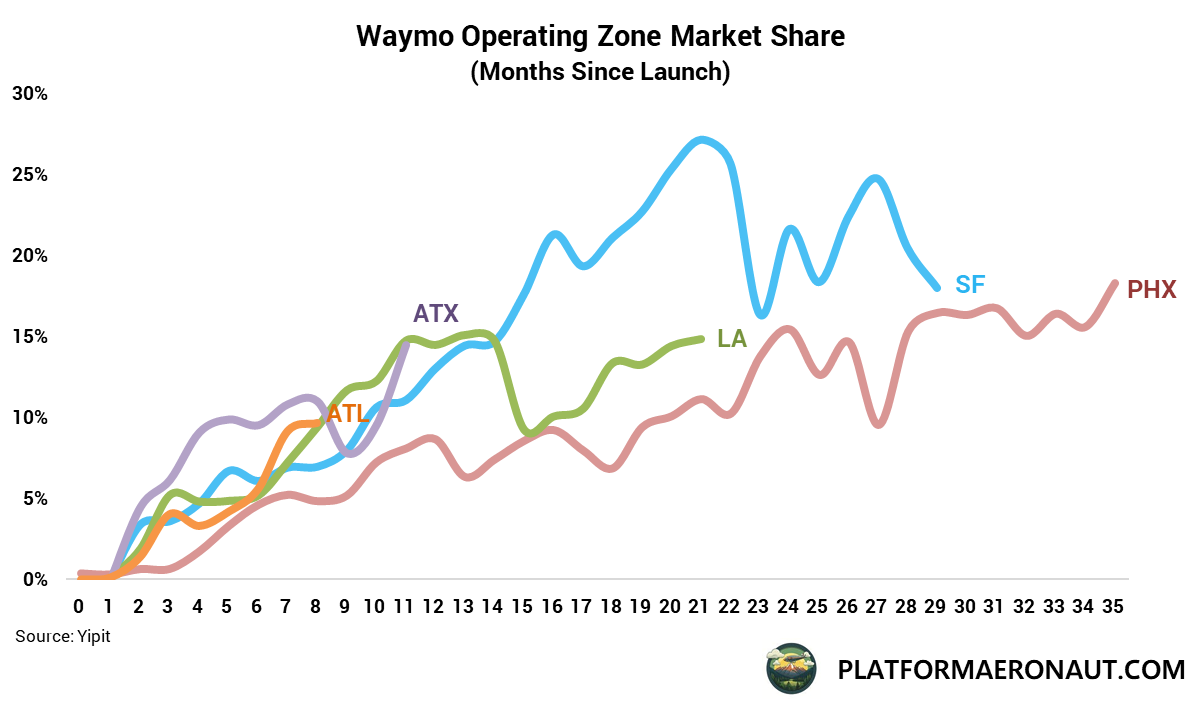

I used a Waymo analogy on stage because it captures the adoption psychology. The first time you get in, you’re tense. Five minutes later you’re staring at your phone like it’s an Uber. If a robotaxi can earn trust when the consequence of failure is catastrophic, travel booking can absolutely earn trust when the consequence is… annoyance and a customer service escalation. Humans are terrible at intuitively modeling exponential adoption curves and we’re about to relearn that lesson again.

Will AI travel slop trigger a “Fyre Fest of 2026”?

No, not one big, theatrical implosion that discredits AI travel. The risk is more subtle and arguably more important: homogenization. The two lines that matter are AI capability and AI personalization. If capability grows faster than personalization, the agent recommends the same ten hotels, the same three neighborhoods, the same “top experiences” to everyone. That crushes the long tail and accelerates overtourism. At scale, that becomes systemic.

I’m actually optimistic here because personalization is the natural counter-force. An agent in your pocket can learn your constraints, preferences, and tolerance for trade-offs far better than an OTA ever could. The future failure mode isn’t “AI lies and ruins travel.” It’s “AI makes travel boring.” The solution isn’t rejecting AI it’s making sure personalization outpaces raw capability.

Will independent hotels finally be able to go direct to consumer?

Yes, and if you’re an independent hotel group, now is the moment. OTAs have historically earned 15–25% commissions largely because they controlled discovery and standardized the marketplace. AI weakens that choke point. The biggest unlock isn’t “cheaper customer acquisition”, it’s richer offers. Hotels can expose structured, differentiated inventory and packages directly to agents: bundles, experiences, flexibility, loyalty perks, hyper-specific room attributes. OTAs flatten hotels into a template; AI can unflatten them.

The underappreciated catalyst is that AI collapses the hotel tech disadvantage. Hotel tech has been chronically underfunded and understaffed. But with modern AI coding tools, five developers can do the work of fifty. That changes what’s feasible for independents: better booking flows, better data exposure, better merchandising, better conversion, better servicing. Direct doesn’t mean abandoning OTAs, it means rebalancing power. A few points of mix shift is a step-function change in hotel economics.

Will vibe coding unleash a tsunami of startups that revolutionize travel?

I wish it would, but I don’t think the big wave is in consumer booking. AI makes building easier, but it also centralizes distribution harder. That’s the paradox: lower build cost doesn’t automatically create sustainable businesses when the “front door” is consolidating into a couple of superhuman agents. On stage I talked about my own experiment: I vibe-coded a lie-flat-seat “OTA” in ~1.5 days. It proves that building is becoming trivial, and it also proves how irrelevant building alone is.

The real opportunity isn’t “compete with Booking.com’s homepage.” The opportunity is selling into industry pain points: infrastructure, ops, supply tech, servicing, data normalization, and the messy physical reality layer where incumbents are slow and fragmentation is high. Ironically, vibe coding might be most disruptive inside the industry, not at the consumer front door. And yes, if a credible MVP takes 1–2 days, it does raise a very uncomfortable question about what 40,000 people at the major OTAs are doing when the consumer UX hasn’t meaningfully changed in a decade.

Bottom line

AI doesn’t “kill” OTAs. It re-prices them.

Discovery is moving upstream into AI interfaces.

OTAs get pushed down the funnel → take rates compress.

“Zero-click” threatens the click-dependent arbitrage core.

Consumer trust will flip faster than most expect.

The biggest risk isn’t fraud, it’s homogenization.

Independents finally have a real shot at direct mix shift.

Vibe coding spawns a million toys…and a smaller number of real businesses (mostly B2B).

Performance & Valuation Snapshot

As a reminder these snapshots below are interactive (filter/order/search). Unfortunately substack emails present them as a stale image that you need to click through to view them so I highly recommend clicking or viewing on Platform Aeronaut if you’re coming from email.

What I Read This Week

Waymo opens Miami to the public: First riders are entering a 60-sq-mile driverless service zone, with airport service “soon.

EQT leads $300M into AI-forward PMS Mews (valued $2.5B): Fresh growth capital earmarked for AI-driven operations and payments.

Op-ed: MCP may add vendor-controlled complexity. Industry critique argues “layers of simplicity” could mean more cost/lock-in for hotels.

Amazon shutters Go & Fresh stores, doubles down on delivery/Whole Foods. Physical footprint consolidates as grocery strategy pivots.

Zipline raises $600M; expands to Houston & Phoenix. Big funding and new U.S. markets signal drone delivery scaling beyond pilots.

NYC delivery worker rules take effect. Judge denies Uber/DoorDash bid to block tipping laws; DCWP confirms $21.44/hr minimum pay

Uber backs Waabi’s robotaxi push. Up to $500M from Uber as Waabi pivots from trucks; plan calls for 25,000 AVs on Uber’s network.

Recent Posts

Transcript Highlights (Exec Signals)

About American: “We are not going to allow them to win a single gate at our expense in 2026.”

“The strategy we’ve had to build a revenue diverse, brand loyal airline...is remarkably resilient in tough times.”

“Economic gravity always wins in the end.”

“At the midpoint of our EPS and CapEx guidance, we would hit our 2027 goal to have total debt below $35 billion a year ahead of schedule in 2026,”

“It’s a combination of both macro and strategic efforts that we expect to drive improved profitability moving forward.”

“American invented airline loyalty, and the Advantage program continues to lead the industry.”

The information presented in this newsletter is the opinion of the author and does not reflect the view of any other person or entity, including Altimeter Capital Management, LP (”Altimeter”). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for informational purposes and should not be construed as investment advice or an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Altimeter and its clients trade in public securities and have made and/or may make investments in or investment decisions relating to the companies referenced herein. The views expressed herein are those of the author and not of Altimeter or its clients, which reserve the right to make investment decisions or engage in trading activity that would be (or could be construed as) consistent and/or inconsistent with the views expressed herein.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

I'm wondering about legacy web companies vs AI, big time.

It's possible AI democratizes internet traffic back directly to hotel brands themselves from the cutthroat big monopolistic players: Tripadvisor, Expedia, Marriott, etc, as you note.

I'm not seeing hospitality or many people talk about this, but there is something fascinating about the achilles heel of being software or web based only. The AI bubble is in legacy software and web, and the future is hardware.

If you're software *only*, it doesn't matter if you're a major player that adds AI to their website. Anyone can spin up an AI software model anywhere in the world now, so the future post-AI-bubble is physical AI and hardware. People won't be going to Tripadvisor to ask that AI, they will be using whatever hardware they use: watch, google home, smartphone, the television (the washer or fridge?).

I'm also attaching a clip that I think nails it, and it was confirmed at a product launch Tuesday, where there was a VS and AI round table. This is from a podcast that concurs: https://i.imgur.com/n1i2Ytd.mp4

They all said physical AI and hardware is the future, but the most wildly overhyped thing that doesn't make sense is humanoid robots. They in-depth explained why, and then Elon mentioned retiring Model S and X for the fremont factory to focus on his Optimus Robots. LOL

Also, a clip of the non-autonomous Optimus failing and falling when someone doesn't log out post demo. https://i.imgur.com/z4zfs8y.mp4

So the bubble is there, very much centered around legacy software and web.

Re "OTAs get pushed down the funnel → take rates compress" — How and why? Google chose to tax OTAs instead of kill them. Why wouldn't AI do the same?

OTAs "take" about $60-80B/year in revenue. Google gets a substantial portion of that by letting OTAs tax hotels and other travel operators, and then taxing OTAs by auctioning off user intent through ads.

I can see take rates compressing if the ones being "taken" from (eg. hotels and operators) gain more power as a result of the operators themselves being able to leverage AI and go direct to consumer, but that isn't what we're seeing.

The power is seems merely to be shifting from traditional search engines to AI engines. From one top of tunnel intent engine to another. Yes, AI will inevitably change the UI/UX flow and compress the booking funnel but that would suggest AI engines gain leverage. At no point do AI engines appear to lose leverage to operators and get disintermediated.

Yes, AI engines have the capacity to disintermediate the OTAs. So did Google, but they chose to tax the OTAs, and let the OTAs tax the operators. That's how Google extracts the maximum value from the travel industry. Why would they give that up now at the point where they gain even more leverage over the travel industry and operators? Altruism? Competition from other AI engines?

Despite OpenAI's early headstart, Google quick catch-up and existing distribution advantage will likely keep it on top. So, how exactly do we arrive at a point where Google extracts less from the travel industry?

There might be one way. If AI engines become autonomous agents that act more like a fiduciary, where they are responsible for procuring the best outcome for end users regardless of the commercial interests of the AI engine platform. Perhaps that reduces the platforms ability to monetize consumer intent. That may require a post-advertising world though, and that's certainly not a forgone conclusion.

Interested to hear what others think.