Platform & Leisure Multiples Entering 2026 | PA Dispatch No. 8

A quick view of this week’s shifts in platforms, valuations, and AI adoption. Numbers, context, and curated reads you can use.

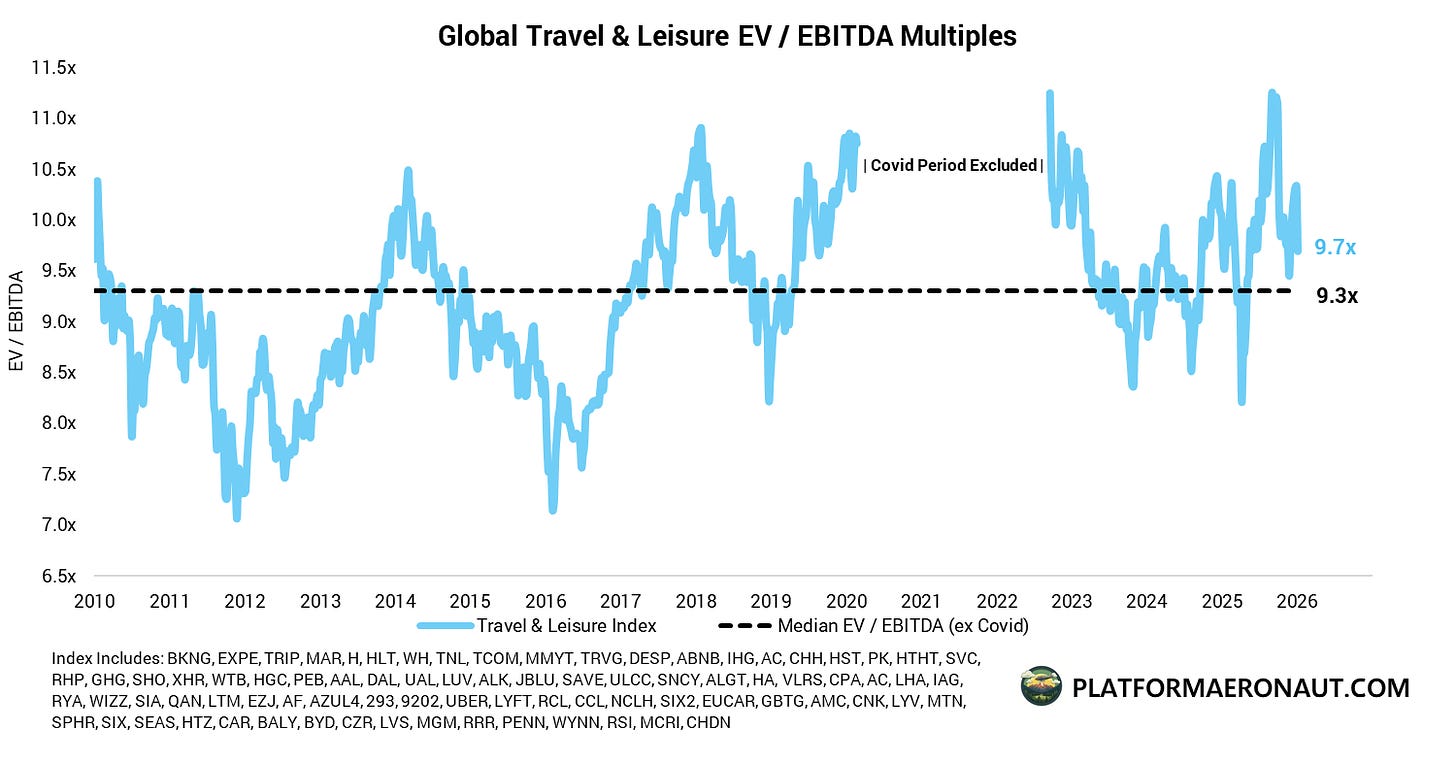

As we enter 2026 I wanted to do a quick overview of where multiples across platform and leisure businesses sit. At a super high level if you roll up every business we’re sitting at 9.7x EV / EBITDA vs a long term average of 9.3x (excluding covid period):

And if we look at cumulative enterprise value it sits at $2.1T, up from $1.3T right before covid. Despite the volatility of covid, it ended up being great for leisure margins and growth. It shook the weak hands out, rationalized capacity, and allowed companies to push pricing. Regardless of this though, the multiples across the space do not appear terribly demanding. At a high level the sector looks fairly priced on headline multiples, but increasingly asymmetric beneath the surface.

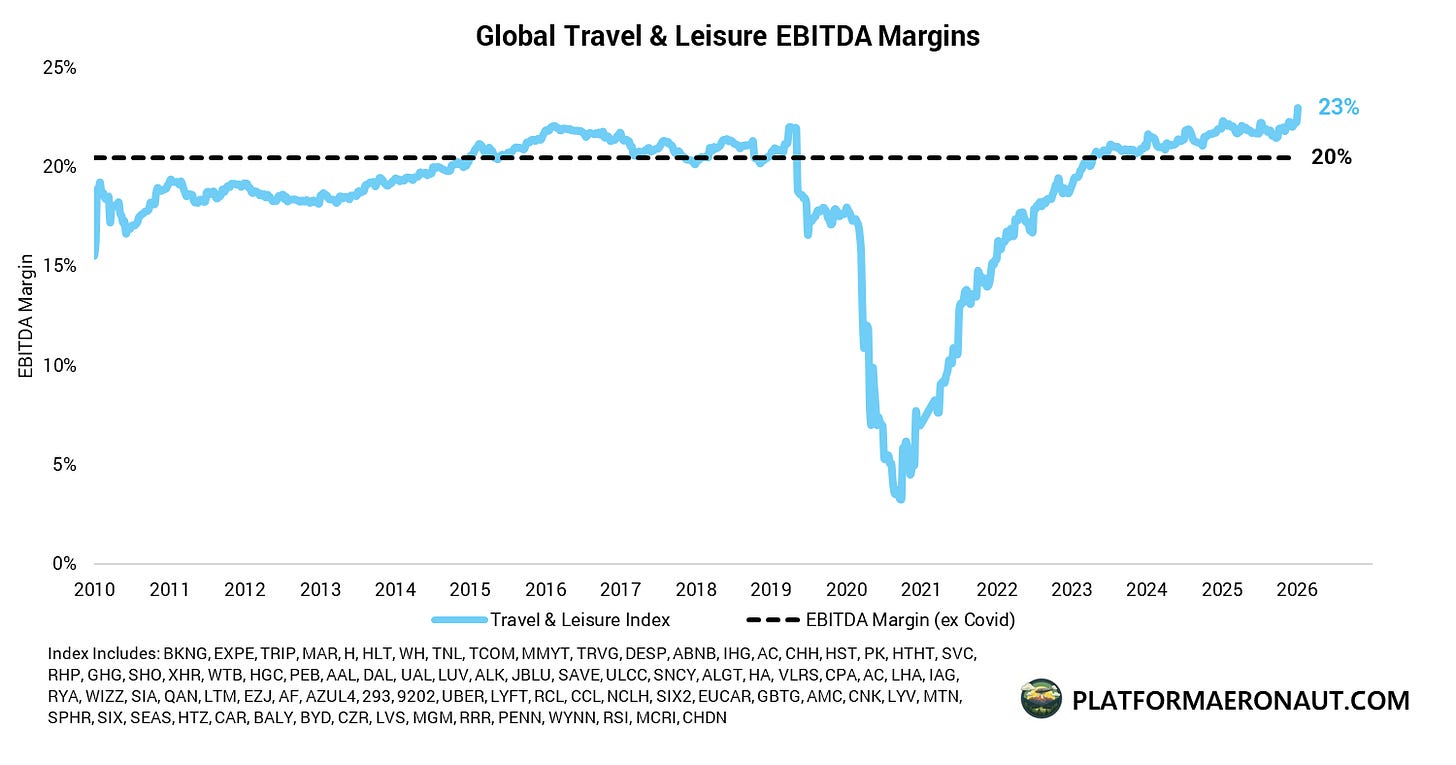

EBITDA margins across the spectrum are now at a peak of 23% vs 20% long term average. Drilling into Free cash flow margins shows us sitting at 12% up from 8% long term average (pretty much where the market was pre-covid as well)

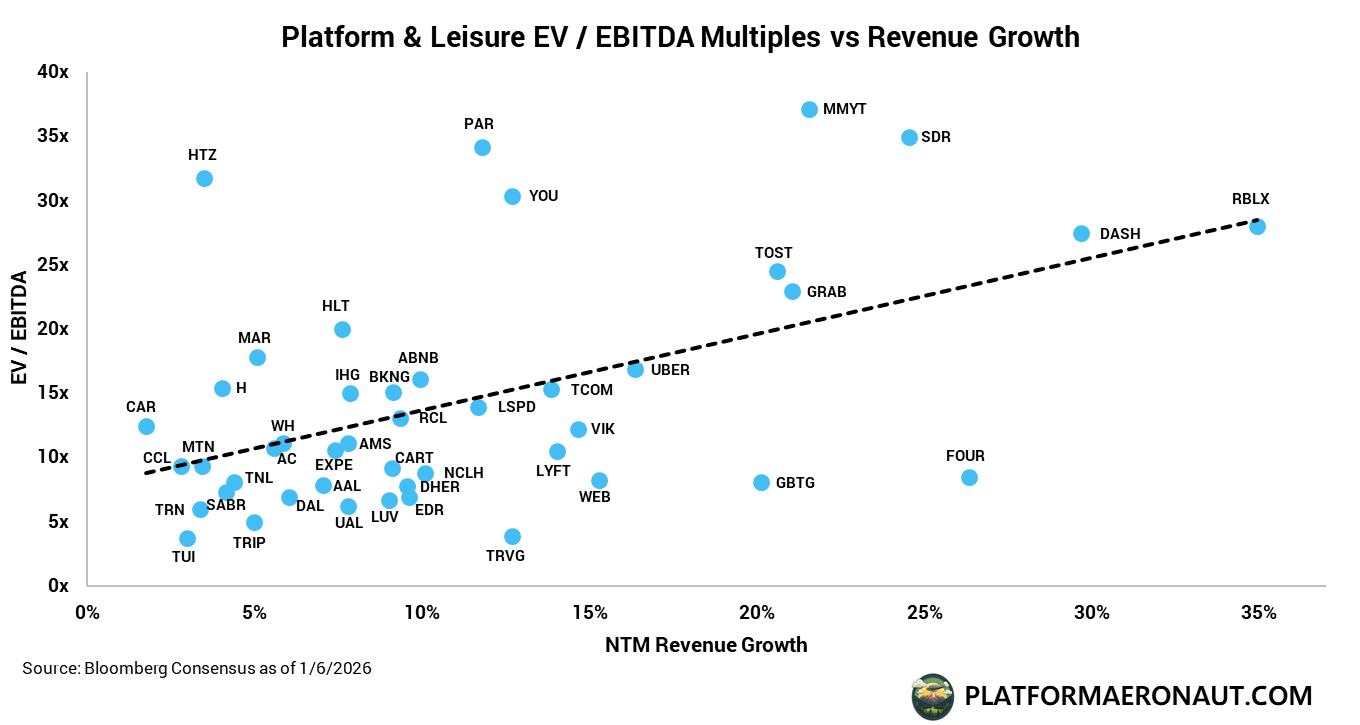

I like to look at scatter plots of NTM revenue growth vs EV / EBITDA multiples to get a gut check of where various companies sit. As we sit today here’s the platform and leisure space scatter plot for names:

Investors tend to pay more for growth (although not always, quality of growth matters (take Shift4 for example). It’s a good way to mentally filter names and see how it shapes up vs peers then you can do your own qualitative overlay. For example MakeMyTrip trades at a premium more due to India than quality of the business. Hertz business is theoretically temporarily impaired. Trivago has existential threats to its existence despite solid top-line growth.

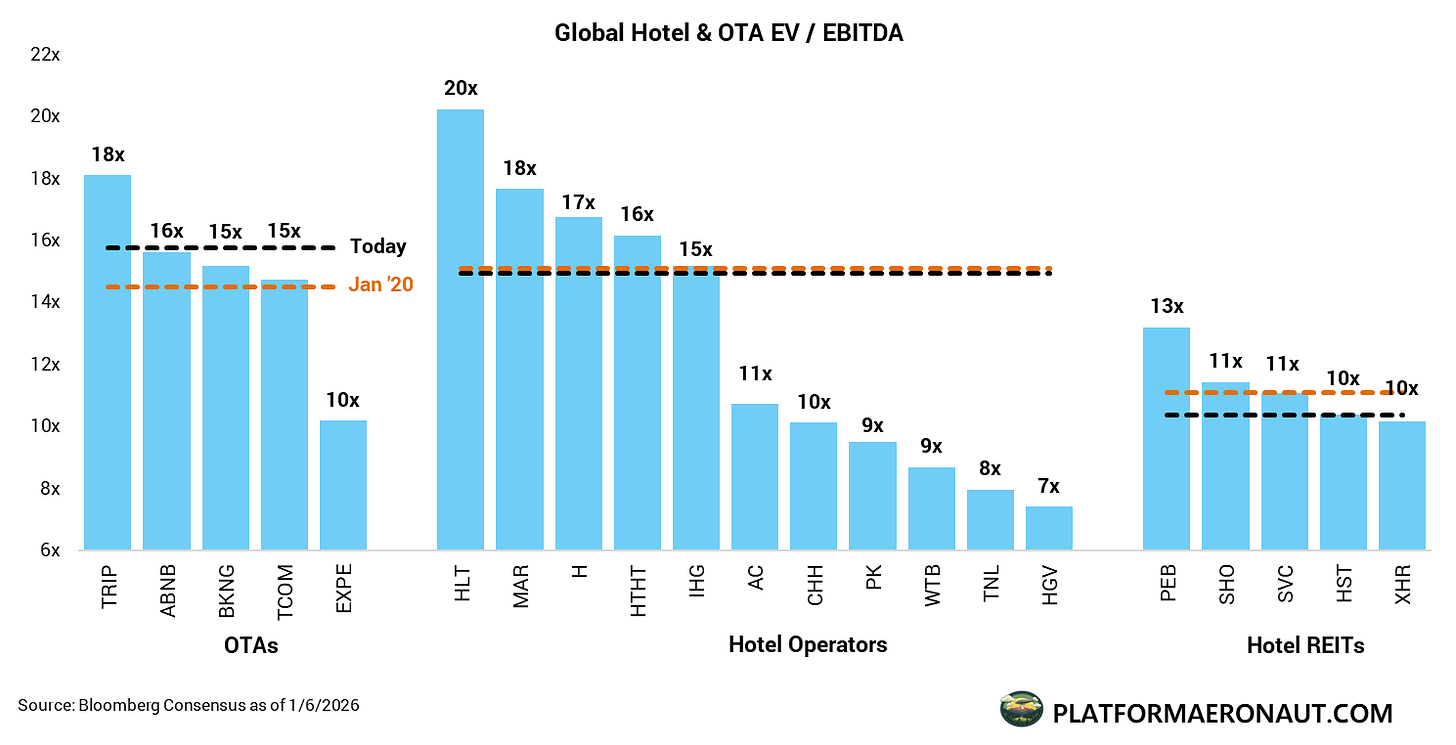

OTA & Hotels

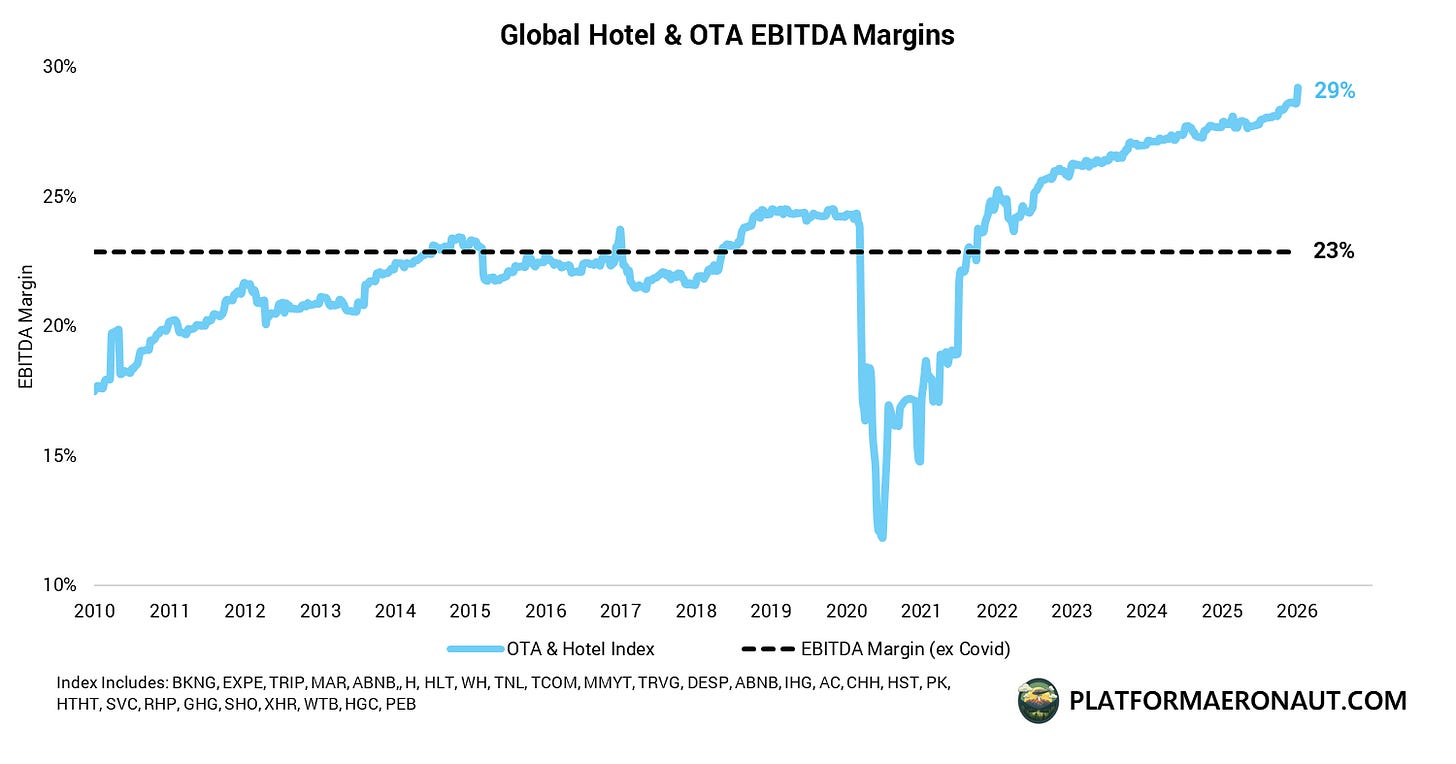

One interesting call-out is within the hotel & OTA space. We’ve seen EBITDA margins (and FCF margins as well) just absolutely explode from historical levels. These businesses generated low 20% EBITDA margins pre-covid, and have just been on a historic run with NTM consensus EBITDA margins now sitting at 29%!

But despite this we’ve seen multiples generally at the same levels as they were in Jan 2020:

So you have great margins, multiples in-line with historical levels, slightly slower growth, and a potential risk (at least on the OTA side) from AI disruption. I’ve been adamant that margins at the OTA level will likely go down over time as AI adoption and capability accelerates.

Cyclical Risks: demand normalization, ad efficiency plateauing

Structural Risks: AI agents collapsing discovery + servicing layers

If the middle man layer gets collapsed (similarly to what happened to the GDS layer during the age of the internet), are we likely to continue to see the OTAs put up the margins that they do? Does more get re-allocated to the direct suppliers and property owners? As a side note I’m going to be doing a debate-style discussion at Skift Megatrends 2026 around travel and AI disruption.

Performance & Valuation Snapshot

As a reminder these snapshots below are interactive (filter/order/search). Unfortunately substack emails present them as a stale image that you need to click through to view them so I highly recommend clicking or viewing on Platform Aeronaut if you’re coming from email.

What I Read This Week

“Travel Slop” is here: Skift warns AI-generated itineraries and content are flooding travel, risking brand trust if quality controls lag.

MCP shows up in 2026 tech roadmaps: Hospitality Investor flags MCP as the standard to connect hotel data to AI agents; execution details still fuzzy.

Amazon’s Alexa+ to integrate Expedia: Travolution reports a 2026 integration that makes Alexa+ a bookable travel assistant via Expedia’s inventory.

Uber, Lucid & Nuro unveil a robotaxi at CES: Production-intent AV built on Lucid Gravity with Nuro autonomy and Nvidia Thor; Bay Area testing underway.

Waymo maps out 2026 city expansions: 9to5Google tallies upcoming markets including Dallas, Miami, Nashville (with Lyft), DC and more.

New California law forces real refunds for missing items: AB 578 now requires food-delivery apps to refund undelivered items and disclose fees clearly.

Action-taking AI needs guardrails, says WaPo op-ed: Great primer on risks as AI agents start booking travel and spending money on users’ behalf.

Leaders’ 2026 predictions: Priceline, Cloudbeds and more share near-term AI, distribution and demand outlooks.

Recent Posts

Transcript Highlights (Exec Signals)

Lyft will invest $10–15 million to construct a purpose-built Waymo depot in Nashville: “We’ll invest about $10 million to $15 million in getting that done.”

“Riders who come to the platform through a partnership tend to take a higher mix of more profitable rides.”

“AVs are really opening a new lens in terms of bringing riders into the marketplace.”

“We saw an inflection point in the U.S. direct channel... a very, very healthy indicator for the future.”

“We’re growing faster in flight tickets than any airline... faster in rental car days than any rental car company... faster in Attractions..”

“Alternative Accommodations… will continue to outgrow our Traditional Accommodations.”

“We outgrew the U.S. in general from a room night perspective in the third quarter by quite a wide margin.”

“We are the largest technology travel platform outside of Mainland China by really a length.”

The information presented in this newsletter is the opinion of the author and does not reflect the view of any other person or entity, including Altimeter Capital Management, LP (”Altimeter”). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for informational purposes and should not be construed as investment advice or an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Altimeter and its clients trade in public securities and have made and/or may make investments in or investment decisions relating to the companies referenced herein. The views expressed herein are those of the author and not of Altimeter or its clients, which reserve the right to make investment decisions or engage in trading activity that would be (or could be construed as) consistent and/or inconsistent with the views expressed herein.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.