Mature Tech Dilution: Up and to the Right

Over the last decade mature technology companies have continued to dilute at increasingly higher levels.

TL;DR

Mature technology companies have almost doubled SBC as a % of revenue over the past decade.

When you dig deeper on SBC as a % of Operating CF it’s even worse, god forbid you look at SBC/FCF.

Software is even worse and not a *single* company has achieved leverage on their SBC expense.

To use Uber as an example, their management is compensated on Adjusted EBITDA metrics which exclude SBC. There is no alignment of incentives with shareholders when you use adjusted metrics.

I hesitate a bit to continue harping on stock-based compensation (SBC) and dilution as there’s so many more interesting things to discuss, but the deeper I dig on it, the more perplexing and outrageous some of the data becomes. I promise a renewed focus after this on other topics I’m excited to write about including travel tech, gaming, OTAs/STRs, etc.

One of the discussion points around SBC is that it’s more of an issue at earlier stage software companies like SNOW, MDB, or CFLT. It makes sense that an earlier stage growth company is likely to align employee compensation with stock results. As a company matures and growth slows one would anticipate that SBC and dilution approach a level that doesn’t impact results. Think of the risk required for an employee joining Confluent (founded 2014) vs joining GE (founded 1892).

Thus one would assume that “mature” tech companies founded >10 years ago are diluting at increasingly lower levels as the risk required to attract employees has diminished over time. I have a young family and I certainly would require higher risk adjusted returns to join a startup vs a mature company. I define mature tech companies as those who have reached long-term run-rate margins and FCF generation. What I found though, is that this cohort of mature tech companies is diluting more and more each year:

Mature Technology Company Dilution and SBC Efficiency

SBC / Revenue (Dilution)

The black line is a simplistic Stock Based Compensation expense divided by Revenue. It’s a fairly well understood metric, and has pros/cons. I prefer the methodologies I used for the Ridesharing and BKNG, but it’s a decently acceptable short-hand, especially over a multi-year period for companies who have been public for many years. If you take a step back it’s pretty outrageous that dilution at mature tech companies has almost doubled over the past decade.

SBC per 1% Revenue Growth (Efficiency)

The blue line is a little bit more complex but shouldn’t be too inside baseball. It is essentially the level of SBC $ required to generate 1% of revenue growth. In 2012 it was <$250m on an index level and grew to over $1.7B in 2022. Naturally companies decelerate top-line growth over time, but this is the crux of the argument that SBC is to incentivize the alignment of employees with the growth of company value (otherwise you would just pay cash bonuses). It would be reasonable to assume that SBC on an absolute level also comes down as growth slows and a company matures, but that’s not what the mature tech cohort is doing.

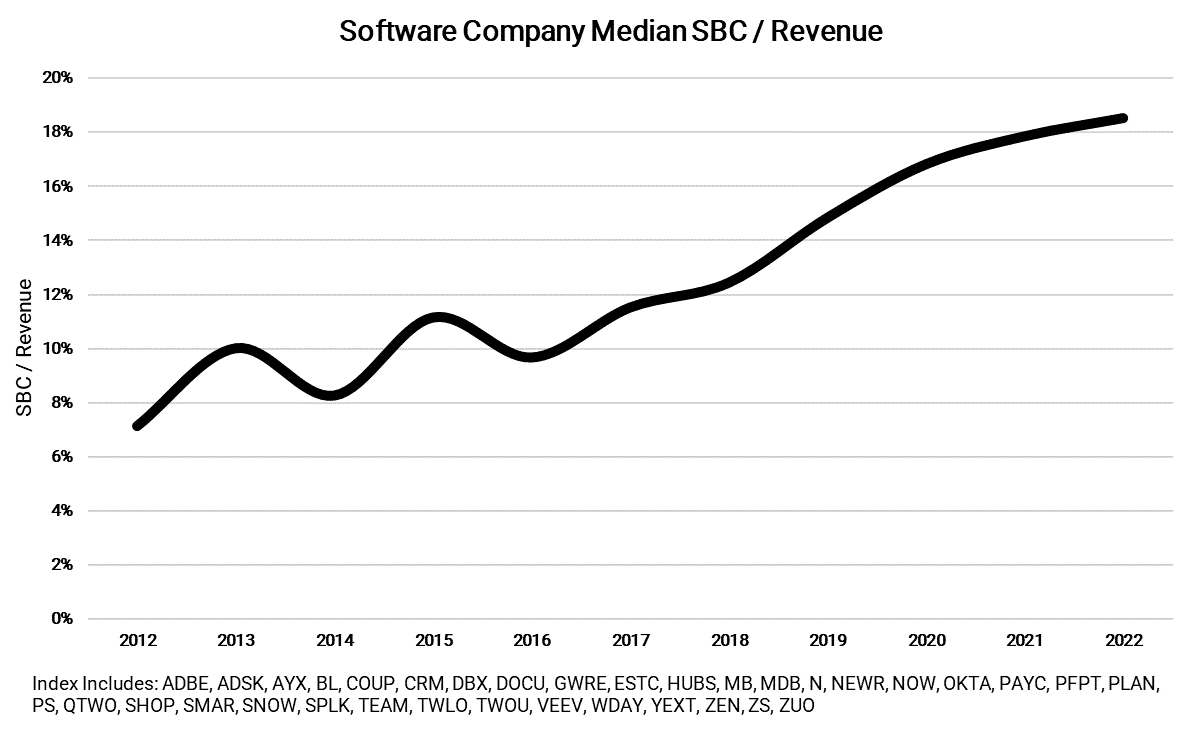

If we look at the most egregious cohort of Software companies the numbers are worse, even if SNOW is the newest member of that cohort.

It’s a bit more difficult to get a relevant metric when there’s new IPOs, so I was unable to reasonably represent the blue line that is in the first chart, but I can’t imagine it is any better.

The worst thing is that of the listed 30+ companies in the Software Index, not a *single* company has reduced SBC as a % of Revenue over any meaningful time period despite some of them being public for 5-10 years.

Let’s take a step deeper, Operating Cash Flows (OCF)

The long term terminal value of any business is really distributable free cash flow per share. So what an investor should really look at is OCF (-) Maintenance Capex (-) SBC (although I prefer EBITDA (incl SBC) (-) Interest/Taxes (-) Maintenance Capex). That is truly what is generated by the business and available for distribution to shareholders in the form of dividends or share repurchases.

If you run the same analysis on the same cohort but use Operating Cash Flows as the denominator you get a more egregious result. Dilution at that level has >2x over the past 10 years since 2012. It’s worse than revenue as companies continue to load up on SBC.

Why is SBC exploding as a % of Revenue?

Perhaps it’s unfair and I should use SNOW or MDB or COIN, but since I’m most familiar with it I’ll use UBER despite them not being the worst offenders (sorry DK). Fundamentally the issue is alignment of management and shareholders.

Brad Gerstner (Altimeter’s CEO and Founder) was recently on the All-in Pod and it encompassed the issue well:

If I look at the language from last year’s proxy statement for Uber,

Essentially the entire management team at Uber is compensated on the basis of their Adjusted EBITDA achievements. This is prevalent throughout the proxy statement from Dara’s pay to other senior leadership. As Charlie Munger has said, “Show me the incentive, and I will show you the outcome.” When both senior management and segment leadership at both Uber Eats and Uber Mobility are compensated on Adjusted EBITDA excluding SBC, the incentive is to offload as much of your cost structure to SBC as possible. Why pay a senior engineer $2m a year in cash and hurt my ability to achieve bonus payouts when you can pay them $500k and the remaining $1.5m in SBC that doesn’t count?

And it’s not necessarily picking on Uber, this is a problem across public technology companies. The only reasonable change is for compensation committees to adjust their metrics to include stock based compensation. If my return as a shareholder is truly on the basis of FCF/share, management (both senior and mid-level) should be compensated on the same metric.

Let’s look at what Booking Holdings does

BKNG isn’t perfect and nobody is, but they treat the stock-based compensation line like every single other line item when it comes to executive compensation. They do report an Adjusted EBITDA metric and the proxy references “Compensation EBITDA”, but it doesn’t back out SBC, but rather other arguably reasonable “one-time expenses”.

Maybe it’ll never occur, but if you’re running the theoretical NPV of a company you need to account for SBC/dilution in your metrics. It makes a material difference. There are potential solutions from an accounting perspective, but the reality is that this is something fairly easily solved through demanding that compensation committees utilize GAAP accounting or at the very least include SBC in their Adjusted EBITDA metrics.

Tickers Mentioned:

UBER 0.00%↑ SNOW 0.00%↑ MDB 0.00%↑ CFLT 0.00%↑ AAPL 0.00%↑ NFLX 0.00%↑ GOOGL 0.00%↑ AMZN 0.00%↑ EXPE 0.00%↑ BKNG 0.00%↑ CSCO 0.00%↑ CRM 0.00%↑ ORCL 0.00%↑ NVDA 0.00%↑ AMD 0.00%↑ EBAY 0.00%↑ TRIP 0.00%↑ META 0.00%↑ ADBE 0.00%↑ ADSK 0.00%↑ OKTA 0.00%↑ NOW 0.00%↑ PLAN 0.00%↑ TEAM 0.00%↑ TWLO 0.00%↑ ZUO 0.00%↑ ZEN 0.00%↑ SHOP 0.00%↑ DOCU 0.00%↑ DBX 0.00%↑ HUBS 0.00%↑ COUP 0.00%↑ ESTC 0.00%↑ PAYC 0.00%↑

Resources:

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

How do you expect the need for companies to reduce the amount of SBC consuming free cash flow to impact the original purpose of SBC, which is to attract and retain talent? If the problem begins when these high-growth companies rely heavily on SBC to accelerate through talent acquisition, and worsens as companies mature, should the goal be to find lower-cost retention tools?