Rideshare & Delivery SBC and Dilution Hell

Uber, DoorDash, and Lyft are all facing significant shareholder dilution into 2023+

TL;DR

Endless debates over SBC, dilution, and the right way to skin the cat just muddy the water.

Uber dilution of 2.8% going to 4.5% in 2023?

DoorDash dilution of 4.7% going to 7.8% in 2023?

Lyft dilution of 6.5% going to 15.3% in 2023?

Whatever valuation methodology you use, you first need to know what the actual dilution of the business is.

Stock Based Compensation & Dilution: More than one way to skin a cat

It’s all the rage to endlessly argue and debate over SBC, RSUs, stock options, and how they should be accounted for. Should it be FCF minus SBC? Or Adjusted EBITDA pre/post SBC? Or it’s not a cash expense so just account for it in your share count over time?

In an attempt to get to real numbers using actual numbers from the DASH 0.00%↑UBER 0.00%↑ and LYFT 0.00%↑ 10-Ks and 10-Qs, I’m presenting the data in a couple different ways. The real ground truth is likely somewhere down the middle of both methodologies.

Analysis Methodology #1: Statement of Shareholders Equity

The least used and often forgotten financial statement: Shareholders Equity. It’s right after the Income Statement, Balance Sheet, and Cash Flows but most analysts don’t look at it and usually never integrate it into their model.

Using this we can build up a historical model of what common shares, employee (RSU/Option) compensation, acquisitions, repurchases, etc were and through that we can see what the actual net dilution of the business was.

Methodology #1: UBER

Uber absolute share count is up a lot given the acquisitions of Drizly and Transplace, but whether those make sense are for a different discussion. What I care about is what the annualized dilution is as a result of shares issued to employees (as compensation). That dilution tied to employees (RSUs net of withholding, ESPP, stock options) has been adding to the share base by 2.5-3.5% fairly consistently.

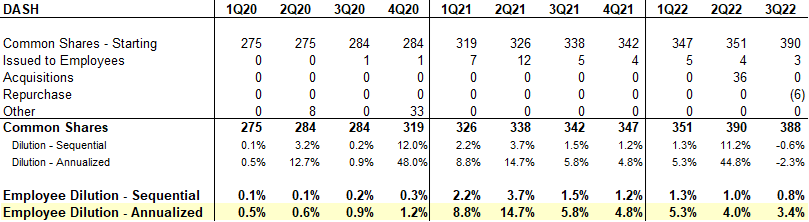

Methodology #1: DASH

DoorDash is a bit messier historically due to a) The IPO in 4Q20 and b) the Wolt acquisition in 2Q22. But stripping those out you can see a company in the three phases of a new IPO:

Not much dilution in 2020 pre-IPO (fairly common as a company converts from stock options as a private company to RSUs as a public company)

Tons of dilution in 2021 as RSUs get issued and options get exercised.

Step down to more normalized dilution in 2022

Even post-IPO adjustment period, DASH is diluting at 3.5-5.0% under this more backwards looking methodology.

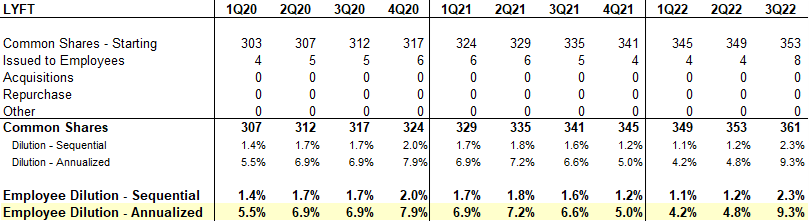

Methodology #1: LYFT

Lyft is extremely clean since the IPO, no acquisitions, no repurchases, no other financings, just straight share issuances to employees. Even though it’s clean the dilution for shareholders as a result of SBC is fairly horrific. Dilution has been averaging north of 6% and despite stepping down in 1H22, it was more than made up for in 3Q22 with dilution >9% on an annualized basis.

Analysis Methodology #2: RSU Grants

The more forward looking methodology is to look at the absolute number of RSUs granted in a year and see what that implied dilution is. In a simplified example a company with 100m shares issuing 10m RSUs/year is diluting shareholders 10% through RSUs. All three companies do have traditional stock options outstanding but minimal new grants so I’m ignoring them in this analysis.

I’m also going to take a few assumptions on what 2023E could look like under the following assumptions:

RSU grants on a share basis are driven by RSU grants on a dollar basis. Essentially if you grant your employees $1B / 10m of RSUs a year, the subsequent years will be driven by the dollar amount as opposed to the share amount. Employees think of compensation on their $50k of RSUs a year, not a share equivalent.

In 2023 RSU grants on a dollar basis will be down 20-30% sequentially from 2022 for the following reasons:

Several companies paid out high retention refreshers in 2022 that are unlikely to re-occur in 2023

Hiring freezes, attrition, and RIFs (LYFT/DASH) result in lower subsequent grants

New hires are often coming from international locations with lower SBC component of compensation

New hires in the US are anecdotally seeing total comp packages 20-25% lower than 1H22.

I also had to make some swags at what 4Q22 RSU grants look like and those are in the notes.

If you think any of this is wrong the analysis is pretty easy to replicate by checking the filings or reach out and I can send you the raw data.

Methodology #2: UBER

Under this more forward-looking methodology due to the nature of how RSU grants are accounted for, UBER 0.00%↑ has been diluting at a 4.1% pace from 2019A-2022E.

What’s dangerous in a declining stock is what the future dilution looks like. The stock is currently $28 and if they issue 20% fewer RSUs on a dollar basis in 2023 it’s 90m RSUs / $2.5B and a further 4.5% dilution. The consensus street target is $46 which would bring dilution down to a more manageable 2.8%. The danger zone is if the stock gets cut in half to $14 the dilution is 9.0%

Methodology #2: DASH

DASH 0.00%↑ is in a much more challenging place. Their dilution to date has been significantly higher than UBER at 6.0% and even assuming 30% lower RSU grant on a dollar basis in 2023 puts dilution at 7.8%. The danger zone is north of 15% dilution and even at the consensus street target of $75 it's over 5%.

Methodology #2: LYFT

The perfect example of what might be a dilution death spiral is Lyft. They’ve consistently diluted at a high rate from 2019-2022 and even if they bring RSU grants on a dollar basis back to 2021 levels it’s 15.3% dilution on a forward-looking basis. Even if they get to the consensus target price of $21 it’s 10% dilution. God forbid the stock goes to $7 in a rough recession and dilution is 30%.

Takeaways from the two methodologies

Obviously this analysis is all done somewhat in isolation. Companies can do layoffs or RIFs, they can dramatically reduce RSU grants, they can offshore or hire employees exclusively in lower market-rate SBC domiciles. The market could rip higher or lower or the economy could be a lot stronger or weaker. All of these variables inevitably affect RSUs, SBC, stock prices, and valuation. But I think the two methodologies can help draw a reasonable upper and lower bound to what dilution ends up being.

Uber Takeaways

Methodology #1: Dilution of 2.9% historically

Methodology #2: Dilution of 4.5% at the current stock price (range 2.8%-9.0%)

Dilution likely takes a step up at Uber for 2023 from historical levels, but not to an insane extent.

DoorDash Takeaways

Methodology #1: Dilution of 4.7% historically (ex pre-IPO period so 2H21-3Q22)

Methodology #2: Dilution of 7.8% at the current stock price (range 5.4%-15.7%)

High dilution since the IPO and it’ll continue. The wild card here is impact of the Wolt acquisition and the layoffs in November.

Lyft Takeaways

Methodology #1: Dilution of 6.5% historically

Methodology #2: Dilution of 15.3% at the current stock price (range 10.0%-30.6%)

Ugly, ugly, ugly. Even if you get to $700m of EBITDA and meaningfully positive FCF you’re diluting shareholders significantly. This could be impacted by the 13% RIF in November but that remains to be seen.

Why does dilution matter?

Simply put, the value of a company is the net present value of the future cash flows. Investors take all kinds of shortcuts to this with EV/Revenue, EV/EBITDA, EV/FCF, P/FCF, P/E; but the trusty old DCF is the sanity check on what the fair multiple for a business is.

When a company is growing quickly (think >50%) the vast majority of the value of the DCF is in the out years when the company is significantly larger. For a growth company there is more tolerance for equity dilution because the NPV of the future FCF per share can overwhelm the dilution.

On the opposite end, a slower growing company gets more of it’s DCF value from what it’s going to deliver in FCF/share in the near term and is significantly more sensitive to dilution.

Under the simple framework of a company growing 25% in year one, a 12% discount rate, and 3% annual dilution you can justify paying 20x FCF. At 10% dilution that implied fair FCF multiple is only 12x.

I’m not going to make the argument that the true north on the issue is FCF minus SBC or any other metric everybody is arguing about. The relevant point is when looking at any particular company you need to understand the dilution to shareholders historically, today, and into the future to really understand what a fair multiple to pay for the business is.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.