Decoding the Restaurant Tech Stack: Vertical Platforms vs Point Solutions

Restaurant ops now run on a maze of specialized apps and payment rails. A deep dive on how vertical-integrated players are outflanking point solutions and running away with market share.

Modern restaurants run on a complex technology stack that powers everything from the cash register to the kitchen and from employee scheduling to bookkeeping. Throughout the 2010s most restaurants either cobbled together point-solutions or stuck with a old all-in-one solution from legacy vendors.

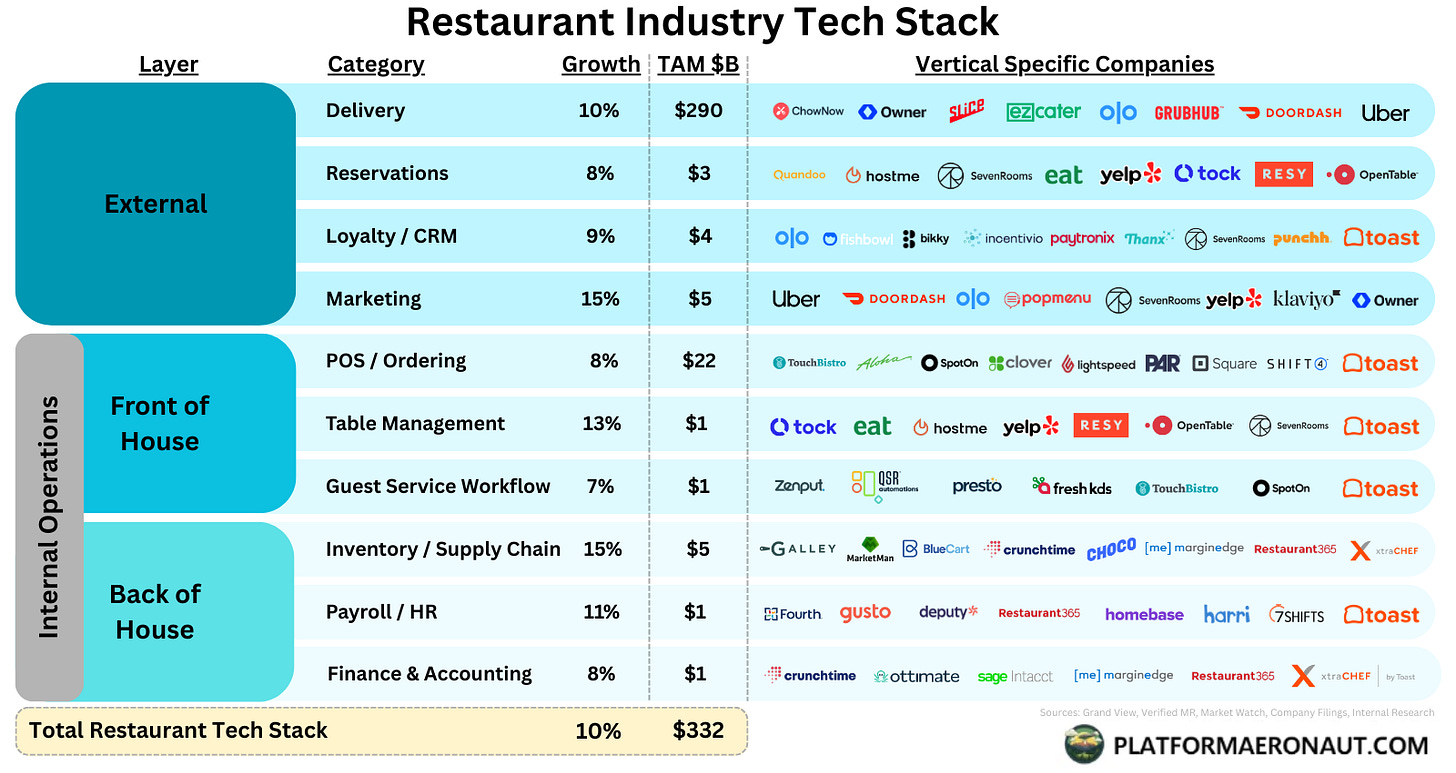

Today however, the industry is witnessing a platformization of restaurant tech. Vertical software companies built specifically for restaurants (with Toast as the leader), are offering integrated solutions across the stack. To start I put together a infographic of the restaurant industry tech stack as it stands today:

I’m sure there are some players that I’ve missed and I purposefully avoided listing more horizontal offerings for each of these (think ADP for payroll). If you notice any big gaps don’t hesitate to reach out or comment.

Point of Sales Systems / Ordering

The point of sales ecosystem is the classic software disruption story of older incumbents versus cloud disruptors. Legacy point-of-sale incumbents like NCR’s Aloha and Oracle’s Micros long dominated enterprise restaurant chains with on-prem systems. They cost tens of thousands of dollars in up front fees and were powerful but complex. Cloud based disruptors like Toast, Square, and Lightspeed stepped in to serve independent and SMB restaurants with one-stop shop solutions. Fast forward and the restaurant POS market share map in the US looks roughly like this:

But the emergence of players like Toast as a platform across restaurant tech has turned this upside down. The restaurant POS ecosystem today can be divided up into two groups enterprise and independent, and let’s look at POS system adoption through these two lenses:

Enterprise / Chain:

Enterprise and large chain restaurants are either on self developed solutions or more often Micros or NCR Aloha. They’ve invested heavily in these more legacy systems and are hesitant to adopt cloud solutions like Toast. Although we’ve started to see the expansion of Toast into enterprise chains like Applebee’s, Caribou Coffee, and Potbelly Sandwiches, their focus historically has centered on mid-market and emerging chains. Additionally the legacy incumbents have been making cloud oriented acquisitions over the past decade to try to keep up on the feature and versatility side.

Independent / SMB:

The independent and SMB cohort can be best thought of as anywhere from your favorite local taco truck (probably running Square) to a 3 location restaurant group (likely running Toast), to a mid-market or emerging chain with 10-30 locations (frequently chosing Toast).

While Toast, Clover, Revel, and Square can’t easily compete on pure economics from payment processing, they can provide depth, platform software solutions beyond POS, cloud nativity, and integrated payment processing that is a razor-and-razor blade model as opposed to legacy software and separate payments with point-solutions for every other business need.

Integrated fintech is the real margin engine: Toast processed ~16 % of all U.S. restaurant card volume in 2024, and PAR/Shift4 each top $110B in annual GPV. Lending, cash-advance, and instant-tip payouts now account for a mid-single-digit share of platform revenue (small today), but a sneak preview of the next monetization leg.

Front-of-House Operations (Beyond POS)

Beyond the POS we’ve seen the proliferation of point solutions to assist with table management and guest service workflows. Many POS platforms like Toast have these features integrated but they tend to be more basic or lack some of the customer-centric dominance players like OpenTable have. This tends to me a smaller portion of the market though with niche point solutions or bundled solutions as part of the POS given a combined TAM for table management and guest service of $1-2B.

Table Management

Front-of-house tools help restaurants optimize the dining room experience beyond just taking orders. Table management software, for example streamlines how hosts handle seating, waitlists, and table turnover. It provides a real-time view of which tables are occupied, free, or reserved, turning a traditionally hectic task into a data-driven process. By integrating with reservation systems, these tools can reduce wait times and improve the flow – staff can instantly see table statuses and anticipate upcoming free tables, leading to more efficient seating of guests. This is one domain where specialized point solutions have popped up, often connected to the reservation platforms (e.g. SevenRooms or Yelp Waitlist).

Tabletop computer-vision startups like ClearCOGS forecast covers and suggest staffing in real time, hinting at a future where AI pairs hostess data with back-of-house prep.

Guest Service

“Guest service” tech refers to digital tools that enhance the in-restaurant service and guest experience. This can include tableside ordering devices, pay-at-table systems, and other customer-facing interfaces. Think of this as things that help the server and restaurant speed up service and reduce errors.

Customer-facing displays or tabletop kiosks (such as those used in some casual dining chains) let guests review their order or even self-order, boosting satisfaction through transparency and convenience. Many modern restaurant platforms bundle such guest service features, Toast offers handheld order devices and integrated feedback collection.

Reservations

Beyond the POS, most external parties think of the reservation system as the most obvious part of restaurant-tech, after all it’s where most consumers first interact with websites like OpenTable, Tock, and Resy.

OpenTable is the dominant incumbent here used by the largest number of restaurants globally (over 60k). It pioneered digital reservations but has a reputation for high fees and originally was on-prem. In the past decade challengers like Resy (now owned by American Express) and Tock (originally bought by SquareSpace but now owned by Amex) have come at it from a premium high end restaurant perspective. If you make a reservation at a Michelin star restaurant it more likely than not is a prepaid reservation on Tock.

Today OpenTable remains the leader by responding with better pricing and a great UX/mobile app for general dining reservations, but Tock, Resy, and other point solutions have come at the problem from a segmentation and partnership perspective.

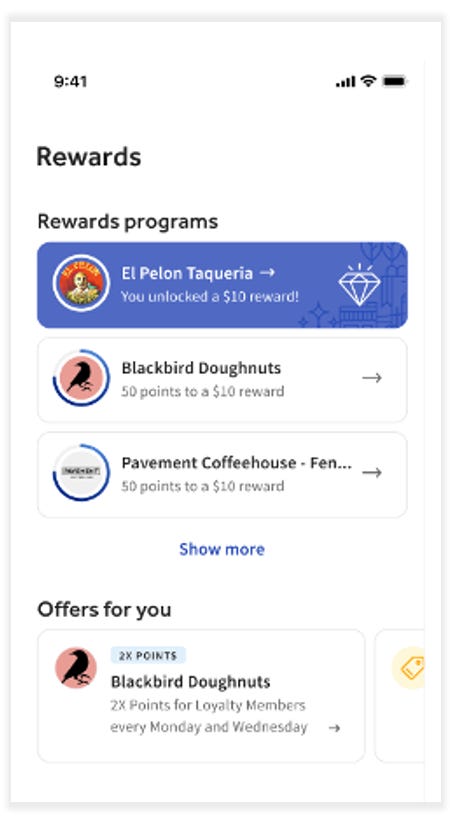

Loyalty & CRM

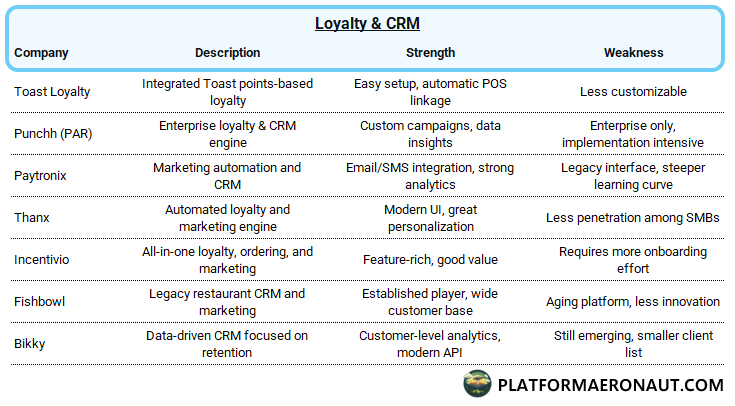

Cultivating repeat business is crucial in hospitality, and loyalty/CRM systems help restaurants do exactly that. Many restaurants use loyalty programs to reward frequent guests and capture data about their preferences. Toast offers a built-in loyalty module integrated with its POS, enabling guests to earn and redeem rewards seamlessly as they pay because it’s linked to the credit card or customer profile, there’s no need for punch cards or separate apps.

Third-party specialists provide more advanced loyalty and CRM capabilities, especially for larger chains. Punchh, for example, is a leading loyalty and engagement platform (now part of Par Technology) used by major restaurant brands to run customized rewards, push notifications, and personalized offers at scale. The ecosystem also includes lighter-weight solutions (from startups like Thanx or old-school punch-card apps) for smaller operators. The common thread is integration: the best loyalty/CRM tools tie into the POS and online ordering, so every visit (whether in-store or digital) is tracked. This data powers targeted marketing campaigns (like birthday offers or lapsed-customer promos) that drive incremental visits.

Enterprise groups are experimenting with clean-room collaborations (PAR × AWS, Olo’s CDP) that match POS spend to third-party media buys without sharing raw PII, essentially turning first-party checks into ad-tech fuel

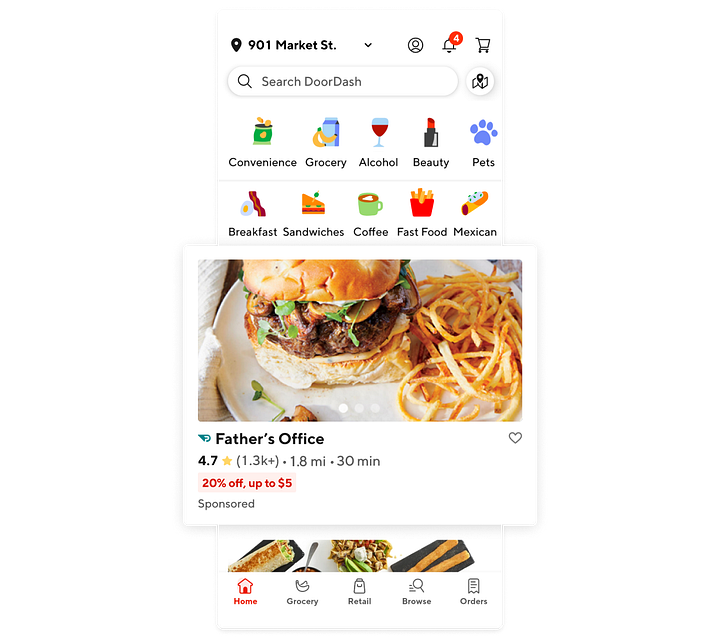

Delivery Technology

Third-party delivery has become a fixture in the restaurant business, and a few giants dominate this arena. DoorDash and Uber Eats together control the bulk of the U.S. food delivery market. These platforms connect restaurants to millions of consumers, but they come with steep commission fees and often mediate the customer relationship. Most restaurants feel they must participate on DoorDash/Uber for the visibility, despite the cost it’s a trade-off between reach and margin. To mitigate this, some restaurants are turning to more restaurant-friendly delivery solutions. This has become huge business with run-rate TAM for DoorDash and Uber Eats well north of $170B.

Slice, for instance, focuses on pizzerias and offers online ordering and delivery services at a fraction of the commission that the big apps charge (its model is tailored to independent pizza shops, charging flat fees that preserve the shop’s profit on each pie). As a side note I recommend following Slice founder and CEO Ilir Sela on twitter for great takes and data.

There are also companies like Owner.com that help restaurants reclaim their delivery business: Owner.com provides restaurants with a branded online ordering system and even facilitates delivery using third-party fleets, but on a zero-commission basis (restaurants pay a flat subscription instead). The idea is to convert customers to ordering direct from the restaurant’s own website/app after perhaps discovering it on DoorDash/Uber initially. For more on delivery economics I have several other posts deep here:

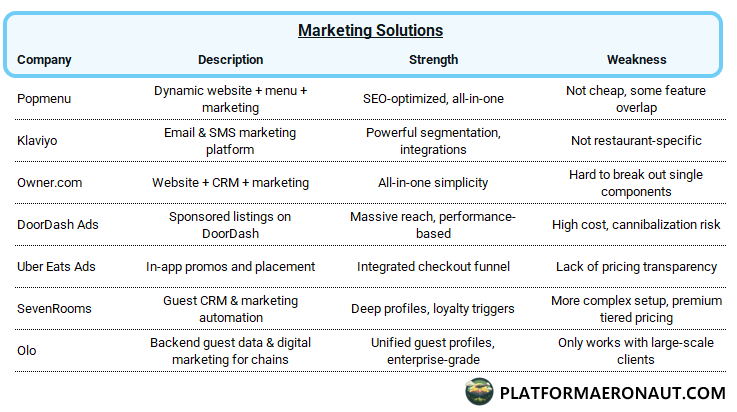

Marketing Technology

Effective marketing can be the difference in driving diners to a restaurant versus a competitor. With the rise of in-app marketing at DoorDash and Uber Eats we’ve seen the TAM and revenue potential blow up.

Restaurant marketing tech falls into two broad categories:

Traditional Direct Marketing (Web, Email & Engagement)

This encompasses the tools a restaurant uses to promote itself directly to customers, outside of third-party marketplaces. Popmenu offers an all-in-one marketing platform with interactive menus, built-in SEO, and automated email/SMS outreach to turn first-time visitors into regulars. Owner.com similarly provides an integrated toolkit (website, online ordering, mobile app, and marketing automation), allowing restaurants to run campaigns (like email newsletters or limited-time offers) that drive customers back without paying third-party fees. Many restaurants also leverage general-purpose marketing tools using solutions like Klaviyo or Mailchimp to send targeted emails if they’ve built a sizable customer email list through loyalty programs or reservation sign-ups.

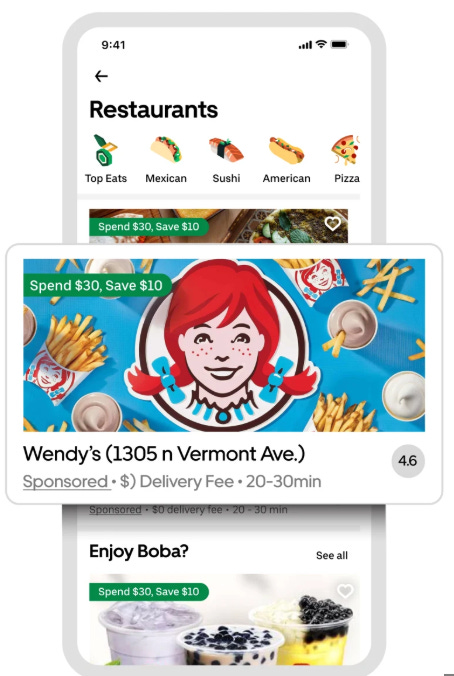

In-App Marketing (Within Delivery Marketplaces)

The other side of restaurant marketing happens within third-party apps like DoorDash and Uber Eats. These platforms have introduced advertising options usually called sponsored listings or promotions that restaurants can pay for to improve their visibility.

This in-app marketing targets customers at the point of ordering decision, which can be highly effective. Reports have shown that restaurants using sponsored listings on delivery apps often see a significant uptick in sales (each $1 spent on these ads can yield an estimated $10–$20 in additional sales). Promotions can also include discounts or free delivery deals funded by the restaurant to attract orders via the app. The trade-off is that the restaurant is essentially paying the delivery app for both commission and advertising, which cuts into margins. It’s a lucrative area for the delivery platforms and has essentially created a parallel marketing channel that restaurants must manage alongside traditional marketing.

Those ad rails are scaling fast: both DoorDash Ads and Uber Eats are north of $1B revenue run rates, and CPMs routinely clear Facebook by 4–6x given the closed-loop attribution.

Back Office Systems

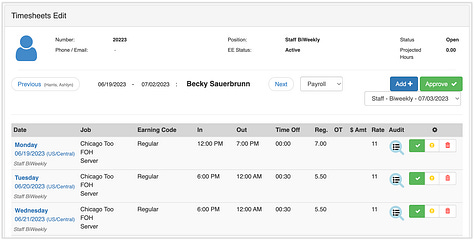

Payroll & HR

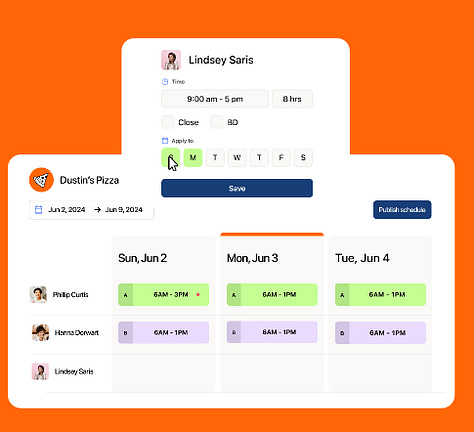

Back office for restaurants tends to be a bit more complex than a normal brick and mortar business. Payroll and HR software for restaurants needs to handle tip calculations, irregular schedules, high turnover, and labor law compliance (like tracking hours for overtime and meal breaks). Many small restaurants use general payroll providers such as ADP, Paychex, or Gusto, but the rise of restaurant-specific solutions is notable. Toast itself expanded into this arena by acquiring StratEx (a restaurant HR tech company) in 2019, later launching Toast Payroll & Team Management. This integrated system ties directly into the Toast POS, so employee time punches flow into payroll automatically, and it offers features like streamlined onboarding, team scheduling, and even tip pooling calculations.

Aside from Toast’s offering, other popular restaurant-centric workforce platforms include 7shifts and HotSchedules (by Fourth) for scheduling and labor management that these can forecast staffing needs based on sales and help control labor cost % by optimizing shifts. On the hiring and HR side, platforms like Harri focus on applicant tracking and onboarding in hospitality, recognizing the industry’s fast hiring cycle.

Finance & Accounting

Restaurant finances are notoriously tight-margin and complex, which has led to specialized accounting and inventory management solutions for the industry. Restaurant365 (R365) stands out as a leading all-in-one back-office platform for over 40k restaurants that combines general ledger accounting with restaurant-specific modules for inventory, vendor management, scheduling, and more. Even Toast has moved into this space: in 2021 Toast acquired xtraCHEF, a back-office tech provider specializing in accounts payable automation and inventory management.

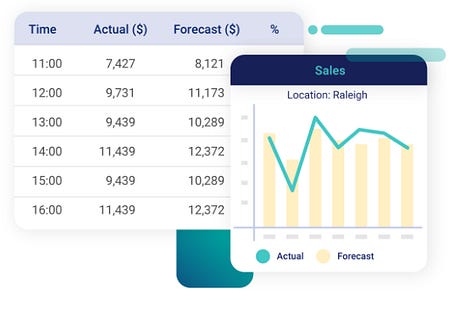

Another notable player is CrunchTime, which is often used by large chains for inventory and supply chain management (tracking inventory across dozens of outlets, optimizing orders to distributors, etc.). There are also newer entrants like MarginEdge which focus on automating invoice entry and providing real-time food cost dashboards for independent restaurants. Back-office finance tech is about integration and insight by integrating purchase data, sales data, and workforce data to present an accurate financial picture, and surfacing insights (like “your seafood taco has a 10% higher food cost than target”) that management can act on quickly.

Inventory & Supply Chain

Closely tied to accounting is the inventory and supply chain management technology, which warrants its own call-out. Restaurants juggle dozens or hundreds of ingredients, and keeping the right stock levels while minimizing waste is a perpetual challenge.

Restaurant365, mentioned above, includes robust inventory modules that allow tracking of inventory depletion, recipe costs, and automatic generation of purchase orders. It can even integrate with vendors so that order guides and prices are updated in the system, giving managers a clear view of what to buy and how much. Enterprise brands might use systems like CrunchTime to manage supply chain at scale. For smaller restaurant groups and independents, tools like xtraCHEF by Toast or MarginEdge fulfill a similar role. The benefit is proactive insight: if chicken wings suddenly cost 20% more this month, the software will reflect that in profitability reports, prompting the operator to consider menu price changes or portion adjustments.

Platformization is the Future

In the age of AI the platformization and one-stop-shop orientation of restaurant tech solutions like Toast are likely winners. Legacy providers like NCR and Micros will remain and continue to innovate, but Toast is making a concerted effort to push into the enterprise side with wins at Applebee’s, Caribou Coffee, and Potbelly Sandwiches in the past 12 months.

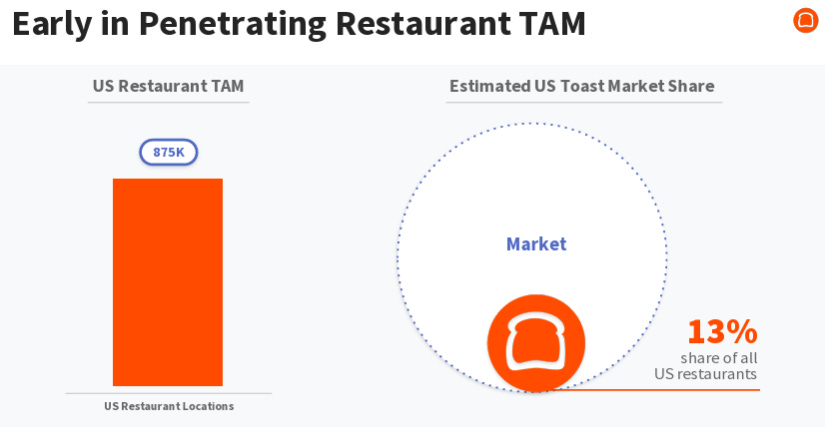

The side, scale and economics of Toast speak for themselves. They’ve carved out a great vertical niche for themselves with strong incremental operating margins and coming out of covid strong FCF generation as well:

The restaurant TAM is big and by Toast’s estimation they’re early in the penetration story. For a sector that generates a notable portion of GDP it’s still in the middle of the disruption stage as Toast and other cloud native offerings take share.

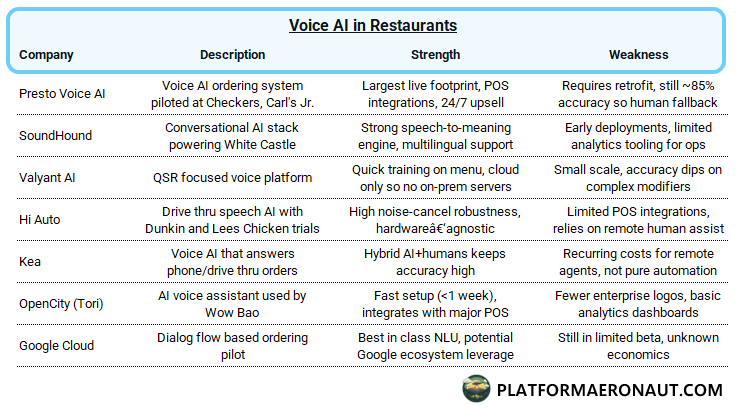

AI in Restaurant Tech: The Drive-Thru Gets Smart

While much of the restaurant tech stack has been evolving steadily over the past decade, AI innovation is accelerating most visibly in the drive-thru lane. Voice AI, natural language processing, and machine learning are starting to replace human order-takers at QSR windows, with startups and incumbents alike racing to capture this labor-intensive, high-throughput touchpoint.

Companies like Presto, SoundHound, and Valyant AI (now part of ConverseNow) are leading the way, offering automated drive-thru agents that can take orders with high accuracy, upsell customers, and integrate directly with the POS. McDonald’s, Checkers, Panera, and Hardee’s have all trialed voice AI ordering, often touting labor savings, consistency, and improved throughput.

The value proposition is straightforward: reduce headcount needs at peak hours, improve order accuracy, and never forget the upsell. Some systems now combine voice recognition + computer vision (to read license plates or detect loyalty accounts) to further personalize the interaction. The most ambitious players even link AI ordering to predictive inventory, traffic data, and POS history.

Reality check: live pilots still clock 83–88 % order-capture accuracy, so a human ‘whisper agent’ has to step in on roughly one of every five transactions, good, but not yet a cashier-free utopia.

Tickers Mentioned: TOST 0.00%↑ UBER 0.00%↑ DASH 0.00%↑ OLO 0.00%↑ YELP 0.00%↑ BKNG 0.00%↑ AXP 0.00%↑ XYZ 0.00%↑ KVYO 0.00%↑ VYX 0.00%↑ FI 0.00%↑ LSPD 0.00%↑ PAR 0.00%↑ FOUR 0.00%↑

The information presented in this newsletter is the opinion of the author and does not reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for informational purposes and should not be construed as investment advice or an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Altimeter and its clients trade in public securities and have made and/or may make investments in or investment decisions relating to the companies referenced herein. The views expressed herein are those of the author and not of Altimeter or its clients, which reserve the right to make investment decisions or engage in trading activity that would be (or could be construed as) consistent and/or inconsistent with the views expressed herein.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Thank you

Very good overview and quite accurate. The hospitality B2B space is witnessing a platforming on many fronts. It used to be all about "best of breed" or point solutions in the industry. But people are realizing how messy that is and are opting for all-in-one/platforms.

https://www.hospitalitynet.org/opinion/4127834.html