Q4 Food Delivery Review & Rideshare Dilution Update

Dilution still ugly, but delivery sequential improvements a bright spot

TL;DR

DoorDash continues to extend dominance over US delivery marketplace, Uber is holding in okay, Grubhub is a disaster.

Uber driving profitability and margin improvements much greater and faster than Doordash is.

UBER and DASH dilution in 4Q22 was still at unacceptable levels of +3.0% and +3.5% respectively

LYFT dilution of +10.2% Y/Y in 4Q22 is honestly so unbelievably bad it hurts my brain to think about.

Let’s start out first with a quick review of the food delivery results from 4Q22. I previously posted emphasizing the dispersion we’re seeing for LYFT 0.00%↑ vs UBER 0.00%↑. Over a long time horizon we’ve continued to see DoorDash consolidate market leadership while Uber Eats is hanging on, and Grubhub is descending into oblivion.

Uber Delivery 4Q22

Uber Eats top-line grew 6.5% year-over-year in Q4 which was a little light vs consensus and well below commentary made earlier in the year that 2H22 would see acceleration vs 1H22. Order frequency remains a bright spot +4% Y/Y but basket size decelerated to +1% vs +4% in 3Q22. Implied customer growth was only 1% in Q4 which doesn’t bode particularly well for growth into 2023. The largest outstanding question is whether the market is fully penetrated.

Where Uber’s delivery segment really shined was the focus on profitability. The above chart is Uber’s delivery segment incremental EBITDA margin growth on a TTM basis. Essentially for each new dollar of delivery GBV Uber generated, they generated $0.25 of EBITDA on a trailing 12mo basis. Note that I’ve re-allocated overhead expenses based on Delivery GBV as a % of total GBV similarly to the way I’ve done so with Uber Mobility.

Incremental margins came from:

Efficiency in the marketplace.

Competitors also focused on profitability

Step function change in cost per transaction due to technology

Advertising business outperforming and augmenting margins

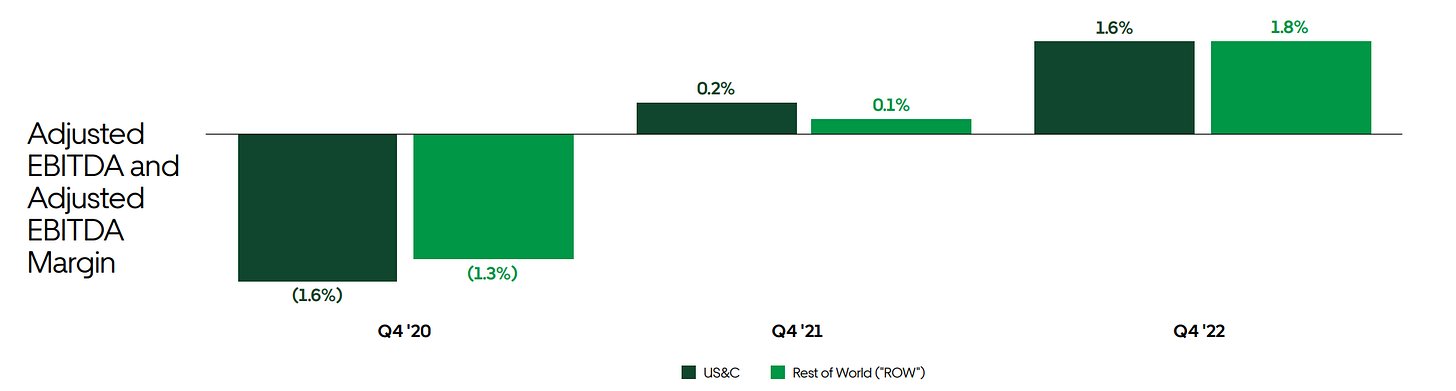

It’s interesting to note that the EBITDA margin improvement for Uber is equally good for both US & Canada and the Rest of World (“RoW”).

Rationalization

Rationalization of the competitive environment from has been one of the biggest contributors. Peers in Europe (Deliveroo, Just Eat, Delivery Hero) have been aggressively cutting promotional spending, pulled back on growth, and refocused on profitability. The cleanest way to appreciate this for Uber is to look at their consumer incentives per trip over time:

Although this is inclusive of the ridesharing half of the business. We’re seeing the prevalence cheap/free/discounted orders for delivery disappear. In 2Q20 consumer incentives per trip was as high as $0.58 and in 4Q22 it had declined to $0.21. Even at $0.21 that’s ~$2B of promotional expense that Uber can still remove from the P/L.

DoorDash: Saying the Right Things

DASH results were solid, with DoorDash +20% and Wolt +50% Y/Y in 4Q22 and a small EBITDA beat. We saw a re-acceleration on margin as some of the growth push into DashMart and other initiatives are being digested and rationalization in the competitive environment takes hold.

More important was what Tony and the team said in the shareholder letter and on the call. I highly recommend reading the sections titled “Maximizing Long-Term Free Cash Flow per Share” and “The Value of Our Shares”. Some of the pertinent language:

Tony and the management team are clearly focusing on the right things and using the right language. If there’s anything I could find fault with it’s the usage of a new $750m repurchase authorization to offset dilution with the guidance of net dilution in 2023 to be around 2%. A much better framework is one I referenced on twitter last week:

Uber Dilution: Still Elevated

In Q4, Uber’s annualized dilution to employees remained elevated at +3.0% Y/Y. This should come down over time as a result of a) Stock price performance and b) comping retention RSUs paid out in early 2022 that likely aren’t repeated.

DoorDash Dilution: Also Still Elevated

DASH provided guidance of 2% dilution net of buybacks and color in the shareholder letter that 8.7m of the 31m RSUs issued in 2022 were related to the Wolt acquisition and employee retention. Despite that, dilution was still running +3.5% Y/Y in 4Q22 excluding repurchases/acquisitions. Note this is the same analysis as previously used in my Rideshare & Delivery SBC and Dilution Hell blog

LYFT Dilution: Holy shit

And just for pure entertainment purposes, here is Lyft’s dilution clocking in at +10.2% in 4Q22. It’s honestly difficult to see the path forward for Lyft that doesn’t involve PE levels of layoffs and org restructurings. Lyft is diluting more every year than the stock market historically returns to investors.

Tickers Mentioned:

UBER 0.00%↑ LYFT 0.00%↑ DASH 0.00%↑

Resources:

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

"Even at $0.21 that’s ~$2B of promotional expense that Uber can still remove from the P/L." What's the reason to believe promotional expense eventually goes to zero? It's seems like steady state for both rideshare and delivery is likely to contain some form of discounting through consumer incentives.

Thanks. Really enjoy the analysis. Do you have a sense on why Uber keeps falling short on delivery? It seems like all the Grubhub share loss is going straight to DD. While you would expect that Uber being a platform with more to offer and ability to cross-sell, it should be the other way around. Plus, Uber One should be a more valuable proposition to users than DashPass. Often Selection is raised as the key advantage of DD, but it feels Uber should have had plenty of time to catch-up on that.