Platform Aeronaut Dispatch | No. 1 | Navan IPO Filing, Toast Pricing Error

A quick view of this week’s shifts in platforms, valuations, and AI adoption. Numbers, context, and curated reads you can use.

I’m going to experiment with a more newsletterish format that I’ll more frequently post in addition to the deeper dives I’ve been posting. I figure it’s a good way to keep myself focused and intellectually organized around both the small and large moves around travel, software, and delivery.

Recap of What’s New

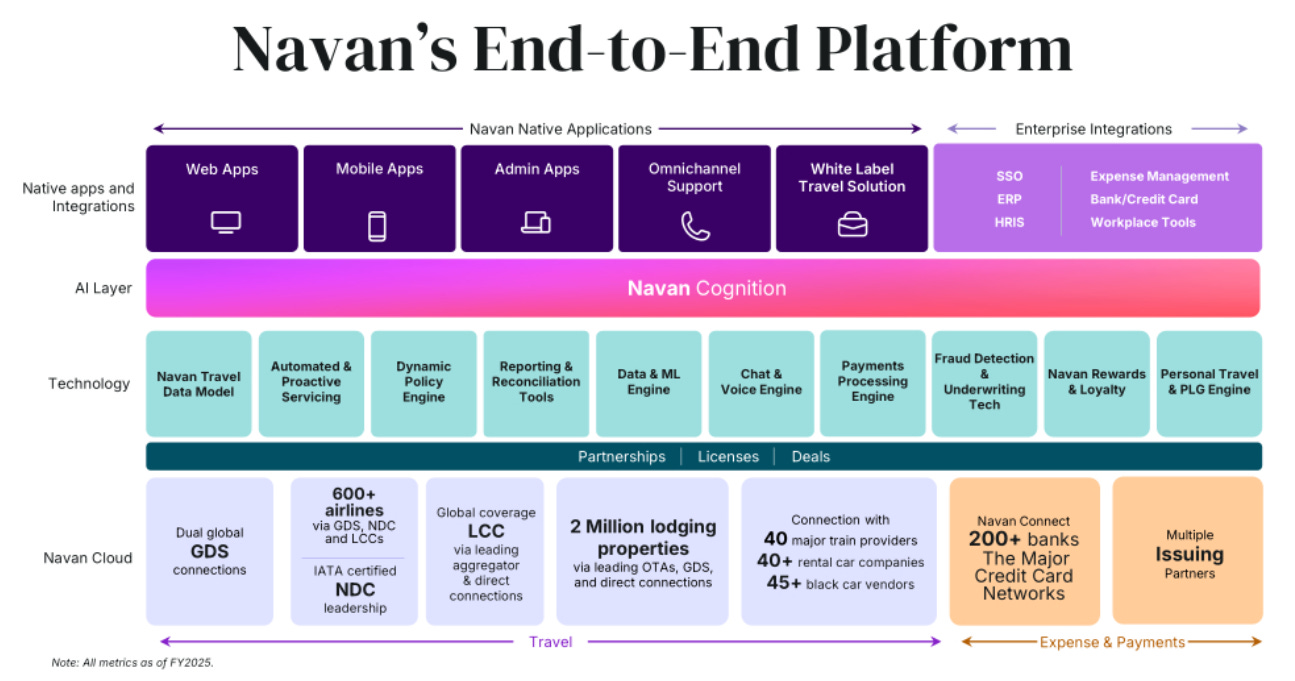

Navan (NAVN) IPO Filing

Navan filed their S-1 revealing 29% revenue growth in the quarter ending Jul 31, 2025 ($172m). The company did $614m in LTM revenue on $7.6B of GBV (a 12% take rate) with 71% gross margins. Although it’s been mostly loss making, they’ve jumped to non-gaap operating income profitability in the last two quarters.

Reuter’s is reporting the IPO could value the company above $8B versus the last private round at $9.2B, but down round IPOs are a necessary part of the process not a red flag. With the business growing >25% in a sector that’s still fast growing I’d expect Navan to capture a premium valuation (Navan BTI business travel index is growing >15% Y/Y right now)

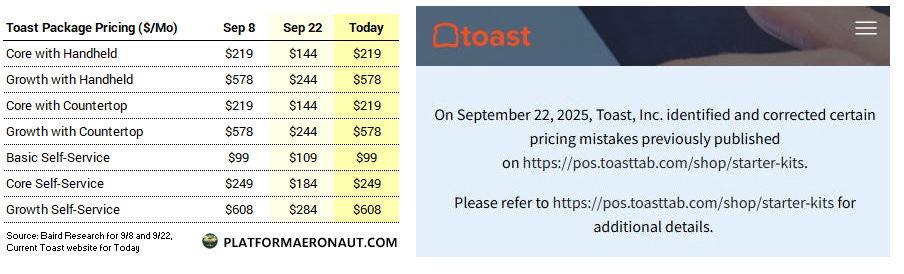

Toast (TOST) Crushed on Pricing Error

On Monday 9/22 Baird analyst David Koning published a note that the Toast website had trimmed pricing for their software packages by 26-58% which sent the stock down 9.5%. Shortly afterwards the company reverted the pricing and put a notice on their IR website

Post the correction they actually increased pricing for several of their packages, and the stock recovered but still closed down over 5% for the day (and -9% Mon-Wed) as there was plenty of confusion over intention and reality vs market perception. This just goes to show the volatility we’re seeing in markets today and when you’re a growth oriented business small changes even if in error can have a large impact.

Performance & Valuation Snapshot

I’m working on a big list of companies reasonably within what I’m discussing across leisure, delivery+ridesharing, internet, OTAs, gaming, fintech, and software. More to come here as I flesh this out a bit more on valuation. Happy to receive feedback or comments on what you’d like to see here.

What I Read This Week

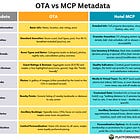

Apaleo launches MCP server for hotels: First PMS vendor to expose hotel systems to agentic AI via an MCP server; big step toward standardized agent connectivity.

Waymo launches “Waymo for Business”: Corporate robotaxi accounts target business travel in LA, SF, Phoenix and Austin.

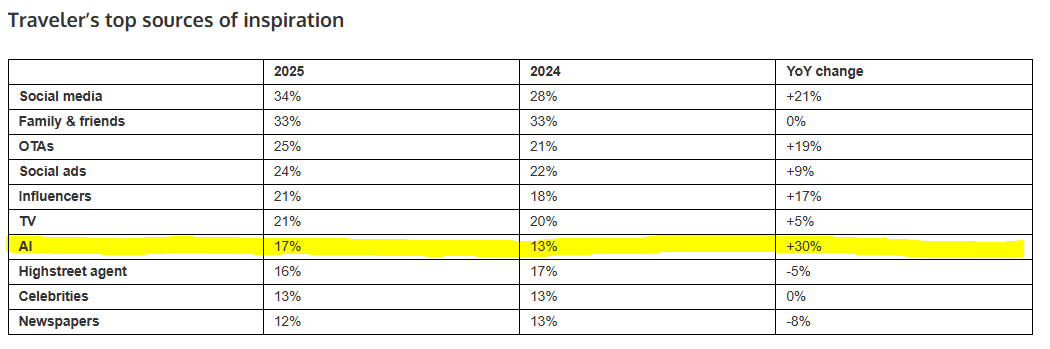

AI usage by travelers is rising fast: Survey data shows AI use in travel planning more than doubled from Oct 2024→Jul 2025.

Lucid delivers first Nuro-Uber Robotaxi: The first of 20,000 AVs in the US over 6 years has been delivered to Nuro for retrofitting as an AV for use on the Uber network

Amadeus research shows AI shift in travel planning showing a big jump in inspiration from AI year-over-year to 17% as a top source.

Sabre launches agentic AI solutions with MCP: Travel agencies can now use both APIs and Sabre’s MCP server to link their own AI systems with SabreMosaic

Amazon Adds Winn-Dixie for Same-Day Delivery: In push for more perishable item delivery (and vs regional giant Publix), Winn-Dixie and Amazon are partnering up.

MCP risks for hoteliers: Trade piece outlines integration/security risks and governance questions hoteliers should address before adopting MCP.

WeTravel raises $92m Series C: Intention to focus more on AI tools for multi-day trip operators

From My Recent Work

Transcript Highlights (Exec Signals)

I’ve also started compiling some Transcript Insights from conferences and earnings calls. It’s still a work in progress and I’m working to further automate it, but I’ve added a few so far and here’s a few quick takes from the GS TMT conference that were interesting:

Booking (BKNG) 2025 Goldman Sachs TMT Conference

Alternative Accommodations Strategy: Continue supply growth, 8.4M listings (+8% YoY), still significant U.S. upside, and proposition benefits from unified hotel + alt accommodations platform.

Role of AI? Already impacting customer service costs and cancellations; future will be transformative in creating a fully integrated connected trip.

Instacart (CART) 2025 Goldman Sachs TMT Conference

Thoughts on Amazon’s grocery push? Instacart growth is unaffected; Amazon’s SKU count and delivery times inferior; will use this to deepen retailer ties.

Macro ad environment? Volatile due to tariffs and SNAP regulation changes, but Instacart still delivered 12% YoY ads growth.

Uber Technologies (UBER) 2025 Goldman Sachs TMT Conference

AV adoption? Consumer reception strong; vehicles outperform most human drivers; cost curve for hardware highly favorable; expansion accelerating globally.

Mobility growth drivers? Strong trip growth in top 20 markets; faster in suburbs/secondary cities; barbell model of premium & affordable products; commuter-focused “Price Lock” boosts trips.

Poll of the Week

The information presented in this newsletter is the opinion of the author and does not reflect the view of any other person or entity, including Altimeter Capital Management, LP (”Altimeter”). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for informational purposes and should not be construed as investment advice or an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Altimeter and its clients trade in public securities and have made and/or may make investments in or investment decisions relating to the companies referenced herein. The views expressed herein are those of the author and not of Altimeter or its clients, which reserve the right to make investment decisions or engage in trading activity that would be (or could be construed as) consistent and/or inconsistent with the views expressed herein.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.