Tech Dilution: Stabilization on Large; Divergence at the Margin

Continued progress on dilution at big tech while growth software & internet stabilized at pre-covid levels. Meta has gotten worse within it's cohort, Snowflake has struggled, and Robinhood gets an A+

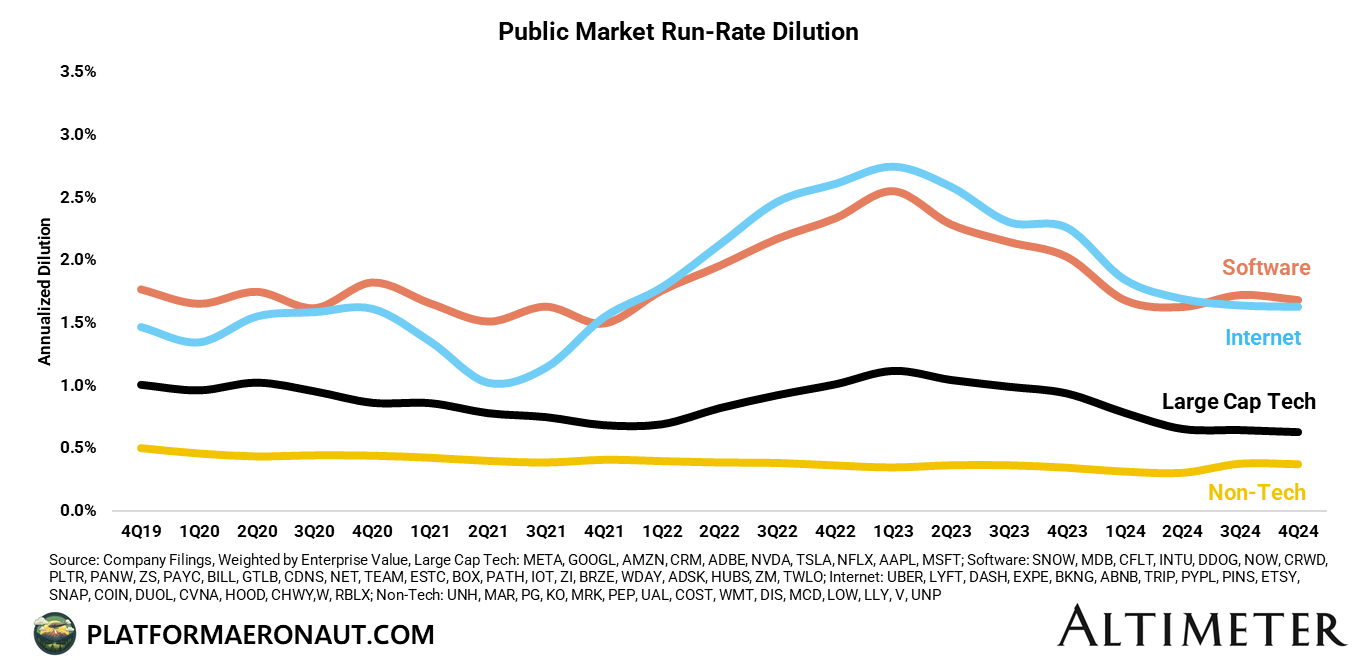

We’ve finally started to see levels of stabilization in dilution and surprise-surprise, it’s at similar levels for software and internet as it was pre-covid. Large cap tech has continued to deliver improving levels of dilution with scale and current trajectory has the Mag 7 names hitting non-tech levels of dilution in the 2028-2030 time frame.

We’ll likely look back at the 2020-2022 time frame as the golden age of employee equity compensation, especially at the big tech companies. As companies increasingly get fit and mature (and as top-line growth decelerates over time), we’re likely to see the black line for large cap tech converge with that of non-tech. After all, those non-tech names were the growth leaders of the market back in their hayday.

My favorite chart to try to separate and see outliers and outperformers on dilution is this updated chart on tech company dilution versus market capitalization:

I’ve taken the initiative to highlight companies I think are overdiluting for their size (Box, Lyft, Twilio, Snowflake, and even Meta/Google on the mega cap size), or are outperforming (Booking, Tesla, Netflix, Paycom).

After all it’s not necessarily fair to cross compare a mature technology firm like Apple to a growth name like Confluent or Duolingo. And one pushback I’ve gotten is that some of my dilution metrics on % are really an expression or output of stock price.

If a company has a $100 stock price and grants $100m of RSUs per year as fair market value compensation to employees that means they’re granting 1m shares per year. We can look at two scenarios:

The stock goes to $50 and to grant that same $100m of value to employees (what has been expected) the company needs to grant 2 million shares.

The stock goes to $200 and now the company only needs to grant 500k shares.

So the above chart and analysis is a more fair way to cohort companies based on dilution versus the market capitalization/size.

Cohort Leaders and Laggards

Here is a non-exhaustive list of some of the cohorts and individual companies charted out in some of the above graphs. I’ve highlighted in red those companies that are notably diluting higher than their peer set.

More interesting on this is perhaps what the dilution run-rate has changed from through 4Q24 versus a year prior in 4Q23:

The list of companies improving dilution levels is definitely larger than that worsening. And certainly you can draw correlations between stock price and change in dilution levels, but I do want to give kudos to Lyft for continuing to reduce dilution. They were in the death zone from my prior analysis and they’ve made some step function changes to RSU dilution since then.

Tech Company Dilution Leaderboard

As I previously disclosed last summer, I put together a cumualtive leaderboard of sorts for company dilution across a variety of metrics. I most heavily weight towards:

Stock Based Compensation as a % of Free Cash Flow

Dilution versus it’s peer cohort (software, internet, and big tech)

Absolute dilution % level

Generally the way to read this is that names in the top couple groups are doing pretty good all else being equal. Those in the bottom half are doing pretty poorly. The numbers are where they rank in total and I’ve highlighted the top and bottom decile for each category. Unsurprisingly Booking Holdings has maintained it’s positioning atop the leaderboard.

Digging into the biggest changes since I published this last time here are the top and bottom 10 improvers or decliners:

So let’s dig into a couple of these:

META: Better on absolute but worse on relative & cohort basis

Meta has essentially round-tripped dilution back to where they were pre-pandemic. We saw a meaningful draw down from 3-4% dilution levels to 1.4% run-rate the past three quarters as the company has “gotten fit”. But that’s stalled out in the age of AI. As other big tech companies like Amazon, Netflix, Tesla, and Nvidia have continued to improve their metrics the relative positioning on the leaderboard for Meta has deteriorated as discipline around SBC has slowed.

Snowflake: Slowly getting worse

The bump early on was from normal post-IPO dilution messing with the metrics a bit, but even post-IPO and post pandemic, we’ve seen dilution metrics at Snowflake continue to worsen. Some of this is the dichotomy of a previously high stock price, aggressive hiring, and expensive engineers overlaid with headcount growth and some of it is a new CEO. Either way Snowflake’s stock-based compensation and dilution practices are pretty egregious.

Robinhood: Worst imaginable to huge success

HOOD post IPO in the height of ZIRP pandemic induced madness was doing over 10% dilution annually. As a reminder at those levels even if you’re in hypergrowth mode you’re facing a huge stock headwind from SBC issuances. Since that CEO Vlad Tenev and the team have made enormous strides. In fact on a forward basis, Robinhood is issuing net new RSUs at a rate <1% of shares outstanding which is better than the likes of GOOGL, CRM, DASH, UBER, and NOW.

As I’ve said before, the SBC analysis is super interesting but given the large amount of manual data entry and analysis is prone to some mistakes or potential future adjustments to the methodology. I’ve heard from some management teams that I’m looking at it incorrectly or overstating dilution because it depends on whether you use basic shares, diluted shares, or fully diluted shares outstanding. Healthy feedback like that is definitely valid but the above is my best effort to really cross compare companies on an apples to apples basis. I continue to welcome feedback or different ways to think about this.

Tickers Mentioned: SNOW 0.00%↑ UBER 0.00%↑ NOW 0.00%↑ META 0.00%↑ HOOD 0.00%↑ EXPE 0.00%↑ BKNG 0.00%↑ MSFT 0.00%↑ CRM 0.00%↑ DASH 0.00%↑ CRWD 0.00%↑ BOX 0.00%↑ LYFT 0.00%↑ TWLO 0.00%↑ TSLA 0.00%↑ PAYC 0.00%↑ NFLX 0.00%↑

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Hello Thomas,

I hope this communique finds you in a moment of stillness.

Have huge respect for your work, specially the unique reflections.

We’ve just opened the first door of something we’ve been quietly crafting for years—

A work not meant for markets, but for reflection and memory.

Not designed to perform, but to endure.

It’s called The Silent Treasury.

A place where judgment is kept like firewood: dry, sacred, and meant for long winters.

Where trust, patience, and self-stewardship are treated as capital—more rare, perhaps, than liquidity itself.

This first piece speaks to a quiet truth we’ve long sat with:

Why many modern PE, VC, Hedge, Alt funds, SPAC, and rollups fracture before they truly root.

And what it means to build something meant to be left, not merely exited.

It’s not short. Or viral. But it’s built to last.

And if it speaks to something you’ve always known but rarely seen expressed,

then perhaps this work belongs in your world.

The publication link is enclosed, should you wish to experience it.

https://helloin.substack.com/p/built-to-be-left?r=5i8pez

Warmly,

The Silent Treasury

A vault where wisdom echoes in stillness, and eternity breathes.