Tech Dilution: Shareholder Heroes, Equity Vampires, and New Dilution Leaderboard

An overview through 2Q24 of stock-based compensation, equity dilution, and the worst offenders with a bonus most improved overview.

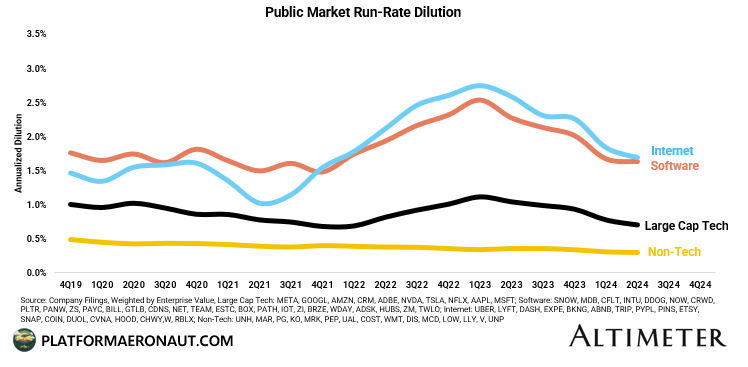

To start, we’ve clearly seen a reversion to pre-covid levels of dilution for Software and Internet, and even mega cap tech has been slowly trending towards 0.5% dilution.

A couple changes to methodology vs before:

Now using a blended dilution metric that is a mix of:

Trailing Dilution from Statement of Stockholders Equity (what RSUs/Options get added to share count)

Forward Dilution from Net RSU/Option Grants

SBC Expense as a % of Market Cap

Given the more backwards looking nature of metrics 1 & 3 I give a higher weighting to forward dilution because that’s a closer representation of what the company is doing today. I also added 10-12 additional software and internet companies into this giving a wider breadth to the analysis and capturing a significantly larger share of the technology landscape.

Since I’ve previously presented the dilution data either on a rolled up basis or some one off dilution metrics for a list of companies I wanted to add some detailed analysis and charts to really benchmark companies versus each other and establish who are the shareholder heroes vs what I call equity vampires.

Dilution vs Revenue Growth

In earlier stage public companies (and especially in venture capital), there is a mindset that higher levels of dilution are acceptable at higher levels of revenue growth. Whether you disagree or not, management teams argue that high SBC (and Sales and marketing expense) is helping drive top-line and get the company to scale and capture more of the TAM quicker. So here are 50+ publicly traded companies charted with run-rate dilution versus NTM consensus revenue growth:

When looking at it this way I’ve bucketed names into 3 categories to watch:

Potential Dilution Problems (Yellow):

Names that are growing quickly but diluting at 1.5-2x the median. Names like SNOW, CFLT, GTLB, and DASH are running >2.5% dilution and if we start to see deceleration in top-line you’ll increasing levels of dilution all else being equal. If Snowflake consensus revenue growth decelerates 500bps to 15% without management action to reduce headcount or reduce SBC grants to employees you’d see it quickly move up and left on this axis.

Dilution Issues Today (Orange):

This is a bit more of a wide bucket, but generally names that given their revenue growth are diluting way too high. Whether it’s LYFT or SNAP growing quickly but dilution at 3x the rate UBER or META are, or TRIP and ETSY growing slowly but dilution at 3%, it’s an issue and something management needs to resolve.

Death Zone (Red):

Companies growing slowly and diluting excessively. These are the classic value traps where they look super cheap on EV/FCF or other multiples, but if you roll in the 5-6% dilution they’re just melting ice cubes from a shareholder return perspective. If you’re Box, Twilio, or Zoom and you can’t re-accelerate growth you need to do an aggressive RIF or slash SBC and get in-line so you’re not just treading water at best and sinking at worst.

Dilution vs Market Cap

There’s often a misnomer or an explanation from management teams and investors that dilution is only high because the company is sub-scale, or the stock has traded off temporarily. And certainly when a stock is on it’s ass and close to recent lows like TRIP, SNOW, or W all else being equal it will result in higher dilution as you grant more RSUs to employees to compensate them at the same dollar amount. But keeping that in mind when you look at dilution vs market cap across the spectrum there’s definitely higher levels of dilution for smaller market cap companies, and it is very obvious >$10B:

I’ve highlighted in red the big outliers. For the smaller market cap companies it’s fairly similar to the death zone in the previous chart: TWLO, W, BOX, ZM, CHWY, but also adding in names with dilution issues: LYFT & SNAP. Way over to the right the previous chart didn’t view META and GOOGL as issues, but given the scale of their business they’re diluting at 2-3x the rate that AAPL and MSFT are.

In green are some of the better performers from a dilution perspective: PAYC, CDNS, NFLX, MSFT. Microsoft and Netflix would be some of the best on both a relative and an absolute basis.

There’s the argument to be made that regardless of market cap or growth rate you shouldn’t be diluting above 3%, but even if you assume the curvature of this chart is “right”, if your business is an outlier there’s some definite cause for concern and shame.

Relative Change in Dilution Year over Year

So despite companies like LYFT and TWLO looking awful when it comes to dilution by any metric, they have made significant changes year over year:

Lyft went from what I’d consider the death zone to merely dilution being a pertinent problem for the business. One I think is interesting to call out is Robinhood. This was one of the poster children for excessive dilution and run-rate in 2022 was north of 10%, but they got the business more fit, RIFed a portion of the employee base, and cancelled a 35m share grant to the founders and now they’re diluting at 1.1%. Gold medal there.

Introducing the Company Dilution Leaderboard

Now I’ll admit it’s difficult to benchmark companies across different industries, growth rates, and maturities, but here’s a first stab at a leaderboard for all the companies I’ve included in the previous analysis.

No terrible surprise that Booking.com is atop this leaderboard given best in class SBC and dilution practices. Netflix being up there is also no surprise. And given some of the previous dilution analysis I’m not surprised to see Snapchat, Confluent, and Wayfair down at the bottom.

In terms of methodology, I’ve applied a custom weighting to each of the metrics to calculate the overall rank but here is a quick overview of how I calculated each ranking:

Dilution %: Simple run-rate dilution % for each company ranked lowest to highest

Dilution vs Peer Cohort: Companies ranked vs how they compare to their peers (Meta vs other big tech, BKNG vs other internet, WDAY vs other software) and then rank ordered.

SBC as a % of FCF: Simple rank order of how much of your distributable FCF are you using for Stock-based compensation

Rule of 40 (-SBC): Rank order of companies by Rule of 40 (NTM consensus revenue growth + FCF Margin) but adding back SBC expense to FCF.

vs Dilution/Market Cap Avg: Using the Dilution vs Market Cap chart earlier there’s a regression line in black. How much better or worse is the company dilution vs that regression line. Then rank ordered.

All of this analysis is interesting and fun to put together to really try to stack rank companies and give investors, management teams, and the boards the information to really ask the tough questions on dilution and stock-based compensation.

I welcome any and all feedback on the work, analysis, and methodologies here. The goal is to get a reliable and fair view into dilution across TMT.

Tickers Mentioned: BKNG 0.00%↑ CDNS 0.00%↑ META 0.00%↑ AAPL 0.00%↑ MSFT 0.00%↑ SNAP 0.00%↑ TWLO 0.00%↑ HOOD 0.00%↑ CVNA 0.00%↑ COIN 0.00%↑ DASH 0.00%↑ GOOGL 0.00%↑ ADBE 0.00%↑ NFLX 0.00%↑ CFLT 0.00%↑ SNOW 0.00%↑ SNAP 0.00%↑ W 0.00%↑ LYFT 0.00%↑ CHWY 0.00%↑

Thanks for reading Platform Aeronaut! Subscribe for free to receive new posts and support my work.

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Excellent post. It should be read in conjunction with "No such thing as a free lunch" which focuses on some of the less well understood impacts of stock based comp, including huge market distortions as uncovered by Deutsche Bank research. This is a link for anyone interested: https://rockandturner.substack.com/p/a-free-lunch-no-such-thing

Awesome post!