Rideshare & Delivery Nov '23: Profitability and Strong Growth (for some)

All of the big rideshare and delivery companies have reported and so here is a deep dive on margins, FCF, and profitability as well as interesting quotes from UBER, DASH, LYFT, CART, TKWY, and ZOMATO

We’re through Q3 earnings for most of the rideshare & delivery universe and we’ve seen some meaningful separation in the pack both YTD and since Q2 earnings:

At first glance the amount of dispersion is surprising but 2023 has finally been a bit of a stockpickers market. UBER, DASH, ROO, and ZOMATO have either shown clear continued high growth, meaningful improvement in profitability/FCF, or a combination of the two. While the underperformers have been either losing share or struggling with profitability.

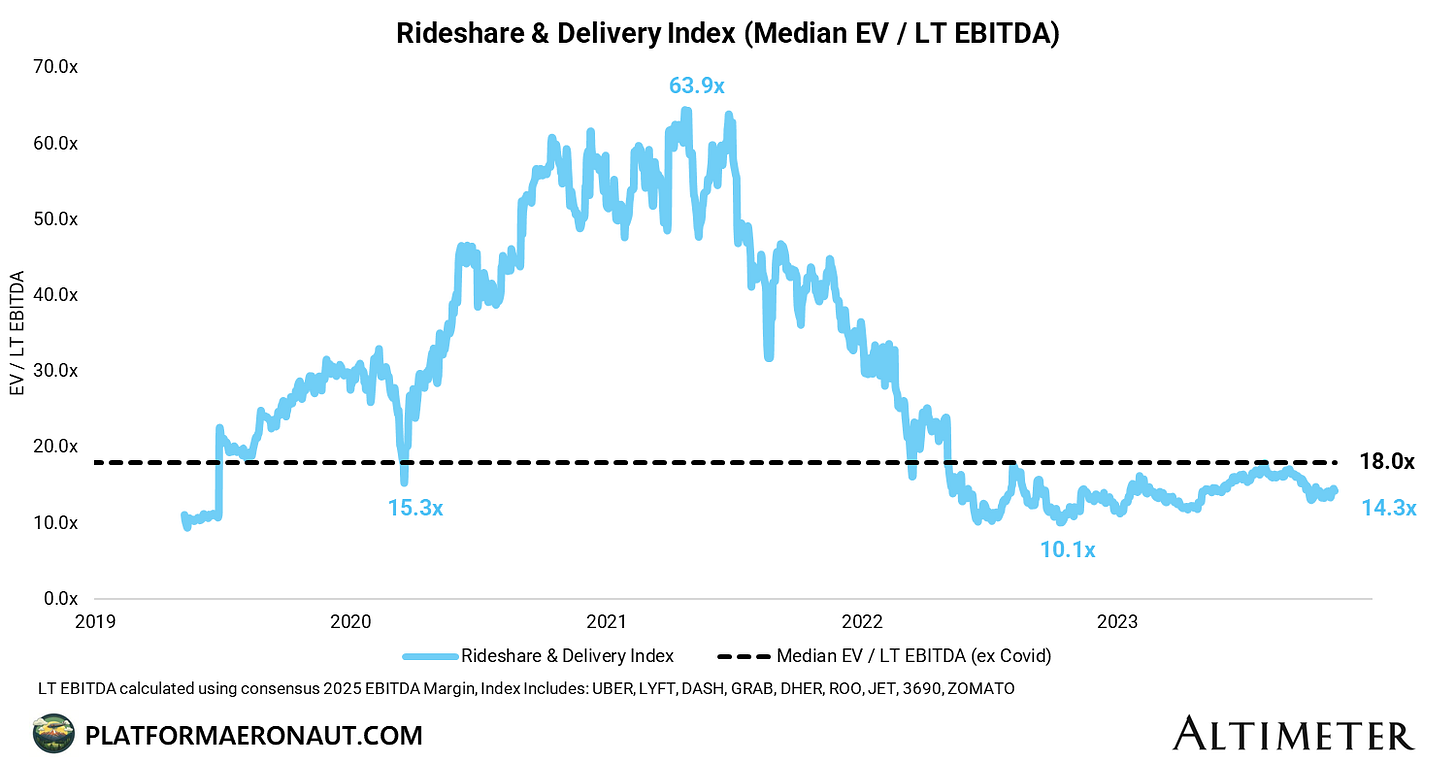

If we look to multiples though we remain well below the median average excluding covid periods. Using 2025 consensus EBITDA margins applied to NTM Revenue and current enterprise value the index is trading at 14.3x vs average of 18x. So despite some meaningful outperformers we’ve seen compression in multiples as growth normalizes and interest rates have gone up.

Current 2024 Comp Set:

We’re a long way from 2021 where there was no EBITDA or FCF. We have reasonable growth assumptions and multiples (with the exception of Zomato) that seem reasonable depending on growth and profitability profiles.

Uber: Global Dominance Offsets Macro

Going into the Q3 call there were concerns about macro and the impact to demand (especially in Europe) in October. We got a number of yellow flags from the rest of travel and leisure earnings, but Uber continues to dominate, demonstrating that global exposures and underlying growth in mobility and delivery are strong.

And interestingly, if you look at when the stock bottomed, there’s a fairly strong correlation to when free cash flow was just starting to inflect positively. There was a lot of concern over whether it was just pulling one-time levers to get the business to FCF breakeven or whether it was actual operating leverage in the business. Given that we’ve seen $3B of TTM FCF generation and consensus at $5.6B for FY2024 I think that concern can be put to rest.

Quotes from Uber Q3 Call:

"In general, look, we've been looking for pockets of consumer spending weakness across our platforms, both our mobility platform and delivery platform. We read the news, we watch CNBC just like anyone else, and frankly, we haven't found it."

"I think part of the reason is that when you look at consumer spend, one, the US consumer is incredibly strong. And two, I think in the consumer spend bucket, if you look at spend on services versus spend on retail, spend on services is still not back to where pre-pandemic spend was. So we do think that the tailwind that we've seen in terms of spend on services continues."

One of the callouts they mentioned which I thought was interesting was on new vertical growth. UberX Share, high capacity vehicles, and Reserve is now $9B and growing 80%+ year-over-year. Geographically Germany, Spain, Argentina, Japan, South Korea, Turkey (focus markets) grew 150%+ year-over-year.

The big question now with the new CFO on board is around capital allocation and shareholder returns. I went back on old call transcripts and well over a year ago Dara said they would return cash once they’re FCF positive and they’re clearly in that territory now. Uber committed to some sort of capital allocation plan and possible repurchase authorization announcement on the Q4 call in February.

DoorDash: Continued Excellence

Despite worries about a slowing economy and difficult comps causing deceleration in delivery, DASH put up Q3 +24% GBV growth vs consensus of +19% and guided to $17.0-17.4B for Q4 with improving profitability. Quarterly incremental EBITDA margins continue to expand and hit 8% in Q3.

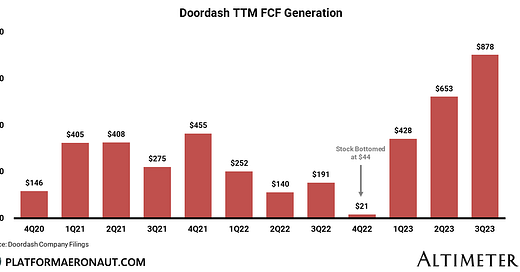

Similar to Uber, the stock bottomed at the same time that TTM FCF bottomed. Investors can mull over top-line growth, but at the end of the day distributable free cash flow is what drives stocks.

Quotes from DoorDash Q3 Call:

"While, sure, maybe not every meal has to be eaten when it comes to delivery or takeout, but what we tend to see is that there is also the macro trend of convenience increasing in the direction of greater convenience, and so if someone has, you know, some dollars to spend, it tends to start with the category of the highest frequency where they also seek convenience, and there's just more opportunities to do that given that someone consumes food 20 times to 25 times a week."

"What you're seeing in the underlying cohort is, as we are continuing to improve the selection, as we're making the quality of the product better, as the service levels continue to increase, we're seeing strength across all the cohorts that we operate in."

Really interesting in their investor letter this quarter was a cohort chart showing continued sequential improvement:

Lyft: Good Growth But Profits Lag

The turmoil and volatility at Lyft continues on CEO David Risher’s second earnings call. He’s trying to stabilize things and refocus on Lyft’s core competencies, but every quarter that goes by we see Uber running away with the market. Lack of scale is just a really tough thing to overcome.

One of the more interesting things is that Lyft released Gross Bookings numbers finally by quarter and is focusing the business and guidance around that as opposed to revenue. This is a long time coming, although I wish they had also broken out the segments of core ridesharing and bikes/scooters to give a better sense of the health (or lack thereof) on the bike/scooter side. Reminder that Bird is essentially bankrupt and trading at a $97m enterprise value today.

One takeaway from the analysis is that Lyft’s take rate on gross revenue is >40%, so for every $1 that is generated in fares/bookings, Lyft is keeping 40%. They’re then returning 8% of that to drivers in the form of incentives and keeping 30% of net revenue. Uber has been saying that Lyft take rates are not competitive and part of the reason they’re losing share, and when you compare that 30% net take-rate to Uber’s 21% (adjusting for changes to business model in UK/elsewhere), it’s not a great place to be from a competitive standpoint for Lyft. I’ll caveat that I had to make some assumptions around the size of the scooter and bike business because that ought to be almost 100% take-rate and I estimate they’re $250-300m of annual GBV/Revenue given similar size/scale to Bird.

Quotes from Lyft Q3 Call:

"We see a lot of reasons to be really optimistic about growth. Let's start with where we are today and then try to extrapolate a little bit. Again just looking back the last couple of weeks, we've seen growth, higher than we've ever seen in our corporate history."

"When you look at where we fit in we really are again we're customer fast. Right. So we're really trying to take a look at large segments like women for example or like airport travel, which includes business travel leisure travel and so forth and say how can we create more and more experiences that drive that incremental use and incremental frequency."

Instacart: Low Growth, High Profitability

The post IPO digestion of Instacart in the public markets has been a bit ugly. The stock priced at $30, ripped up above $40 and is now trading at $27. In my S-1 deep dive I presented the comp set and it’s being valued more towards the Lyft and Expedia end of the scale than the DoorDash end. But despite gross bookings growing a fairly anemic 6% and Q4 guidance of 5-6%, the incremental and absolute EBITDA margins remain impressive.

And focusing on FCF we see healthy levels of absolute generation but not the same level of Y/Y growth that we’re seeing at Uber or DoorDash.

Quotes from Instacart Q3 Call:

"Pretty much all segments of customers have become more price-sensitive. However, within those, there are still some people who value price over convenience and some who value convenience over price."

"This is an industry that is still only 12% penetrated online. And so a lot of focus and some of what you're seeing in terms of investment in sales and marketing and customer incentives are really geared towards accelerating online adoption."

"Our business continues to be impacted by several macro headwinds."

“On the advertiser side, we have 5,500 advertisers on the platform that number continues to grow. And what we're seeing is that there isn't really any upscale brands that sell on the platform that isn't already advertising with Instacart. So here again, a lot of the game is continuing to attract more emerging brands, but also in big part deepening the investment rate from our advertisers by continuing to show them the value of the platform.”

Just Eat Takeaway: Share Loss but Profits

Grubhub in the US continues to lose share and is a anchor around the neck of Just Eat Takeaway. They’re trying desperately to clean it up and sell it but I’m not sure who is the willing buyer at a reasonable price for the #3 asset who is bleeding share. TKWY is seeing some momentum in continental Europe and the UK and profitability has dramatically improved, but overall remains a show-me story.

From Just Eat Takeaway Q3 Call:

"The momentum that we currently have in Northern Europe and the U.K. and Ireland is actually quite encouraging. I don't -- we don't obviously control inflation in countries but we see good consumer behavior and it's -- the way these segments are operating, reminds us of the days in which we were running a food delivery business before the pandemic, so that's quite encouraging."

Zomato: Riding High on Growth

Still fairly early in the penetration game with competitive factors normalizing we’re seeing Zomato reap some of the benefits of the hypergrowth in India.

Quotes from Zomato Call:

"I think the longer-term view on growth, as we mentioned in the letter in response to one of the question also is that majority of the growth should be driven by growth in or MTU or MTC, as we're calling it, monthly transacting customers."

"Now, I think the pace of that change, I don't think is going to be linear. There'll be periods of time when either because of demographic change or incomes going up or macro changes, you know, this frequency will increase."

Tickers Mentioned: UBER 0.00%↑ DASH 0.00%↑ LYFT 0.00%↑ GRAB 0.00%↑ CART 0.00%↑

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Excellent ✨