Proxy Season: BKNG, UBER, AAPL, UAL

Uber tiptoes towards being onside while Booking runs away from the pack, Apple remains A+, United Airlines impressively bad

It’s not quite Christmas, but proxy season is a great time to take a step back and evaluate the performance and incentives for management at companies and how it aligns with shareholders. Similar to our political process in the US, most investors don’t pay much attention to the issues, vote without due diligence, and then complain that nothing changes.

TL;DR

UBER making some progress on alignment but falls short of adequately taking dilution into account when creating incentives and set targets below consensus

BKNG continues as best in class with low dilution, alignment of shareholders and management team, and clear incentives and compensation structures.

AAPL ties mostly to total shareholder return (TSR) and sets financial targets that albeit sandbagged, aren’t a slam dunk.

UAL proxy is laughably bad with no ties to shareholder returns and prioritizes metrics that don’t directly tie to earnings or financial results.

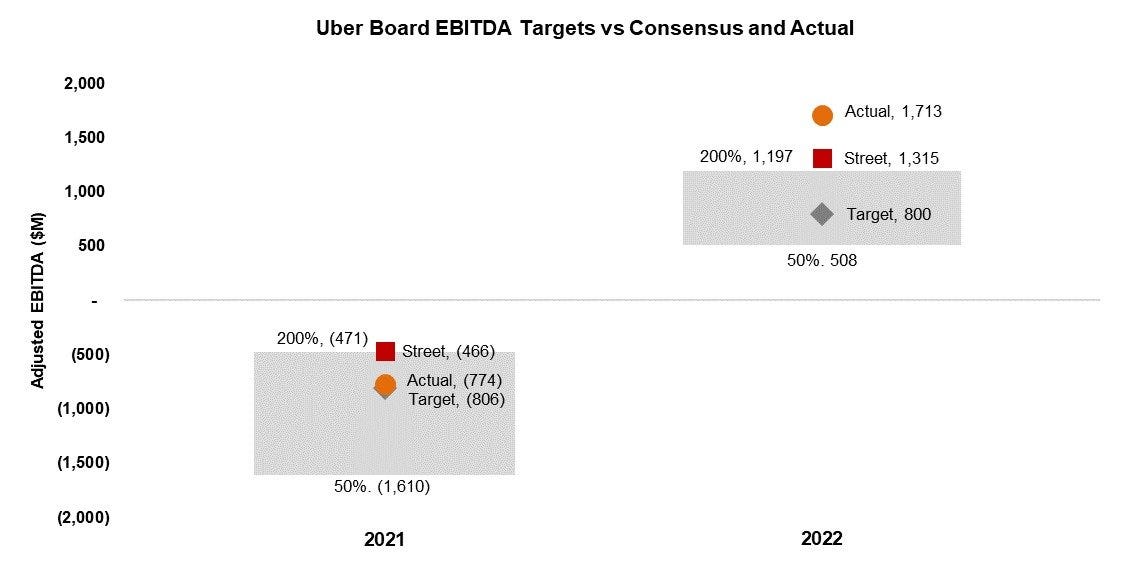

Uber: Slow progress with a low bar

As I previously posted on Twitter, Uber’s 2022 compensation plan violates what I believe to be two cardinal rules:

1) Excludes SBC from calculations for Adjusted EBITDA or Compensation EBITDA.

As Munger said, “Show me the incentives and I will show you the outcome” and the incentive when SBC is excluded from compensation metrics is that it’s used as a dumping ground for expenses to boost the metrics compensation is based upon. Senior and middle managers who are compensated on the basis of Adjusted EBITDA excluding SBC are incentivized to offload salary expense in the form of RSUs to artificially boost their Adjusted EBITDA metrics.

2) 200% Bonus Targets Set Below Consensus

Particularly egregious is that the bonus targets for Adjusted EBITDA for 2021 and 2022 were set at levels below street consensus. It requires a more in-depth discussion and analysis but it should be obvious that setting the upper range of an incentive target below where the street (and the market) are valuing the business at just doesn’t make sense.

Some Positive Changes from Uber

To be fair, the board at Uber is making some adjustments that increase alignment with shareholders. Namely they’re adding SBC expense as a component of 2023 annual cash bonus targets and decreasing annual equity grants by 10% for individual NEOs vs 2022.

It’s commendable to include SBC as a component of comp, but my guess is that it’s a cash bonus tied to either decreasing SBC expense or coming in below some board set target. This is sub-optimal as opposed to the simpler methodology of just only using metrics for compensation that are inclusive of SBC or are on the basis of FCF per share (which includes dilution).

Booking: Transparency and Accountability Continues

As I’ve previously written about, BKNG is a role model for dilution among technology companies. And to re-iterate, for all of their metrics Booking uses Compensation EBITDA which is defined as: “Adjusted Earnings before Interest, Taxes, Depreciation and Amortization, as publicly reported in our earnings press releases (“Adjusted EBITDA”). And if you look at their filings for that calculation SBC expense is included in the metric.

Two new things that BKNG added into their recently filed proxy are a couple charts comparing the company to their compensation peer group. These can speak for themselves:

It’s exceedingly rare for a company to be 100% transparent and upfront with it’s investors on where it falls within it’s peer group for SBC and dilution, but it’s an incredibly important metric that’s often overlooked.

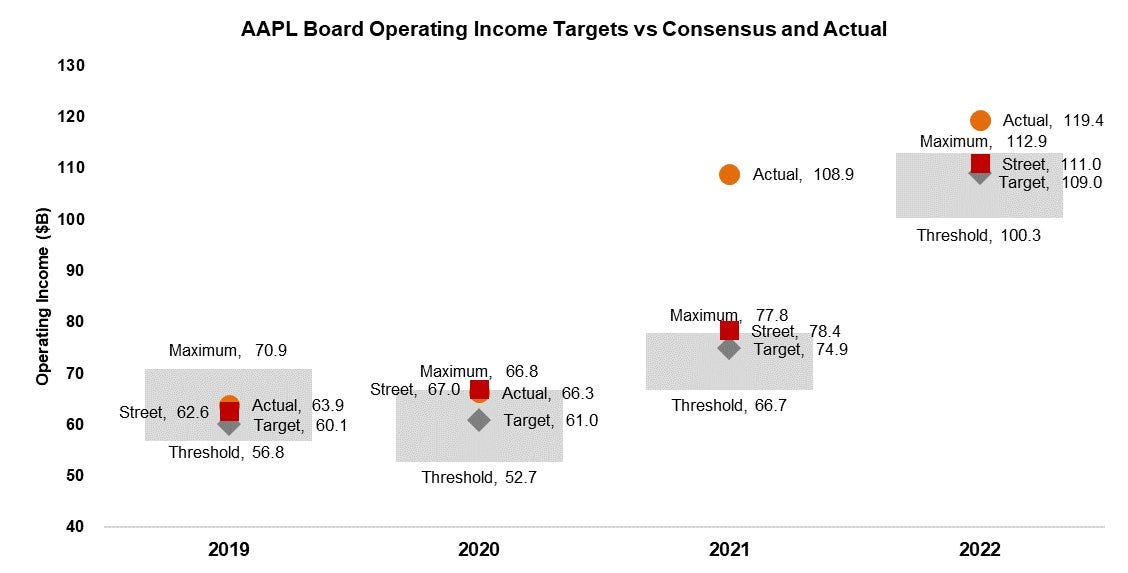

Apple: Fairly Straightforward and Aligned

Similarly to BKNG, when AAPL compensates executives the metrics are inclusive of SBC. One of the chosen metrics tied to annual incentive comp is Operating Income which is a GAAP metric as opposed to adjusted. And even more importantly, the board sets targets that are more reasonable in terms of threshold, target, and maximum payouts compared to UBER.

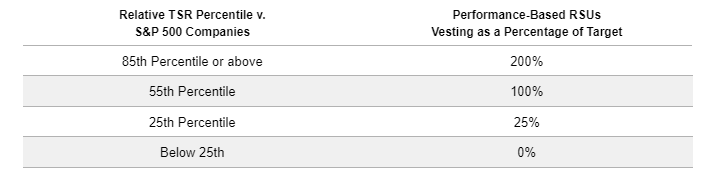

The biggest component of compensation is tied to total shareholder return which when measured over an extended time period is effectively inclusive of dilution.

United Airlines: Grading the Proxy for Fun

Let’s provide a little context vs big tech names who are diluting at significant amounts. Just because a company is non-tech and doesn’t have significant dilution doesn’t mean there aren’t significant issues with the compensation structure for senior management. Humor me here given how much time I’ve spent investing in airlines as I digest United’s proxy.

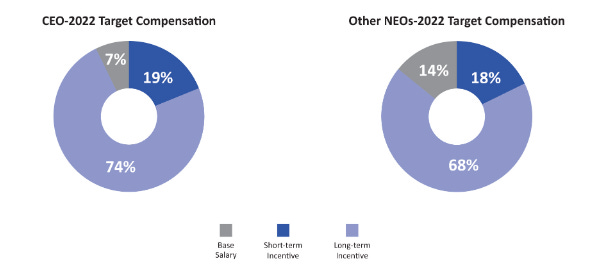

At first glance, UAL compensation makes sense right? ~70% is long term oriented, ~20% is short term, and only a little bit is cash oriented.

Short Term Incentives (Grade: D)

The 25% NPS and 25% operational performance are valuable I suppose, but have very little tie to actual stock performance. Airline fundamentals don’t tend to suffer unless your NPS and ops are a disaster (look at Southwest over the past few months). And anyways, these metrics should be a longer term measure because even if you bump your NPS 200bps in a year, it won’t show up in any theoretical revenue premium immediately.

The 25% going to strategic initiatives is a very fuzzy item, almost impossible to tie to stock performance.

Finally the 25% tied to CASM ex (unit cost excluding fuel) performance is impactful to stocks, but there are a lot of ways for an airline to get CASM ex low that actually destroy shareholder value and actual earnings.

Long Term Incentives (Grade: F)

Okay, so 50% is just time-based RSUs, pretty much in-line with most other companies and it’s important to keep Scott Kirby and the team involved. I’d prefer 100% performance based but that’s a different fight.

For the 50% of PRSUs:

20% on 2023 CASM ex: Same issue with this as with the 25% of short term incentive, you can get CASM ex low in a lot of ways that aren’t shareholder value maximizing.

10% 2023 Aircraft Availability to Schedule: UAL is going to do what they can but this is more a Boeing or Airbus issue than anything else, not sure why this is even in the metrics.

10% 2023 Aircraft Utilization: Sort of tied to ability for the team to adequately hire to fill pilot shortages. If anything this should be a short term incentive tied to recruitment or headcount per Aircraft metric.

10% ESG: Unavoidable in 2023 but no relation to shareholder returns

UAL Proxy Grade: D-

It’s actually a pretty egregiously bad proxy and compensation structure. There’s no tie to actual shareholder returns, there’s no longer term financial metrics (there used to be an absolute pre-tax margin target), and the metrics that were chosen either don’t matter much (ESG, NPS) in the grand scheme, or they can be achieved in a way that actually destroys shareholder value.

Tickers Mentioned:

BKNG 0.00%↑ UBER 0.00%↑ AAPL 0.00%↑ UAL 0.00%↑

Resources:

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

![[MISSING IMAGE: pc_target-pn.jpg] [MISSING IMAGE: pc_target-pn.jpg]](https://substackcdn.com/image/fetch/$s_!ei7n!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F1932178c-907c-470d-8928-6d5a5c49cb15_1647x647.jpeg)

![[MISSING IMAGE: pc_performance-pn.jpg] [MISSING IMAGE: pc_performance-pn.jpg]](https://substackcdn.com/image/fetch/$s_!I7kb!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fc32dfeda-8f92-427a-a433-ed276dd524a0_1595x537.jpeg)