Is the Consumer Weak or Not? Anecdotes from Companies

Color from Uber, Lyft, Doordash, the airlines, and other leisure names on consumer health

Post a bump in unemployment and myriad of mixed earnings calls most investors are confused about the health of the US consumer. Are we on the precipice of a recession? Is this a mild softening as part of a soft landing from the fed? Is something else going on?

The concerns over consumer health as well as general market weakness around the yen carry trade, a potential AI air pocket, Kamala winning and raising taxes, and Iran attacking Israel has driven global travel & leisure NTM consensus EV/EBITDA multiples below the LT average of 9.0x:

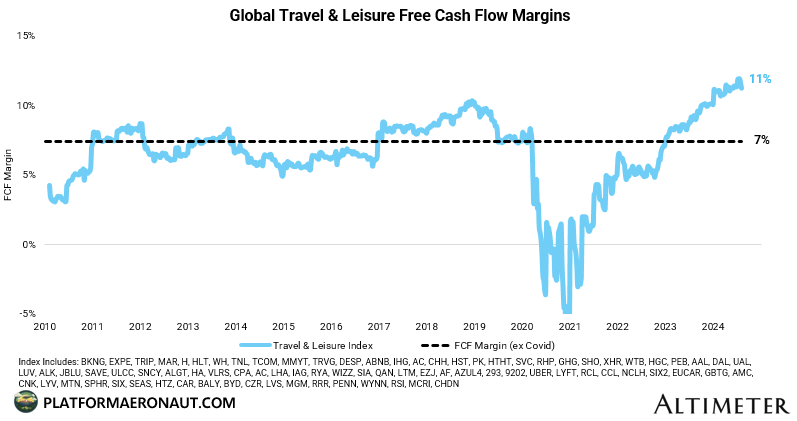

And all this is despite global FCF margins for travel and leisure being at all-time highs, so clearly the market is messaging a slowdown

Broken down by industry here is a high level view of consumer health:

Ridesharing/Delivery: Strong consumer health, no softness of trading down

Airlines: More of an issue of too much capacity than demand weakness

OTAs / Hotels: Much more mixed messaging, Airbnb weaker, hotels and Booking seem okay

Other Leisure: No signs of weakness for car rentals or cruise lines

Quick anecdotes from credit card issuers:

American Express: “So we feel that, look, the U.S. consumer has been pretty consistent, and we think it's going to be pretty consistent throughout the year.”

Mastercard: “The macroeconomic environment remains mixed, and we continue to monitor the positives and negatives. A few to note: Strength in consumer spending continues to be supported by a solid labor market and wage growth. While there are some signs of labor market growth moderating, this is off very strong levels of job creation.”

Visa: “In the U.S., while growth in the high spend consumer segment remained stable compared to prior quarters, we saw a slight moderation in the lower spend consumer segment.”

Ridesharing: Strong consumer health and spending

Uber: Strong consumer

“While our consumers tend to be higher income, we're not seeing any softness or trading down across any income cohort. Where the current macroeconomic fears materialize, we're confident that Uber can perform well because of the countercyclical nature of our platform.”

In fact, in Q2, the number of first-time consumers on Uber Eats in the U.S. was higher than at any point over the past 5 quarters.

While Uber called out consumer health as robust, one specific thing they called out gave me pause:

“Let me give you 1 metric we haven't shared before and that is, globally, restaurant-funded offers or merchant-funded offers have grown 70% year-over-year.”

While part of this is strategy from Uber to offload consumer incentives from self funded to 3P funded, I have to imagine part of that is restaurants feeling a bit of pain and looking for incremental volumes through discounting/promotional activity.

Doordash: Strong

“We're seeing really strong demand on the consumer side. So we're not actually seeing some of the challenges that you may be hearing about or reading about in other headlines. I think there are a few reasons for this. I think, first, we're still in the earliest innings of the move towards digital and the overall omnichannel experiences that every restaurant and retailer is participating in and we're lucky to play in the part that is growing.”

Lyft: Strength across the board

“So big picture, we're seeing strength across the board, right? That's the big picture. And it's interesting. I mean, we all read the same newspaper articles and so forth. I think maybe people are a little attuned to pick up bad news. But frankly, we see people go into concerts and events and so forth and so on.”

“So for example, we call party rides kind of Friday, Saturday night rides late night after, I think it's after 5:00 through midnight or maybe later depending on your definition of a party, anyway. And there we saw, I think, about 19% growth year-on-year, which obviously is a little faster than some of our other segments.”

Airlines: Mismatch of demand and capacity but healthy consumer

United Airlines: Strong consumer, mismatched capacity

“Q2 revenue results for United and the industry did trail expectations. Looking back at the quarter now, it is increasingly clear that demand was, in fact, strong. It just could not keep up with the incremental industry domestic capacity added in 2024. Excess capacity, in turn, pressured yields.”

We also continue to see strong demand for our premium domestic first-class product with sold load factors up 13 points versus 2019 and 8 points versus 2023.

American Airlines: Demand okay, pricing softness led by capacity

“That excess capacity led to a higher level of discounting activity in the quarter than we had anticipated. As we said we would to address the domestic softness, we pulled down our planned capacity growth in the back half of the year. To better align our growth with demand expectations, we now plan to grow capacity by approximately 3.5% in the second half of the year.”

Delta Airlines: Same as UAL and AAL

“And while demand for air travel remains strong with record TSA travel volumes up 7% from last year's levels, domestic industry seat growth has accelerated through the summer months, impacting yield performance in the Main Cabin.”

“Air travel demand is at record levels, with this past Sunday marking Delta's highest ever summer revenue day. For the September quarter, we expect continued demand strength…”

Southwest: More self harm than macro harm

“Moving to revenue performance. We have experienced challenges in managing demand across booking curves as we deployed efforts to address load factor underperformance. As a result, we experienced yield and ultimately revenue dilution from selling too many seats too early in the booking curve.”

“It's also clear -- in the RM system, it's also clear that there's simply more capacity than -- on the domestic side than demand right now.”

Hotels / OTAs:

Booking: European weakness but US is okay

“Looking at our other regions, we continue to see high growth levels in Asia and a slight improvement in growth in the U.S. As we look ahead to the third quarter, we believe room night growth will be impacted by a booking window that expands less than it did in Q2 as well as by the more moderate market growth we have seen in Europe, where our growth has remained stable from May through July.”

Airbnb: Slowing demand from US guests

“However, we are seeing shorter booking lead times globally and some signs of slowing demand from U.S. guests and our Q3 outlook incorporates these recent trends. We're watching these trends closely, along with the impact any macroeconomic pressures might be causing.”

“And the -- I would say the silver lining with regard to the trends that we see right now. It's not that consumers are not necessarily going to book that trip for Thanksgiving or Christmas, it just appears that they have not booked it yet.”

Marriott: Ancillary spend weak but core hotel is strong

“U.S. and Canada and frankly, all of the other regions, ancillary spend with a hair softer than we anticipated. And I think it does show that the consumer in general is perhaps being a bit more judicious about the fancy dinner or going on that extra trip when they're on a vacation. And that is really the only thing. It's not trade down in any meaningful way.”

“So while I think there is at the margin I hear more caution from the U.S. customer. We do see that there continues to be very strong demand on the leisure front.”

Hyatt: Business demand slowing? Messy comps?

“Bookings for business travel over the next 2 months look very strong, led by corporate negotiated accounts. While there are signs of slowing demand in lower chain scales, we saw strength among the high-end consumer”

“I would say that we are lapping some unusual periods last year. And so the results that we're reporting are -- when I say unusual results last year, I mean, both calendar changes and also significant demand in certain parts of the year. So what we're seeing is sort of evening out of demand over time. The disruption in airline traffic due to the systems outages was a unfortunate shock to the system. And -- but that was relatively short lived. Nonetheless, it did cause a lot of disruption in terms of bookings.”

Hilton: Strong but normalizing, International weaker

“We expect full year system-wide RevPAR increased 2% to 3%, driven by positive growth across all major segments and regions. We tempered the high end of our expectations versus prior guidance due to softer trends in certain international markets and normalizing leisure growth more broadly. With continued strength in group and steady recovery in business transient, we expect higher-end chain scales to continue to outperform.”

Tripadvisor: Weakness or Normalization?

“In Hotel Meta, we continue to see demand headwinds in July, and our outlook assumes that we see a continuation of these trends for the remainder of the quarter.”

“Also, given what we're seeing in the normalization of pricing trends across the hotel category, we are assuming a softening of pricing relative to the last few quarters. For experiences across the group, our outlook assumes continued normalization of demand, reflecting the overall travel market, although still benefiting from higher growth relative to other travel categories given the secular opportunities.”

Other Leisure: Looking good from a consumer perspective

Avis Budget: Demand remains robust

“I think if you look at in totality of demand, we still had a record demand quarter, Chris, in the second quarter for us. And if you look at volumes and TSA volumes just in general, we're double digit over 2019 and TSA volumes are not at that level yet. So maybe we took -- we have taken action to grow our company maybe in different ways. But pretty comfortable with the demand aspect.”

Royal Caribbean: No signs of weakness

“We're about 400 plus basis points higher than we were in our expectations in the beginning of the year. So that's a reflection of an acceleration demand and really acceleration in price. So your takeaway from that is, clearly, we left some money on the table and we were too booked going into Wave”

“The North American consumer who represents approximately 80% of our sourcing this year continues to be robust, driving strong yield growth across all key products. In addition to strength in the Caribbean, European and Alaska summer itineraries are performing exceptionally well, and we have experienced greater pricing power than expected since our last earnings call, leading to increased expectations for yield growth”

Norwegian Cruise Lines: Strong bookings, strong price, strong onboard

“The company continues to experience strong consumer demand. In the second quarter, we continued to see strong bookings with our 12-month forward booked position at the upper end of our optimal range on strong pricing. During the second quarter, we observed continued strength in onboard revenue as well, which was driven by our guests' continued enjoyment of our short excursion and onboard amenities including specialty restaurants and communication services, which have been bolstered by the continued implementation of Starlink across the fleet.”

Tickers Mentioned: UBER 0.00%↑ LYFT 0.00%↑ DASH 0.00%↑ ABNB 0.00%↑ BKNG 0.00%↑ TRIP 0.00%↑ MAR 0.00%↑ HLT 0.00%↑ H 0.00%↑ DAL 0.00%↑ AAL 0.00%↑ LUV 0.00%↑ UAL 0.00%↑ RCL 0.00%↑ NCLH 0.00%↑ CAR 0.00%↑ H 0.00%↑

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.