Instacart Overview & CEO Strategy

Strategic overview and network effects at Instacart as they prepare for their eventual IPO and the public filing of their S-1.

From a financial perspective Instacart has had a volatile path, with a peak valuation of $39B in March 2021, to $10B in Dec 2022 and most recently $12B from an internal 409a valuation.

I’ll do a real deep dive into Instacart once the S-1 is publicly filed with a lot more focus on the financials and unit economics, but given that CEO Fidji Simo has recently been on Invest Like the Best and The Information published details on Instacart’s Ad business, I wanted to do a deep-ish dive on the strategy and fundamentals. Setting the stage, it’s been reported that Instacart did about $29B of GBV in 2022, up from about $25B in 2021 (+16% Y/Y). Incrementally supposedly 4Q22 Adjusted EBITDA was $100m which demonstrates they’re seeing leverage on the bottom line.

TL;DR

Although valuation for Instacart has gone from $15B → $39B → $12B over the past several years, financials may justify a solid IPO (pending public S-1 filing)

Grocer relationships have always been called into question, but data sharing, omnichannel, and new customer acquisition are key value propositions to grocers.

Unit Economics require scale (both at Instacart and Uber) and network density to achieve profitability. Instacart lost money on every order until they had over 100m.

Advertising revenues are now 2.5% of GBV and Instacart can provide big CPG advertisers with direct, measurable, and targeted high ROI advertising.

US Grocery delivery could CAGR at 15% over the next 5 years if overall grocery spend grows 3% and penetration for delivery goes from 13% → 26%.

A Complementary Relationship with Grocers?

The biggest negative argument I often hear about Instacart is that the grocers don’t really like the company and see it as a leech or necessary evil, especially as a result of the pandemic. Grocery margins are already super slim (3%), and if high value loyal customers transition to delivery from Instacart those margins are eliminated. The most critical math you can find is:

Grocery order in Store: 3% margin

Grocery order fulfilled by Instacart: 0-2% margin

Grocery order fulfilled by Ocado: 4-5% margin

I do have a certain level of skepticism with this math (especially with Ocado given significant struggles there and little financial proof), but I think there is definitely opportunity for indirect and direct value from Instacart back to grocers in the form of data and/or incremental sharing of economics.

I found Fidji’s responses to this to be far more eloquent way of how I tend to think about it:

“The thing that's really interesting is that there are tons of data showing that an omnichannel customer that shops with you both online and in-store is more valuable, more retentive, more profitable than an online-only customer or an in-store-only customer.

The thing that I work with, with grocers is not -- is telling them that it's not about shifting an in-store customer to be an online-only customer. It is about shifting someone from being in-store-only to purchasing on all channels, because fundamentally, that shift is coming. There isn't going to be a possibility to just let the e-commerce trend on the side.”

….

“We've had many surveys showing that it is actually capturing a customer they just wouldn't capture otherwise if they only focus on their own website.”

…

“And I think we're now at a place where it's very clear that our success doesn't come at their expense. In fact, incentives are aligned. And by driving this customer online, we are actually driving their business for the future and making sure that their customers remain loyal and increase their share of wallet with that grocer. And so that, I think, has really changed in the last couple of years where that attention used to exist and doesn't exist that much anymore.”

Additionally the grocers benefit from data sharing. Instacart does a significant amount of direct fulfillment through their platform as well with Publix or Sprouts where the grocer owns the customer but both Instacart and the grocer benefit from a data and financial perspective.

Advertising Driving Financial Returns

The biggest change at Instacart since the pandemic began has been an increased focus on advertising revenues. It’s been reported that Instacart’s 2022 ad revenue was $740m (+30% Y/Y) which accounted for 30% of revenue and 2.6% of GBV.

For some context, Uber generated less than half that amount total on a significantly larger customer base and was only 0.6% of delivery GBV in 2022. I think this comes down to advertiser relationships. With a majority restaurant delivery segment, Uber has to go out to their hundreds of thousands of restaurants and convince them to purchase preferred listings or offer discount codes.

Compare that to Instacart who can go out to the 5 largest CPG companies on the planet and offer them advertising/promotions for their individual products with direct ROI analysis and discrete control. It’s similar to the software enterprise vs SMB models, where enterprise can scale quickly and be dramatically larger than SMB if the product offering is good.

From the Invest Like the Best Podcast:

“We've recently launched what we call shoppable display and shoppable video ads where brands can have full video messages about the attributes of their products and then within one tap, encourage people to buy them. We're seeing a lot of momentum with brands leveraging these products, and we just released new studies that show that by using Instacart ads, brands are able to see a 15% sales lift, which is actually really massive in that industry.

And so we know that our advertising solutions work. And in fact, during these interesting market conditions, what we've seen is that brands have tended to cut down on unmeasurable top-of-the-funnel advertising and put more dollars behind very high-performance targeted advertising and with exactly that, you can literally advertise right as a person is building their cart and get your product in the hands of that person within two hours.”

Unit Economics

A constant criticism of all the gig economy and delivery platforms is that the unit economics are horrible and they’ll never make money (*cough* Chanos). I think the real misunderstanding is that a) Scale is required, and b) Free money obfuscated true network effects. One interesting quote from Fidji is on scale:

“Scale is absolutely everything in this business. We used to lose money on every single order until we got to 100 million orders. That's a lot of orders. It took a lot of investment to get to the point where we had delivered enough orders and we had enough densities that we could turn a profit. And the way it works in our business is basically having density of orders at the store level so that we can batch orders.”

It’s the exact same thing we see with Uber and DoorDash and exactly why Lyft continues to struggle. If Uber has scale and network density in a location of both drivers and riders it runs away with the market and Lyft just can’t compete on speed, offerings, price, or driver earnings.

We’ll have more on specific unit economics if/when Instacart files their S-1 for the potential IPO (which they’ve had confidentially filed for a year).

Instacart as an AI Native Company

In a previous post I discussed how companies including Instacart are integrating ChatGPT into their platforms, but it’s incredibly interesting to read how CEO Fidji Simo describes Instacart as an AI Native Company:

“In the context of Instacart, we've already been using AI for pretty much everything. If you go to Instacart, search is obviously powered by AI. Or replacement algorithm, if something isn't available in the store, what we recommend instead, that's powered by AI and informed by the massive hundreds of millions of data points we have on what people choose as replacements.

Same thing with how we connect shoppers to the right store and so that they get to you as soon as possible, all of that is powered by AI. And for us, it meant a very big investment in our data infrastructure, because fundamentally, without unique data and data that's easy to feed into models, it's really, really hard to take advantage of these new technologies.”

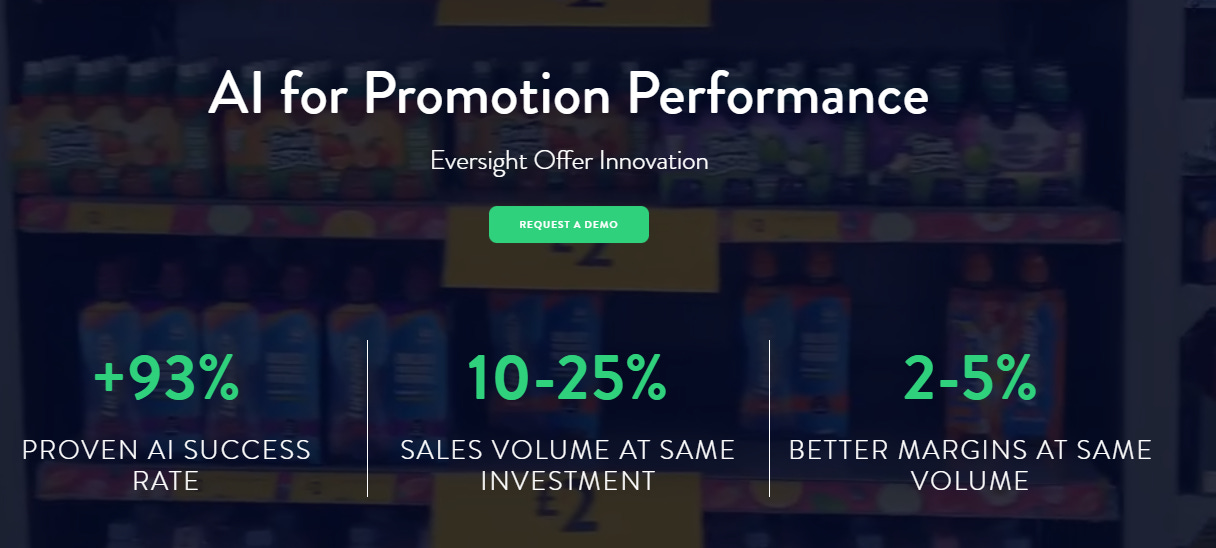

One of the key acquisitions that they’ve made is of Eversight in Sep 2022. Eversight is an AI-powered pricing and promotion platform for CPG brands that allows brands to continuously test customized pricing and promotions directly with customers.

Competition from Uber and DoorDash?

It’s been reported that Instacart did about $29B of GBV in 2022, up from about $25B in 2021 (+16% Y/Y), if you take the simple comparison of UberEats GBV of $56B and DoorDash GBV of $53B you’d think Instacart is a small player, but the reality is that the vast majority of order value for Uber and Dash is restaurant or convenience as opposed to traditional grocery.

The reality is that <3% of DoorDash and Uber Delivery GBV are grocery which would put the real comparison as follows:

I would also argue that the segment of the market that Uber and DoorDash serve is dramatically different. Uber and Doordash average order value (AOV) for grocery is $40-50 vs Instacart at well over $100. That discrepancy is a result of consumer behavior where Instacart customers are ordering weekly for their groceries while Uber/Dash customers are more “convenience” customers which is part of the reason behind DoorDash’s strategic investment in DashMart locations.

While both Uber and DoorDash are rapidly growing in grocery and it’s a strategic focus for both, the reality is that they are absolutely miniscule compared to Instacart. The real competition today is self-fulfillment by grocers and Ocado (who has an exclusive partnership with Kroger).

Walmart and Amazon/Whole Foods E-Commerce orders and delivery are the biggest segments of the grocery delivery market although it’s not quite the on-demand option that Instacart is outside of test markets (note that Instacart also delivers Walmart grocery on-demand orders).

What is Sustainable Growth?

Historically the US grocery market has grown at approximately 3% for the last 30 years, but growth since 2020 has been about double that with significant price inflation. Today online grocery delivery has 12-14% penetration of total grocery spend up from virtually nothing in 2016/17. Certainly the pandemic accelerated growth, but unlike other categories (think NFLX or sporting goods) I think for delivery this was more of a step function as opposed to a temporary bump from covid. We’ve seen continued penetration growth even as covid has ended and life returned to normal.

If we assume inflation returns to more normal levels and grocery spend also returns to historical ~3% level then your base growth for grocery delivery would be 3%, if one estimates that penetration can go from ~13% today to ~26% over the next 5 years then you end up with a US grocery market of just over $1T and a delivery market that CAGRs 15-16% over that time period.

I don’t think any of those assumptions are particularly heroic which puts online grocery delivery CAGRing 15% and other opportunities for Instacart (and DoorDash/Uber) from other verticals likely growing faster. You can use your own penetration assumptions 5 years out, but the fat part of the distribution curve is Instacart and peers growing 10-20% CAGR over that time period.

Capital Allocation Strategy

I’ve recently been talking to a bunch of later stage companies about dilution, stock-based compensation, and how incentives need to be aligned. These conversations have been both outbound and inbound, and it’s super refreshing to hear a private company leader emphasizing the right things. On Invest Like the Best, CEO Fidji Simo had this to say about capital allocation:

“I also think a lot about the fact that the tech industry has very much gotten a pass in the past for that base comp. And now we need to hold ourselves to a much better standard and actually think about stock-based compensation as actual compensation, really wanting to be profitable net of stock-based compensation. And once we clear all of these milestones, really thinking about the cash that we have in terms of opportunities to fuel the business and grow and that can include M&A.”

I’m glad that companies are paying attention, and that they’re thinking about SBC and dilution in a rational manner. If you’re running a for-profit company it’s gross negligence to ignore it.

Tickers Mentioned: UBER 0.00%↑ DASH 0.00%↑ LYFT 0.00%↑ KR 0.00%↑ WMT 0.00%↑

Resources:

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.