Executive Comp at Founder Led Companies

Founder led companies like DASH and RBLX have very different Proxy Statements that evolved directly from the Elon Musk TSLA package

Let’s dig a little deeper on executive comp amid proxy season. Previously I covered a few companies like UBER and BKNG, but those are companies that are not founder led. Dara didn’t found Uber and we’ve seen Founder CEOs compensated differently like Tony Xu at Doordash who has significant founder ownership.

TL;DR

Elon’s Tesla pay package back in 2018 set a new standard for Founder CEO compensation, big targets = big awards

DoorDash CEO Tony Xu has an Elon-esque package that is aligned with shareholders but the rest of the executive team has no performance metrics

Roblox CEO David Baszucki has a very similar package and the board moved 20% of non-CEO executive comp to PSUs

The Elon Package: Setting a New Standard for Founder CEOs

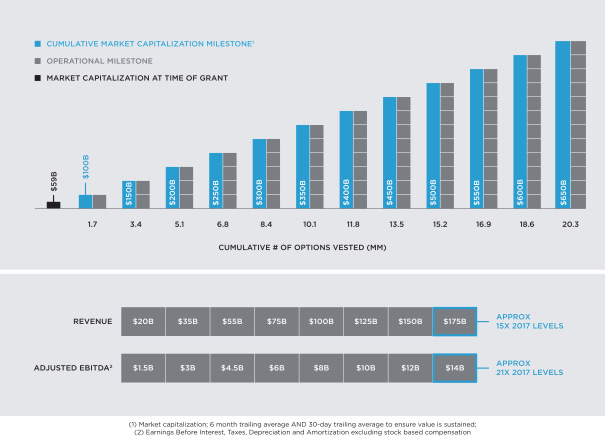

Back in 2018 Elon Musk received a package wherein he would receive up to 12% of the shares outstanding at the time in 12 tranches over a maximum of 10 years. The tranches were dependent upon Tesla hitting $100B in market cap for the first and then $50B incremental market cap for each subsequent tranche up to $650B. Additionally these were tied to 16 operational milestones (8 revenue and 8 profitability) of which 12 had to be paired with the market cap milestones for all tranches to vest.

At the time it was a fairly absurdly large grant, but it was directly tied to shareholder value creation, after all if TSLA goes from $60B to $650B in market cap a lot of that success can be tied directly to Elon’s stewardship as CEO. My biggest pushback is that the 8 milestones tied to Adjusted EBITDA excluded stock-based compensation which creates a bit of a negative feedback loop where GAAP Profitability is even more negatively impacted from the pure size of Elon’s grant. There’s been a lot of pushback from the package including recent lawsuits seeking to invalidate it, but you can’t ignore the impact that the “Elon Package” has had on other Founder CEOs.

DoorDash: Incentivized for the Long Term

DASH CEO Tony Xu owns 36.6m shares worth approximately $2.3B and thus is in a significantly different place than non-founder peers at other companies. In Nov 2020 at the time of the IPO, Tony was awarded a Elon-esque package tied to long term performance.

The total RSU award was 10,379,000 shares (theoretically worth up to $5.1B) but similar to Elon had tranche requirements:

Each of the individual tranches require that the average stock price be above the tranche minimum for a consecutive 180-day trading period during the performance period. Tony must also hold after-tax shares that vest for at least two years following the award, no quick flips of vested shares. So far, the performance period didn’t even start until Jun 2022 (1.5yrs after grant date) and to date none of the tranches have been vested given the stock performance.

What about other Executives at DoorDash?

We’ve established that CEO Tony Xu’s compensation is almost exclusively tied to long term performance based RSUs, but what about the rest of the team? From the 2023 Proxy, two of the first things that stand out are that :

a) Base Salaries for NEOs are fixed at $350k/yr

b) No cash bonuses or short-term incentive compensation.

Both of those are positives: fairly low salaries and no playing games with short term incentives or bonuses tied to questionable metrics like we see at Uber. My biggest issue with the rest of the executive team is that they are awarded straight up RSUs with no performance standards.

I strongly believe that the vast majority if not 100% of equity compensation for executives should be tied to reasonable performance metrics that have alignment with shareholders. While Tony as CEO is held to a high standard with almost 100% of his compensation tied to shareholder value, the rest of the DoorDash executive team is compensated on the basis of just showing up with traditional RSUs vesting over 4 years.

How Aligned is Comp with Shareholders and Messaging?

Doordash is one of the few companies who has achieved alignment between 1) CEO Compensation 2) Shareholders and 3) Strategy + Messaging.

Clearly the CEO is only compensated if shareholders also win over the long run as compensation is directly tied to share price over a measurement period of 7 years. More importantly if you go back to the Q4 2022 shareholder letter, the messaging and strategy that is laid out is very much in-line with how to create long term shareholder value:

Growing free cash flow per share is the best way to efficiently grow your business and subsequently the stock price while managing dilution. It’s the closest you can get to targeting actual distributable cash to shareholders.

Roblox: Like DoorDash but with Performance RSUs for Other Executives

Much like other Founder CEOs, David Baszucki owns a significant portion of his business. As of the Apr proxy, he holds over 63m shares worth $2.2B today. To align his compensation with shareholders he also received an Elon-esque package directly tied to company stock performance laid out in multiple tranches:

Theoretically it’s a maximum of $4.3B of shares if the stock is above $375/sh after 2026. And Baszucki would be awarded that $4.3B in exchange for driving the market cap of the business from $22B today to >$200B which shows a pretty decent alignment with shareholders.

The justification language from the proxy is fairly interesting to read and put yourselves in the shoes and minds of Compensation Consultants (the worst) and the Compensation Committee:

In determining the terms and conditions of the Founder and CEO Long-Term Performance Award, the LDCC in consultation with an independent compensation consultant, considered many factors in determining whether to grant the Founder and CEO Long-Term Performance Award and the size and terms of the award. The LDCC was intent on establishing an award that would align Mr. Baszucki’s long-term interests with those of stockholders, would require significant and sustained Company performance, and discourages short-term risk taking to achieve short-term performance. The LDCC considered Mr. Baszucki’s significant ownership percentage in the Company obtained primarily in connection with his founding of Roblox in 2004 and the amount of his ownership interests that were unvested as of the date of the grant in its deliberations of this award. Upon review of market data for similarly situated executives at comparable companies with an emphasis on the ownership percentage and equity value of founder chief executive officers at the time of an initial public offering, the LDCC believed that providing meaningful incentives for Mr. Baszucki to continue his leadership of Roblox as our CEO and to execute on his vision to further drive the growth of our business was of paramount importance.

New: PSUs for Other Executive Officers

In 2022 RBLX introduced PSUs for NEOs besides the CEO. 20% of total equity awards were converted from RSUs to PSUs with a stock price hurdle requirement to vest. Although an improvement in alignment vs before and definitely compared to DoorDash, 20% is fairly low when even Uber has a minimum of 30% in PSUs and 50% for the CEO/CFO.

Roblox took that first step in starting to align non-CEO executives with shareholders through performance requirements, but I’d argue that 20% is too low. Much like DoorDash, Uber, and other companies I’ve looked at, it’s reasonable to envision executives who are well compensated almost exclusively on reasonably set performance standards. We’re not quite there, but the trajectory is moving in the right direction.

Tickers Mentioned:

DASH 0.00%↑ RBLX 0.00%↑ TSLA 0.00%↑

Resources:

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.