Cash-vs-Equity Flex Compensation: Dilution Math & Market Benchmarks (Q1 2025 Update)

A data-driven look at cash-versus-equity flexibility—plus the latest Q1 ’25 dilution scoreboard.

With Q1 reporting season behind us I wanted to first do a deep dive on what I’ll call the Netflix method of cash vs option or RSU compensation for employees. Then I’ll do a quick update on the dilution scoreboard.

Compensation Conundrum: Hyper Inflation

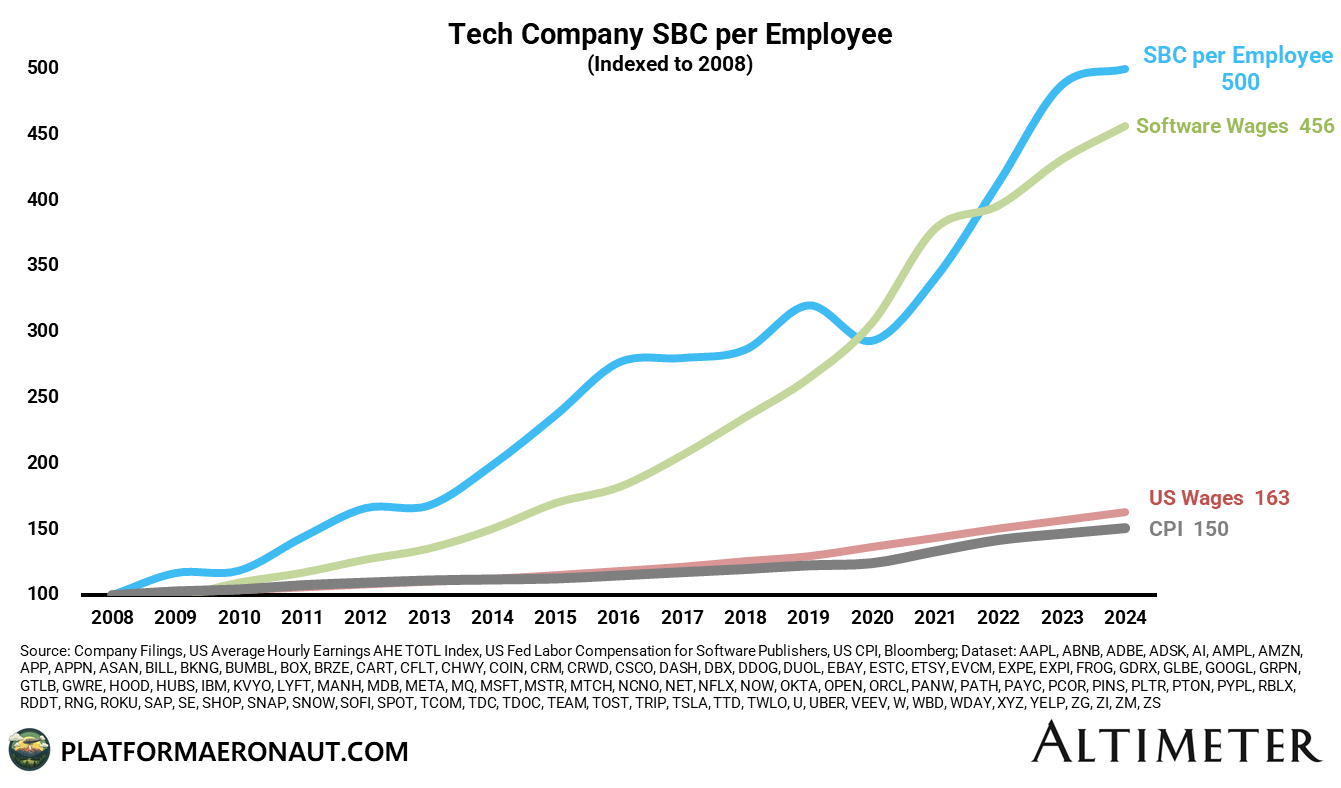

I first wanted to frame the conversation with a chart showing the inflation of SBC at tech companies going back to 2008:

While US wages overall have marginally outpaced CPI indexed back to 2008, we’ve seen wages at Software companies (and tech at large) explode 4.5x. I wanted to see what stock-based compensation per employee looked like across technology so I pulled SBC and employee counts at 98 different internet, software, and technology companies and indexed what they were expensing as SBC per employee. Since 2008 that number has gone up 5x, outpacing overall tech wages and far surpassing the US wage market at large.

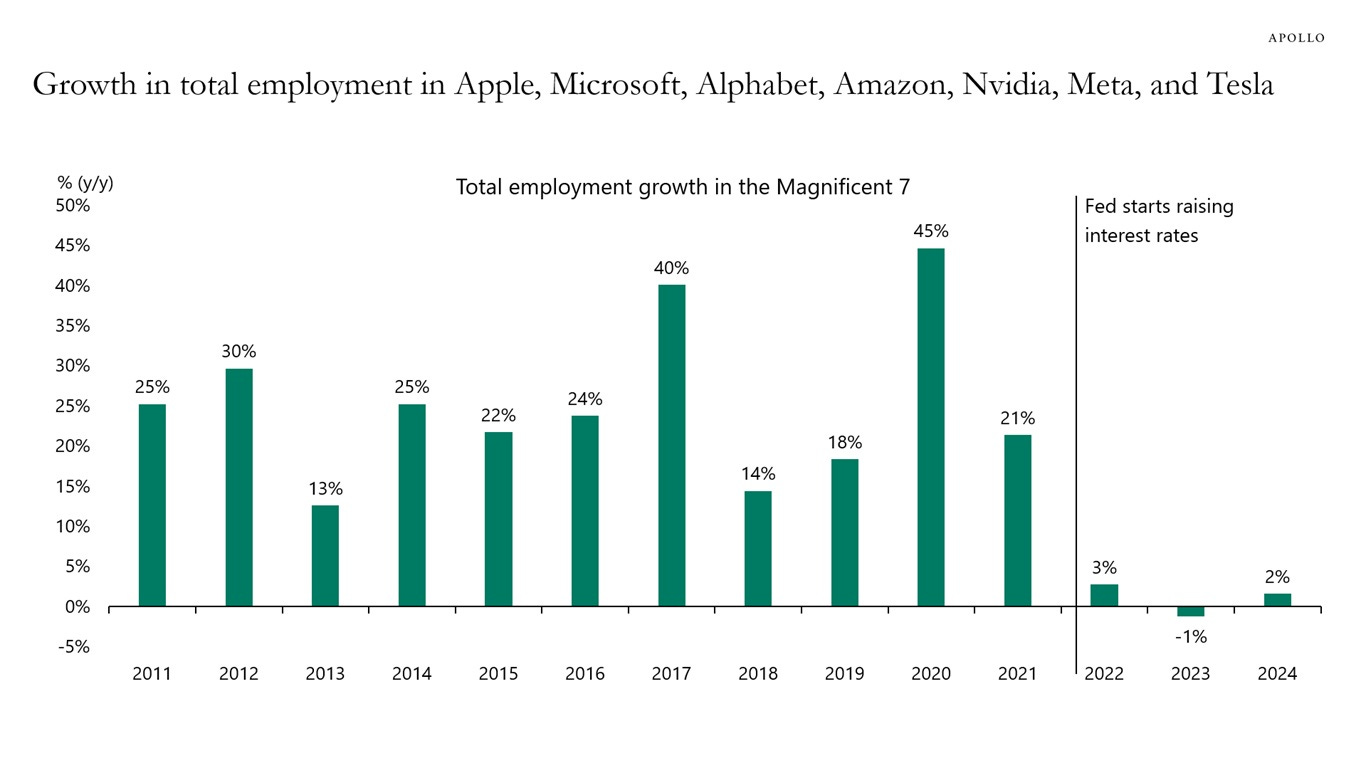

The combination of post-pandemic cost discipline, higher interest rates, and AI-driven productivity gains has brought head-count growth at large-cap tech to a screeching halt, as the next chart illustrates:

The challenge is how do companies reduce dilution, fairly compensate employees, and maximize shareholder returns?

The Netflix Compensation Method

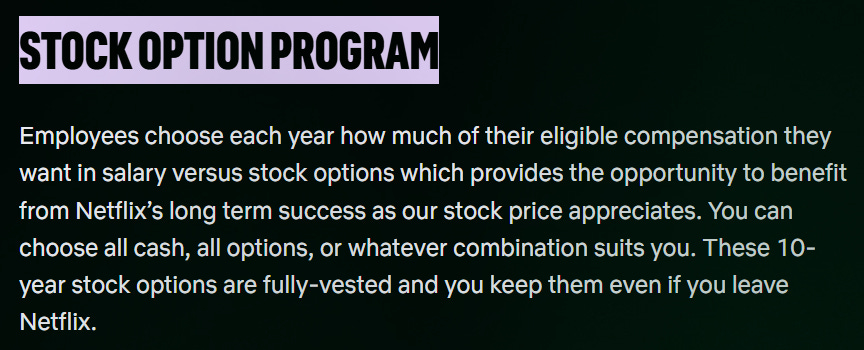

Netflix is best-in-class on dilution partly because it lets employees decide what share of their pay comes in cash versus equity (options for Netflix):

Most tech employees now receive RSUs rather than vanilla options. I won’t relitigate the alignment debate here; the point is that Netflix’s “choose-your-mix” philosophy works just as well with RSUs.

Cash is King?

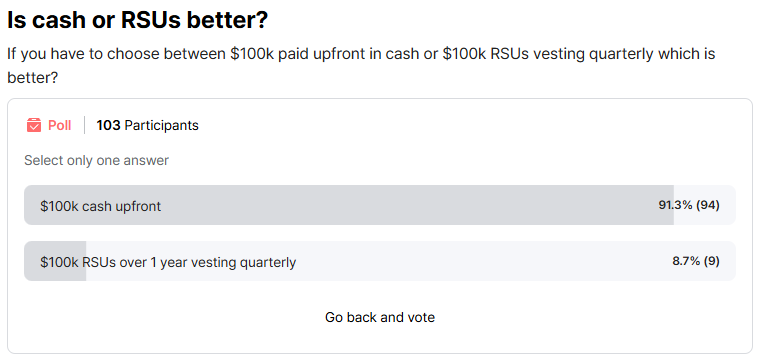

Headlines about long-tenured Nvidia or Tesla staff netting $50 million are eye-catching, but most rank-and-file tech workers still favor cash over equity. A Blind poll (103 participants) found ~91 % chose $100k cash up-front versus RSUs vesting quarterly.

So the reality is that giving employees the option can provide a win-win-win solution for all parties:

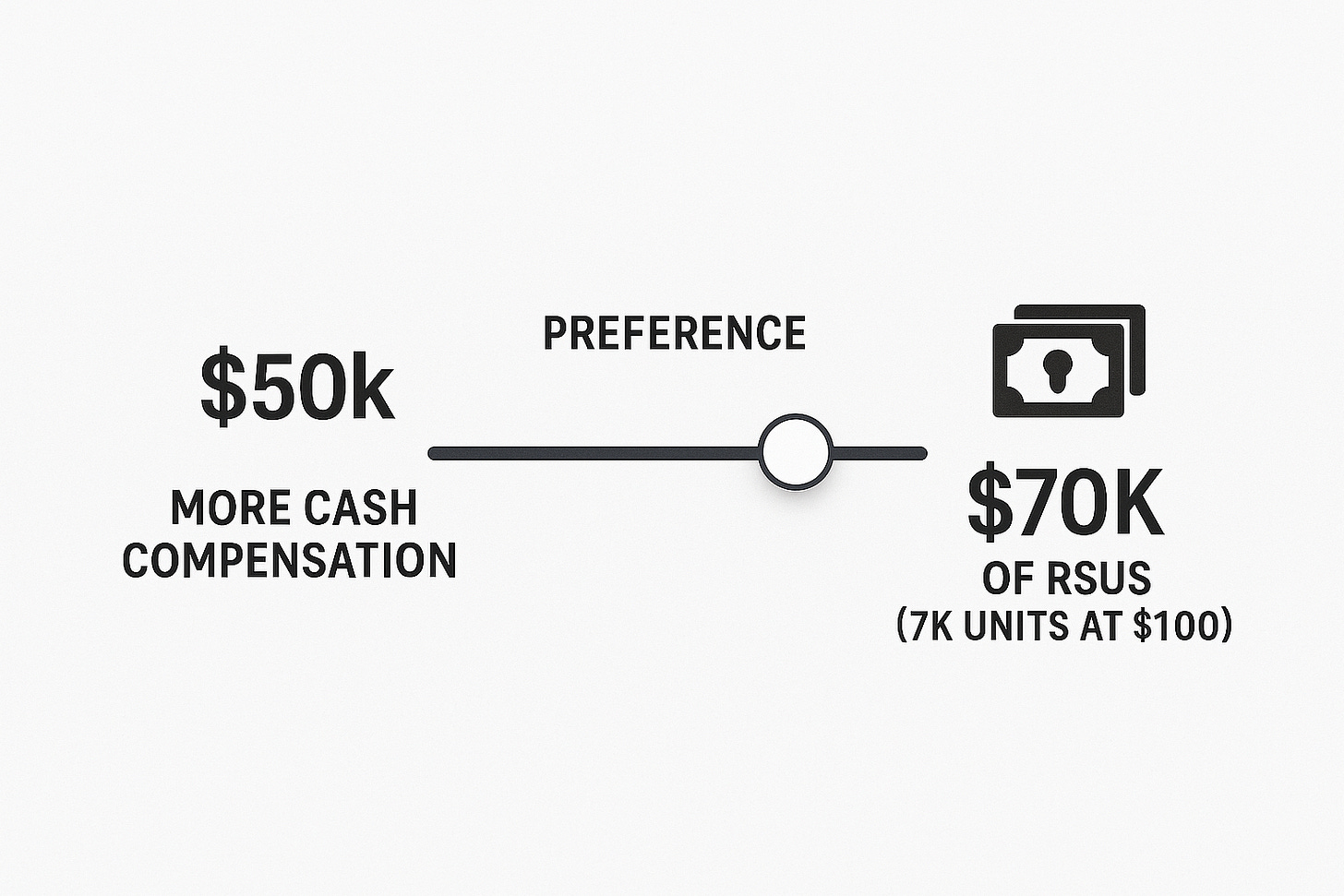

Employees: Benefit from flexibility and the ability to choose their level of risk tolerance. One employee may prefer $50k of bonus spread throughout the year in cash versus RSUs or options exposed to company stock performance.

Companies: Benefit from the ability to reduce dilution by flexing or incentivizing cash pay. If 90% of employees prefer 1:1 cash upfront vs RSUs, what would the ratio be at 0.75:1 or 0.5:1? Would 50% of employees take $50k of cash versus $70k of RSUs? It could potentially be big savings

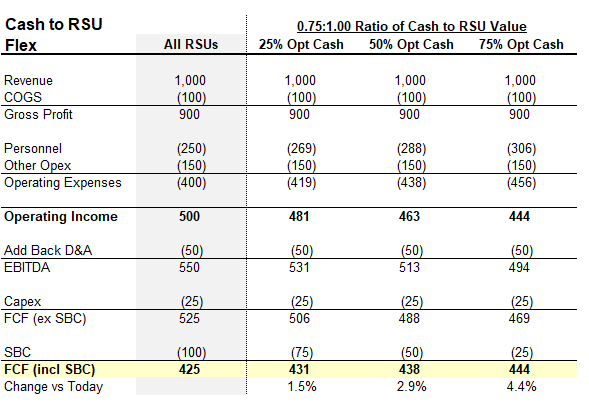

Let’s do some quick math of the true impact to a company. Here’s an illustrative company doing $1,000m of Revenue, $250m of personnel expense and $100m of SBC expense. The true metric to look at fully loading SBC and dilution would be Free Cash Flow including SBC expense. Steady state this business generates $525m of FCF but $425m of FCF including stock-based compensation.

If the company set a 0.75 : 1.00 ratio of cash to RSU value for employees the real ground truth metric of FCF including SBC would increase as more employees opt into getting 75% of their RSU as cash guaranteed. How many employees would take a guaranteed $75k in their paycheck instead of $100k of RSUs with market risk? The reason a lot of companies like SBC and it gets abused though is that the base FCF metric goes down in this analysis. Companies like Booking Holdings who focus on the FCF incl SBC or fully baked GAAP earnings win over the long run by focusing on the right metrics.

Investors: A heightened focus from companies on dilution and the trade-offs of SBC is valuable. If every company looked at SBC like Booking Holdings does, then dilution would be a hell of a lot lower across the board.

The potential downsides exist and include:

Administrative complexity vs a one-size-fits-all comp structure

Risk of employee regret or inequality (same level employee comp could be materially different if one goes all cash vs all RSU)

Reduced retention incentive (although great companies offset this in other ways)

Impact on Winning Together Mindset (although I would argue there’s plenty of non-tech companies that don’t compensate in equity at all that have great culture)

If employees truly valued RSUs and options and wanted long term alignment with the company they would hold onto more of their variable compensation when it vests. But the reality is that 70-80% of employees sell all of their RSUs within one week of vesting. So this isn’t alignment of ownership, this is just more complex cash compensation with higher risk. Give employees choice.

The biggest argument though is that employees want cash and if you believe in your company as a CEO you should want to minimize dilution and skewing compensation away from equity and towards cash is a win-win.

The Landscape Today of Flex Cash/RSUs/Options

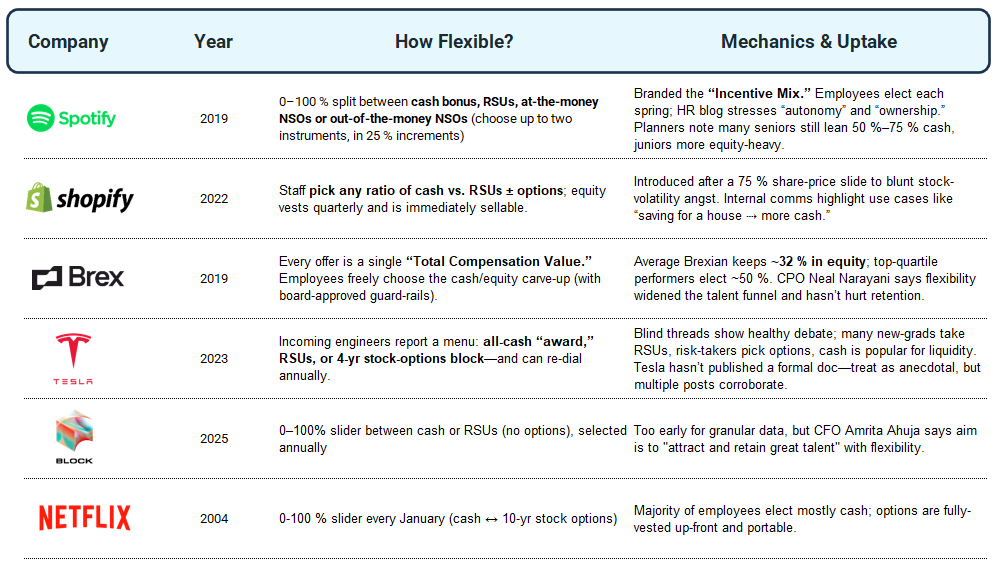

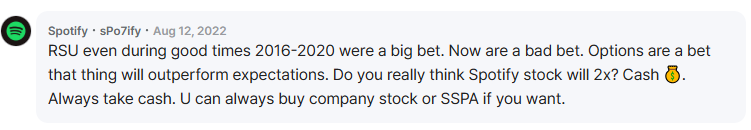

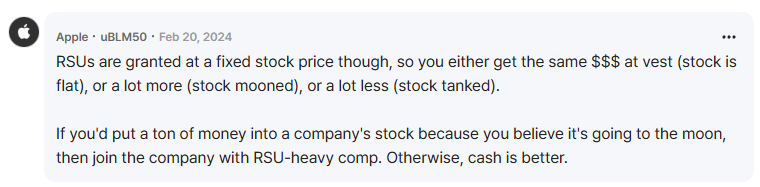

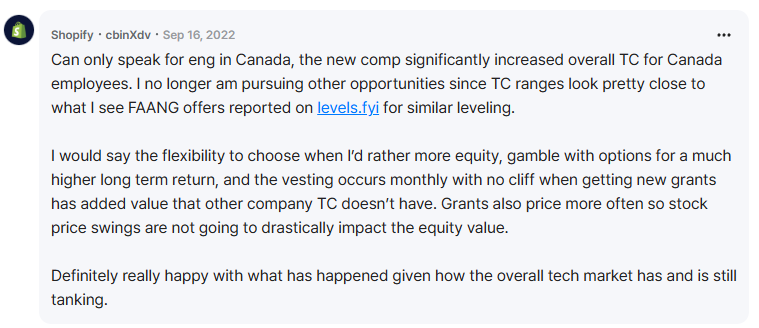

Beyond Netflix, a growing list of firms (Spotify, Shopify, Brex, Tesla, etc.) offer cash-vs-equity flexibility. Uptake varies by seniority, risk tolerance, and life stage. Just as businesses segment their customers, flexible comp lets companies segment their employees.

Here are a few representative quotes from employees at some of these companies:

I expect we will see increasingly more companies adopt this and I expect it’ll be a positive tailwind to dilution as management teams take a more rational approach to dilution and equity management. It can be a win-win-win for all stakeholders: employees, companies, and investors.

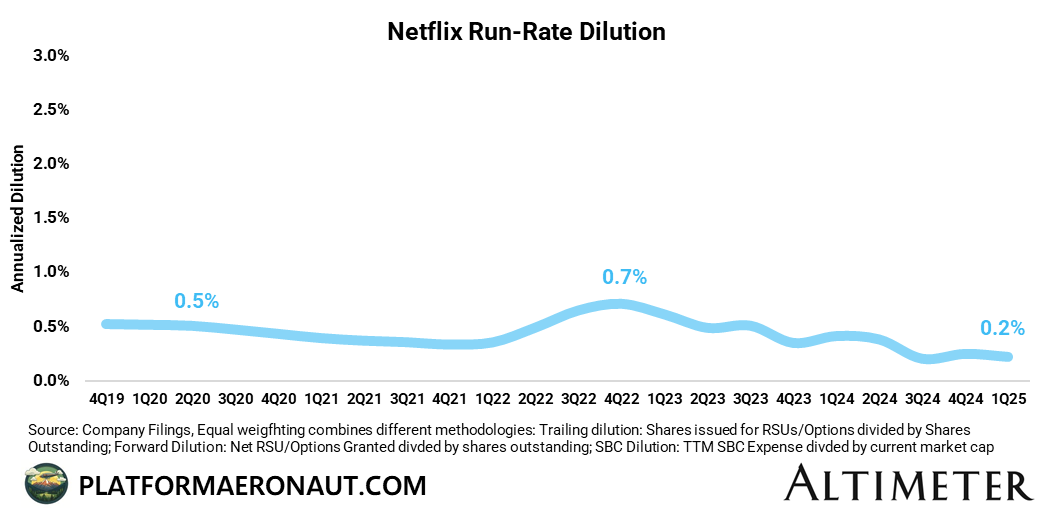

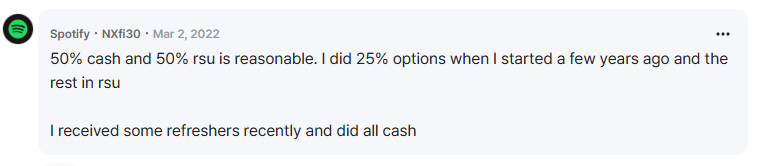

Tech Dilution: Stable (still)

On a macro level, we have continued to see stability within tech for dilution.

With the market generally up (despite the Liberation Day drama from Trump that we appear to be past), you’d expect some small tailwinds from dilution as companies can issue fewer RSU shares for the same dollar amount to compensate their employees.

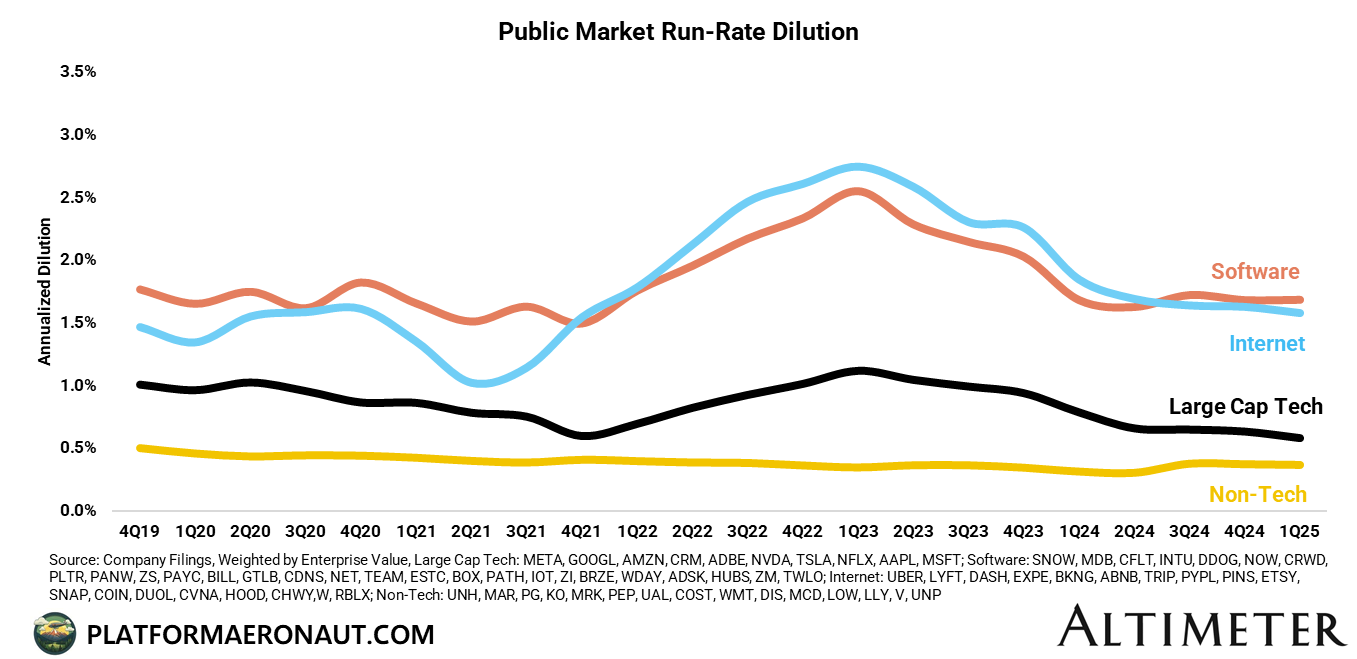

Tech Dilution Leaderboard

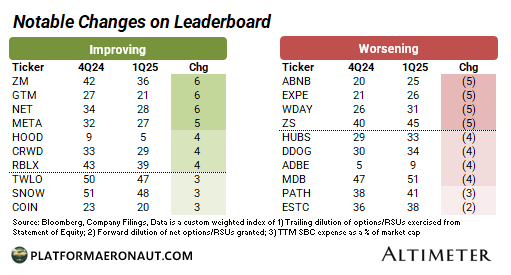

There haven’t been a ton of changes to the leaderboard with perennial champions Booking and Netflix at the top and Snapchat and Wayfair at the bottom.

Part of the strategy from those improving is a strategic move away from 4 year RSU grants and to 1 year grants that help better align to an up-or-out mentality for quality where top performers likely make more and get bigger grants, and those underperforming likely see cuts or get zero’ed. Beyond this change, which we’ve seen at other companies like Reddit, Lyft, and Coinbase, I wanted to focus most of this post on making the case for flexible cash vs RSU bonus compensation for employees.

Tickers Mentioned: BKNG 0.00%↑ NFLX 0.00%↑ XYZ 0.00%↑ TSLA 0.00%↑ SHOP 0.00%↑ SPOT 0.00%↑ LYFT 0.00%↑

The information presented in this newsletter is the opinion of the author and does not reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for informational purposes and should not be construed as investment advice or an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Altimeter and its clients trade in public securities and have made and/or may make investments in or investment decisions relating to the companies referenced herein. The views expressed herein are those of the author and not of Altimeter or its clients, which reserve the right to make investment decisions or engage in trading activity that would be (or could be construed as) consistent and/or inconsistent with the views expressed herein.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

SBC is the most abused aspect of corporate finance today and US tech are the worst offenders. You miss a critical issue in your analysis. Repurchases to offset dilution typically happen at the time of vesting, so the true cost to the company and it's shareholders is not known until years after the grant. A windfall gain to the employee is paid for our of shareholder equity. It's a buy high from the market and sell low to the employee strategy . Madness! But the employees won't complain. Oddly enough, neither do most shareholders! Fools.

Fairfax Financial do it better. At the time of the grant, long before vesting, they buy stock in the market and hold it as Treasury Stock thereby fixing the cost. For every other company, the SBC cost on the 8k and 10k are just fictional numbers, usually vastly underestimating the true cost. It would be great to see your first chart redrawn with the true cost based on how much the company spends on repurchases to offset dilution (cash flows from financing).

All that repurchase activity - buying at any price regardless of intrinsic value - artificially inflates the stock price and causes market efficiency to break down and bubbles to form. Apple has seen flat to deteriorating top and bottom line numbers since 2022 yet the share price has doubled - this is why - It can't end well. It's why Buffett sold down his stake.

More shareholders need to take notice of this egregious behaviour and stop acquiescing. Regulations need to wake up!