AI Agents and the Future of Grocery Delivery

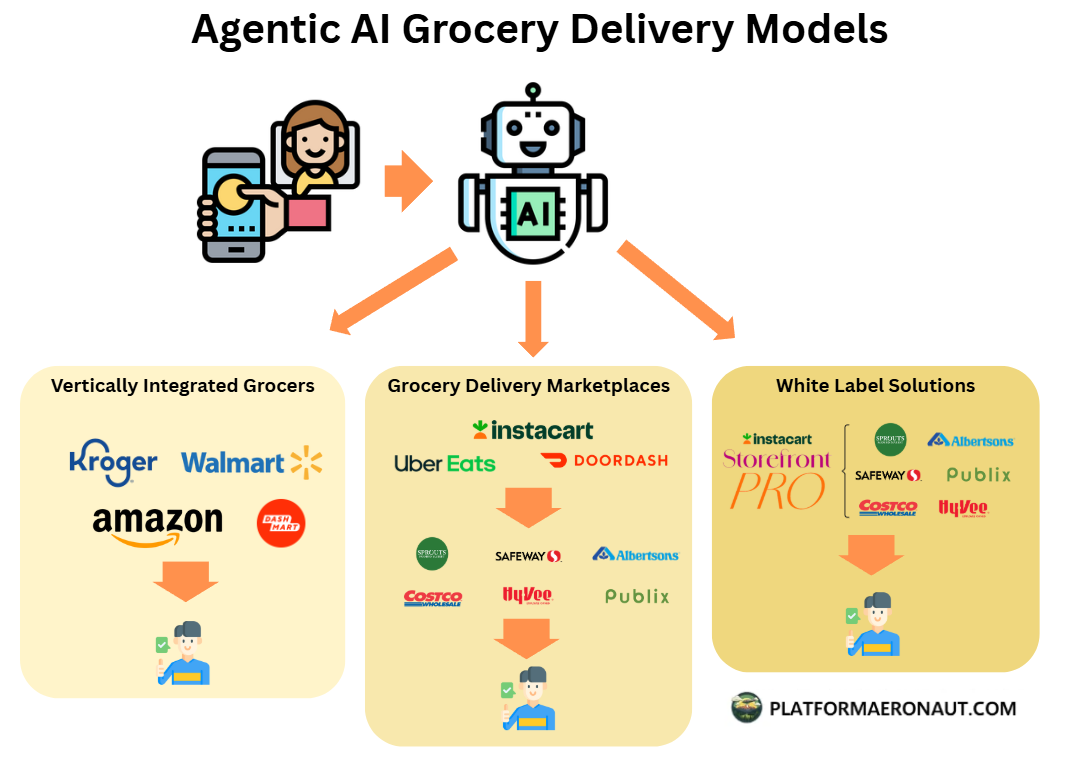

App Marketplaces (DoorDash/Uber/Instacart), White-label Storefronts (Instacart), and Vertical Integrations (Amazon/Walmart) in an AI-Agent first world.

Imagine never touching a grocery app again, your personal AI agent knows your fridge, your family, your plans, and orders before you realize you’re out. While I recently mapped out the grocery delivery landscape, I wanted to spend some more time doing a bit of future looking towards an AI Agent first world and what that means for the future of grocery delivery.

In a similar way that I looked at the impact of AI/LLMs on travel distribution, we’re going to potentially see big changes to how consumers interact and order groceries over the next 5+ years. Imagine you have an AI agent in your pocket that knows your personal preferences and what you need for both a weekly grocery trip or a pre-dinner top-up order. What would that look like and what are the implications for the three strategies (vertical integration, delivery marketplaces, and white-label)?

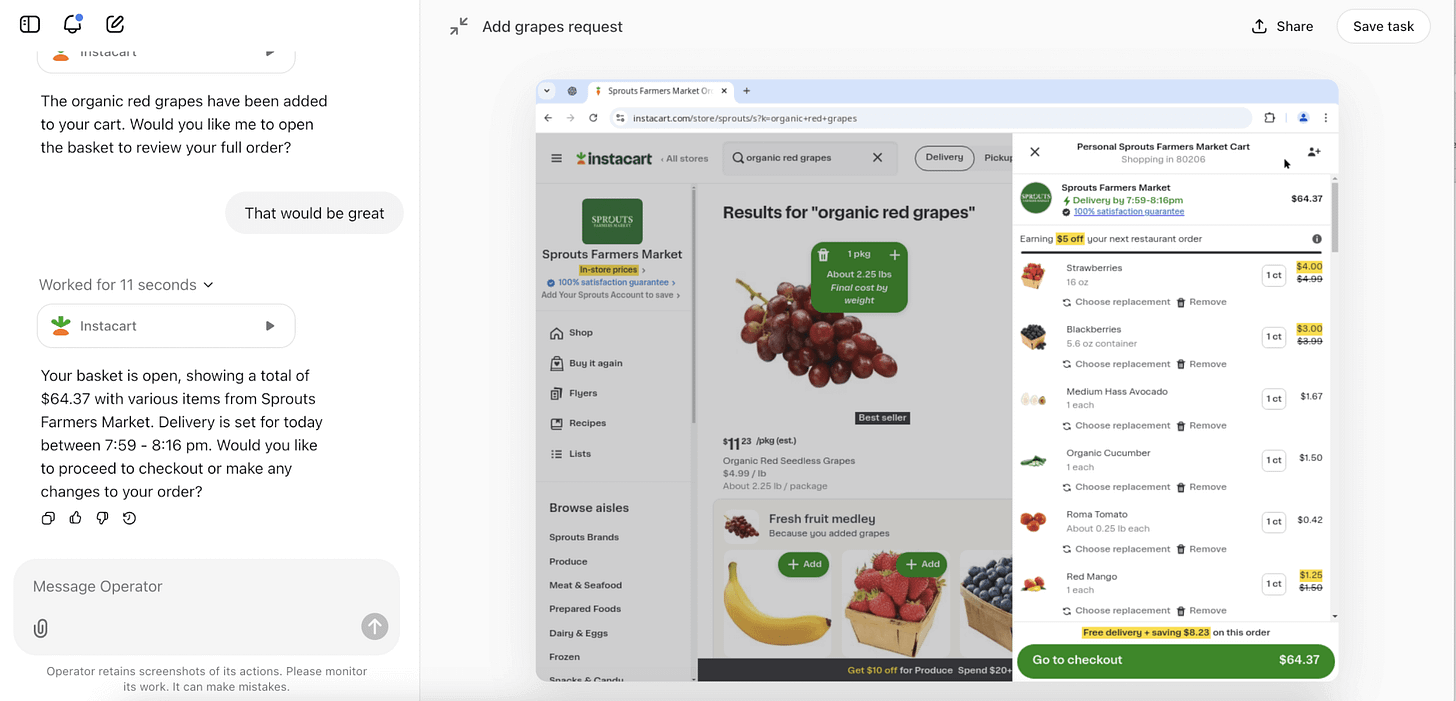

With the launch of OpenAI operator in Jan 2025, Instacart demonstrated the capabilities of how it could order groceries for you:

While it’s clunky today, remember how clunky the first iPhone apps felt. The glide path is clear and we are marching towards an agentic future.

What the Future May Look Like

Whether it’s OpenAI, Gemini, Siri, or some other tool, every consumer will have a personal agent in their pocket. It will book travel for you, make dinner reservations, manage your schedule, and for purposes of this discussion it will order your groceries for you.

For the average American family that gets groceries 1x per week it’ll know what you often order, it’ll recommend recipes, it’ll monitor past usage and wastage of food products, and it’ll know your consumer preferences around store loyalty. If you change your plans and tell your agent that you’re hosting a dinner party for 8 people serving it can assist by recommending what to serve and automatically ordering it from the grocery store.

The big question though is how does this impact existing incumbents in the industry? Generally I’m breaking down the incumbents into three categories:

Vertically Integrated Grocers

With the huge success of Walmart grocery delivery and the renewed focus from Amazon these are the vertically integrated grocers who handle everything. Kroger and their partnership with Ocado fit in here as well. You use their app, they manage inventory, fulfillment, and delivery, and it’s essentially a one-stop shop. I’d also include more boutique solutions like DoorDash’s DashMart here.

Near Term (1-3 Years): Winners

Long Term (5+ Years): Winners

Grocery Delivery Marketplaces

This is generally inclusive of Instacart, Uber Eats, and DoorDash. The main consumer UX is the app or website where you’re entering the marketplace, choosing the store/retailer, and then on the back end the marketplace is managing picking, fulfillment, and delivery.

Near Term (1-3 Years): Winners

Long Term (5+ Years): Potential Losers

White Label Solutions

Beyond vertically integrated grocers there is the long tail of every other regional and local grocer across the country. With razor thin margins and lack of technical expertise, grocers like Safeway, Albertsons, and Publix rely on white label solution providers like Instacart Storefront to enable their e-commerce abilities.

Near Term (1-3 Years): Neutral

Long Term (5+ Years): Potential Winners

Looking across these models there’s two key areas where there are middlemen to be disrupted: 1) Grocery Delivery Marketplaces and 2) White Label Solutions. The Age of AI is going to be the age of efficiency and wringing out middlemen from the equation. Grocery Delivery Marketplaces are definitely middlemen and I’d argue that white label solutions from providers like Instacart Storefront sort of are. I’ll dig deeper into each below, but generally:

Near Term (1-3 Years): Grocery delivery marketplaces and vertically integrated grocers will continue to win while white label solutions continue to develop and expand.

Long Term (5+ Years): Grocery delivery marketplaces faced existential threats, vertically integrated grocers dominate, and white label solutions emerge as the key unlock for offline grocers.

Vertically Integrated Grocers in an AI Agent First World

It’s no surprise that Amazon and Walmart as the two behemoths in US retail are investing heavily to thrive in an AI agent dominated future. With no middle-men, huge R&D budgets, data capabilities, and strategies that optimize on price, selection, and speed, the vertical integrated grocers are well positioned for an AI agent world.

Near Term (1-3 Years)

Both Amazon and Walmart are already baking AI into their shopping experiences anticipating the rise of agentic customers. Andy Jassy has spoken about building products for “software agents making decisions on their own” aka hitting “buy” without a human in the loop. Maybe this is finally the time for Alexa to shine?

Product-wise, the hyperfocus on speed and convenience it likely optimal for an agentic world. If your agent is just doing a top-up grocery order for 6 bananas, 3 yogurts, and some waffle mix, the optimal decision from a speed, convenience, and most importantly work-flow/AI-readiness puts Amazon and Walmart in a strong position.

Longer-Term (5+ Years)

When you look longer term, the deep R&D budgets and ability to develop agent-specific advertising and SEO strategies puts Amazon and Walmart in pole position. If we flipped a switch and only agents could order groceries for every US consumer it’s easy to imagine that relative market share for vertically integrated grocers would increase.

AI agents mean that the importance of brand goes down, while the importance of service goes up, and that’s where all the incremental dollars from both players are going. They can best position themselves to win in a world where AI agents make decisions based on best outcome (cost, quality, speed).

DoorDash with their DashMart concept is trying to take themselves out of the middleman equation and focus on being the 1P provider which is a lot more defensive in an AI agentic world.

The biggest challenge will be on crossing the trust chasm. While consumers have high trust in Amazon for shelf-stable goods, it’s non-existent for fresh goods. Early returns from Amazon same-day perishable trial showed 75% of consumers were first-time perishables shoppers at Amazon but only 20% reordered multiple times within the first month. “U.S. shoppers have shown they prefer to buy fresh goods from retailers that run brick-and-mortar stores, as evidenced by the struggles of online-only grocers like Peapod and FreshDirect.”

For Walmart there is a higher degree of trust today for fresh produce and meats given it’s brick-and-mortar background. How will the AI optimize where to order from? How much will it take into account your personal bias or preferences?

Grocery Delivery Marketplaces in an AI Agent First World

Although Instacart remains the dominant grocery delivery marketplace, you have both DoorDash and Uber Eats aggressively expanding into the segment. These companies excel at on-demand logistics and aggregating supply across a variety of merchants.

Generally the rise of AI Agents is a lot more mixed picture for the delivery marketplaces. On one hand, an AI that can spontaneously order anything might increase demand for delivery, on the other hand these services might be commoditized as the consumer UX slowly fades away and the importance is put on the underlying speed, convenience, and price.

Near Term (1-3 Years)

Instacart is far and away the biggest in grocery delivery among the three, but both DoorDash and Uber Eats have been aggressively expanding into grocery.

Most of the AI innovation from these marketplaces have been to embrace AI to enhance their own appp UX. DoorDash has tested an in-app AI chatbot called DashAI to give personalized recommendations. They’re all working on AI voice ordering capabilities as well. The immediate future is trying to become AI-friendly front ends themselves but focused from a human perspective. AI can help make it easier for humans to order on the DoorDash or Instacart app. There’s also a user penetration story outside of AI that’ll continue with 15%+ of Uber Eats customers now ordering grocery, and order frequency growth at DoorDash for small basket size grocery orders.

Longer-Term (5+ Years)

As AI agents proliferate, the most negative outlook for the delivery marketplaces is that they are relegated to pure delivery utilities. An AI that is brand-agnostic might see all of the options as interchangable ways to get grocery items to a customer.

Given that DoorDash and Uber don’t own any product inventory (except DashMart), exclusive relationships are generally dead, and the cost to serve to a consumer tends to be higher than vertical grocers, they might end up completely bypassed as middlemen. Loyalty is one important component, but today a consumer opens DoorDash out of habit, in five years the user just asks the AI who weighs multiple options that the marketplace has to win the algorithmic auction rather than win on pure loyalty.

Even in a world where the marketplaces flourish from a usage perspective, the above dynamic is likely to pressure commission margins to compete. As the marketplace consumer UX fades away and is replaced by agentic UX the value proposition for the marketplaces is on the fulfillment and delivery component which is naturally a lower value business if you no longer own the top of the funnel for demand aggregation.

The upside for the marketplaces, especially DoorDash and Uber is if AI agent order flows move towards more frequent, lower AOV, on-demand orders that require a desne courier network. If consumer and agentic preference moves towards ordering groceries 4-5x a week instead of 1x per week that is a world where the marketplaces have a huge strategic advantage over vertically integrated grocers.

White Label Solutions and the Long Tail in an AI Agent First World

Beyond the marketplaces and the vertical integrated grocers there is the entire long tail of grocery commerce that is done from local and regional grocers like Safeway, Publix, and Albertsons. If you are running one of those grocers you have three options for enabling e-commerce grocery:

Homegrown software solution

Utilize Instacart/DoorDash/Uber Eats Marketplaces

Use Instacart Storefront white-label solution

Over the past several years we’ve seen increased adoption of Instacart Storefront and it’s contribution to total GTV for the company has been accelerating. Management has referenced adding 30+ retailers in 2024 and 40+ retailers in 1H25 alone to the Storefront enterprise SKU and it’s showing up in the numbers.

There’s also the possibility that just like the 2017 acquisition of Whole Foods by Amazon was a huge catalyst for grocers to get on the Instacart marketplace, that the success and expansion of Walmart and Amazon grocery delivery will push grocers to Instacart’s Storefront product even more aggressively. Legacy regional and national grocers often don’t have the e-commerce expertise or budget to invest heavily and Instacart has proven it’s ability to deliver. When the option is do nothing and lose offline grocery share to Amazon and Walmart or lean into E-commerce through Instacart it’s a fairly easy choice.

Near Term (1-3 Years)

Over the next several years I’d expect more offline grocers to lean into white-label solutions because it gives a hedge in the AI agent era. Grocers using white-label from Instacart will benefit from the same consumer facing AI UX changes as described above in the marketplace segment. These don’t necessarily provide all the answers to an AI agentic world, but they give the long tail of retailers a leg up while things are still mostly human-focused.

Recently we’ve seen Stop & Shop parent Ahold Delhaize close down dedicated e-comm grocery fulfillment centers to focus on in-store fulfillment. A localized fulfillment model powered by Instacart Storefront is the near term tailwind for local grocers.

New Moat: API & Identity Readiness: Agents need login, loyalty, coupons, real-time availability, and sloting APIs. Publix’s white-label privacy language shows how retailer data flows when the site is Instacart-powered, this is good for agent UX and attribution.

Longer-Term (5+ Years)

The success of white-label and thus for the regional grocers is incumbent upon human behavior and preferences being adequately represented in agentic AI actions. What I mean by that is that if an AI is acting as you want it to in terms of loyalty and preference, then it will place the local grocer higher up on the preference list than perhaps Walmart or Amazon.

Statistical surveys support that consumers tend to have a lot of loyalty to their local or preferred grocery store:

71% of Americans report being loyal to their grocery stores, often maintaining loyalty for around 13 years, with one-third loyal for over 20 years

53% of grocery shoppers are more loyal to retailers (merchants) than to specific products

73% of shoppers say they favor brands or retailers that offer loyalty programs.

70% of consumers report using their grocery loyalty program almost every time they shop

For Instacart white-label specifically either they are cemented as a vital middleman enabling e-commerce for the bulk of US grocery stores or they get bypassed. The bypass would occur if consumer preference and loyalty to regional and local grocers breaks down and we live in a world where all e-commerce is done by Amazon and Walmart. In a world where consumer preference and loyalty is adequately represented by personalize AI agents, Instacart stands to win big as the penetration rate of offline grocery spend continues to move online. Even in a declining environment for regional grocers the e-comm pie is growing quickly to enable them to win.

Tickers Mentioned: AMZN 0.00%↑ WMT 0.00%↑ DASH 0.00%↑ UBER 0.00%↑ CART 0.00%↑

The information presented in this newsletter is the opinion of the author and does not reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for informational purposes and should not be construed as investment advice or an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Altimeter and its clients trade in public securities and have made and/or may make investments in or investment decisions relating to the companies referenced herein. The views expressed herein are those of the author and not of Altimeter or its clients, which reserve the right to make investment decisions or engage in trading activity that would be (or could be construed as) consistent and/or inconsistent with the views expressed herein.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

This is probably the worst idea the Republicans have today. It became obvious to me that repealing Obamacare was impossible when the Republicans had the house after Donald Trump won the first time, and they were absolutely decimated if not annihilated on the house floor by their counter parts citing l the number of people who would become uninsured if Obamacare was repealed—you’re never gonna be able to repeal it, into the extent that you do, you will regret it politically. You need to stop trying. If anything what you should do is try to move the ball toward the Medicare advantage model, even though that doesn’t seem to actually save any money, but this endless crusade to repeal people‘s healthcare is not getting anybody anywhere especially the GOP. President. Trump was right when he said don’t touch Medicare or Medicaid for that matter and he should’ve included Obamacare—people like their healthcare. You’re not gonna roll it back

If I ruled the world I would make third-party payment illegal and make everybody pay cash—no private insurance, no public insurance. You know what would happen? The cost of healthcare would come down I think by 90% and we would all be in a free market, but guess what that is never going to happen and if you tried to propose it, your own voters would turn you out. office.