Travel & Leisure Demand: Peaking or Not?

Overview and quotes from Q2 earnings calls on demand into Q3 and 2024 show continued strength from peak summer travel but can that strength continue?

We’re partially through earnings season for travel and leisure companies and the big question from a macro (and micro) perspective is on the strength of the consumer. From a stock perspective things have been mixed recently but incredibly strong on a YTD basis:

My quick takeaways for each segment of the travel+leisure economy:

Cruise: Incredibly strong demand both Y/Y and vs 2019. Consumers are flocking back to cruises and we’ve haven’t seen much deceleration in demand trends (yet)

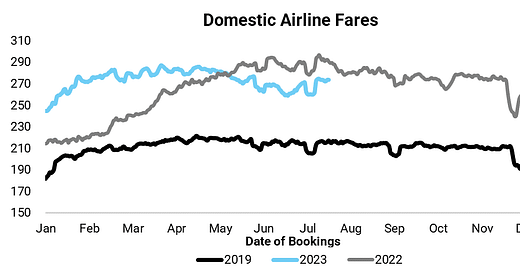

Airlines: Demand overall remains strong (especially international) but seeing some pockets of domestic weakness (from ALK and HA) and business/corporate continues to slowly recover.

Food Delivery: Northern Europe (incl the UK) is seeing strength and normalization but Southern Europe is lagging.

Hotels: Pricing and consumer demand is still strong, early bookings (especially group/corporate) for 2024 are well ahead of pre-covid levels. International still recovering but China back to 100% of 2019 RevPAR levels

Car Rental: Lots of Americans (and Europeans) traveling this summer leading to continued peak RPD pricing. We’ll see what things look like into September but late summer continues to be strong.

Quick quotes from the Credit Card Q2 calls:

American Express: "Travel and Entertainment spending increased by double-digits in the quarter and remained strong across customer categories and geographies. Looking forward, I would expect this growth rate [for Travel and Entertainment spending] to remain in the double digits through the rest of this year."

Mastercard: “Cross-border travel continues to show strength, reaching 154% of 2019 levels in the second-quarter. We remain well-positioned to capitalize on this trend with our travel oriented portfolios in our initiatives in areas like loyalty and marketing.”

Visa: “Summer travel across most regions picked up with travel in and out of Asia seeing strong gains along with travel inbound to SEMEA and outbound from Europe. Travel into the U.S. is still hovering at 2019 levels.”

Delivery: Early but Improving Still?

Uber, Lyft, and Doordash are still due to report but we’ve seen Q2/H1 results from Just Eat Takeaway

From Just Eat Takeaway H1 Call:

"Northern Europe and the UK and Ireland, we turned to GTV growth in the second quarter of 2023, and it is important to understand that these two segments of course represent the majority of our orders."

"I think it's fair to say that Northern Europe, UK, and Ireland, that looks pretty normal to us that looks like we're back to relatively normal, normal seasonality. We still have a way to go. Of course, in North America and Southern Europe, but no the line share of our business looks like it's in very good shape."

"I think it's important to understand that this is comparison still if a period in which people could not leave their houses or actually were reluctant to leave their houses because there was, there was an ongoing pandemic."

"Revenue per order has improved through advanced upselling and expansion into new verticals with higher average order values."

Hotels: Still Pushing Price and Recovering International

From Hilton Q2 Call:

"As we look to the back half of the year, we expect continued strength driven by a recovery in international markets, business transient and group demand."

"We think the broader environment is generally supportive for continued rate strength."

"On the group side, we continue to see very positive trends, our bookings in the quarter for 2024 arrivals grew 30%, with the group position now at 13% up driven by the Corporate segment."

"If you said to me could we drive occupancy, consistent with the prior peak? The answer is, yeah. I can probably do it in the next couple of days but it wouldn't be the right answer. Meaning, we are pushing hard on price because we've been obviously in a highly inflationary environment, and for the standpoint of trying to make our hotel owners the most money, that relative trade is the right trade keep pushing price hard even though it might impact occupancy."

From Wyndham Hotels Q2 Call:

"US RevPAR is now normalizing against the record comps we saw last year. Yet growth versus pre COVID levels has remained strong. We saw growth of 9% in April, moderate to 6% in May and then rebound to 10% in June and July month-to date stands at 12%, a 200 basis-point acceleration from June."

“We're seeing July accelerate from those in the second quarter growth rate. So we feel really confident about travel demand throughout the summer season. All of the leading indicators we look at remain positive, we're seeing a double-digit increase in TSA figures were seeing booking windows, continue to advance as well. And Google search volume remains strong.”

From Travel + Leisure Co Q2 Call:

“Owner nights on the books for the second half of the year, continue to track ahead of 2019 providing us good visibility into the remainder of the year."

"And when you look at demand and close rates across our geographies, we're really not seeing particular variation in the last quarter. I think, we've all seen the news that Central Florida is a bit down, but our demand remains very consistent in Central Florida, which again speaks to the timeshare model."

Airlines: Strong demand but mixed messages, Fares weakening

From Delta Airlines Q2 Call:

"On corporate, we expect steady improvement in demand. Our recent corporate survey shows businesses expect to increase travel in the second half with several of the least recovered sectors conveying optimism for increased travel in the fall."

"On International, demand strength is continuing and we are confident in delivering record profitability and margins across all three international entities."

“System bookings for travel beyond Labor Day are encouraging into the fall."

“And then we have the holidays, which was the peak holidays. That's all that's really left in here and we have good bookings for the holidays. We have good visibility on that."

From United Airlines Q2 Call:

“The demand environment remains strong, and September and October look particularly strong relative to both 2019 and July and August, another sign that seasonality has changed and the summer peak period is more spread out relative to the past."

From American Airlines Q2 Call:

"Bookings remain strong and we continue to see a constructive demand environment. We saw record revenue for the 4th of July holiday period and booked load factors for the third quarter are in line with what we saw in 2022. International entities continue to lead the way in terms of year-over-year performance and we are encouraged by domestic business demand, notably from small and medium-sized enterprises."

From Southwest Airlines Q2 Call:

“Moving to the third quarter, we're seeing leisure booking and yield strength continue throughout the summer travel season with July revenue, which is essentially booked, expected to also be a record. Of course, much of the post-Labor-Day booking curve comes in closer, but we're very encouraged by the response to our June, fare sale for off-peak fall travel and what that suggests for continued leisure demand.”

“Overall, however, we expect corporate travel demand will remain lower than leisure for the foreseeable future, particularly compared with pre-pandemic.”

From Hawaiian Airlines Q2 Call:

"Leisure demand remains robust throughout our network, reflected in strong second-quarter revenue performance, and encouraging advanced bookings for the back half of the year."

"Although revenue continues to be affected by competitive supply and unsustainably low fares. The most recent DOT statistics show us generating unit revenue that was two and a half times Southwest with a load factor that was 32 points higher, proving that customers continue to value our superior schedule, high quality service, and loyalty value proposition."

From Alaska Air Q2 Call:

"Demand remains very strong even as we've come off the peak of historically high fares, a trend we knew would happen at some point. Notwithstanding this evolution, yield is still meaningfully above 2019 levels."

“As a primarily domestic leisure carrier, this summer presents a unique situation with the unprecedented surge in international demand, not dissimilar to the domestic surge last year. We believe pent-up international demand has had the effect of a larger pull from would-be domestic travellers than has historically been the case.”

"We have a normal capacity growth to RASM reduction model that we sort of assume it's pretty consistent over the years. What we're saying is the pricing reductions is slightly higher than that model would suggest and that's what Andrew's attributing to coming off the peak pricing impact."

From Volaris Q2 Call:

"We anticipate travel improvement year-over-year for the second half of the year."

“For the second half of the year, the seasonally stronger semester, we are looking forward to several top-line tailwinds, including solid booking curves, stable international fares, a return of Cat 1, strong Central American growth, and more solid domestic network, and a ramp-up of ancillary projects, all contributing to lifting ancillary revenues towards 50% of total operating revenues."

Cruise: Strong Consumer Demand

From Royal Caribbean Q2 Call:

"The North American consumer remains incredibly strong and volumes from European consumers looking to book their summer vacations accelerated."

"The percent of guests who are either new to brand or new to cruise surpassed 2019 levels by a wide margin and we have seen post-cruise repeat booking rates nearly double 2019 levels."

"Future cruise consideration is near all-time highs and a contributing factor to a doubling in website visits compared to 2019."

From Carnival Q2 Call:

"In North America, the booking curve is as far out as we have ever seen it, while our European brands are quickly catching up to 2019 levels."

"Bookings taken in the second quarter for the European deployment for each of the third and fourth quarters achieved double-digit percentage increases in both volume and price compared to 2019."

"Demand for our European brands has continued to strengthen and is now outpacing 2019 booking volumes at a rate that's comparable to our North America brands."

Rental Cars: Premium vs Pre-Covid Holding

From Hertz Q2 Call:

"Our expectation on rate for the balance of 2023 is for year-over-year comparisons to improve from here."

"Looking forward, we expect to see a sequential uptick in both rate and demand into Q3, with rate holding at a material premium to pre-pandemic levels."

"With an early view into July to date, we have seen rate move higher versus Q2 by more than 5%."

Tickers Mentioned: HTZ 0.00%↑ CCL 0.00%↑ RCL 0.00%↑ WH 0.00%↑ TNL 0.00%↑ HLT 0.00%↑ VLRS 0.00%↑ DAL 0.00%↑ AAL 0.00%↑ UAL 0.00%↑ ALK 0.00%↑ HA 0.00%↑ V 0.00%↑ MA 0.00%↑ AXP 0.00%↑ LUV 0.00%↑

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.