State of the Leisure Recovery: Feb 2023

A quick look at airlines, OTAs, ridesharing, cruise lines, and rental cars and where they are vs 2019 post-pandemic

TL;DR

For the most part leisure oriented companies are at the same Enterprise Value as pre-pandemic, but significant changes in terms of capital structure (debt vs equity)

Airlines, Ridesharing, OTAs, Cruise Lines and Car Rental generally are back above 2019 levels of demand and bookings, still below 2019 on a customer level, and meaningfully above 2019 on AOV/RPD/Unit Revenue.

Will supply chase high yields and drive it back to a normalized CAGR vs 2019 or will a tight jobs market and other industry-specific challenges keep supply constrained and pricing high?

Leisure Company Enterprise Value Now vs 2019

Equity sectors are an odd animal. Airlines and rental cars are industrials, OTAs and Ridesharing are internet, and hotels and cruise lines are Hotels, Restaurants & Leisure. I tend to think of all of the names above as leisure companies as they’re impacted by the same general macro trends, namely consumer demand for travel on both leisure and business side.

Airlines: Generally same Valuation

Despite significant headwinds from Covid-19, the airlines have generally recovered from an enterprise value perspective. The meaningful dilution and incremental debt + warrants mean the capital structures are materially different, but the value of the businesses as a whole is approximately the same.

Supply is still constrained due to pilot and staffing shortages (plus Southwest’s operational breakdown in 4Q22). Demand domestically fully recovered in 1H22 mostly off the heels of high fares which has been a significant contributor to CPI inflation. Despite demand (total revenues) being strong we can see from the TSA Checkpoint data (as well as separate fare tracking data), that until recently the actual passenger throughput was 10-20% lower.

And a few transcript notes on airline demand from recent 4Q22 Calls:

First, while the specifics of the demand environment will be different, we expect it to return to at least 2019 level -- think it could go higher.

UAL 4Q22 Call

Let's talk more about the fourth quarter and full year results. We produced revenues of $13.2 billion in the fourth quarter, an increase of 16.6% versus 2019 and the highest fourth quarter revenue in company history. Notably, we achieved this record revenue while flying 6.1% less capacity than we did in the fourth quarter of 2019.

AAL 4Q22 Call

Ridesharing: Divergence despite recovery

It’s a bit complicated to apples to apples compare Uber to Lyft because Lyft doesn’t disclose Gross Bookings and Uber has a bunch of accounting adjustments to revenue due to laws in the UK around driver status. Everything I’ve seen points to Lyft lagging Uber materially on the recovery but from a positive standpoint let’s look at Uber’s Mobility GBV vs 2019

The chart looks pretty damn similar to the airline demand and there’s been very similar trends. Rides are lagging vs 2019 but average fares are up 30%+. It’s not surprising that it matches airline recovery trends as 15% of Uber’s business is airport pickup, and general leisure demand trends should be similar.

Uber vs Lyft Divergence

The divergence in enterprise value for the two can be derived from a few things:

Uber Eats meteoric rise and incremental GBV there

Improved profitability at Uber vs Lyft

Leadership position in US/Canada for Uber where they’re taking market share vs Lyft

Online Travel Agencies: Airbnb accrued value

Expedia and Booking are fairly equivalent to 2019 from an enterprise value perspective and the real value growth has come from Airbnb. They likely accelerated the growth along their S-curve and TAM penetration by several years as a result of the pandemic. Through 3Q22 ABNB GBV was +62% vs 2019.

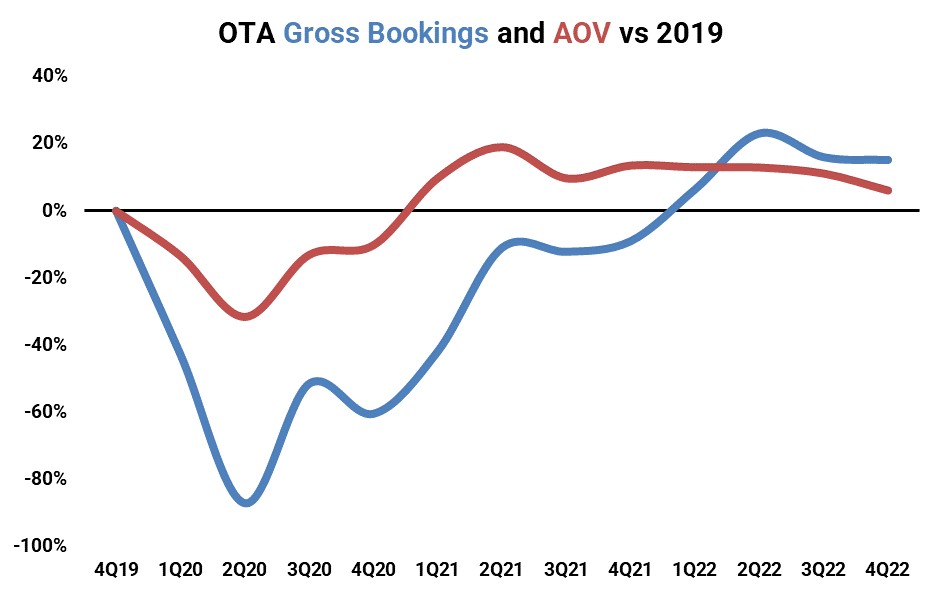

Gross Bookings follow a pretty similar trajectory to what airlines and ridesharing have. A little bit stronger than other industries due to the strength of STRs like VRBO and ABNB. The mix shift from hotels to STRs also helped keep AOVs well above 2019 levels and has started to decelerate into 2H22 as a result of:

Mix shift back to hotels from STR

Additional GBV for BKNG from air tickets and connected trip

Experiences growth at Airbnb

Cruise Lines: Ultra equity dilution, same EV

The pandemic regulations around testing and the brand headwinds from covid outbreaks on ships caused ultra dilution for all of the cruise lines. Despite enterprise values being ball-park similar to 2019, all three public players have added an absolute ton of debt to the balance sheet to survive. It’s difficult to put together an industry model for the cruise lines due to CCL being on an off-calendar fiscal year.

It appears that consumer demand for cruise is back to normal and CCL echoed this on their Q4 call back in December

Pricing for our 2023 book business is currently at considerably higher levels than 2019, adjusting for FCCs. And it is very encouraging that since announcing our relaxation in protocols in mid-August, we have already seen a very meaningful improvement in booking volumes. We are now running considerably higher than 2019 levels.

CCL 4Q22 Earnings Call

Car Rental: Valuations well above 2019 on crazy trends

What used to be a fairly boring and poor returning industry went absolutely nuts in 2021 and 2022. The industry model tends to be:

Acquire discounted fleet vehicles

Maximize rental RPD over 13mo while you hold vehicle

Sell vehicle and benefit from D&A arbitrage

During 2021/22 you had two things happen, both of which are incredibly powerful on EPS for both Avis and Hertz:

Used car prices skyrocketed which resulted in depreciation expense for HTZ actually going negative in 1Q22 and almost flat for CAR in 3Q22 (vs normalized ~$220 depreciation expense per month per vehicle)

Leisure demand skyrocketed as covid ended but consumer behavior was still biased against public transportation and rideshare so car rental benefited.

With most of the other leisure names the concerns are just on demand and whether the high fares, rates, etc can be maintained as supply and capacity come back on board. For the rental car companies the big concern is also around depreciation expense. With Manheim coming down, ASPs at KMX and CVNA coming down, price cuts at TSLA 0.00%↑ and F 0.00%↑ , it appears there is still room to go on used car prices which have a material impact on the car rental companies EPS and FCF.

Net-Net: Strong Demand, High Prices

Across the leisure sector, demand has tended to be meaningfully above 2019 levels with STRs like VRBO and Airbnb achieving that early and the cruise lines achieving that late. The vast majority of strong demand has been a result of higher fares, RPDs, ADRs, etc as opposed to customers/transactions because those are mostly still 10-20% below pre-pandemic levels.

The big questions for the 2023 are:

Can high prices be maintained with a weakening consumer and incremental supply being added (supply will chase yields)

Will consumer counts / transactions get back to 2019 levels for Ridesharing and OTAs, or were a lot of those customers “empty-calories” at lower non-profitable price points? ($5 Uber rides to work don’t make economic sense)

Can supply even be added given the jobs market and difficulty in hiring?

Tickers Mentioned: UAL 0.00%↑ AAL 0.00%↑ LUV 0.00%↑ DAL 0.00%↑ UBER 0.00%↑ LYFT 0.00%↑ CCL 0.00%↑ RCL 0.00%↑ NCLH 0.00%↑ HTZ 0.00%↑ CAR 0.00%↑ TRIP 0.00%↑ EXPE 0.00%↑ BKNG 0.00%↑ ABNB 0.00%↑

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.