Fortnite Going All-In on UGC but Chasing Roblox

Big changes to Fortnite developer compensation, selling in-game items, and chasing engagement but lost time and ground to Roblox. Is it too late?

Epic Games has been attempting to push UGC and drive engagement and players for the past several years but delays and missed timelines around the launch of Creative 2.0 and UEFN missed the covid window and Roblox has captured the vast majority of mindshare and engaged hours. I wrote about it in a deep dive when it launched back in 2023, but we just haven’t seen the huge tailwinds the company and investors anticipated.

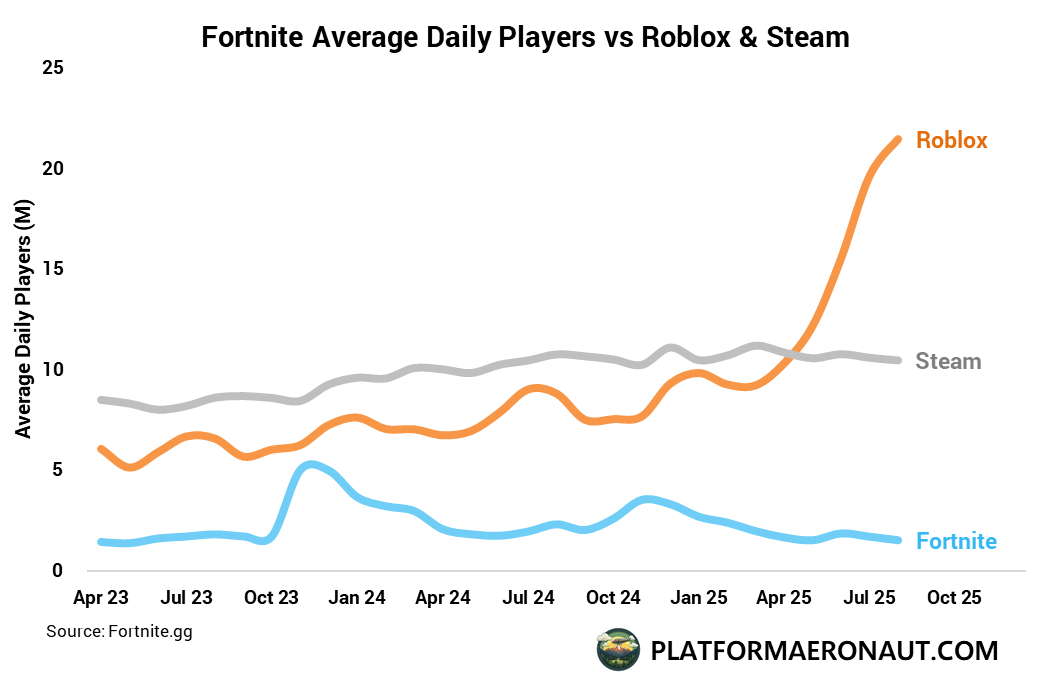

Pulling together average daily player counts for Fortnite, Roblox, and Steam you can see the lack of traction and expansion for Epic beyond the core Battle Royale mode in the game:

Roblox has gone vertical on the back of viral hits like Grow a Garden and Steal a Brainrot and not only hit 22m concurrent players for a single experience but hit 45m concurrent players on the entire platform. Steam continues to chug along and execute but doesn’t have the virality or same network effects that Roblox has.

Fortnite has sustained an extremely solid core player base for the core Epic created modes like Battle Royal, Reload, and Fortnite OG. Coming out of covid they saw the same sort of negative player tailwinds as life normalized as the rest of the industry saw, but there were high hopes that a push into UGC would invigorate the player base and hand the keys over to developers. When they launched UEFN (Unreal Engine for Fortnite) there were big expectations, after all it was a super powerful skinned version of Unreal Engine 5 specifically for Fortnite that theoretically would allow independent developers to create game experiences that were quasi-AAA quality but within Fortnite’s walled garden, but riding that distribution channel.

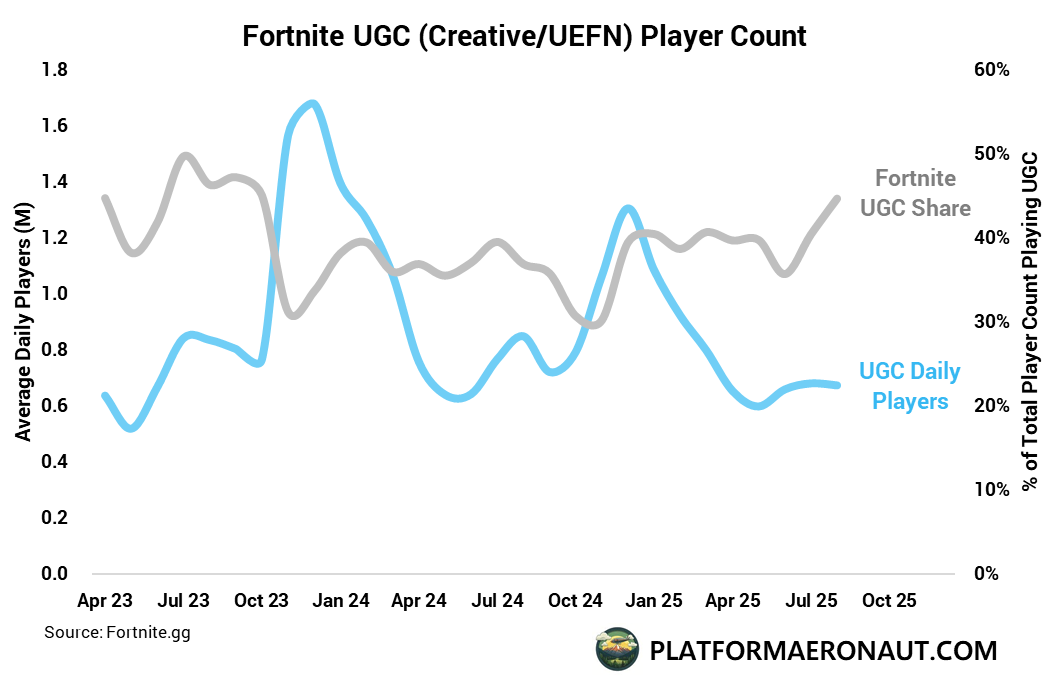

To date though, the Fortnite UGC player count hasn’t really grown and has continued somewhat stagnant at 40% of total hours:

The big question is why didn’t creative/UEFN take off in the same way that Roblox has? Here’s a few of my thoughts on why that’s been the case:

Challenges to Fortnite Expansion over the Past 5 Years

Innovators Dilemma

Not to say that UGC and 3P games aren’t a core component of the DNA at Epic Games, but there’s definitely a sense of dilemma around promoting 3P games vs 1P Epic developed games within the Fortnite client. Remember that Fortnite went wildly viral pre-pandemic but that was exclusively off of Battle Royale and direct monetization through skins sold by Epic itself. It’s really difficult to balance moving to a 3P developer driven economy without completely destroying the revenue generation abilities of your core 1P business.

Breadth of Experiences & Items

I think any company coming from behind will face challenges catching up on breadth. Roblox has been long positioned as independent of the experiences themselves and given it’s 3P-first it’s handed all fo the tools for creation to its community. While Epic had to directly model, create, and price their skins, outfits, and accessories, the community at Roblox has been empowered to create, list, and sell their own user-created skins. Certainly there’s a ton of trash in the catalogue, but you can find almost anything and if you don’t you can make it yourself.

Developer Incentives and Monetization

With the launch of UEFN and Creative 2.0 Epic put in place a playtime based compensation model. The more players that play in your game (and the longer they play), the more Epic would pay out to you. Theoretically this incentivizes developers to focus on quality and playability vs the loot boxes and in-game monetization that can feel abusive over at Roblox.

The reality is that it enabled a complex black box where developers struggled to know how to monetize. There’s a mainstream and well paved way to monetize games on Roblox and you have direct control and knobs to turn as a developer to optimize it. In the abscence of those tools for Fortnite UEFN it’s hard to tweak and really know. Roblox gives developers a sense they’re in control of their destiny vs in Fortnite.

Mobile Access

It goes without saying that the absence of Fortnite from iOS and Google Play Store globally throughout covid and into normalization was a huge negative. It just naturally limits your potential player base in 2025 when you aren’t on mobile. This absence allowed Roblox to just run up the scoreboard on mobile-first players both within the developed world and especially in emerging markets. This has changed as Epic has won a series of anti-trust lawsuits and Fortnite is back on mobile, but it’s a lot of lost time.

Technical Requirements

Simply put, Fortnite is not a low technical requirement game whether it’s on desktop or mobile. The file size is huge, there are decent GPU and phone requirements, and that just naturally limits your player base to the developed world with faster more high spec devices. Additionally the load times are significantly slower than Roblox or other mobile games and I’d expect there’s a notable drop off in engaged hours when a user has to wait 30 minutes for a game update, or 1-2 minutes just for the app to load and get into game.

So What is Epic Doing About it?

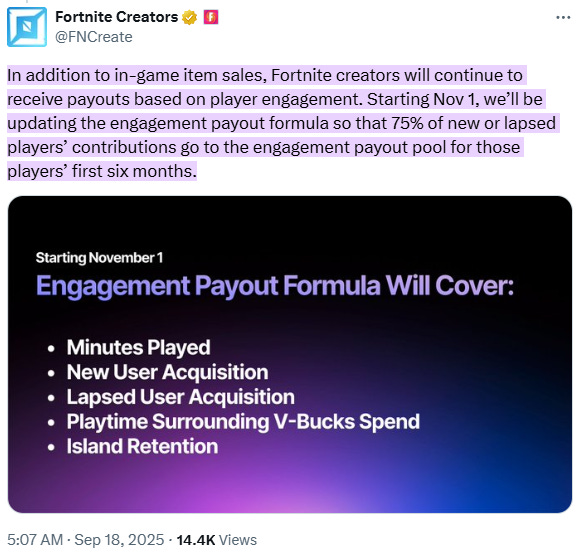

Last week Epic announced a radical change to the compensation model to creators on UEFN. It essentially gives such a good deal to developers in the ecosystem that if it doesn’t work in terms of bringing high quality experiences to Fortnite, I’m not sure what will.

Developers Will be Able to Sell Items Directly

Beyond normal engagement based payouts, Epic is enabling developers to create and sell items from their games. I think having a robust in-game economy for creators is the missing link in engagement and monetization. Epic noted:

“Developers will use a Verse-based API and new UEFN tools to create and offer purchasable durable items and consumable items in their games. We’ll share more details soon.”

Most importantly here is that through the end of 2026 74% of all in-game items sold by a developer will go to the game developer themselves versus approximately 25% on Roblox.

New/Lapsed Player Payouts

Since the launch of UEFN Epic has used an engagement based payout through a pool of approximately 40% of net revenue. Essentially if there is $100 of revenue and 100 hours on Fortnite that makes an engagement pool of $40. That $40 is divided up into 1P and 3P based on engaged hours. Today with 3P being ~40% of hours that’s approximately $16 out of $100 of revenue going directly to creators.

For the next six months, Epic will pay out 75% instead of 40% if they bring in new players to the platform or re-engaged lapsed players. This should directly improve cohorts and re-activations from older cohorts.

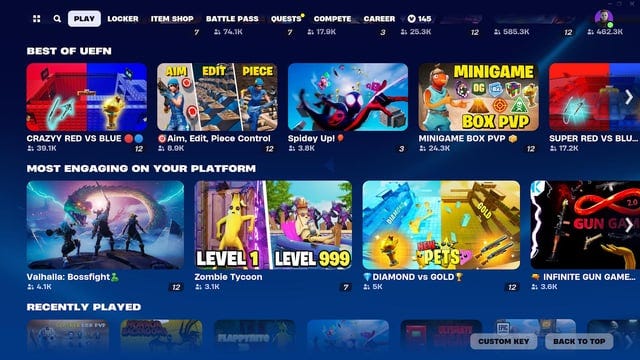

Sponsored Row in Discovery

Epic has long struggled within Fortnite to help players discover new experiences. It’s been a huge focus for Roblox but they don’t face the same innovators dilemma given there’s no 1P experiences there. To help solve this Epic is launching a sponsored row in discovery where creators can pay to receive increased visibility for their games. It’ll be a transparent and dynamic market to bid.

And long term 50% of this will go back into the engagement pool with 100% of that revenue doing so through the end of 2026.

What this might enable is an optimization and flywheel where a big developer with a great game can utilize the sponsored row to push engagement, and if they are actually successful in generating more players and hours they essentially get a rebate back of that money spent through the engagement pool.

Reducing Technical Requirements

There’s also a robust effort underway to reduce technical requirements and size. Epic hinted on a thin client last year, but there’s a specific roadmap now on mobile to reduce download size and speed to launch.

Will it Make a Difference?

It’s still very much a TBD, but I’d expect faster loading, better developer incentives, and a renewed push into discovery for new games will help jump start the UEFN 3P ecosystem on Fortnite. Is it going to see the hockey stick that Roblox has recently? Not likely at least for awhile, but can it re-accelerate growth and should it grow multiples faster than the overall gaming industry’s +3-4%? I think so.

Beyond the 3P part of the equation there’s also the following big items on Epic’s roadmap:

Development of the Disney Metaverse after their $1.5B investment into Epic.

Continued LEGO partnership and investment into LEGO Fortnite

Deepening IP collabs

But the true crux of the problem now is competing for share of time spent not only against Roblox, but also Netflix, TikTok, TV, schoolwork, and offline socializing.

Tickers Mentioned: RBLX 0.00%↑ GOOGL 0.00%↑ AAPL 0.00%↑ NFLX 0.00%↑

The information presented in this newsletter is the opinion of the author and does not reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for informational purposes and should not be construed as investment advice or an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Altimeter and its clients trade in public securities and have made and/or may make investments in or investment decisions relating to the companies referenced herein. The views expressed herein are those of the author and not of Altimeter or its clients, which reserve the right to make investment decisions or engage in trading activity that would be (or could be construed as) consistent and/or inconsistent with the views expressed herein.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

This is a brillant breakdown of why Roblox has such a commanding lead. The mobile absence during covid was absolutly killer for Fortnite, and the technical requirements gap is underappreciated. Roblox runs on anything while Fortnite needs serious hardware. The developer incentive structure difference is key too, Roblox devs know exactly what they're making whereas the Epic engagement pool is a black box. Epic's new changes are agresive but might be too late to catch the wave. The moat Roblox built is real.