Excerpts from BG² Conversation with Dara Khosrowshahi

Dara, Brad Gerstner, Bill Gurley, and Jason Calacanis sat down to discuss Uber's history and future around AI, trends, growth, and getting fit.

Brad Gerstner and Bill Gurley have been experimenting with Jason Calacanis on a new podcast (as of now called BG²). Their second episode features Uber CEO Dara Khosrowshahi and there were a few interesting takeaways.

Top Takeaways:

Since 2019 Gross Bookings have doubled but have only grown headcount by ~10%, and the majority of headcount growth is coming from outside of the Bay Area.

Uber has a custom AI layer where they plug in public models, open source models, and work with the larger players.

Using AI to algorithmically price and offer promotions and discounts to consumers.

Around 20% of developers at Uber are using Github Co-pilot and goal is to expand that base of power users to 50% then to 80%

Using AI to custom summarize and make recommendations to customer service agents on refunds and other issues.

AI is still too slow on the customer facing side so most of the benefits will accrue on the back end for Uber.

Take-rate for Uber has actually been consistently 20-21% but two big changes have been 1) dynamic pricing of rides and 2) dramatic increases to insurance costs which are a headwind and confusing to drivers.

Grocery is a $5B+ business and it could be $50B+ in the future

% of Delivery Gross Bookings from UberOne members is approaching 50%

The bar for M&A is incredibly high and trying to integrate other businesses into a 2-sided marketplace is really hard.

Artificial Intelligence / LLMs:

“And what's And what's fun about those kinds of upsells is it used to be a bunch of people kind of sitting around table, having ideas. Let's do this upsell. Let's do that upsell. And then it's like, let's put this percentage of our inventory to, you know, upsell on safety, etcetera. All of that is now being driven by AI… I have no idea what the algorithms are gonna come up with, but we have more consumers, more services than anyone else, more upsells than any other player. That combination is a potent combination, even outside of membership.”

“So the we now have a subset of our developers who are power users of GitHub Copilot, and it is excellent. And so the job now is to to and it's and it's truly adding productivity, but we now have to sell it from, like, 20% of those power users to 50% to 80%. And And you you shouldn't take that for granted by, like, locking you to do that tomorrow because we want developers to do their day jobs while they're training on how to get more productive.”

“The next for us is is customer service… When you call in, we have to know what kind of customer you are because there's a lot of fraud in in the system. There are a lot of people taking advantage of the system… A human being has to go through all that. Now essentially and and we've taken the steps. Right? First step is AI summarizes all of it. So it's in a nice little package now the AI not only summarizes it, but gives the recommendation to to the customer service agent.”

“We look at those recommendations, how they write, are they wrong, and eventually we'll be able to move much more of the customer service to to AIs as well. So that's another one. We are building out customer facing products as well for Eats, some cool stuff. My instinct is the next, 24 months gonna be much more focused on back end stuff. On the customer facing side, it's still too slow…Like, you you know, our responses have to be in milliseconds. And there's, you know, even very small delays can and can cause drop off.”

“So we have an application layer, that is our own AI layer, and we can plug in public models, open source models, and we work with all of the larger players. And and I actually think the answer is gonna be all the above. There's certain, highly idiosyncratic, idiosyncratic use cases where a smaller custom built model will be the right solution. And then for, I think, github co pilots, etcetera, it might be you want more general models than some of these larger models.”

On Covid / ZIRP Environment:

“When the music starts, everyone has to get up and dance. I think it was pre, the real estate crash, etcetera. So I think the music was, like, really loud in the free money era and everybody was dancing. And, you know, for us, the music stopped earlier, which was COVID, And literally overnight, 85% of our business disappeared in terms of our rideshare business. That was the profit generator at the time. And it was a complete disaster, and nobody knew when it was gonna come back. Now our Uber Eats business actually grew and grew very, very quickly, but it was unprofitable business at the time. It was much less mature, etcetera.”

“So post COVID, while a lot of companies started spending again, when things started coming back, we were actually very, very disciplined in terms of costs. And I think since 2019, you know, our gross bookings have doubled, but we've added about only 10% in terms of headcount. And, you know, to your words, Brad, we we stayed fit.”

“The private kind of spending as much as you can to put off competition. Like, that was not my comfort zone. You know, I I was running a public company for 13 years, and the public markets instill a discipline is instill a kind of return on, invested capital discipline that that I was quite comfortable in. So I did have to play the game.”

On Company Structure / Leadership:

“And I think that the heroes at the company aren't the people who, you know, are growing from 50 head count to a 100 head count to 150 head count. They're the ones who keep drive thing and keep building and keep innovating with small teams. You know, the definition of heroes change within the company and I think the nice thing is that with success comes kind of the positive reinforcement that people are looking for.”

“Yeah. the majority of our engineering head count or technical head count is in the bay area, SF, Sunnyvale, etcetera. And the fact is that, like, there is great freaking talent in the Bay Area. And despite what some people say, it's great talent. Who works hard.”

“the majority of our growth in headcount is coming outside the Bay Area. And there are incredible town hubs, India, for example, in Brazil, Sao Paulo for us in Amsterdam, So we are actively looking to diversify, our technical talent with a core of you know, rock star ninjas in the Bay Area. They really it like, it is an excellent core. But just like we diversified our business globally, We should diversify a talent based globally. And sometimes, you know, having talent outside of the Bay Area can actually help you build better product.

CEO Search / Taking over for Travis Kalanick:

It’s been discussed ad nauseum in the media about Dara taking over for Travis and the other two finalists for the job Meg Whitman and Jeff Immelt. With the benefit of hindsight it’s a no brainer that Dara was the better option.

One piece of side commentary from former Uber Chief Business Officer Emil Michael that is pretty interesting:

“And and I would say that this is the magic of magical product. Right? If I hadn't used Uber myself, if I didn't love the product and what it did for me, and how would it improve my life personally and how's an everyday part of my life? No way I would have taken the job. But the fact is that, you know, Travis had to fight and do a lot of good and a lot of, you know, things that were actually cost his job in the end.”

Driver Supply, Insurance, and Compensation:

“Yeah. And it it it helped us build a better product. Like, the the the service doesn't exist without drivers, and actually I say drivers are the number one growth driver for the company. As we get more drivers, the the network becomes more liquid. ETAs come down, surge comes down, just the demand almost shows up.”

“…the truth is Drivers were making about 30% more than they were making 5 years ago, but so's everybody kind of you know, so that that is the spot cost of labor. It has gone up. The drivers are absolutely do doing better. Our take rate It's affected by revenue recognition and kind of merchant versus agency, etcetera. Kind of the true take rate of the mobility business has stayed flat around 20 to 21% for the past 5, 6 years.”

“Now what is happening in the US, two things are happening in the US that that I do think are affecting driver perception and how they feel, which is real, that we haven't done a good enough job managing through, and and we have to do better.”

“One is that, on the driver's side, instead of drivers getting paid a flat rate, based on distance and time, in order for us to show drivers the upfront destination, we now essentially algorithmically price a specific ride. So we tell you exactly where you're going and we price out the ride. And for example, if you're going to the suburbs and the boondocks, we will price more than what would the normal rate be because you're gonna come back. Your utilization Jason gonna be low. You're gonna have a bunch of empty miles.

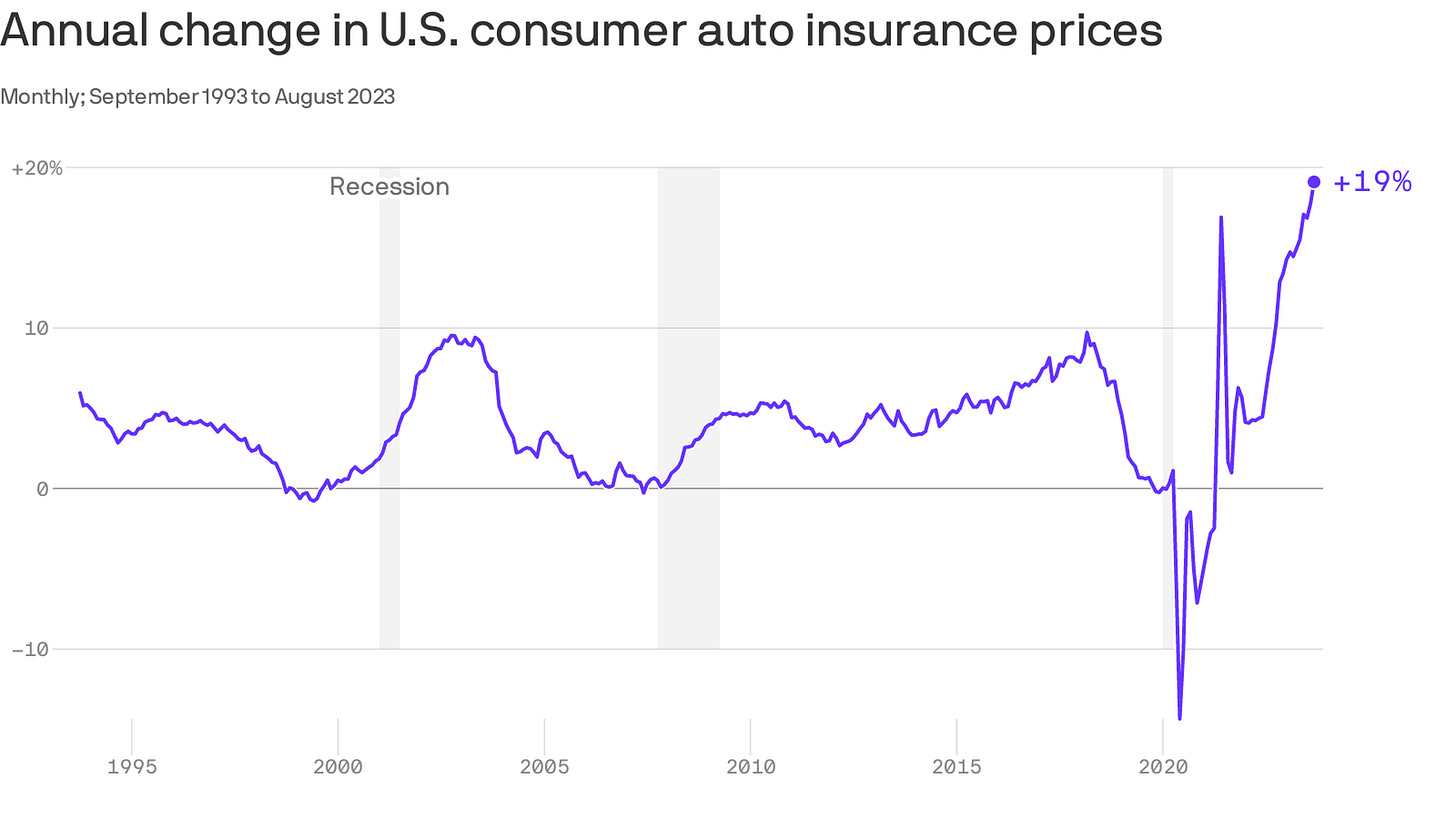

“…the cost of commercial insurance in the US has gone up significantly… That so in the US, our take rate, net of those insurance costs are less than 20%. They're 15, 16%. If you include that insurance cost, which is really just a pass through, they're north of 20%, and that is a pain that drivers are feeling. So in the in California, for example, commercial insurance costs have increased by over 60% over the past 2 to 3 years.”

Our driver’s have grown over 30% on a year on year basis.

So in a England where there's it it's harder to become a driver or the regulatory burden is higher a higher percentage of drivers tend to be full time, in a Brazil, a lower percentage of drivers tend to be full time. So you do have a mix of full time part time The majority of drivers are are part time, but there's a core of full time drivers that are very valuable to us who really understand the system,

On M&A / Business Verticals:

“Grocery is a $5B+business. It could be a $50B business.”

“…there are very large opportunities right in my backyard. So that's the stuff that we are focusing on. But what you're talking about, which is this work platform. We do have a global work platform. It's better than any other work platform.”

“We have some of our drivers now working on artificial intelligence labeling, right, work from home, work drive for Uber … High quality mechanical turk business. They're building. It's a nice little adjacency. I'd love for it to get to a nice big adjacency. And so we are definitely working on different kinds of work because we do have this work platform, flexible work platform that's absolutely second to none.”

“Our driver app is is the closest thing, I think, to a western Super app there is, but not that many people see it.”

“It's not exactly rocket science, which is what we find is people who use more of our stuff tend to engage with our platform more. They tend to stay longer. They tend to to spend more. And so actually have Uber 1, which is our membership program. It's growing very, very well.”

“[UberOne is] 15m and it's grown since. And and more importantly, I look at the percentage of gross bookings that come from Uber One members. And for example, with Eats, it's getting to that 50% mark. And it is it's priced the same exact as our competitors. And we have more content, which is there's you not only get delivery benefits, but you get mobility benefits.”

“[On M&A]…it should always be on a radar, but but one thing that I've learned with Uber is running a business and and trying to trying to integrate other businesses into a 2 sided marketplace is really hard. And the organic path for the company is great unless I screwed up. But it looks great. So the the cost of an acquisition in terms of, in terms of just the distraction from the from the daily grind, which is a wonderful grind that that we love, it's it's pretty high. So it would have to be awesome for us to look.”

Tickers Mentioned: UBER 0.00%↑

Resources:

Dara Khosrowshahi, Bill Gurley, Brad Gerstner, & Jason Calacanis on Uber's growth and future | E1878

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.